Financial ratios like profitability and efficiency ratios help a finance team tell the story behind the company’s performance. They’re essential for going beyond the traditional monthly cycle of generating cash flow analysis, balance sheets, and P&Ls for financial reporting and assuming a more strategic role in the company.

The right financial ratios can tell you if your current growth pattern is sustainable, how efficient your billing team is at collecting payments, and whether you should spend money on marketing or focus on your product instead. They can also tell you about your company’s ability to secure funding once you connect with investors.

To see if you’re on the path to growth and be able to address issues proactively, you need to do financial ratio analysis. Here are the ones we feel are the most important financial ratios to analyze a company.

Table of Contents

1. LTV:CAC Ratio

The LTV:CAC Ratio compares the lifetime value of a customer—how much they spend with you in their entire time as a customer—to the customer acquisition cost—the amount you had to spend to acquire them as a customer.

It tells you your ROI per customer so you can understand the financial efficiency of your sales and marketing strategies. With that knowledge, you can decide if your customer acquisition tactics are feasible in the long term.

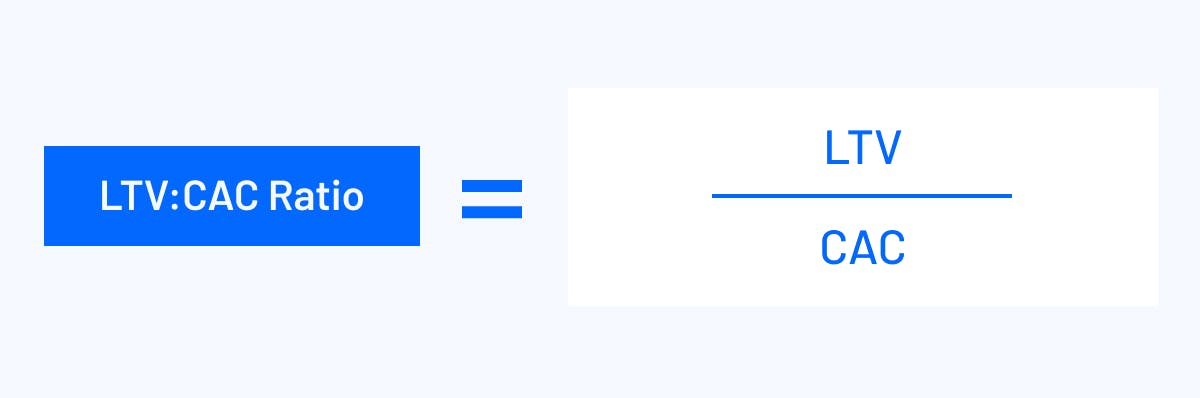

How to calculate LTV:CAC ratio

To calculate your LTV:CAC Ratio, divide a customer’s LTV by your CAC.

2. SaaS Quick Ratio

The SaaS Quick Ratio measures the efficiency of a company’s growth by comparing customer bookings and upgrades to customer churn and downgrades. It can help you determine if your current growth is sustainable or if you need to work to reduce customer churn. The higher your SaaS quick ratio, the better your position and long-term solvency.

How to calculate SaaS quick ratio

Calculate SaaS Quick Ratio by dividing your new MRR, including expansion/upgrades, by your lost MRR, including contraction/downgrades.

3. Rule of 40

According to the Rule of 40, when a SaaS company adds its growth rate and its profit margin, the result should ideally be 40% or higher. This calculation sums up a company’s operating performance by showing how its growth and profitability balance against each other. This allows investors, boards, and management teams to quickly understand a company’s overall sustainability.

How to calculate Rule of 40

For this simple calculation, add your growth rate percentage to your profit margin percentage. Any result greater than 40 is considered strong.

4. SaaS Magic Number

The SaaS Magic Number tells you how efficient your sales and marketing efforts were within a chosen quarter or a month, helping you know when you should invest more in your sales and marketing efforts or when you should pull back.

If the result is less than 0.5, keep working on improving your product-market fit. If the SaaS Magic Number is approaching 0.75, you’re tracking well with your sales efficiency. And if it’s 0.75 or over, you can feel confident to expand on your sales and marketing efforts.

