The recurring revenue business model boasts many advantages, from scalability to predictability and the potential for your business to reach unicorn status if all goes well. But, the SaaS model has its challenges, too, especially when it comes to billings, collections, and revenue management.

The complexity of usage-based billing models, varied billing cycles, and offering multiple pricing structures makes SaaS billing and accounting processes prone to revenue leakage. And, if you aren’t able to identify and plug leaks quickly, they can grow from a slow drip to a rushing stream.

Luckily, most SaaS businesses aren’t going to suffer the same fate as the Titanic as a result of revenue leakage. In most cases, the risk of revenue leakage can be well managed with a few best practices and the right software with real-time data.

Table of Contents

What Is Revenue Leakage?

Revenue leakage is the difference between revenue you’ve earned, potentially even recognized, and revenue you’re actually collecting. Essentially, it’s the amount of money your company should have in its accounts, but doesn’t. Revenue leakage can often be traced to flawed payment processes, mismanagement of customer data, billing errors, and several other issues common to SaaS.

Why SaaS Businesses Are Vulnerable To Revenue Leakage

SaaS businesses are particularly vulnerable to revenue leakage because they depend on recurring revenue. Since the recurring revenue model is so complex (varieties of plans, inconsistent billing cycles, contract compliance issues, etc.), it’s not hard for finance teams to make mistakes when invoicing. But human error isn’t the only source of revenue leakage — even billing software can have trouble keeping up with SaaS processes.

It’s crucial to note the recurring revenue model amplifies the effects of any one instance of revenue leakage. That’s because revenue leaks repeat each month per customer. For example, if you’ve made a change in price point for a specific plan, and that change hasn’t been recorded in your subscription management system, customers will be charged the incorrect amount month by month until the issue is recognized. The size of the resulting financial loss depends on how many customers were using that plan each month. In SaaS, the effects of just one leakage can be proportional to your MRR.

If you’re scaling quickly, by the time you notice a leakage, it could have escalated to a major problem.

But have no fear! The one good thing about revenue leakage in SaaS? It’s preventable. The first step to tackling revenue leakage in your business is to be aware of the causes.

Common Causes of Revenue Leakage in SaaS

With a range of pricing points and payment methods, SaaS is particularly vulnerable to revenue leakage. But many causes of revenue leakage can be traced to a common source: poor management of customer data.

Inaccurate Billing

Any successful SaaS business depends on streamlined, regular billing processes. But when a business offers multiple tiers and relies on so much customer data, it’s easy for there to be a disconnect between different systems. Customers can miss their renewal, or you may even mistakenly charge them for the wrong plan.

Inaccurate billing can lead to revenue leakage in two ways. The first is through undercharging. For example, say a customer upgrades their subscription in the middle of a billing cycle. Your billing system might have trouble reflecting this, meaning the customer ends up paying less than they owe.

Second, inaccurate billing can result in customer attrition or churn. If customers are overcharged one or more times, they may grow frustrated and decide to cancel their subscription, moving to another SaaS provider altogether.

Pricing Discrepancies

Offering customers different tiers and pricing packages is a staple of SaaS. But a problem can occur when your systems don’t reflect price changes. Customers are (understandably) upset when they aren’t charged as advertised.

Finance needs to make sure sales teams are immediately notified about changes in pricing, so that new customers aren’t on-boarded with a price tag that ultimately doesn’t hold. Pricing discrepancies will make your business seem less trustworthy and lower your CLV. Ensure your pricing strategy is consistent from the get-go in order to secure long-term customer loyalty.

Errors in Payment Processing

Errors in payment processing are a huge cause of involuntary churn in SaaS. Involuntary churn is when customers fail to renew, not because they don’t find value in your product, but as a result of mechanical issues.

Errors in payment processing can be as simple as rejected credit card payments, or as complex as billing systems sourcing the wrong payment data thanks to poor integration with your CRM.

One way to prevent payment processing errors is to have a dunning process in place. Pre-dunning will notify customers if one of their payments doesn’t go through. With the right software, you can automate dunning emails to alert customers of problems with their payment methods before processing the payment (known as post-dunning).

To prevent recurring payments from being flagged as fraudulent, you can tag them as recurring in your payment processor.

Finally, prevent revenue leakage by allowing customers to set up backup payment methods your system can move to if the first method fails.

Poor Customer Data Management

SaaS depends on successful management of masses of customer data. Managing it poorly can lead to problems like incorrect invoicing or failure to renew subscriptions, not to mention data breaches resulting in an erosion of trust.

But there’s another side to this that’s easy to miss: poor management of customer data can mean you’re missing out on valuable insights into your audience. This can result in revenue leakage through factors like lack of price/plan personalization, or underutilization of up-sell opportunities.

Inefficient Financial Processes

At the end of the day, even the best billing software relies on finance to properly build and administer contracts. Stay on top of sales to make sure AEs aren’t offering unauthorized discounts.

Revenue recognition in SaaS is completely different from more traditional business models. Not having a handle on ASC 06 can lead to delays in collecting payments, resulting in shortages of revenue.

