For fast-growing SaaS startups, revenue is king — it’s the main measuring stick for your growth trajectory. But in recent years, customer retention metrics have become equally (if not more) important in SaaS valuation.

Tracking retention metrics helps you complete the picture of company performance and health. However, it’s not the straightforward “how many customers stayed this period?” calculation it seems.

There are many ways to run financial analytics and dig into your numbers. Finding the right way to slice and analyze user retention metrics can unlock new insights that drive growth. You just have to determine which metrics are available to you, which ones matter the most, and how to calculate them.

Keep reading to learn more about customer retention metrics and the seven essential ones to track.

Table of Contents

What Are Customer Retention Metrics?

Retention metrics are measures of how many customers your business keeps and the value those customers deliver over a certain period of time.

Your retention is the inverse of churn. So if your churn is high, your retention is low — and the opposite is true, too: High retention rates can lead to low, or even negative churn.

Think of retention as a quantitative form of customer loyalty. Accounts with high customer satisfaction find a ton of value in your service and continue to enjoy your features, are more loyal, and are easier to retain — which are all good indicators of strong business health.

That’s especially true for SaaS companies, where repeat purchases come in the form of subscription renewals and longer contracts.

In a subscription-based software company, effective retention strategies help ensure customers pay more for your products over time. But there’s no real one-size-fits-all for tracking retention metrics. That’s why there are several strategic finance metrics that measure various types of customer retention.

The Value of Customer Retention and Why It Matters to Business Performance

There are many well-known adages on the effectiveness of customer retention. One is the Pareto Principle — the idea that 80% of sales could come from just 20% of your customers if your retention engine is strong enough.

Another says that it costs five times less to convert an existing customer than it does to gain a new one.

While the numbers are mostly estimates, recent research backs up the power of customer retention, specifically in SaaS.

McKinsey conducted a study of 40 public B2B SaaS companies and found that those with a net retention rate of 120% or more had much higher growth rates than other companies. That’s why 120% NRR is an oft-cited industry benchmark for SaaS.

Retention is a significant factor in a startup’s ability to quickly build revenue and drive profit. And a high level of retention offers many important effects to companies.

Rapid Growth

The benefits of retention can multiply a company’s success since it can be a strong positive indicator for current and potential investors. It’s what creates a powerful ARR snowball that compounds revenue over time.

High customer retention shows you’re increasing the value of your customer base, which makes you more attractive to potential investors and improves your brand perception.

Brand Awareness

Customer loyalty generated from high retention positively impacts your brand. Highly satisfied customers are more likely to leave reviews on sites like G2 and social media.

With several positive reviews, you’ll soon become a leader in your niche through the social proof of customer success.

Employee Morale

Not every benefit of customer retention is quantitative. It can also improve employee morale. It makes sense: happier customers mean employees feel greater job satisfaction.

When customers are less likely to contact support with complaints, employees feel less stressed. Customer retention also increases business stability, which gives your team a greater sense of accomplishment and security in their roles.

Clear Product Roadmap

Invested customers can provide insights into your brand’s direction. Loyal customers provide insightful feedback on features and services they’d like to see. By zeroing in on your repeat customers’ target persona (as well as overall repeat purchase rates), you can quickly grow your business to serve multiple needs.

Word-of-Mouth Marketing

Customer retention is also a critical factor for your brand presence. Keeping your customers happy with your product makes them more likely to drive word-of-mouth marketing and referrals.

Word-of-mouth marketing can:

- Grow your business organically

- Establish you as a leader in your niche

- Decrease acquisition costs

Now that you know more about why customer retention metrics matter, here are seven you should start tracking.

8 Customer Retention Metrics Every Business Should Track (and How to Calculate Them)

The first step to increasing your customer retention is getting a complete picture of where your retention stands. Beyond a singular data point on how many customers stay with you over time, these key metrics can help you build a thorough customer retention strategy.

