The process of raising SaaS funding is often all-consuming. You’re in a constant process of connecting with new investors and fielding requests for information seemingly 24/7.

Some investors will inevitably request information that requires some ad hoc analysis or quick updates to your main deck. But if you take the time to prepare crucial information like administrative basics, performance metrics, and financial forecasts to share on the fly to any investor, you’ll make a much better impression with investors.

Here are the different investor documents you should have on hand, ready to go as you start seeking funding.

Table of Contents

5 Key Documents to Satisfy Any Investor

Every investor will want to see an array of information on your company’s performance, status quo, and plans for the future. And while some investors may want a tailored packet of details on your startup, you can prepare the bulk of your financing documents ahead of time.

Compile the following essential documents as a startup competing for investor funding.

1. The Administrative Basics

While the first round of documents is a laundry list of fairly straightforward legal and administrative paperwork, it’s a crucial starting point. So, it’s wise to have these on hand at all times.

- Info on prior investments: Compile all your investor rights agreements (IRAs), preferred stock purchase agreements (SPA), disclosure schedules for SPA, voting agreements, and right of first refusal documents.

- Incorporation certificate: Get your legal certificate of incorporation together, along with essential info on rights, privileges, preferences, and restrictions of your company’s stock.

- Cap table: Include a list of all your major investors, shareholders, board observers, board of directors, and the option pool.

- Customer and vendor contracts: Have your top 10 customer and vendor contracts in your packet so potential investors can understand the ins and outs of your terms in both relationships.

- Signed agreements: Bring along any binding legal contracts like leases and settlements.

2. Financial Model

Prospective investors want a deeper understanding of your company’s current performance and where you expect to be in the next few years.

Include a comprehensive financial forecast for 3-5 years out, complete with multiple scenarios modeled out. Ensure you provide a forecast that includes your funding raise and how the company would benefit over time from that capital.

In your forecasts, include data points like:

- Top-line growth

- Headcount metrics

- Expenses

- Balance sheet components, particularly net burn

The goal of your financial forecasts is to be clean and easy to understand — so, keep your fp&a models sleek and simple for prospective investors. To help potential investors discern your financial assumptions, give them additional context during the due diligence process. Add a brief narrative to your forecasts. That way, your thinking around inputs and performance models will be crystal clear.

3. Historical Monthly Financials

Once the basics are out of the way, an investor will want to see the nitty-gritty of your company’s finances. To dive deeper into your company’s financial health, show them what you’re currently spending and how you’re spending it.

Provide financial transparency with investors by providing:

And while compiling account-level reports for each of these is a solid start, also include reports on spending by department. Break down expenses for sales and marketing, research and development, as well as general and administrative costs. That way, it’s easier for investors to understand the structure of your organization, visualize how you can scale, and where it makes most sense to allot their funding.

4. Investor Pitch Deck

You can’t successfully pitch prospective investors without a strong presentation. And an effective funding presentation hinges on a persuasive pitch deck.

In your presentation, center your narrative around the company’s future. Discuss your business plan through the lens of future growth so investors can picture where the company might be five or 10 years down the line.

While you’ll want to tailor your pitch deck to cater to potential investors, a strong presentation will have some common elements, including:

- An executive summary. Explain the “why” behind your company. Define what problem exists in the market and how your company addresses that specific pain point.

- Market size. Outline the potential market for your service or product. This includes data points like market growth, market size, and total addressable market (TAM).

- Competitive insights. Highlight your direct competitors and your company’s place in the current landscape.

- Product roadmap. Lay out the milestones for developing your product or service. For early stage startups, this often looks like a timeline for hiring engineers, working with them to create the product, and then launching it.

- Financial and operational metrics. List important go-to-market metrics like expense composition, customer retention metrics, and sales performance metrics. Also add operational data points like headcount, employee ramp to productivity, and system efficiency.

- Revenue model. Outline your SaaS pricing strategy.

- Financial forecasts and fundraising goals. Clearly state how much capital you’re seeking and what your company could accomplish with that amount.

- Founder and team info. The team makes the company — so investors will want to ensure the founder and team are well-equipped to do the work successfully.

