How Qwick Uses Mosaic to Build a Culture of Financial Collaboration

“Mosaic is helping us raise the financial acumen of non-finance team members across the company. We have about 40 company users in Mosaic and it’s opening up a lot of eyes to how our finances work. We’re taking financial data and making it make sense to them.”

Zack McCarty

Director of FP&A

About Qwick Technologies

Qwick is the professional platform at the heart of hospitality that matches experienced industry freelancers with shifts at restaurants, hotels, caterers, stadiums, and more. As the leading staffing platform solely dedicated to serving the hospitality industry, Qwick gives businesses the flexibility to fill shifts in real-time with qualified staff, while empowering freelancers to work when and where they want.

The Challenge

Building for Growth

Eliminating Unnecessary Roadblocks

As a startup in high-growth mode, Qwick and its finance leaders knew it was time to evolve their tools and processes to properly support their growing operations. When Zack McCarty, Director of FP&A, came into the role all of their financial modeling was being done in Google Sheets and built on high level assumptions.

They had to source key revenue and expense detail from multiple disconnected systems (namely Quickbooks, Salesforce, ADP, and Divvy). They did their best to manually stitch it all together, but this approach left them with several major problems that impacted some of their most important deliverables.

- Prepping board financials was a week-long process of dumping reports from various places and piecing it all together in the right format.

- During fundraising diligence, they spent dozens of hours triple-checking their work to make sure there weren’t any errors.

- They could only update metrics like CAC and LTV on a quarterly basis as it took hours to build them out each time.

- Revenue and cash forecasts were extremely high level, far from the precision they ideally wanted in their financial projections.

”We were trying to figure out how to better forecast our revenue and expenses, but didn’t have a tool that plugged everything into one place. We quickly realized if we wanted to get more intelligent about the way we forecast our business, we needed a tool that could help us do that.”

Zack knew there was a huge opportunity here to uplevel the finance team’s impact while also building a culture of collaboration by improving their ability to translate financials into a context that non-finance department leaders could understand and turn into action. They just needed the right tools to help.

The Solution

Up-Leveling the Finance Team

Finding the Right Solution

What sold Qwick on Mosaic was the perfect balance of guided functionality, fast time to value, and an intuitive user experience that put them in control. Zack and team looked at a number of tools in the market, including some of the large enterprise solutions.

“After doing the demo with Mosaic, we realized that everything we loved about the big up-market solutions… Mosaic does it too. Combined with the fact that Mosaic is much more user friendly for a company of our size and the price tag was not even close to the same. So it was an absolute no-brainer to go with Mosaic.”

“Other tools we looked at didn’t give us much ownership to build things ourselves. We really liked how everything in Mosaic was set up for us to really build and explore on our own.”

Improving Fundamental FP&A Workflows

Within the first few days on Mosaic, Qwick had set up direct data integrations with all the key systems in their tech stack — Quickbooks for financials, Salesforce for pipeline data, ADP for headcount, Divvy for expenses, and Snowflake for LTV, CAC, and more. With live data automatically flowing into Mosaic for instant analysis, the next goal for Zack and team was to rebuild their financial model from the ground up.

They determined the best forecasting method for every line item on the P&L. They established which expenses should use a historical run rate, a per head driver, or a manual input for known and predictable expenses such as rent. Then they stress-tested each one to see how accurately it predicted real results.

Next, they focused on scenario planning. Using Mosaic’s 3-statement modeling tools, they were able to quickly spin up multiple scenarios to ask and answer questions such as “what would accelerated hiring look like?”, “what does no hiring look like?”, and “what’s the impact on cash burn and runway?” What used to take Zack and team hours or even days, now takes minutes in Mosaic.

Finally, the integration with Snowflake alongside Mosaic’s Metric Builder completely revolutionized how they’re able to combine different sources of data into meaningful metrics.

“Every month we were coming out with new forecasts and explanations on what happened in the prior period. And we were realizing that the information just wasn't landing the way we thought it should. Then it hit us...it's because no one is in the finances like we are.”

Building a Culture of Financial Collaboration

After Qwick really “got their groove on with Mosaic” as Zack puts it, the next priority was to bridge the gap between what the finance team knows about the company’s finances and what everybody in the company knows.

“Every month we were coming out with new forecasts and explanations on what happened in the prior period. And we were realizing nobody understands what we’re talking about at all. Because no one is in the finances like we are.”