1. Customer Retention

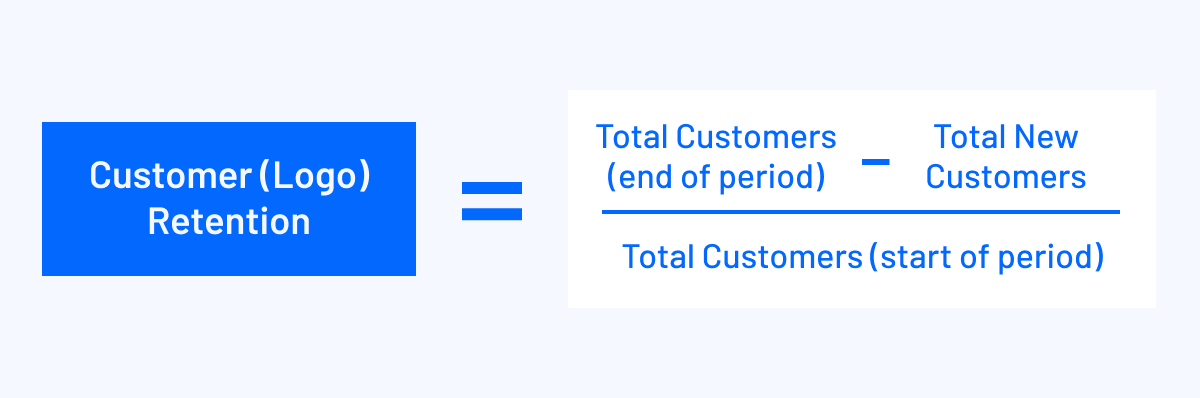

Start with the most straightforward metric. Customer retention, also known as logo retention, measures how many customers you retain over a given time frame.

Here’s how to calculate your customer retention:

- Find how many customers you currently have and subtract the number of new customers you acquired during the current period.

- Divide that number by how many customers you began with at the start of the period.

- The result is your customer retention rate.

How often you measure customer retention depends on your company and how quickly it’s growing. A typical period to calculate retention is at the end of the month, each quarter, or annually.

It’s helpful to analyze your customer retention by period and across several as an average. That will give you insights into specific strategies you used during those periods and a high-level look at your performance as a whole.

Look out for any sudden changes in your customer retention. A large drop could show a strategic misstep, while a large bump means you should identify the cause and try to repeat your success.

2. Customer Retention Cost (CRC)

Customer Retention Cost (CRC) provides insights into the amount of money invested by a business into maintaining its current customer base and deterring them from churning. This metric underpins a SaaS company’s strategy to create long-lasting brand allegiance.

Understanding CRC can help businesses prioritize their spending to enhance loyalty and, by extension, customer lifetime value.

Here’s how to calculate CRC:

- List all expenses linked to customer retention during a specific period, such as loyalty program costs, customer support, training, feedback initiatives, and any promotional activities geared towards existing customers.

- Sum up these expenses to get the total customer retention expenditure for the time frame.

- To get the average CRC, divide this total expenditure by the number of customers retained during that period.

The result is your CRC. A lower CRC generally indicates efficient strategies in retaining customers, while a higher CRC may suggest potential areas of improvement.

3. Net Revenue Retention

Net revenue retention (NRR) measures how much of your overall revenue you’ve retained over each period. It’s sometimes known as net dollar retention (NDR), and it’s the inverse of revenue churn. It often roughly correlates to customer retention, but it’s distinctly different.

NRR can tell you if you’ve gained or lost customer value over time, thanks to upsells, cross-sells, expansion, or churn.

Here’s how to calculate NRR:

- Find your monthly or annually recurring revenue (MRR/ARR).

- Find the change in revenue by adding upsells and expansions and subtracting the downgrades and cancellations.

- Divide that answer by your monthly recurring revenue.

- The result is your NRR.

Because you can upsell or expand customer accounts, the resulting percentage can be greater than 100%. That indicates an increase in revenue from your existing customer base over that time period.

4. Gross Revenue Retention

Related to net revenue retention, gross revenue retention (GRR) measures how much revenue you retain without factoring in upsells or expansions.

The focus of GRR is on maintaining the value of existing revenue sources rather than measuring your overall revenue. Since the formula doesn’t take into account upsells and expansions, your GRR can never be over 100%.

Here’s how to calculate GRR:

- Take your monthly recurring revenue at the start of the month, minus churn and contractions.

- Divide that answer by the MRR at the start of the month.

- The result is your GRR.

5. Customer Lifetime Value

The customer lifetime value (CLV or LTV) is the average amount a customer will spend over their relationship with you.

Also known as average customer lifespan, lifetime value is an important metric that empowers you to plan for how much revenue you can expect, on average, from individual customers over the lifecycle of their relationship with your business.

It’s also one of the more difficult retention metrics to calculate. There are many ways to interpret customer value, and it can take some time to collect enough data about your customer journey to get an accurate read.

A simple way to calculate LTV is to:

- Multiply your average revenue per customer each year by your gross margin.

- Divide that number by your customer churn rate.

- The result is your LTV.

Measuring customer lifetime value can help you appropriately scope your acquisition and retention efforts to ensure a positive ROI. The LTV also helps you and investors gauge how profitable your business is, will be, or could be.

Analyzing LTV across customer segments can also help your business figure out which segments are the most profitable for the future.

