CAC Payback Period Guide and Formula

What Is CAC Payback Period?

CAC payback period describes how long it takes to recover money spent on customer acquisition, and is a key indicator of a company’s ability to drive returns on invested capital. CAC payback also helps internal finance and business leaders gauge how quickly they can deploy more cash.

As a CAC-driven metric, acquisition-specific costs, like marketing campaigns (whether through SEO, PR, or social media marketing) and operational costs like salaries for the sales and marketing team, factor into the payback period across a given period of time. Ideally, the CAC payback period is shorter than the customer lifetime value (LTV) — otherwise, the customer costs more to acquire than what they’re paying the company over their contract value.

Categories

Other than running out of cash, the second biggest fear for CFOs is misrepresenting numbers in an important meeting with board investors or potential investors. And misrepresented numbers begin with finance calculating important metrics that tell a company’s growth narrative.

Ben Murray, founder of The SaaS CFO, attested to this in an episode of The Role Forward podcast. “We have the traditional calculation, the traditional formulas for a lot of these metrics, but then people like to start excluding things,” Murray said. That is why Murray proposed creating a customer acquisition cost (CAC) profile that gathers a variety of sales and marketing efficiency metrics to determine what’s working and not working within the business.

CAC payback period is one of the most crucial metrics for SaaS companies and one of the most widely misunderstood, miscalculated, and misrepresented — until now.

Table of Contents

How to Calculate CAC Payback Period

While the CAC payback formula can change as a company matures, the goal remains the same: to use the CAC payback period to establish the baseline for profitability and consistent, predictable income.

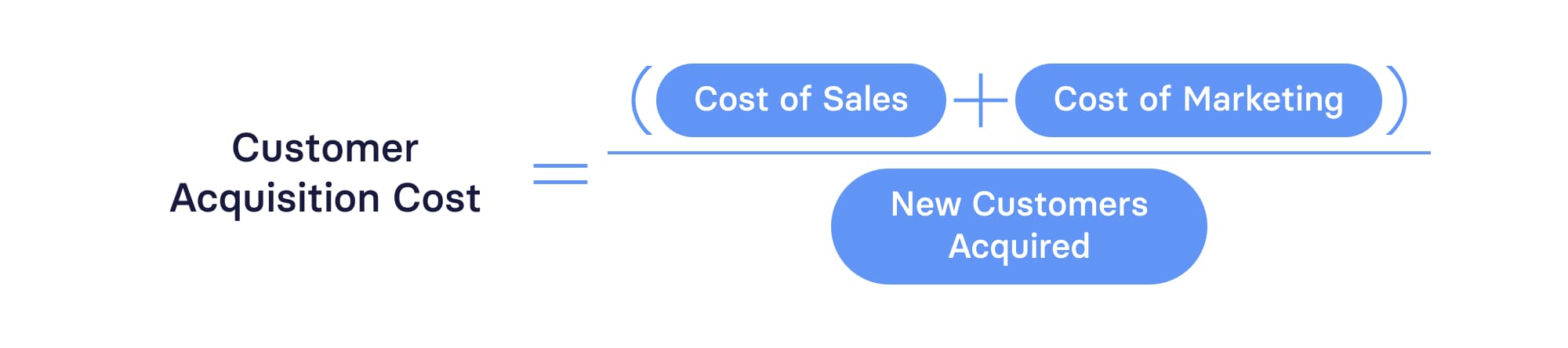

As CAC payback is a CAC-driven metric, you must first calculate CAC, which factors in the various costs of attracting and nurturing the customer toward the dotted line of a contract for your product or service. Remember to include any cost of sales (like commissions and salaries for your sales team) and cost of marketing (marketing and advertising spend, alongside the marketing team’s salaries).