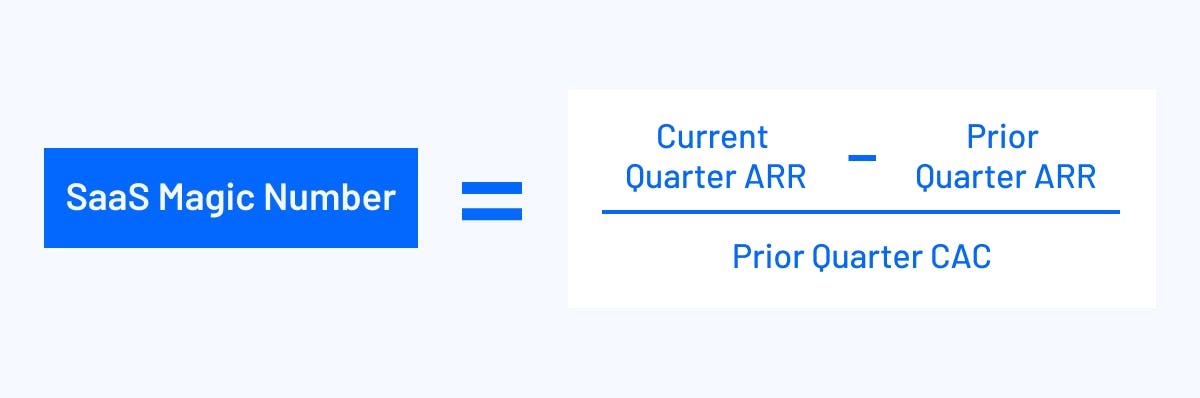

How to calculate SaaS magic number

To calculate your SaaS Magic Number on a quarterly basis, subtract your prior quarter’s ARR from the current quarter’s ARR and divide the result by your prior quarter’s CAC. If you want to calculate monthly, swap ARR for MRR.

5. Net Revenue Retention

Net revenue retention tells you whether your product is valuable to current customers as well as whether they’re happy with your customer service, pricing, and reliability. Knowing the rate at which your company is retaining revenue helps you understand your business’s growth trajectory.

How to calculate net revenue retention

Calculate your Net Revenue Retention by adding your current month’s starting MRR to the change in MRR then divide the result by the starting MRR.

6. Gross Profit Margin Ratio

The Gross Profit Margin Ratio compares a company’s gross margin to its total revenue. It helps you understand what percentage of each dollar in revenue you get to keep as gross profit. If your Gross Profit Margin Ratio is 30%, you’re keeping 30 cents for every dollar you bring in, which then goes to your operating costs and profit. The other 70% is what is being spent on your product as cost of revenue.

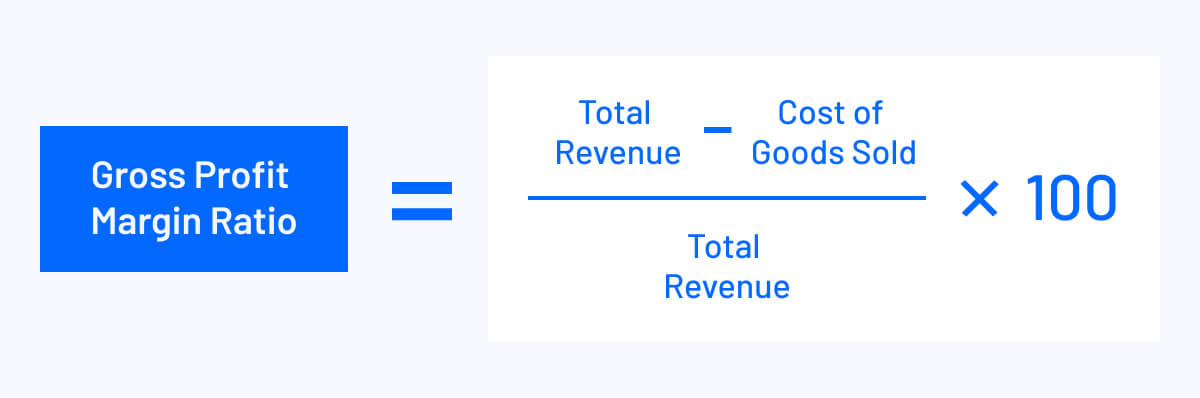

How to calculate gross profit margin ratio

You can calculate your Gross Profit Margin Ratio by subtracting your cost of revenue from your total revenue, dividing that number by your total revenue then multiplying by 100.