Revenue leakage could also come down to something as simple as inefficiencies in your AR workflows. Manual reconciliation leaves the door open to error, making AR an excellent place to introduce automation.

Mosaic’s Role in Identifying and Preventing Revenue Leakage

With so much to keep track of, it’s no wonder revenue leakage runs rampant in SaaS. Fortunately, many sources of revenue leakage come with specific indicators, alerting finance teams to their presence when they know what to look for.

That’s why the first step in preventing revenue leakage is to have a real-time view of collections metrics. Since so much revenue leakage is the result of human error, the second is to automate data entry. Thirdly, CRM hygiene helps ensure there’s a clear link between sales, the customer’s contract, and the accounts.

Real-Time Financial Data Analysis

Many causes of revenue leakage are small, meaning they can fly “under the radar.” You only notice once there’s a massive discrepancy between the amount of money that should be in your accounts and what’s actually there.

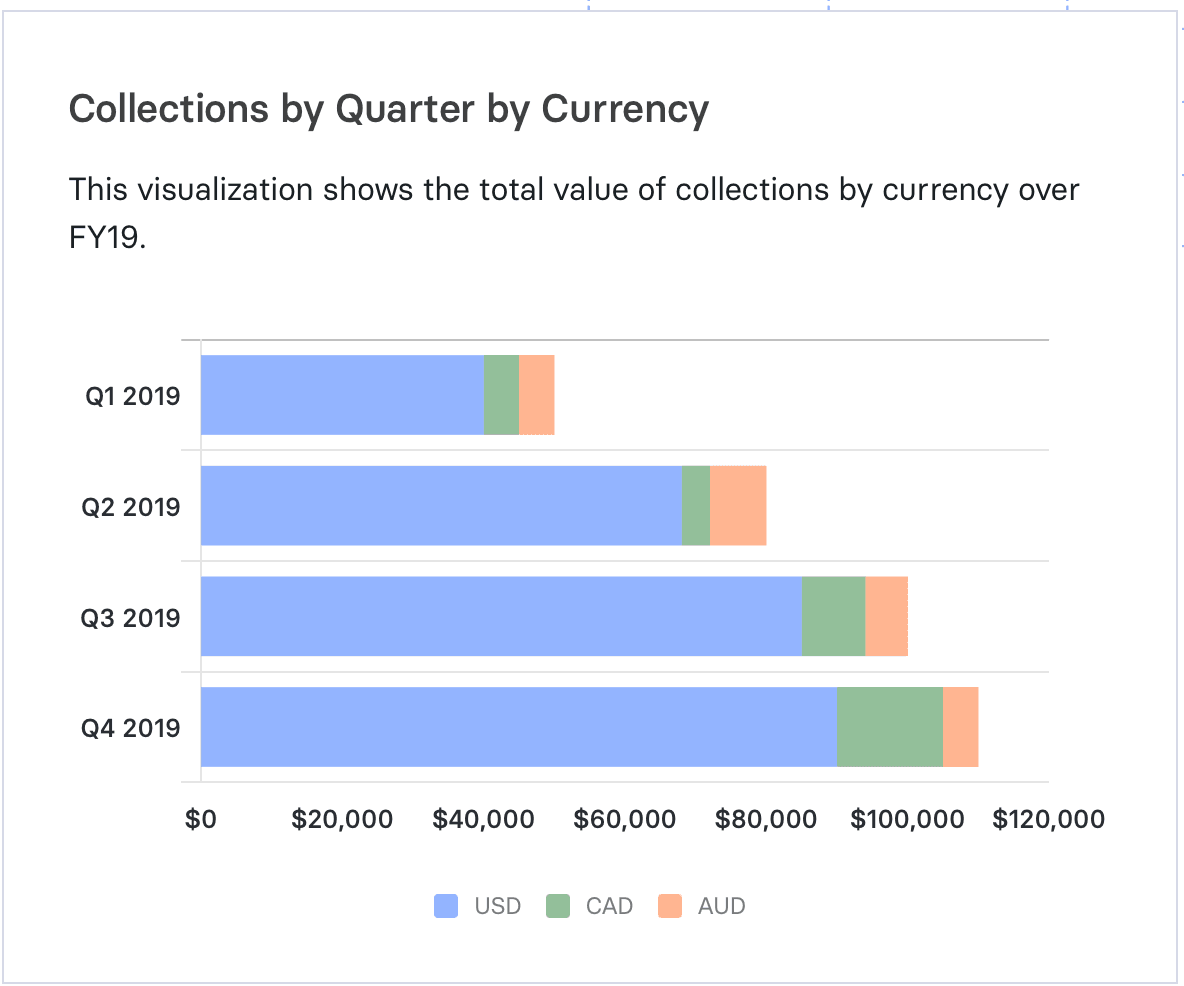

But that’s only the case if you lack a real-time view. With a tool like Mosaic, you can view metrics like AR aging and days sales outstanding in real-time. When combined with metrics like your AR turnover ratio, these can alert you to inefficiencies in your AR collections processes or problems with credit policies.