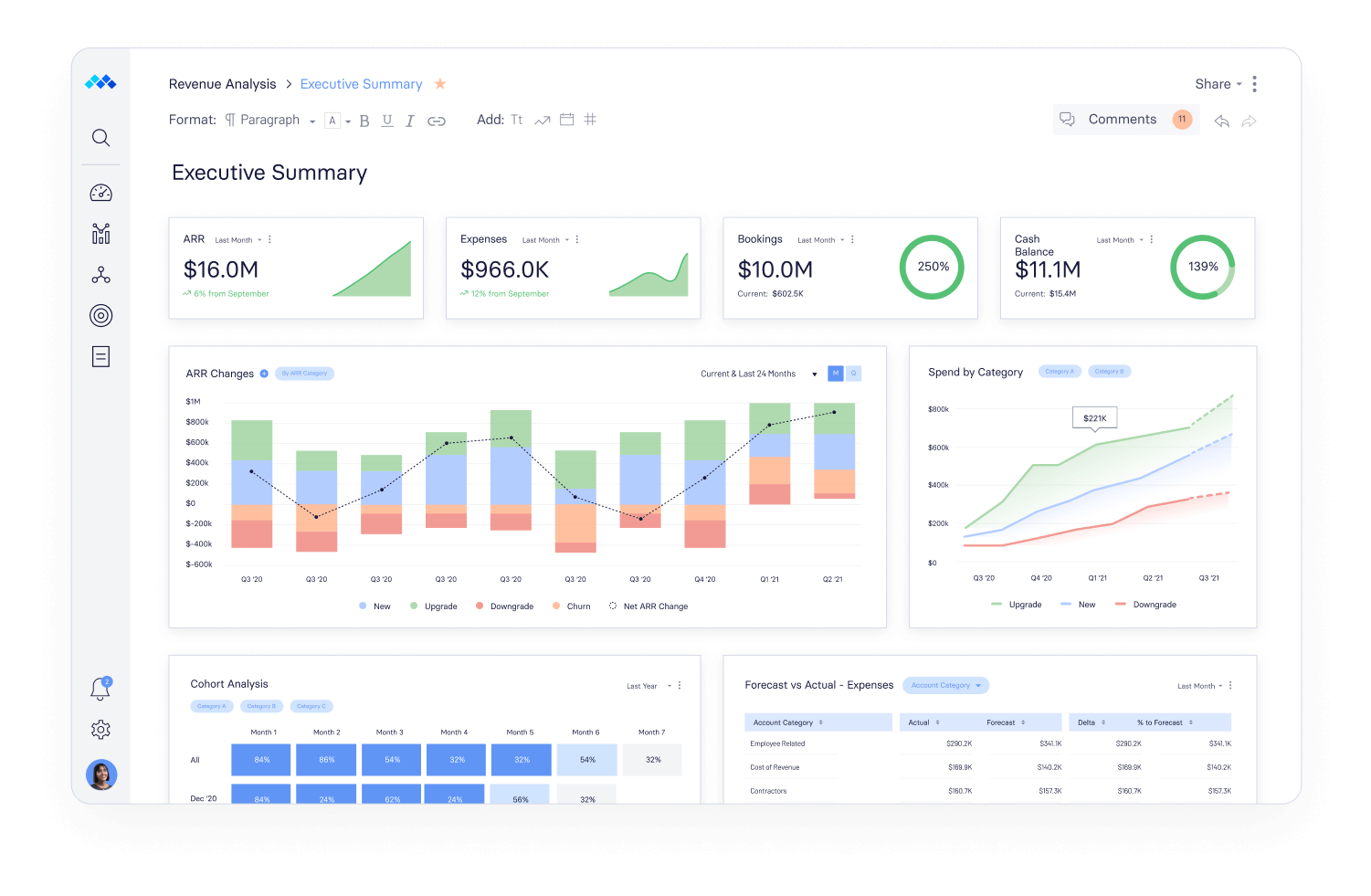

So, Zack and team got to work building department-level dashboards in Mosaic for each business unit and budget owner and populated each with the metrics and analysis relevant to that particular department.

Each dashboard presented a combination of financial and operational performance results that clearly mapped to the strategic goals and plans of each department. Plus, the team used commentary directly on the canvases to translate the financial results into a business conversation.

The Impact

Elevating the Company’s Financial Intelligence

A Game-changer for Finance

Mosaic is already paying huge dividends for Zack and team and enabling them to engage in the kind of strategic work they’ve always aspired to.

The visibility into spend allows the team to thoughtfully track how they are contributing to the bottom line of the company. The real-time feedback is helping drive decisions on where to invest and where to stop investing. It’s allowing them to approach business problems with a deep, data-driven financial understanding versus relying on high-level assumptions.

Bringing Business Leaders into the Financial Fold

Qwick now has 40 departmental leaders using Mosaic on a regular basis. Zack ran a quick training session on the Mosaic basics, and then his budget owners were off and running. Now, VPs across the company have started to show these dashboards to their team members and leading financial discussions on their own. The result is a viral effect where leaders request more insight from finance, finance builds more specific canvases to answer unique problems, and more people in the org buy in.

The impact is extending all the way to the board and investors. Now instead of spending weeks preparing board packages in Google Sheets and Slides, they’re having their board members log directly into Mosaic to see the information in real-time whenever they want to see it.

Zack also created a company-wide “Financial FAQ” canvas where everybody can see key financial metrics such as Average Revenue per Shift, Average Profit per Shift, Customer Acquisition Cost, Lifetime Value, and Spend by Category. This has aligned everyone on the most important metrics and raised the financial IQ of team members across the organization in the process.

Own the of your business.