Categories

Sales funnel metrics, including sales velocity, conversion rates, sales cycle lengths, and average deal sizes, often serve as the lifeblood of a SaaS business. However, many companies remain unaware that a prospect’s initial interaction with the company sets the stage for these critical metrics.

Sales velocity extends beyond mere numbers — it requires companies to understand the psychology of their prospects. That’s because how a lead or account enters your sales pipeline is a subtle yet powerful indicator of their buying intent and proximity to a decision.

By paying close attention to how different entry points correlate with sales velocity metrics, SaaS businesses can make data-driven decisions, fine-tune their marketing and sales strategies, and adapt to evolving customer behaviors.

Table of Contents

Sales Velocity Formula + Calculator

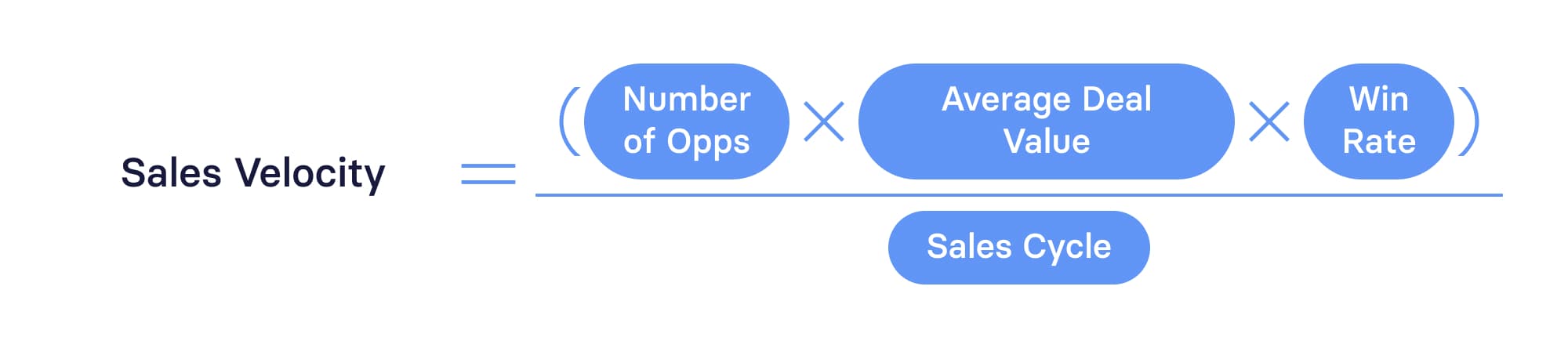

Sales velocity is calculated by multiplying the total number of opportunities by the average deal size and conversion rate and then dividing that result by the sales cycle length. Here’s the formula:

Sales Velocity = (Number of Opportunities) x (Average Deal Size) x (Conversion Rate) / (Sales Cycle Length)

For example, if a SaaS company has 100 opportunities, an average deal size of $1,000, a conversion rate of 20%, and a sales cycle length of 60 days, the sales velocity would be:

Sales Velocity = (100 opportunities) x ($1,000 average deal size) x (20% conversion rate) / (60 days) = $33,333 per day

So, on average, the company generates $33,333 in revenue each day from its sales efforts.

Sales Velocity Calculator

Your Sales Velocity

$0

Number of Opportunities

Number of opportunities refers to the total number of deals or high-quality leads in the sales pipeline. Typically, these opportunities include qualified prospects interested in the SaaS product.

Sales velocity is ultimately about how quickly a company can generate revenue from its sales efforts. The more opportunities a company has in its pipeline, the higher the potential for revenue generation. So, think of the number of opportunities in the sales pipeline as a reflection of the pipeline’s health — a steady pipeline indicates sales teams actively engage with prospects to maintain consistent revenue streams.

Average Deal Size

Average Deal Size (ADS), or average deal value, signifies how much a business makes for each successfully closed deal. Typically, this is calculated on a monthly or quarterly basis. ADS is a key performance indicator (KPI) that offers businesses valuable insights into essential aspects of their sales processes and trends within their sales pipeline metrics.

For instance, leveraging ADS insights can help refine your sales tactics, evaluate the performance of your salespeople, and determine the price point at which prospects are most likely to convert. To gauge your business’s performance, compare ADS insights with industry benchmarks.

Conversion Rate

Sales conversion rate (also known as win rate) represents the proportion of successfully closed-won deals relative to the number of opportunities. The sales funnel conversion rate helps evaluate the effectiveness of marketing and sales efforts, shedding light on how customers perceive the product or service’s value. Plus, sales conversion rates can help you uncover the cause of closed-won and close-lost deals.

Sales Cycle Length

Sales cycle length represents the average time moving a prospect from the initial contact or lead stage to a closed deal in a given period. A shorter sales cycle can often lead to higher sales velocity and vice versa. Knowing the length of your sales cycle can help you with sales forecasting and project revenue more clearly.