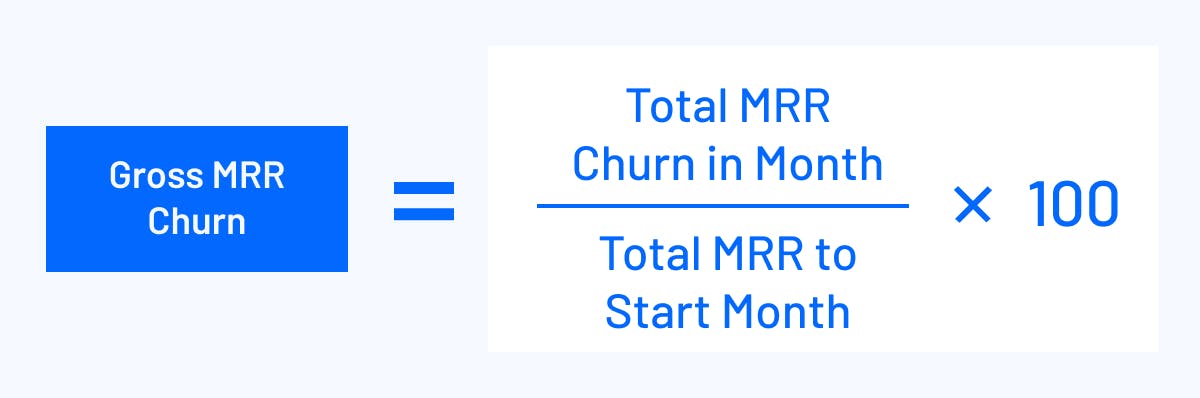

6. Monthly Recurring Revenue Churn

Your business’s monthly recurring revenue churn (MRR churn) measures how much revenue you lose each month. This is an important data point to track because it directly relates to lost profits and can point to opportunities for optimization.

On a larger scale, you can choose to calculate this metric annually to find your annual recurring revenue (ARR) churn.

Here’s how to calculate MRR churn:

- Add the total amount of loss due to cancellations, contractions, and delinquent accounts over the month.

- Divide that number by your MRR at the beginning of the month.

- The result is your monthly revenue churn rate.

There are two types of MRR churn rates:

- The gross MRR churn rate, which only accounts for revenue losses.

- Net MRR, which accounts for expansions and upgrades for a broader picture of your monthly recurring revenue churn.

7. Customer Lifetime Value to Customer Acquisition Cost Ratio

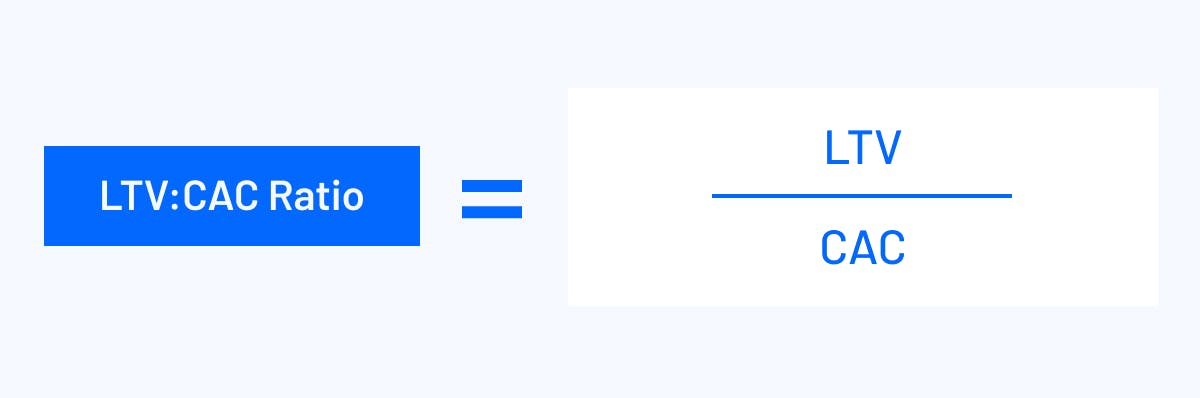

The customer lifetime value to customer acquisition cost (LTV:CAC) ratio measures how much you earn from your customers compared to how much you spend acquiring them.

It’s important to understand this ratio so you can ensure your acquisition efforts are profitable. A ratio above one is a good sign that your efforts are profitable, but the standard benchmark is a ratio of 3:1 for LTV:CAC.

That means you should only spend a third of your customer’s lifetime value acquiring them, or it could negatively impact your bottom line.

Since we already touched on calculating your customer’s lifetime value, let’s dig a little deeper into calculating your CAC.

Here’s how to find your customer acquisition cost:

- Add up everything you spend on marketing and sales in a given period.

- Divide that by the total number of customers acquired.

- The result is your cost for acquiring the average customer.

From there, you can determine if you’re budgeting your acquisition efforts appropriately.

8. Net Promoter Score

The net promoter score (NPS) measures how loyal a customer is to your business, based on how likely they are to recommend your service to a friend or colleague.

NPS is a survey-based question where respondents must answer 0 and 10. Their response designates which category they fall into:

- Promoters: Those who respond with a 9 or 10 are very satisfied, loyal, and likely to be repeat customers.