5. Investor Updates

An investor signing on the dotted line is by no means the finish line: from then on you’ll need an investor communication strategy that keeps them in the loop and ensures you stay aligned. That’s where investor updates come in.

Investor updates highlight news and key info about your business. They’re typically comprised of a few sections like a message from your executive team, important performance metrics, a financial health check-in, and news on any product milestones.

Send these updates at least once a month, if not more often. Communication is key to forging strong investor relations. After all, investors can offer far more than just funding — they can also share their expertise and introduce you to strategic contacts in their network who could help your business down the line.

Important Metrics to Share With Investors

Investors will need insights into your company’s financial and product performance metrics. But that doesn’t mean you should inundate them with a lengthy list of data points. Instead, focus on the metrics that will matter most to them.

Revenue by Month, by Customer

The first financial metrics a potential investor will want to see are your company’s annual recurring revenue (ARR) and monthly recurring revenue (MRR). These numbers represent your total revenue from customer contracts over specific time periods — in this case, a monthly report and an annual report (a TTM report might also be handy).

These two metrics give your investor a 10,000-foot view of your revenue and overall growth over time. But you can also offer a deeper level of granularity with a view of MRR/ARR by customer cohort.

Providing details of ARR/MRR by customer cohort establishes the growth or decay of these groups over time, which gives investors insight into your retention numbers and customer lifetime value.

Win Rates and Sales Cycles

Your investor will want visibility into your sales processes to understand what’s working, what isn’t, and what might scale well in the future (particularly with the help of a little funding).

To achieve this kind of transparency, provide a report of your win rates over time and your average sales cycle period. Also, list some of the top reasons deals were closed-lost so venture capitalists (VCs) can understand why prospective customers ultimately passed on your product.

To offer some additional context, include a narrative that demonstrates how your organization has fared during recent economic volatility. For example, if your sales remained steady while the overall economy softened, that’s worth mentioning.

Pipeline Generation by Channel

Providing a channel-level breakdown of pipeline generation demonstrates you can trace your revenue and growth back to specific sources. That way, you can focus your investor’s dollars on the most successful channels.

Include a review of all inbound sales channels, like PPC, paid social, and organic search, plus outbound channels.

Net and Gross Dollar Retention

In your report, ensure you add net and gross dollar retention. Specifying both establishes how well you’re retaining customers over time.

To offer further insights for your investors, dig a little deeper with both metrics. For example, you can include your overarching net and gross dollar retention metrics, and also group both by customer cohort to make it easier to follow their buyer journey.

You can also take it a step further by breaking down retention data points by relevant customer characteristics. Think industry, company size, support tier, and other germane attributes.