Although the number of days in a sales cycle varies based on the industry, product, and price, in SaaS, the average sales cycle is 84 days.

How to Interpret Sales Velocity

Sales velocity is just the start of the story. The key lies in your interpretation of the numbers, which can guide business decisions. For example, a high sales velocity suggests that your sales reps efficiently convert qualified leads into customers with a healthy and productive sales process.

Conversely, a lower sales velocity could surface bottlenecks or inefficiencies in the sales process that require your attention. You can better pinpoint the source of any inefficiencies by analyzing sales performance metrics, particularly those impacting sales velocity, such as conversion rates, average deal size, and sales cycle length.

For example, if your conversions are low, you may need to refine the lead qualification process, or a lengthy sales cycle might indicate a need to streamline sales operations. Accurately interpreting sales velocity can help you make informed decisions, optimize marketing and sales strategies, and drive revenue growth.

Get The Sales Capacity Model Template

4 Tips for Improving Sales Velocity

Now that you understand the calculation of sales velocity, the next question is: How can you make it better? There are four proven methods that generally work for most businesses, including those in SaaS.

1. Streamline the Sales Process

An efficient sales process is frictionless and accelerates the journey from lead to customer, shortening the sales cycle. So, streamlining the sales process is in the company’s best interest.

For example, eliminate unnecessary steps, automate routine tasks, and improve lead qualification to free up your sales team’s time to focus on high-value areas, such as follow ups with warm prospects. This targeted approach increases conversion rates and enhances the customer experience, potentially resulting in referrals for your product or service.

By streamlining the sales process, the company saves time and resources while aligning more with the fast-paced nature of SaaS, where agility often plays a pivotal role in gaining a competitive advantage.

2. Improve Conversion Rates

Conversion rates play a pivotal role in improving your sales velocity. Here’s how: high conversion rates mean a more efficient utilization of leads and prospects, leading to faster revenue generation.

SaaS companies can increase the number of closed deals within a specific period of time by optimizing conversion processes, including lead nurturing, trial-to-paid conversions, and onboarding. The impact extends beyond sales velocity and significantly affects the bottom line.

Additionally, a good conversion rate signifies that the sales team effectively identifies pain points and engages with the right prospects aligned with your ideal customer profile (ICP).

3. Increase the Number of Opportunities

A larger pool of opportunities means you have a more extensive and active sales pipeline, making your sales team more likely to close deals quickly. Moreover, the company benefits from multiple potential revenue streams, placing it in a healthy financial position.

When the number of opportunities is high, sales teams can consistently engage with a diverse range of prospects and quickly identify those highly likely to convert. The outcome? Shorter sales cycles and faster revenue generation.

To boost the number of opportunities and maintain a healthy flow, companies should continuously expand the top of the sales funnel and optimize lead generation efforts.

4. Enhance the Average Deal Size

Deal sizes directly contribute to revenue with each closed deal, so larger deal sizes result in a more substantial revenue stream over time. So, how can companies enhance deal sizes? Sales teams should focus their efforts on strategically upselling or cross-selling to existing customers to maximize the value of each transaction.

In reality, focusing on increasing deal sizes often goes hand in hand with delivering greater value to customers, ultimately improving customer satisfaction. When customers are happy, it can lead to additional referrals and upsell opportunities.

This approach reduces the company’s reliance on constantly acquiring new customers, switching the focus to customer retention and revenue expansion.

Finding Sales Velocity in Mosaic

Mosaic’s Metric Builder comes with a preloaded set of metrics usually specific to SaaS businesses. However, what truly sets Metric Builder apart is that finance teams can build and track metrics unique to their company’s nuanced needs, whether sales velocity or something else.

With Metric Builder, it’s easy to create custom metrics, define them using a familiar spreadsheet-like formula, and leverage data or metrics from multiple data sets as building blocks for your financial calculations. The best part? There’s no need for coding.

Here’s how it works:

Users can easily use existing metrics as the foundation for calculations within the formula metrics section, starting with a list of available metrics. From there, the formula view offers additional options for each building block, allowing you to customize aliases, adjust date rollups, and apply filters as needed.

For example, suppose you want to focus on sales velocity. In that case, you can add a filter to include only opportunities from existing customers (from upsells or cross-sells) in your metric calculation. Once you’ve defined your custom metric, hit save — that’s it. Now, you can easily use these sales metrics across all financial planning and analysis aspects.

With Mosaic’s Metric Builder, calculating sales velocity has never been easier. To see Metric Builder in action, schedule a demo.

Sales Velocity FAQs

Why is sales velocity important for my business?

Sales velocity is essential because it offers insight into how fast your business makes money, helps streamline operations, and indicates if your company is keeping up with the market. This way, you can set growth targets, improve efficiency, and stay competitive.

How does Mosaic assist in improving sales velocity?

How is sales velocity different from conversion rate?

Explore Related Metrics

Own the of your business.