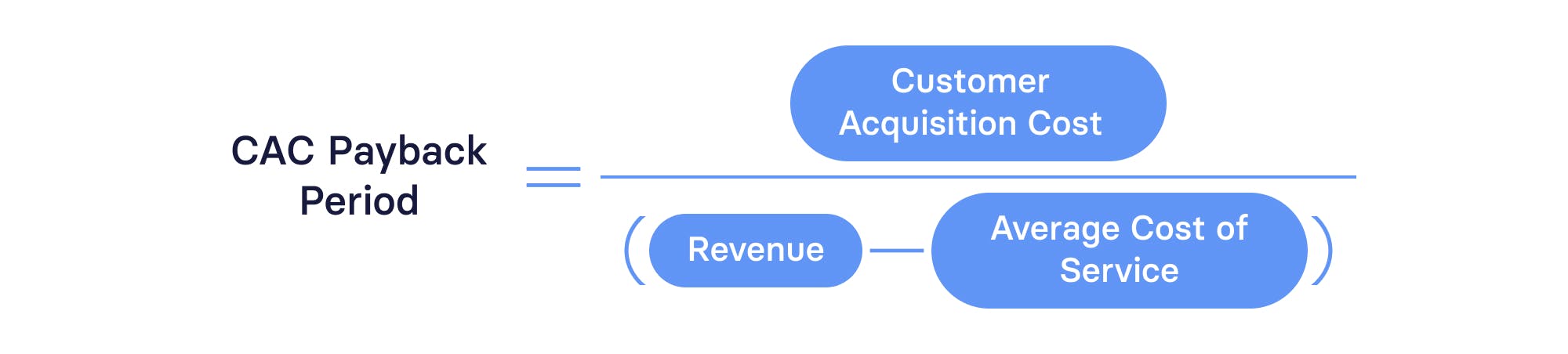

Once you determine CAC, you can then calculate the CAC payback period: Divide the CAC by the difference of your net new monthly recurring revenue (MRR) (any customer upsells and new customers) minus the average cost of service. You can also substitute annual recurring revenue (ARR) for MRR. The difference in the denominator could also be considered as your company’s gross margin.

Murray pointed out that the calculation can change based on company maturity: “Early stage, it could just be, ‘All right, all our sales and marketing expenses, a hundred percent of that is going towards new customer or user acquisition.’ But as we evolve, maybe we have different ideal customer profiles (ICPs), and we want to calculate CAC by those ICPs.”

You can calculate CAC by splitting it into logo basis and dollar basis to understand the CAC payback period within particular demographics, such as small and mid-sized businesses versus enterprise customers. You could also use cohort analysis to determine how CAC is improving or discover what needs to improve over time.

Why split CAC payback periods this way? With deeper dives into the calculation from multiple angles, you avoid a misleading CAC calculation, which makes your CAC payback period more accurate and predictable.

Advantages and disadvantages of CAC Payback

As with most things, there are tradeoffs, let’s examine some of the pros and cons of calculating CAC payback for SaaS companies.

Advantages of CAC Payback

CAC payback serves as a critical sales pipeline metric for SaaS companies. CAC payback builds the foundation for forecasting the breakeven point on cost of acquisition and provides insight into how efficiently your company monetizes customers.

Murray likes to say that CAC is a form of debt — it’s an investment into a customer and has to be paid back over time. Even if a customer churns, that money needs to be paid back. If there’s poor retention, money continues to be invested into CAC, which then places heavy reliance on new customers to make up any churned customers’ CAC.

It’s a snowball effect waiting to implode. This “debt” connects directly with the company’s working capital, which ties the sales and marketing departments’ efforts into opportunity costs for the company’s growth. Any dollar your company spends on acquisition could have been spent on product development or put toward headcount planning.

Your CAC payback period provides insight into when acquisition costs come back into the business. It gives sales and marketing consistent insight into how to optimize and improve CAC, whether it’s through reconsidering how much you should spend on ads or targeting more specific ICPs.

Leadership relies on CAC payback to show investors and board members that they know when customers become profitable, and where and how to invest the revenue back into the company to continue growing revenue.

Disadvantages of CAC Payback

CAC payback is often misunderstood because many companies don’t use a fully-burdened CAC number for the calculation, and factors such as churn rate and retention aren’t inherent to the metric.

A fully-burdened CAC calculation doesn’t mean including just the full headcount for the sales and marketing headcount. If the CEO hops onto sales calls, they need to be included in the CAC. You must also adjust the gross margin for CAC payback over time, as costs associated with customer success impact payback periods. And if the CEO steps in to assist with customer success, the gross margin structure needs to account for their time.

Murray noted that there may, however, be moments where it’s appropriate to twist the CAC payback formula — as long as everyone is aware of the twist and it makes sense. “We have the traditional calculations, but sometimes we have to change it a bit to make it more relevant to our business,” he said. By asking yourself, “How are we managing our business?” and “What data do we need?” you can make calculations far more valuable for your business.

Consider, for example, how sales rep ramp impacts a CAC payback period calculation. Sales reps will ramp months down the line, but their salaries factor into cost of sales. It’s not that efficient for the underlying go-to-market engine. You can calculate CAC in full, then calculate it without the rep ramp to ensure you don’t lose sight of your existing sales and marketing team’s overall efficiency.

What Is the Difference Between the CAC Payback Period and the LTV/CAC Ratio?

While CAC payback period measures the length of time it takes to recover acquisition costs, the LTV:CAC ratio measures a customer’s overall lifetime value to their specific acquisition cost.

The LTV:CAC ratio is a metric that’s very sensitive to churn — after all, if the customer churns, their lifetime value is done. (Remember that CAC payback doesn’t account for churn.) But the ratio can be all over the place, as companies can bring in customers for different contract values upon signing. “If LTV:CAC is all over the place, I calculate a median and maximum,” said Murray. “We want a range for context.” For SaaS companies, your LTV:CAC ratio should be 3:1 — if it’s lower, you need to refine your acquisition methods; if it’s there or higher, you can continue investing in new customer acquisition.

