Revenue vs. Profit

The Difference Between Profit vs. Revenue

Revenue is the money a business earns by selling a product or service, and profit is the money your business keeps after accounting for all the expenses involved in generating that revenue.

Here’s an example: Suppose your SaaS business’s revenue is $50,000 but you spend $40,000 on marketing, the profit from that revenue is $10,000.

Categories

You need to have a read on your business’s financial health to make informed business decisions.

Revenue and profit are the two most important metrics to get that valuable insight into your business’s financial health. These metrics help you understand your financial statements, manage your cash flows, and prepare budgets for the next month, quarter, and year.

Read on to understand the difference in revenue vs profit, how to calculate both, and how you can increase them to improve your financial performance.

Table of Contents

What Is Revenue?

Revenue (also called the top line) is the amount of money a business generates from its core business operations.

In other words, revenue refers to the money you receive from the sale of goods or services. It doesn’t include money your business generates from other sources, such as rent on company-owned property or interest on deposits.

You may also hear revenue referred to as net sales or net revenue because you subtract refunds and discounts from the total sales to get the revenue.

For a SaaS company, revenue typically includes the total amount of money users pay each month or year for using the software.

Revenue helps you understand the incoming cash flow, serves as the starting point for the budget, and enables you to project revenue run rate to get a basic understanding of your future earnings.

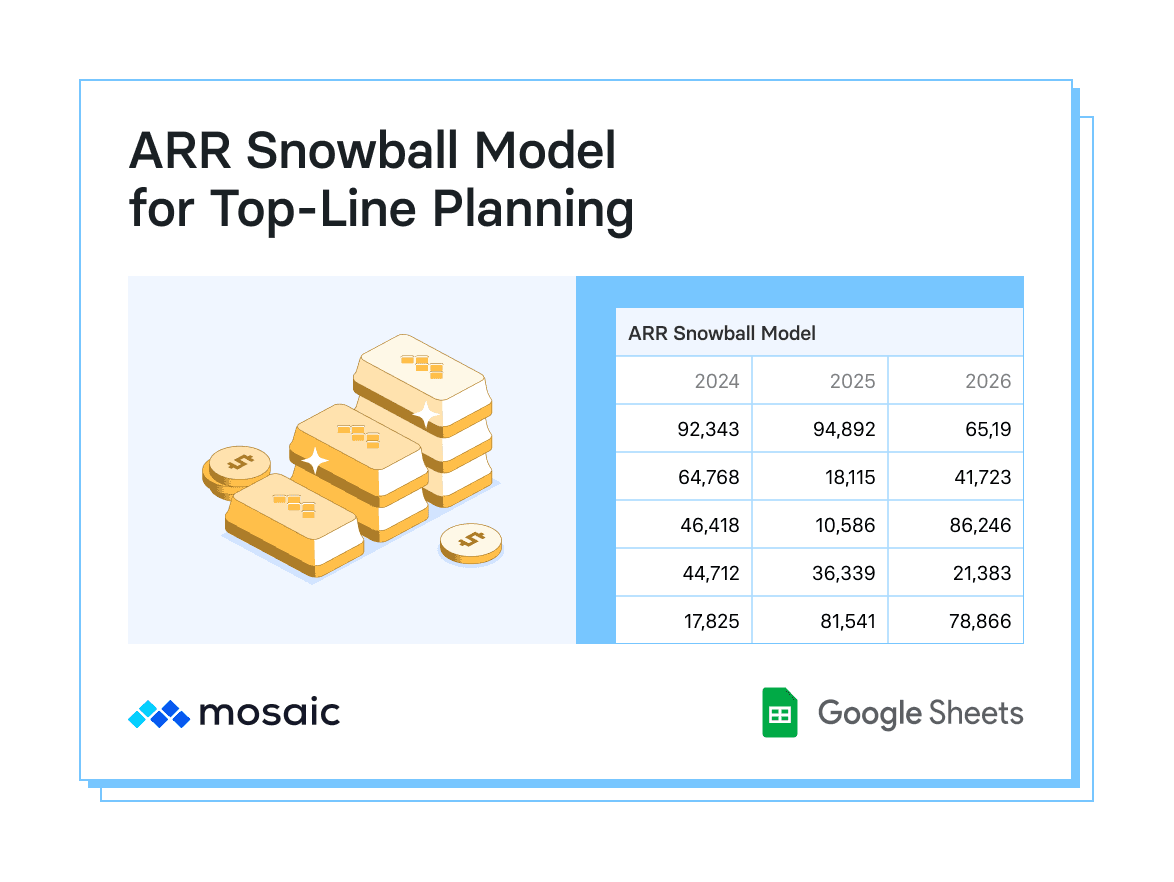

Annual Recurring Revenue (ARR)

If you’ve got long-term subscription contracts, you may also use annual recurring revenue (ARR), which refers to the expected revenue from your contracts for the year.