7. Net Profit Margin

Net profit margin, or net income, compares a company’s profits to its total revenue. Similar to gross profit margin ratio, it allows you to understand how much your company keeps in profit for every dollar it brings in. It is a measure of a company’s operating efficiency and tells you how much you’re profiting on the bottom line.

How to calculate net profit margin

To calculate Net Profit Margin, divide your net profit by your total revenue, then multiply it by 100.

8. AR Turnover Ratio

The Accounts Receivable Turnover Ratio measures the efficiency of how a company collects money from its clients. It’s also called the debtor’s turnover ratio, and it’s one of the most important accounts receivable metrics to track. The higher the AR Turnover Ratio, the better your company is at collecting payments from clients’ accounts payable teams.

How to calculate AR turnover ratio

Determine your AR Turnover Ratio by dividing your net credit sales by your average accounts receivable.

9. CAC Ratio

Your Customer Acquisition Cost ratio, which is also called the Cost of ARR, tells you if your company’s sales and marketing campaigns are effective and worth your current spend. Where CAC measures the cost to acquire one new customer, the CAC ratio compares your marketing expenses to new and expansion ARR.

A CAC Ratio of 50% means the new customers you gained in a month will recoup 50% of that month’s sales and marketing costs in one year.

How to calculate CAC ratio

Calculate your CAC Ratio by dividing your sales and marketing expenses by your new and expansion ARR.

10. Free Cash Flow Margin

Free Cash Flow Margin demonstrates how efficiently a company is turning its sales into cash. It allows you to track your free cash flow over time, which shows you whether you’re becoming increasingly efficient at generating free cash flow from your sales.

How to calculate free cash flow margin

You can calculate your Free Cash Flow Margin by taking your operating cash flow less capital expenditures and dividing that number by your total revenue. You’ll then need to multiply by one hundred.

Tell Your Company’s Story with Financial Ratios

The financial ratios listed above apply well in the context of SaaS finance metrics for startups and other types of small businesses. But there are others to keep in mind if you’re in a different industry or you’ve already reached public status. These include a variety of liquidity ratios, leverage ratios, and debt ratios. A few notable ones include:

- Current Ratio (Working Capital Ratio): A liquidity ratio that compares a company’s assets that can be turned into cash within a year to the total liabilities or short-term obligations it’s required to pay off within a year.

- Acid Test Ratio: Similar to the current ratio, the acid test ratio is a liquidity ratio that compares a company’s short-term assets that can be turned into cash immediately to the short-term liabilities it’s required to pay off immediately.

- Cash Ratio: Another liquidity ratio that compares a company’s current assets, including both cash and liquid assets, to its current liabilities or short-term debt.

- Return on Equity (ROE): A profitability ratio that measures a company’s profitability compared to its shareholder’s equity.

- Debt to Equity Ratio: A leverage ratio or debt ratio that helps a business understand how much of its financing is coming from debt (both short- and long-term debt) and how much is coming from equity from shareholders or investors. It quantifies a company’s financial leverage.

Understanding financial ratios and knowing which are most important to your business allows you to tell the full story of your company’s health, growth, sustainability, and success. They provide insight that can help you discover the best strategic direction for your business. They can also help you find out whether investors will take an interest in what you have to offer and what the valuation and share price might be for your company’s stock.

If you’re planning to put these financial ratios on your radar, Mosaic can help you track them easily. Click here for a demo to learn how.

Build Custom Metrics That Drive Performance

Most Important Financial Ratios FAQs

What is the best ratio to value a company?

The key financial ratios to value a company depend on the status and funding stage of the business you are trying to evaluate. To value early-stage companies, for example, that have secured seed or Series A funding, you’ll need to perform an in-depth cash flow analysis, assess the company’s financial statements, and look at burn rate, cash runway, and headcount plans. To value a company preparing for an IPO, on the other hand, you’ll want to look more closely at revenue and capital efficiency metrics.

SaaS valuation is a complex process that requires more than one ratio.

How do you determine if a company is undervalued?

How do companies tell a strong financial story?

Which metrics tell you how efficient business operations are?

Own the of your business.