Keeping tabs on this data also gives you rich customer insights. By combining some of the above collection metrics with customer usage data, you can tweak pricing and billing strategies.

For example, let’s say you notice a specific customer segment has an above-average length AR aging. You can adjust credit terms for that group or offer early payment discounts.

Alternatively, if a segment has a low days sales outstanding, you may target them for a higher tier.

Especially for early-stage startups, this sort of data can be invaluable as you boost cash flow and are able to fund initiatives that contribute towards growth. Be sure to use SaaS billing software that integrates with your centralized finance platform, specifically your CRM and ERP.

Minimizing Manual Data Entry and Errors

Reading through the above, you may have noticed a common theme: the shared source of many revenue leakage problems is bad data. According to IBM, nearly 90% of spreadsheets contain at least one error. When you’re trying to keep track of customer data, whether that’s simply to send the appropriate invoice or to optimize pricing strategies, that’s a problem.

By going around manual processes, this risk is completely avoided. You can rely on billing data matching charges based on usage time or specific tier. By plugging up sources of leakage, you can also rely on revenue forecasts being accurate.

Mosaic removes the need to manually compile this data, putting it all at your fingertips. It automatically shows your open invoices and outstanding balances down to the customer and invoice level, helping you keep track of payment statuses and overdue invoices across your customer base.

Mosaic’s ARC takes the process a step further, with the ability to automatically generate a list of email addresses associated with your overdue accounts, and then even drafting a collections email to send out. It not only helps prevent revenue leakage, but saves you time as well.

Other Strategies To Stop Revenue Leakage in Your SaaS Business

For SaaS businesses, plugging up sources of revenue leakage is crucial. Getting the right processes in place creates revenue efficiency and boosts your bottom line.

Implement Effective Financial Monitoring Systems

With the right software, you can conduct regular audits to look out for indicators of revenue leakage like high customer churn or a discrepancy between GAAP revenue and your ARR or MRR with a revenue comparison. Metrics help you contextualize leakage issues and determine why they’re happening.

By integrating with your SaaS billing system, as well as your CRM and ERP, Mosaic can help you connect the dots in a way that’s just not possible to do with spreadsheets. It offers centralized metrics with easy-to-understand, beautiful dashboards that allow everyone to notice the signs of outsized revenue leakage.

Communication enabled through integration is important in two ways: first, between your financial systems to avoid things like customers being automatically charged the wrong amount, and second, between your team members.

A tool like Mosaic allows you to get the full picture — a deep, metric-based understanding of your customer data, in order to prevent leakage before it happens and boost your capital efficiency.

Automate Billing and Subscription Management

Automation seems tailor-made for SaaS billing. Rather than relying on finance to send out invoices, software is excellent at guaranteeing steady cash flow. Once you can rely on steady cash flow, you can build tight, accurate financial models and start launching new initiatives.

Your team won’t have to spend time tracking down accounts receivables, and customer success won’t have to deal with reports of pricing discrepancies.

You also need software that can manage all the complexities of SaaS. Look for software that can keep tabs on different subscription types and billing cycles. Most SaaS-specific software now automates ASC 06 compliance. You can even automate dunning emails.

Look for software that is compliant with international regulations, so that you can expand into new markets without having to build out your infrastructure. Finally, subscription management tools can automate renewals, so you don’t have to worry about accidentally skipping billing cycles.

Build an Effective Deal Desk

Some components of revenue leakage can come down to a mismatch in the understanding of the details of the contract. As a really simple example, the customer may be under the impression that invoices are settled on a net 60 basis, while you’re expecting them to be paid on net 30 terms.

An effective deal desk can help ensure data integrity between the terms agreed to by the sales team and the client, and those expected by accounting. The starting point for this is to ensure that customer contracts have a clearly defined section of key terms such as billing frequency, payment terms, billing contact, subscription terms, and cancellation policy. All of these fields should live in your CRM and be updated by your sales team.

After a deal closes, an effective deal desk would match the data in the CRM with the terms of your contracts, lining up the details before invoices are generated. CRM hygiene is an often overlooked component of accurate financial reporting, so it’s worth taking a closer look.

Secure Your SaaS Business’s Health With Mosaic

For SaaS, revenue leakage can make or break your entire operation. Thanks to the recurring revenue model, just one source of leakage effectively scales with your business.

With modern tools that provide a real-time, circumspect view of your financial situation across billing software, CRM, and ERP, you can identify existing leakages and prevent new ones from coming into existence. Revenue leakage should be the last thing you have to worry about as you grow your business.

Make the move from reactive analysis to proactive planning. With Mosaic, you can depend on solid projections and smooth collections so that you have a reliable flow of resources to start putting your plans into action. Request a demo today.

Revenue Leakage FAQs

How can SaaS companies identify revenue leakage?

SaaS companies should perform regular audits of billing and invoicing processes. Pay attention to metrics like AR aging and days sales outstanding to streamline your collections workflows.

What are the most common causes of revenue leakage in SaaS?

How can Mosaic help with revenue leakage?

Own the of your business.