Startup life isn’t easy. You have to constantly monitor your cash runway, manage customer and revenue churn, and ensure you scale at just the right rate. And those are just the factors you can actually control. Throw in external shifts like market changes or economic uncertainty and things can get overwhelming, fast.

To navigate this uncertainty, you build forecasts and budgets that act as your North Star. But as well constructed as they may be, they don’t change to reflect internal or external shifts as the year marches on. By operating as if they’re still accurate after a month, a quarter, or even a year, you end up wasting valuable resources and being too inflexible to respond to crises.

Of course, forecasts and budgets can be much more flexible. That’s the purpose of reforecasting, an agile business process that’s critical for SaaS companies.

Table of Contents

What Is Reforecasting? Why Does It Matter for SaaS?

Reforecasting is, well, when you forecast again. The truth is forecasts aren’t — or at least shouldn’t be — a one-and-done procedure. Especially in high-growth startups, things are constantly changing, whether that’s a delay in product rollout, a shift in your target demographic, or an increase in competition.

Simply put, there’s a reason “pivot” is such a common word in the SaaS startup industry.

Does it really make sense to stick to a budget for a quarter or even a year if the circumstances change? Surely, your situation even 2 or 3 months down the road, won’t be the same as when you built the budget. Why not modify the budget to reflect this?

That’s exactly what rolling forecasts allow you to do. By continuously updating based on actual performance, these forecasts help ensure resource allocation is based on the current situation — not the situation that existed 6 months ago.

Rolling forecasts are useful for any type of business, but especially SaaS, and especially startups. With SaaS, your revenue will almost certainly change from month to month as subscriptions rise or fall. If you enter a stage of rapid growth, headcount planning and infrastructure needs may change faster than you can keep track of.

Throw in economic uncertainty, like we’re currently dealing with, and the likelihood that situations change rapidly increases further and the importance of rolling forecasts is elevated.

That being said, rolling forecasts are just one piece of a strategic budgeting process – they should work with annual budgets, not replace them. Everything needs to be directed towards your goals, and annual plans are best for setting those goals. Rolling forecasts allow you the flexibility to achieve them, no matter what the market throws your way.

When Should You Reforecast a Budget?

So, when should finance teams actually put the reforecasting process into place? Only when a downturn hits, or a big operational expense appears out of nowhere, right?

Well, you’d definitely want to reforecast for major changes like those, but they’re far from the only instances.

Some other times you’d want to reforecast include:

- Loss of major clients

- Product launch delays

- New hires or departures

- Shifts in market strategy

- Shifts in variable costs

- Changes in user behavior

- Seasonal sales fluctuations

The truth is there will always be some kind of budget variance – how do you know if it’s big enough to necessitate reforecasting? Set up a threshold. If things go beyond that threshold, agree to reforecast.

Remember that budget reforecasting isn’t only for when negative events occur – it’s for any kind of significant deviation between your forecasts and actuals, even if it’s positive.

For instance, revenue forecasting might show your top-line is growing faster than expected, and so you decide to model how the company would handle one or two additional hires.

Actually, because headcount will be your largest expense, you’ll want to reforecast whenever you make a new hire or someone leaves the company. Both are easy to do in Mosaic, where you simply add a new line, fill in the relevant details, and see how that affects your top-line, balance sheet, and income statement.

It’s important to make reforecasting a regular practice. By doing so, finance teams are much more likely to allocate resources where they’ll have the best effect, regardless of circumstances.

Typical Pain Points of Reforecasting

While reforecasting is a critical part of your budgeting process, it’s not necessarily easy.

For one, gathering all the data you need for a reforecast can be time-consuming. You navigate from CRM to ERP, to HRIS, from spreadsheet to spreadsheet, just to generate the baseline you need for forecasting.

There’s then the possibility that data will be mistranslated or formulas will break when information is moved into spreadsheets, resulting in errors and flawed forecasts. Flawed reforecasting won’t do you any good, and could even lead you in the wrong direction — the last thing you need when dealing with market uncertainty.

