It’s planning season, and many software-as-a-service (SaaS) businesses are knee-deep in financial forecasting. While some businesses may already use rolling budgets to document these forecasts, this kind of quarterly or monthly check-in can only go so far when you need a holistic view of your finances.

That’s where annual budgeting can bridge the gap. The annual budgeting process will yield a complete 12-month financial roadmap to help meet your strategic goals.

Here’s why the annual budgeting process is still critical to business health even in an age of increasingly agile planning — and how to run your process effectively.

Table of Contents

What Is Annual Budgeting?

Annual budgeting is a detailed plan for a company’s upcoming expenses and income for the fiscal year ahead. When creating an annual budget, a company will stack up its expenses against its expected income for the next 12 months or calendar year to ensure the two are balanced.

Compare that to an annual operating plan (AOP), which is a holistic blueprint of a company’s short- and long-term goals plus the strategies and initiatives that’ll help them get there. A typical AOP includes targeted KPIs and operating budgets that make it easier for companies to divvy out resources to reach those goals.

Essentially, a company’s business strategies outlined in its AOP guide how to allocate funds as part of its annual budget.

This isn’t to be confused with a rolling forecast. As aforementioned, some businesses may already perform this kind of monthly or quarterly projection for their budgeting process. This type of budgeting allows companies to be more financially agile because they update their forecast every 30 or 90 days — so, businesses can quickly pivot if unexpected expenses or market conditions impact their budget.

Get the SaaS Financial Model Template

Step-by-Step Guide to the Annual Budgeting Process

While economic growth may slow in Q4 2023, interest rates are projected to stay put. And that translates to more challenging conditions for raising new funding. However, revamping your annual planning process can keep you positioned to tackle unexpected obstacles ahead.

Take a hard look at your current annual planning process. While the foundation is likely strong and should remain the same, making some adjustments can make your budgeting more efficient and help your company remain financially steady despite any turbulence.

Gather Previous Years’ Financial Data and Insights

The first step in the annual budgeting process is pulling crucial data points on your organization’s performance. These metrics allow you to tease out previous performance trends and establish a benchmark from which you can forecast your income and expenses for the months ahead.

You’ll need to collect data points from across your organization, and while every SaaS business’s success metrics will be a bit different, start with info like:

- Previous budgets (monthly, quarterly, or annual)

- Income statements or SaaS P&L for the last few years

- Total spend by department, broken into major expense categories

- Consistent spending categories (i.e., things your team pays for over and over)

- Inconsistent spending categories (i.e., major one-off purchases that could be potentially cut back in the year ahead)