ARR helps you track the product-market fit and the business’s momentum in the market and benchmark your business against similar businesses.

For instance, the median revenue growth for a SaaS company with an ARR of less than $1 million was 47% in 2020 (down from 68% before the pandemic).

Are you growing faster or slower than the median? How fast or slow do you expect to grow in the future?

What Is Profit?

Profit is the amount of money a business has after paying all expenses. These expenses could include operational costs, taxes, and the depreciation of assets, which is the reduction in the value of an asset over time. Unlike revenue, profit does include income from non-business activities like rental or interest income.

However, you may need to know your business’s profitability on different levels to understand its financial health. That’s why we use several types of profits to account for different earnings and expenses.

Here are the most important types of profits you should be familiar with:

1. Gross Profit

Gross profit is calculated by deducting the cost of goods sold (COGS) from the revenue. COGS includes all direct costs you pay to offer your product or service. For instance, COGS for a SaaS company includes server costs and subscription fees.

You can also express gross profit as gross profit margin, a ratio of gross profit to revenue. With the gross profit margin, you can assess the business’s profitability and benchmark it with similar companies.

As a SaaS company, you’ve got two types of gross profit margins: subscription gross margin and total gross margin. Subscription gross margin doesn’t account for customer support expenses and lets you isolate the core service-offering expenses.

On the other hand, the total gross margin accounts for customer support expenses.

In 2021, KeyBanc surveyed senior executives of 350 SaaS companies with median recurring revenue of $8.5 million (in 2020) and found the median subscription margin to be 80% and total gross margin to be 73%.

To gauge your company’s profitability, you can benchmark the subscription and total gross margins with these numbers.

Software Equity Group recommends that healthy, privately-held SaaS businesses have a total gross margin of over 70%, but there are exceptions. For instance, if you’re a SaaS startup and providing frequent discounts, your gross margins may be lower than average for the first couple of months.

2. Operating Profit

A business incurs operating expenses to keep the lights on. These operating costs include rent, payroll, marketing, advertising, and utility costs. When you subtract these costs from the gross profit, you get the operating profit (or net operating income).

Operating profit accounts for only core business-related cash flows. It neither includes interests and taxes nor considers income from the sale of assets. That’s why the operating profit provides you with more accurate information on your business’s performance.

For example, your SaaS startup may have a high debt load eating away the profits. But if you’ve got a positive operating profit, you can rest assured you’re on the right track.

3. Net Profit

Net profit refers to your company’s actual profit after accounting for all the expenses and income sources.

In other words, you include taxes, interest on loans, any one-off payments, and positive cash inflows from non-core business operations — sale of assets and investments — in your calculations.

As it appears on the last line of your company’s income statement, net profit is also called the company’s bottom line.

VC-backed SaaS companies often have a net loss (not net profit) on their profit and loss statement at the start since they’ve significant upfront costs. However, this isn’t something to panic about if you’ve got a positive total gross profit margin.

Analyze Revenue & Profit with Strategic Finance Software

Is Revenue or Profit More Important?

By definition, profit is more important. If your SaaS product generates $100 million ARR and has negative profitability, you’ll need to find a way to turn the net income positive to generate returns for investors.

However, instead of deciding between revenue vs. profit, track both numbers to understand your company’s financial performance.

However, instead of deciding between revenue vs. profit, track both numbers to understand your company’s financial performance.

For example, revenue helps you gauge the business’s growth since revenue represents the number of subscriptions you’ve sold during a certain period. If your revenue grows consistently, you’re doing a good job growing the business.

But consider the reasons behind growth:

- Did you have to spend any money to fuel that growth?

- Did you offer discounts? If you did, how much did it cost?

- Did you run a marketing campaign?

The expenses you incurred for increasing your revenue will show up on your income statement and affect your net profit. If the net profit increased as well, your growth was profitable.

In other words, both revenue and profit provide different yet valuable insights into a business’s finances.

How To Increase Revenue and Profit

Improving top-line and bottom-line growth largely depends on having an excellent product, but having the product noticed by the right audience can fuel growth too.

Let’s talk about what you can do to increase revenue and profit.

Increasing the company’s revenue boils down to selling more. You can do so by running effective marketing campaigns, upselling your product to increase the average revenue per user (ARPU), and improving retention rates.