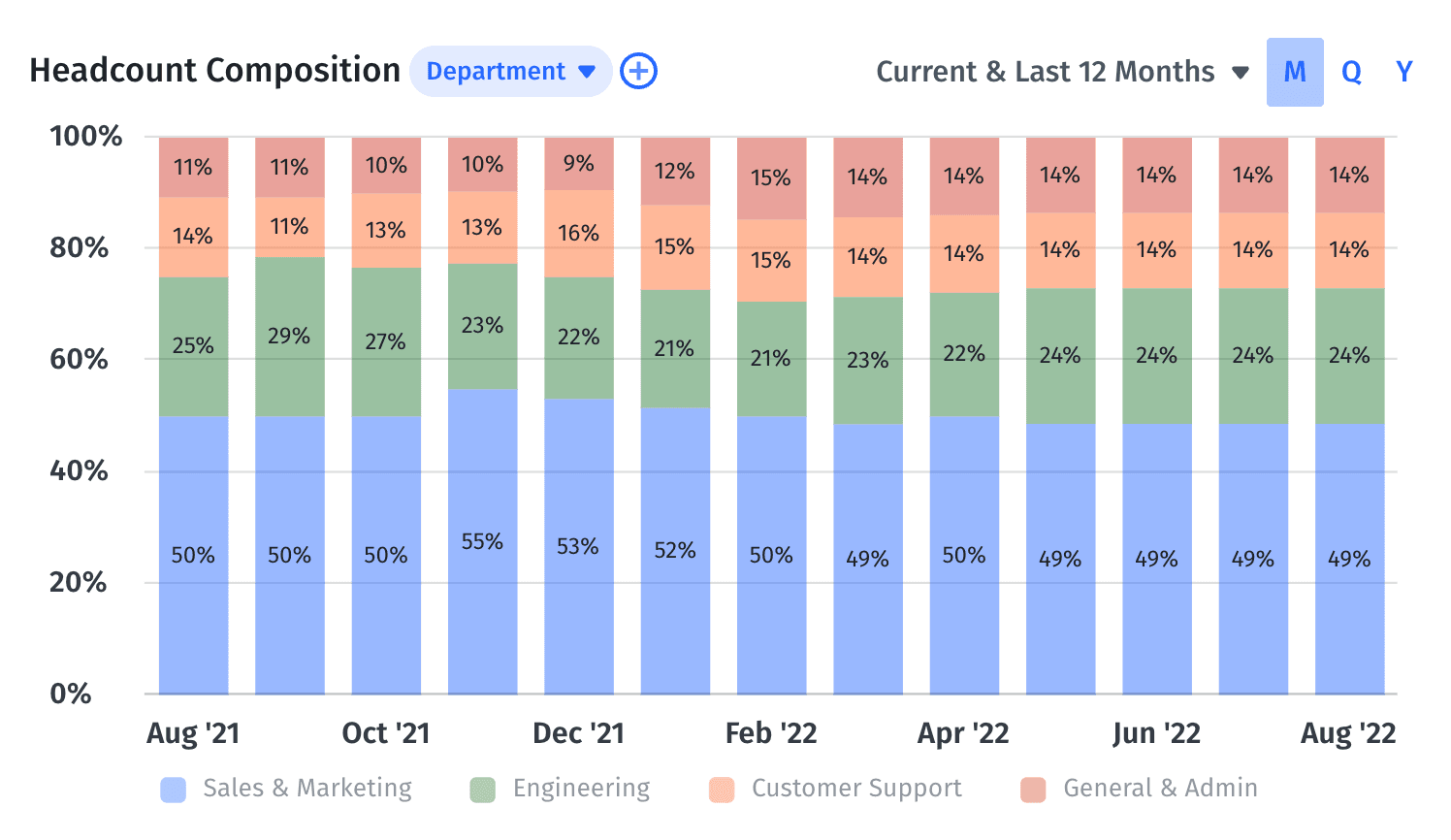

Headcount Costs by Department

Offering a breakdown of your headcount costs gives VCs a view into one of your startup’s biggest expenses. Provide a breakdown for your overarching headcount costs, and then get more granular with an analysis of headcount metrics by department.

To balance out your conversation around employee expenses, provide data points that demonstrate the major contributions your team makes to company growth. Include metrics like R&D payback and annual recurring revenue (ARR) per head to clarify the value your teams bring to your bottom line.

The Role of Mosaic in Streamlining Reporting and Documentation

While staring down this laundry list of data points and metrics to give investors might be overwhelming, the right tool can make this process far easier.

Mosaic makes it simple to quickly populate your investor docs with the metrics that matter most in just a few clicks. While Mosaic’s strategic finance platform can’t create your investor documents for you, its comprehensive suite of tools makes it simple to pull real-time financial data to answer all your investor’s questions. No need to struggle to wrangle your data to provide the right metrics to your potential investors.

Spend 70% less time on data aggregation with Mosaic — that way, you spend less time creating reports for your investor documents and presentation and have more time to perfect your pitch.

Investor Document FAQs

What documents do you need to show investors?

When presenting to investors to persuade them to provide funding, you’ll need to have a wide breadth of documents at the ready, including:

- Typical administrative documents (info on prior investments, incorporation certificate, cap table, customer and vendor contracts, signed agreements like leases and settlements)

- Financial models

- Historical monthly financials

- Success metrics (revenue by month, revenue by customer, win rates, average sales cycle)

- Channel-level overview of pipeline generation (including both inbound and outbound sales)

- Net and gross dollar retention

- Headcount costs by department

What is an investor agreement?

How often should investor documents be updated?

How do I find investors for my SaaS business?

Own the of your business.