- Liabilities

- Revenue, income, and sources

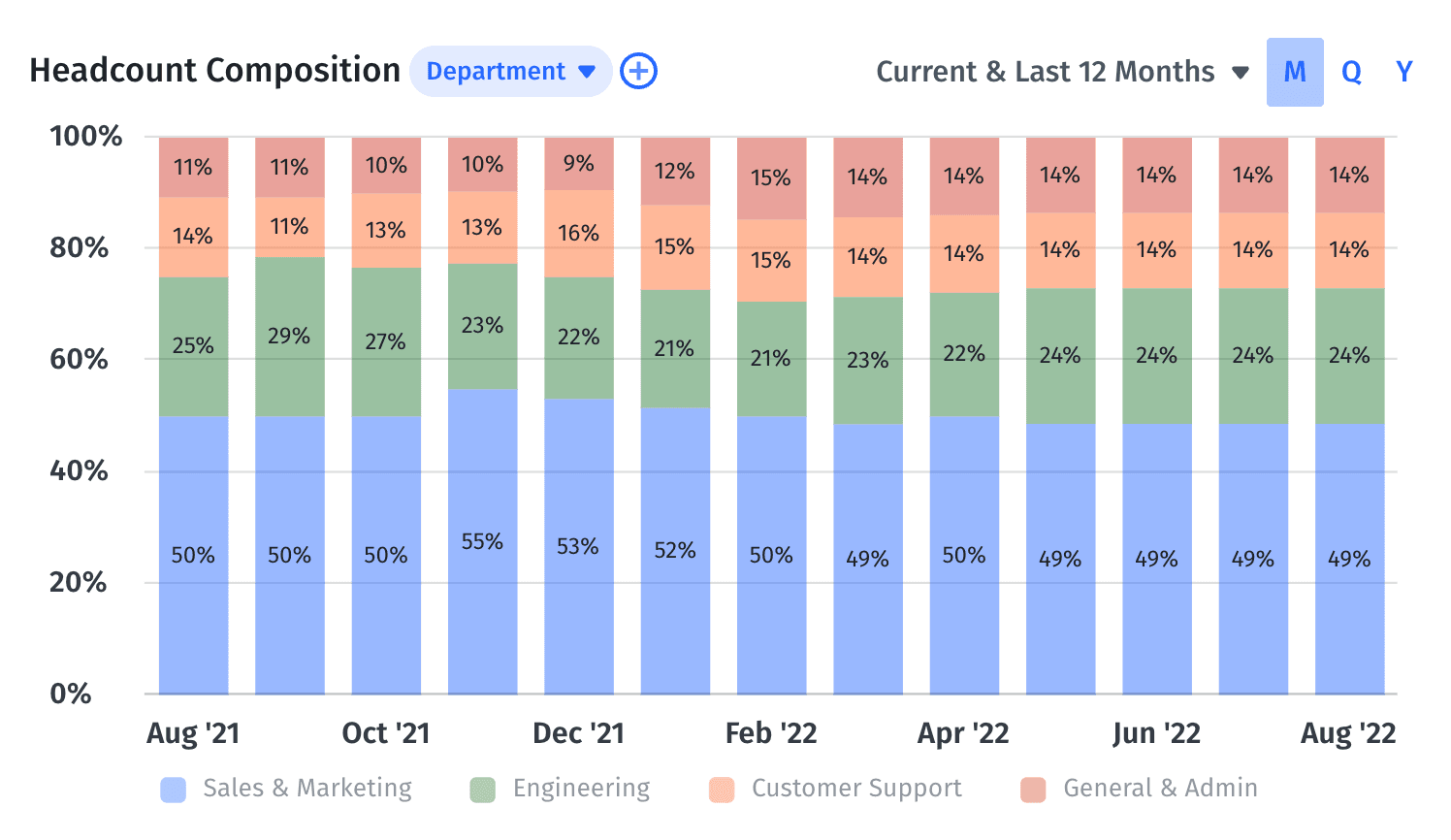

- Current total headcount, broken down by department

With these insights in hand, you can begin to shape your budget forecast. Leverage these data points to inform what successful initiatives to double down on and which inconsistent performance channels to put on the back burner.

Set Clear Objectives for the Year

Once you’ve established a baseline with previous performance insights, create overarching financial goals you’ll reflect in your annual budget.

In this phase, you’ll set objectives for how much you want to grow your income and/or cut your expenses. That could take shape as increasing revenues 5% year over year, or cutting liabilities in half over the next 12 months.

When establishing your bets for 2024, err on the side of realistic optimism.

“A lesson I learned from the previous year was to start with conservatism. It's better to kill your goals and knock them out of the park versus come well short... We're going to go into 2024 planning with a much more realistic approach because it's much better to be hitting your plan every month and the board seeing that than having to answer why you're missing.”

Adjust for Market Changes, Trends, and Unexpected Expenses

While it’s impossible to account for every factor that could impact your budget, you can account for some known-unknowns — think market trends and one-off expenses.

For example, while some financial experts are backing off recession predictions for 2024, inflation is still impacting consumer spending habits. While businesses may not have to completely recession-proof their business, a soft market could still affect your income and spending. So, account for this in your forecast.

You can also review your spending in the last few years to find major one-off expenses. Is all the spending in this category going to recur in 2024 (and accounted for in your budget)? Or can some of these expenses be deprioritized?

To adjust your annual budget for this and more “what-ifs,” lean into scenario planning. This kind of what-if financial modeling allows your team to understand how different versions of the future could impact your growth. So, you can model out what an ongoing soft market will do to your budget and make adjustments.

When you can stress-test your financial forecasts, you can prepare for more possibilities down the road.

Allocate Budgets to Different Departments

When creating your forecast for your annual budget, drill down to the department level. Breaking out your budget this way designates a set amount from the general fund for teams to use to meet their specific goals and implement initiatives.

This kind of budget allocation also breaks down department spending into categories like software, marketing campaigns, contractor help, and new headcount.