LTV:CAC holds a significant lifeline for early SaaS startups, as they’re most likely putting hundreds of thousands of dollars into paid ads to acquire customers as they ramp up their product and customer base. For later growth stages, the LTV:CAC ratio holds valuable information, but factoring in CAC payback period expands the ratio’s value by showing that the company can balance CAC toward profitability over a specific time, hence setting a benchmark for growth.

CAC Payback Period Benchmarks

Benchmarks are set within the context of the industry you’re in. As a rule of thumb for SaaS companies, a good CAC payback period occurs in 12 months or less — yet you can absolutely go shorter, with some SaaS companies aiming for 5-7 months.

Logo retention and net revenue retention have to come into play when considering CAC payback period benchmarks for SaaS companies. With higher customer retention rates, you can afford longer payback periods. And the more granular you can get with payback period segmentation, the easier it is to gut-check your go-to-market efforts and make strategic decisions.

CAC payback ensures the company’s runway continues to grow and there’s room to scale. You need to continually check CAC payback as it impacts operational efficiency within scaling and growth. It’s a metric that provides forward-looking insight into the profitability of your business model and helps you implement funds to accomplish the company’s sustainability and growth efforts.

Automate CAC Calculation (And Other Metrics)

4 Actionable Ways to Reduce the CAC Payback Rate of Your SaaS Business

Customers may sign on at different contract rates and terms, but the faster that customer becomes profitable, the faster you can turn that revenue around into a profitable outcome. You can obtain shorter payback periods with these four actions that depend on creating collaboration and awareness between your sales & marketing peers and finance to optimize the CAC period inputs you can control: retention and CAC.

1. Cut Average Cost of Service

Your average cost of service includes any customer support, your software’s hosting services, and any account managers or customer success managers who support customers throughout their lifetime with the company.

If you’re particularly concerned about cost of service, you can look at your historical data and an AP aging report to find any opportunities to renegotiate with vendors. Or, you could work with your customer success leader to dig deep into the data around CS rep performance — are some performing at a lower level than others? Is there anything you can do to correct course?

2. Update Your SaaS Pricing Strategy

Lengthy payback periods prompt the question: Does your pricing strategy truly align with the value you bring to your customers? Updating your SaaS pricing strategy allows you to make more money with less of a waiting period for the payback period to complete. You can raise prices or switch payment frequency or even method (such as going from subscription to usage-based pricing).

3. Collaborate with Sales & Marketing to Bring Campaign Costs Down

Finance discovers the “why” behind the numbers through collaborating with sales and marketing and asking, “Why?” and “What if?” Instead of paid ads, what would happen with a referral campaign? What is the process for ensuring the company markets toward ICPs and ensures product/market fit to ensure sales and marketing are not wasting their time or dollars on customers who don’t match up?

These conversations prompt sales and marketing to look at the customer journey to strengthen their funnel opportunities, such as building the customer’s knowledge base and promoting well-performing blogs alongside sharing these resources with potential customers throughout the sales process.

4. Upsell and Cross-Sell to Existing Customers

Upselling and cross-selling can be early wins when it comes to CAC payback. If a customer becomes a raving fan of your product, they’re more likely to expand into other product or service offerings. These upsells are not breakeven points for churn and making up other CACs. But when the timing is right, they help fill in the gaps and give an indication for the individual customer growth cycle.

Here’s How Mosaic Can Help You Track Your CAC Payback Rate

CAC payback requires hours to calculate, especially with a large customer base. The CAC payback period formula relies on accumulating CAC across a given time period and ensuring that the formula accounts for the full burden of labor from sales and marketing — and whatever changes to gross margin or cost of services occurred. This gathering of details can take hours to days to fully aggregate into spreadsheets, putting your calculations at risk of human error.

Murray stressed the importance of calculating key SaaS metrics as a part of your everyday operating routine: The less time you have to manually manipulate the data, the more forward-thinking the numbers become so leadership can make better-informed decisions with actionable steps that can cut or grow CAC even sooner.

As a Strategic Finance Platform, Mosaic integrates with your key data sources to ensure your CAC calculations remain accurate in real-time. Mosaic comes pre-loaded with the go-to-market metrics you need to calculate CAC, alongside creating forward-looking models that show scenarios where you cut ad or marketing spend, or hire more sales reps.

With Mosaic, you can amplify your CAC payback metric to drive conversations around spend and profitability. Request a personalized demo, and discover the power CAC payback and other metrics can have with better accuracy today.

CAC Payback FAQs

What is a good CAC payback period?

A good CAC payback period in a SaaS company occurs in 12 months or less, with some companies aiming as low as 5-7 months. Companies with higher retention rates can generally afford longer CAC payback periods, but the right benchmark generally depends on the industry you’re in and your unique go-to-market strategy.

Does CAC include salaries?

What is the CAC payback formula?

Explore Related Metrics

Own the of your business.