An increase in total revenue typically, though not always, results in an increase in profit. You can also increase profit by adding non-operating revenue by renting out a building owned by your company.

Besides that, you can increase the profitability from sales revenue by reducing costs or increasing the price. You can reduce costs for your SaaS business by finding discounted deals or getting flexible plans for server space.

On the other hand, increasing the price can backfire since the market controls the price, and the price hike may impact the demand. However, you can opt for a flexible cost structure to cater to most customers.

You can also reduce total expenses by adjusting your operating leverage, increasing productivity, and using automation.

How To Calculate Revenue vs. Profit

Calculating revenue vs. profit is simple when you know the formulas. But you’ll always need to calculate revenue first since the profit formula requires revenue.

To calculate the revenue, multiply the subscription fee by the number of subscriptions during a time period and then subtract any refunds.

Make sure to use data for the same time frame to collect revenue. For instance, if you’re calculating monthly revenue, use the monthly subscription price and the total number of monthly subscriptions.

Here, the subscription price may vary depending on different tiers (or plans). Similarly, you may offer a discount for an annual subscription. If that’s the case, multiply the different subscription fees by the number of subscribers using that plan and sum up the acquired products.

Once you have the revenue, you can calculate profit (or net profit) by subtracting total expenses (COGS, operating expenses, debts, and taxes) from total revenue and other income.

Essentially, you account for all cash inflows and outflows to reach your profit or bottom line. Here, other income includes income from investments or the sale of an asset.

Now that you know how to calculate revenue vs. profit, let’s talk about other SaaS metrics you should know as a SaaS business owner.

Additional SaaS Metrics To Consider

While revenue and profit are key metrics for any business, SaaS business owners should also look at other metrics to better understand the company’s financial health.

1. Customer Acquisition Cost (CAC)

Customer acquisition cost (CAC) is the money you spend on average to acquire one customer. A higher CAC means a company will have to retain customers for more time to get a positive return on its investment.

CAC is important for almost any industry you can think of, but more so for the SaaS industry since the SaaS business model’s profitability depends on the customer’s lifetime value.

For this reason, lowering CAC can have a visible impact on your company’s total income. Here’s how you can calculate CAC:

2. Average Revenue Per User (ARPU)

The average revenue per user (ARPU) is a useful metric for any business, especially for subscription-based businesses. It shows how much money the business gets from an average user.

As a SaaS business owner, knowing how to draw insights from your ARPU is important.

Suppose you offer 10% on new sign-ups. As more subscribers use your offer, the ARPU will decrease. But this decrease isn’t a bad sign.

However, if your ARPU falls in isolation, look for reasons users refrain from spending on your services. For instance, a new competitor may offer better premium plans, and your high-plan users may shift to that service.

Also, ARPU might increase even with subscriber loss and negative revenue growth. Make sure to use ARPU with other SaaS metrics to have a more accurate picture of your business’s financial situation.

Here’s how you can calculate ARPU:

3. Lifetime Value (LTV)

Lifetime value (LTV) or customer lifetime value (CLV) is an estimated SaaS metric that shows the total net profit the company will generate from a user throughout their relationship.

LTV helps you understand your customer’s worth and make strategic decisions regarding marketing, advertising, and revenue forecasting. For instance, a CAC of $200 may sound bad, but a corresponding LTV of $600 would make up for it.

Here’s how you can calculate LTV:

Here, the churn rate is the ratio of customers who stopped using your service to your total customers during a time frame. For instance, if you’d 1000 users during a specific year and 50 users canceled their subscription, your churn rate would be 5% for that year.

LTV, CAC, and other SaaS metrics collectively make up a crystal ball for your business. If you don’t want to spend time calculating these, you can use software that automatically aggregates financial data into a single dashboard.

See Your Profit, Revenue, and More in Real Time

Having the right set of tools can simplify managing a SaaS business. You may have a full plate and lack time to calculate these metrics, but looking at these metrics is important.

With Mosaic’s Strategic Finance Platform, you’ll have access to your revenue and profit numbers in real-time. You can use the dashboard to get accurate financial data when you need it and make decisions more efficiently.

Reach out for a personalized demo to see how Mosaic’s Topline Planner can help plan your revenue growth.

Revenue vs. Profit FAQs

Can profit be higher than revenue?

Theoretically, net profit can be higher than revenue when a company’s income through non-core business operations, such as the sale of investments, temporarily exceeds operating costs. For example, if a business earning $50,000 in revenue with operating costs of $10,000 sells assets worth $20,000, their net profit of $60,000 would exceed revenue.

How much of revenue is profit?

What is a good annual revenue?

Explore Related Metrics

Own the of your business.