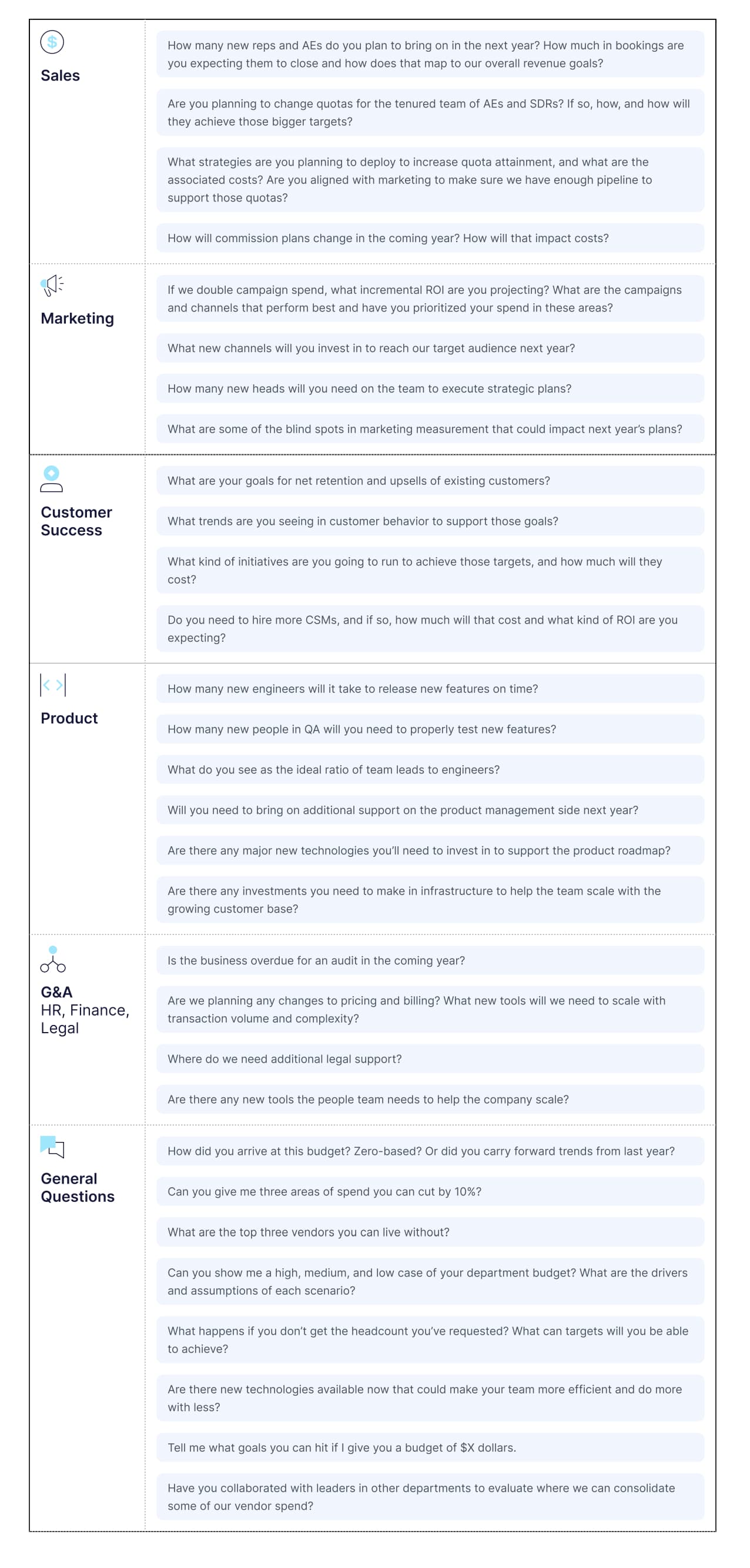

To nail down your departmental budget allocation, start by:

- Hosting meetings with department and other business leaders to discuss the goals, strategies, and major projects that ladder up to their budget

- Getting a sense of future headcount for each department

- Understanding new growth channels each department wants to invest in

- Working through department-level scenarios via modeling (i.e., what does revenue look like if your sales team hits 100+% of their quota? What about at 50% of their quota?)

Use the following sample questions to break down each department’s goals and needs to inform their budget allocation.

Integrate Monthly Rolling Budgets into the Annual Plan

A common critique of annual budgeting is how quickly it becomes outdated. You’re forecasting revenue and expenses for the upcoming year — it can feel like you’re trying to guess at the future using a crystal ball. Factors outside your control inevitably pop up and can wreak havoc on your budget. So, your forecast may feel doomed to be inaccurate from the start.

That’s why it’s important to establish regular check-ins to compare your actual performance and macroeconomic conditions against your projections. Monthly rolling budgets provide the opportunity every 30 days to assess your progress and pivot if needed.

Although it might feel redundant to use both budgets, these forecasts boast different benefits. An annual budget is your map for a long road trip. It outlines where you start, where you want to end up, and what you hope to do along the way. Whereas a monthly rolling budget is like a periodic check-in at rest stops on your journey. You make sure you’re on track to reach your destination, assess factors like traffic and weather, then adapt your route accordingly.

During the rolling budget period, review your actuals against your annual budget projection for that month. Make adjustments for line items like additional headcount or unexpected expenditures. Collaborate with department leaders to discuss your performance and update your strategies accordingly. And dig into deeper conversations about how changes in spending can help you meet your yearly goals.

So, pair the power of the holistic view of an annual budget with the agility of a rolling budget so you can review, refine, and reforecast throughout the year.