- Passives: Those who respond with a 7 or 8 are reasonably satisfied but not likely to tell anyone about their experience.

- Detractors: Those who respond with a 6 or loyal are unsatisfied, unlikely to be returning customers, and may even tell others to avoid doing business with you.

Breaking your customers into categories based on NPS can help you target strategies specifically to their pain points and needs and ultimately improve your loyal customer rate. Your overall NPS score is also valuable insight into your customers’ sentiment before churning.

Tips To Improve Customer Retention

It’s impossible to prevent churned customers entirely, but that doesn’t mean you can’t improve your customer retention metrics. Here are some tips:

Segment Your Data by Cohorts

Broad averages are only so helpful for implementing strategy. That’s why separating your data by customer cohort is crucial. That means grouping customers by start date and analyzing their behavior to identify patterns and draw meaningful conclusions about their needs.

The goal of any important metric for retention is to give you insight into what is and isn’t working for your business. Those insights are much more impactful with a deeper look at net revenue retention, gross dollar retention, and ARR by customer cohort.

Despite that, our recent research shows that just 14% of companies use cohorts to analyze retention. That’s probably because building customer cohorts can be difficult and time-consuming to maintain. So while the insights are worthwhile, it’s not easy to prioritize such granular information when working out of spreadsheets.

Nail Your Product-Market Fit

The goal of any early-stage startup is to find the product-market fit for their service. That’s crucial to:

- Ensure retention

- Lower acquisition costs

- Continue revenue growth

Without it, you may find it easy to acquire customers but fail to retain them as features fall short of their expectations.

To find your product-market fit, you need to understand your buyer personas and their pain points. That starts with founders and product leaders conducting market research on new features and collecting customer feedback to get a better picture of recurring comments.

But finance can add strategic value by closely tracking retention metrics even in the early stages.

Granular retention metrics can tell you if there are patterns in customer drop-off and churn. And they can help business leaders understand which product lines and service tiers are most (and least) effective. Taking that information to executive partners can help the business make crucial decisions about pricing and product development that spark new levels of growth.

Perfect Your Onboarding Process

A significant amount of customer attrition or churn occurs within the first few weeks of using a product or service. That’s in part because there’s a mismatch in customer and product.

One major reason is that the onboarding customer experience couldn’t adequately communicate the product or service’s value to the customer.

Some studies show that one of the largest causes of customer churn is a poor onboarding experience.

There’s an opportunity for finance to proactively collaborate with customer success to address onboarding issues. When finance can surface insights into the when and where of customer churn during onboarding, customer success can develop more targeted strategies for boosting retention and other customer success metrics.

Easily Track Key Customer Retention Metrics with Mosaic

While these SaaS financial metrics all provide valuable insights, we know they can be time-consuming to calculate. From tracking down data points, scrubbing the data, and processing it into valuable insights, the task of measuring each retention metric isn’t easy.

In the past, that forced business leaders to either expend valuable resources to collect the data or make hard decisions about what information they didn’t need.

But Mosaic automates the time-consuming process of data collection and aggregation. It centralizes your financial data to automate metric calculations and give you real-time views of customer retention KPIs with little-to-no setup.

Mosaic integrates with your existing tech across ERP, CRM, HRIS, and billing systems to build insights for you and your team.

The platform automates critical customer retention metrics like:

- Customer lifetime value

- Monthly recurring revenue and annual recurring net revenue retention

- Logo retention

- Customer cohorts

- Net and gross revenue retention

Visualize each metric through live and easy-to-understand charts that take much of the hard work out of analyzing data so you can focus more on strategy.

Tracking monthly active users, their value, purchase frequency, and the cost to acquire them are all essential measures of your business’s success. It just shouldn’t be so difficult to get the job done.

If you want to learn more about how Mosaic automates the tedious parts of retention analysis and gives you real-time access to sales performance metrics, operational KPIs, and more, so you can focus on bringing strategic insights to your partners, request a personalized demo and see how simple tracking each retention metric can be.

How Strategic Finance Software Can Support CFOs & Finance Teams

Customer Retention Metrics FAQs

How do you calculate monthly retention?

To calculate monthly customer retention, you subtract the number of new customers acquired throughout the month from your total number of current customers at the end of the period. Next, you divide that total by the number of customers you started out with at the beginning of the month.

Let’s say you want to calculate your retention rate for July. On July first, you had 5,000 customers and on July 31st you had 5,500 customers. You acquired 750 new customers in July. To get your July retention rate you would subtract 750 from 5,500 to get 4,750. Then, you would divide 4750 by 5,000 to get a retention rate of 95%.

How do you track retention metrics?

What are good retention metrics?

What can retention metrics be used for?

Own the of your business.