Say you do gather all the data manually. That’s only step one. You’d then have to work out your reforecasts in Excel. This is possible, but it’s going to take some time. One wrong move, and your model will break. In other words, the “traditional” way of reforecasting — through spreadsheets — is not ideal for pivoting or acting quickly.

Reforecasting is meant to be something agile, something you can act on almost immediately – if it takes you even a few days to reforecast budgets, the effectiveness of that forecast is diminished.

The right financial forecasting software leverages data centralization, analytics, and a user-friendly interface to glide right past these problems and help make reforecasting a breeze.

How Mosaic Transforms Reforecasting

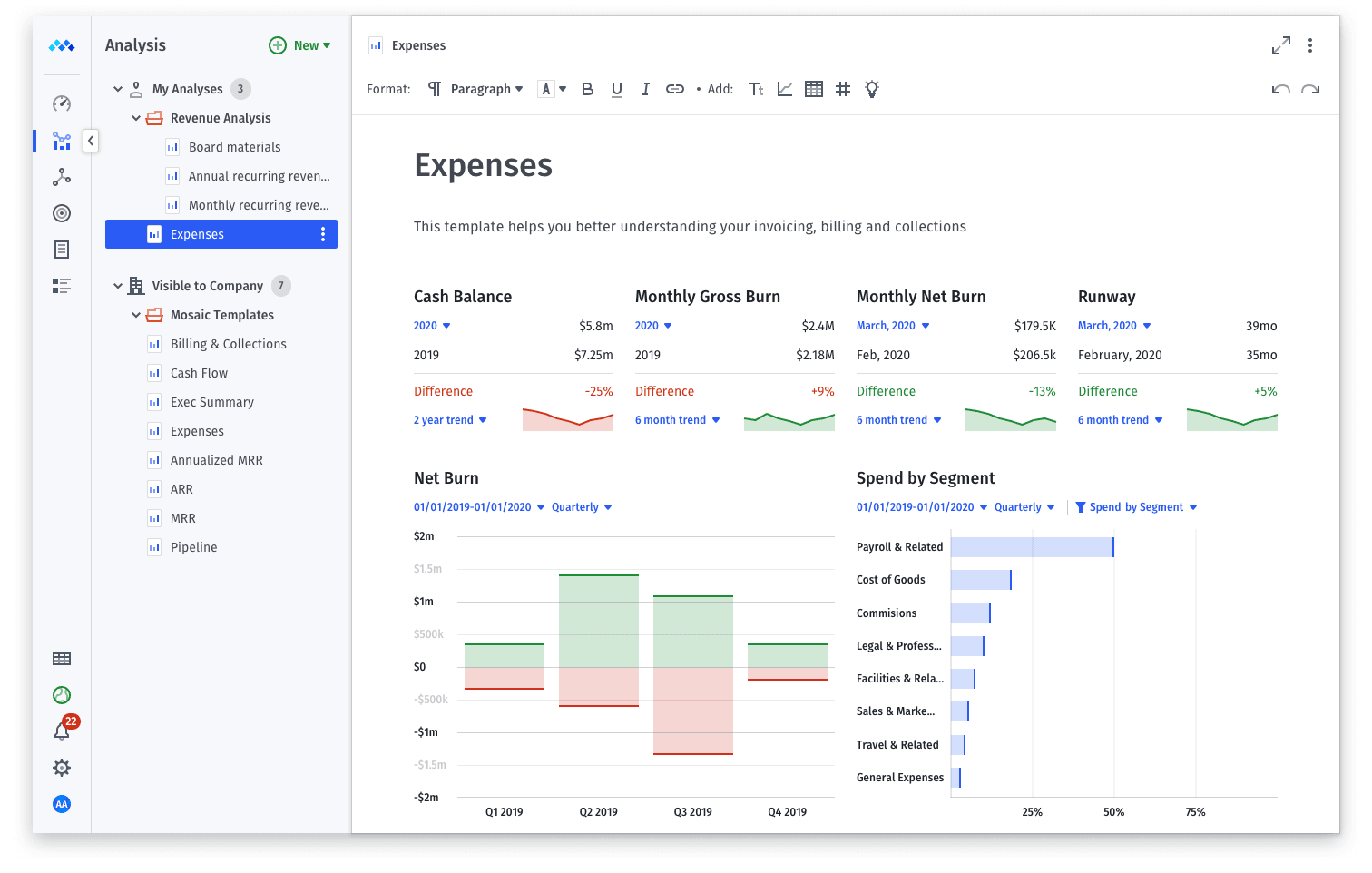

Mosaic is a collaborative budgeting tool that makes reforecasting faster and easier by making your data accessible from one tool in real-time, providing the analytics that matter most to your business, and delivering it within a user-friendly interface.