Annual Budgeting Benefits and Challenges

While planning out an annual budget can be time and labor-intensive, the advantages of a 12-month forecast far outweigh the drawbacks. It’s also easier to temper the impact of annual budgeting’s challenges if you implement a few strategies and tools to help.

Benefits

Annual budgeting boasts a wealth of benefits for SaaS businesses. Not only is an annual budget a forcing function to regularly review critical financial data, but it also provides guidance for your company as you move through the next 12 months. In short, annual budgeting helps you:

Build a holistic view of financial health.

Creating an annual budget prompts you to get (and stay) organized. To inform your annual budget, you’ll collect a variety of historical data points that paint a picture of your company’s financial well-being. You’ll leverage that data to plan a budget that encapsulates your financial status quo plus how you expect your financial health to fare over the next 12 months.

Strategically allocate resources.

When you know what your income and expenses will be for the next 12 months, it’s easier to allot financial and human resources to departments and initiatives that best support your business’s growth goals.

Improve financial forecasting.

As you gather data in your budget planning process, you can tease out trends, what worked, and what didn’t over the last year. You’ll use those learnings as you establish strategic business goals for the year ahead to build a better, more accurate forecast.

Challenges

Although annual budgeting offers plenty of advantages, this type of financial forecasting also comes with some drawbacks. However, you can temper the effect of each with some simple solutions. With annual budgeting, you’ll find that:

Collecting data is time-consuming.

Gathering dozens of financial data points to inform an annual budget is tedious and takes up precious time you could spend on strategic work.

Solution: A platform like Mosaic can help you stay on top of all that data. Rather than digging through dozens of different reports, Mosaic automatically tracks every trend so all your important custom metrics are right at your fingertips.

It’s difficult to be accurate.

When forecasting a company’s income and expenses for next year’s budget, it’s tough to get it right. Many teams overestimate their revenue and underestimate their upcoming expenses, which throws off the accuracy of the entire budget.

Solution: A tool that offers financial modeling can help you create more accurate forecasts. Platforms like Mosaic use real-time data to help you model out every what-if scenario — that way, you can factor them into your annual budget for better accuracy.

Annual budgets quickly become stale.

Even when you work hard to create an accurate budget, unexpected issues arise. The market can soften or sudden supply chain issues can crop up — all of which impact your expected revenues. So, annual budgets can quickly become obsolete.

Solution: Perform regular reviews and adjustments via monthly rolling budgets. That way, your annual budget reflects current realities and can still serve as an accurate financial plan for the year ahead.

Myths and Truths of Annual Budgeting Revealed

While annual budgeting is crucial for businesses, particularly SaaS companies, a few common myths plague this process.

Myth: You Don’t Need Annual Budgeting If You Use Rolling Budgets

While monthly rolling budgets are important periodic touchpoints for teams to assess their progress, that doesn’t mean SaaS companies don’t need an annual budget as well.

As mentioned earlier, annual budgeting gives organizations a more holistic view of their financial health. You can better track trends and long-term shifts that are easy to miss when you’re only looking at the next 30 days.

Myth: Annual Budgeting Is Too Resource-Intensive

Although the annual budgeting process does take time and resources to execute properly, planning doesn’t have to take up all your bandwidth for months. You can complete the annual budgeting process in about six weeks, particularly if you’re using real-time business budgeting software like Mosaic to automatically collect the right data, model out what-if scenarios, and collaborate on your budget with other teams.

Myth: I Have Too Little Data to Inform an Annual Budget

It’s true that the annual budgeting process requires plenty of data to establish a baseline for your 12-month forecast. However, organizations likely have too much data rather than too little — so, it’s easy to get overwhelmed when sifting through the mountains of information.

However, a financial analysis platform can assume much of that burden. A comprehensive finance tool can help you monitor the metrics that matter in real-time so you spend 70% less time on data aggregation. A customizable analytics dashboard ensures you have all the right success metrics at your fingertips and seamlessly track your performance against your organization’s goals.

Bust Budget Myths with the Right Tool

Each company’s financial needs are unique. Every organization will have its own top-priority success metrics, its own distinct goals for the year ahead, and ideas on how to achieve those objectives. Planning via annual budgeting is an effective way to create a tailored roadmap that incorporates those needs — and Mosaic can make that planning process easier. Request a demo today.

Annual Budgeting FAQs

What's the primary difference between monthly rolling budgets and annual budgets?

With monthly rolling budgets, businesses update their budget every 30 days. Updating their financial plans regularly allows companies to be more agile — they can adjust forecasts based on the latest data, market changes, or new trends affecting their business.

On the other hand, an annual budget focuses on a broader view of a company’s finances. With this type of budget, a company projects its income and expenses to create a budget for the next 12 months.

How does Mosaic help in streamlining the annual budgeting process?

Is there a risk of the annual budget becoming obsolete or redundant as the year progresses?

Own the of your business.