Data Centralization

Your budgets and reforecasts need to be based on the whole picture. By integrating with your CRM, HRIS, ERP, and financial statements, Mosaic consolidates your entire financial position in one, centralized platform.

Your FP&A model is then continuously updated based on actuals, in near real-time, which can be imported into your new forecasts.

Mosaic automatically updates your model with historical actuals at the click of a button, saving you time and allowing you to focus on future assumptions vs wrangling data.

Analytics

To build driver-based plans that guide decision-making, you’ll need metrics.

With a huge catalog of over 150 metrics, Mosaic makes it easy to drill down into the most important for your SaaS business: like sales win rates, spend by vendor or time to collect. In Mosaic, you can also build custom metrics using our Metric Builder.

Tie those metrics to key business drivers and assumptions to build reliable rolling forecasts that align with your larger business goals.

Predictive analytics, or the ability to predict business trends before they occur, is another huge piece of reforecasting. Facilitated by machine learning, predictive analytics can provide a clear view of changes in customer behavior or cash flow, which you can then build into your models, increasing their accuracy.

Mosaic helps with predictive analytics by automatically calculating historical trends in data that can be used to accurately forecast future outcomes.

User-Friendly Interface

Building forecasts is one thing. Being able to communicate them to decision-makers outside of finance is another.

In Mosaic, you can quickly build beautiful charts and graphs, drag and drop metrics relevant to your forecast, and add notes explaining the most important aspects of the model. The goal is to explain why you’re recommending a certain course of action based on that reforecast.

How To Reforecast in Mosaic

The first step to reforecasting budgets is one finance teams are used to — building a forecast for the financial year. But as we move month by month, that’s where the process starts to diverge.

In Mosaic, the first thing you’d do is duplicate your baseline model. From there, all you have to do is update your actuals through-date. So, if it’s February, you’d move your actuals through-date from December to January. There you go — your forecast has been updated based on last month’s information, sourced from your connected financial systems.

What’s great about Mosaic is that all aspects of your business are integrated. So, if you want to forecast a headcount increase, you’ll see how this reflects on your income statement (salary, benefits expense, payroll taxes) and balance sheet (cash).

You simply repeat this process each month, rolling forward your original forecast as you go. If the variances pass your threshold, you can modify your budget so that you have a more accurate roadmap going forward, and each resource is put to good use.

From there, you can analyze the results in your analysis dashboard, comparing actuals to forecasts.

Empowering Financial Agility: The Mosaic Advantage

For SaaS startups, the business environment is constantly changing. That necessitates flexibility. And when you have limited resources, allocating them where they’re most needed is critical. Reforecasting helps with both.

While it’s possible to reforecast using spreadsheets, relying on manual time-consuming processes to reforecast is counter-productive. The whole goal of budget reforecasting is to adapt and remain agile, and you need software like Mosaic connected to real-time data to achieve that.

You can reforecast quickly by pairing finance automation with cash flow forecasting software and scenario modeling. And you can make the move from reactive, inflexible budgeting to proactive, targeted cash flow forecasting and financial planning that drives your business forward.

Learn more about reforecasting with Mosaic. Request a demo today.

Reforecasting FAQs

How often should a SaaS company reforecast its budget?

Reforecasting should be performed at least once a month. This way, your budget will always reflect ongoing changes in revenue streams, expenses, headcount, and working capital.

Beyond that, you can establish specific thresholds for when you reforecast. If your forecasts move away from your actuals by that set amount, reforecast.

How long does it take to set up Mosaic?

Why is Mosaic particularly suited for reforecasting in SaaS companies?

Own the of your business.