Imagine you’re in a sales meeting, celebrating the close of a big deal. It’s a great moment, but what’s the real impact? “Too often in sales, we focus solely on closing deals, which is important as a leading indicator of growth. However, ultimately, businesses are valued based on revenue growth, not just bookings,” said Matt Gahr, Chief Revenue Officer at Spiff.

The truth is that your business’s value hinges on revenue, not just bookings. Bookings can have contingencies and take time to convert into revenue, which may not translate to your bottom line when you need it most. That’s why understanding the downstream impact of various factors on your revenue is crucial to any business.

So, how can you navigate the complexities of revenue growth? It all starts with your revenue plan. Because an accurate and reliable revenue plan that can quickly adapt to changing conditions will drive your business forward, regardless of the circumstance.

Table of Contents

What is Revenue Planning?

Revenue planning is the process of setting a goal for how much total revenue your business can expect to bring in over a set period and finding ways to increase that amount, i.e., generate more revenue. It involves analyzing past sales data, current contracts, and market trends, while also prioritizing financial goals to create a strategic plan to reach a set revenue target.

Benefits of Effective Revenue Planning

Revenue planning is important for any company. Because knowing your expected income gives you better financial visibility, allows you to make smarter decisions, and helps you allocate resources efficiently. More importantly, you can boost your bottom line by identifying potential revenue streams and creating strategies to capture them.

Specifically, with revenue planning, you can gauge future cash flows, make informed investments, and mitigate risks that could affect your profitability. But achieving this comes down to a lot of other factors, including collaboration across departments, accurate scenario planning, and continuous monitoring of your cash flow — all to ensure it aligns with your revenue plans. This way, you can quickly adjust your financial or business strategy.

Revenue Planning vs Revenue Forecasting

Revenue planning and revenue forecasting, though closely intertwined, actually serve different purposes in a financial setting.

So here’s the deal on forecast vs. projection: Revenue planning involves a fixed number a company commits to before the start of the year, typically known as the budget or plan. These numbers provide a financial roadmap, outline the expected income, and guide resource allocation and strategic decisions for the year.

On the other hand, projecting — whether that’s reforecast, forecast, and latest estimate — is more dynamic. Instead of sticking to the fixed budget or plan, projections are regularly updated based on actual results from past months and revised estimates for future months.

Most companies create their budget early in the year and rely on it heavily during the first few months. You’d probably start using forecasts once you see trends a quarter or two into the year and adjust the budget with new information. It’s widespread for most companies to compare actual results to both the budget and the forecast.

For example, in a 1+11 projection, the company combines actual results from January with projected revenue for February through December. These projections can either follow the original budget or be adjusted based on new data and assumptions, giving you a more flexible and accurate financial outlook.

Notably, the terminology and frequency of these projections can vary between organizations. Some might reforecast once a year, while others do it monthly. In some places, forecast, reforecast, and latest estimate might mean the same thing, while in others, they have distinct meanings. Understanding these differences and how your company defines these terms is crucial for accurate financial planning and making sure strategic decisions are based on the most current and relevant data.

Watch an Overview of Mosaic's Revenue Planning Features

Best Practices for Revenue Planning

Revenue planning might seem broad and all-encompassing, but how can you ensure you do it well? Here are some best practices to guide you:

Align Revenue Planning with Business Objectives

Aligning revenue plans with business objectives is essential for any company. By forecasting revenue streams and setting targets, you ensure your income strategies match your long-term vision and goals. And this alignment guides your resource allocation, budgeting, and investment decisions. Simply put, you’ll be able to drive sustainable growth that supports your company’s mission.

For instance, if your business is focused on rapid market expansion, you might prioritize aggressive revenue targets from new customer acquisition over short-term profitability. Conversely, if you’re a mature company, you might focus on maximizing margins and cash flows from existing revenue sources.

Either way, by integrating revenue planning with your business objectives, you’ll have better financial visibility, and it’s just so much easier to make data-driven decisions. This way, all your business efforts are in sync, and every financial move supports your broader strategy — fostering cohesive, strategic growth.

Triangulate Your Revenue Plan

When it comes to revenue planning, it’s important to look at it from multiple angles to ensure accuracy and feasibility. This is where triangulating your revenue plan comes into play. Essentially, you build your revenue plan using two or three different models and then compare them to ensure consistency.

For instance, you might use a sales capacity model, a pipeline generation model, and a marketing funnel model. The sales capacity model focuses on the number of sales reps and their productivity. The pipeline generation model looks at how many leads are being generated and converted. The marketing funnel model examines the customer journey from awareness to purchase.

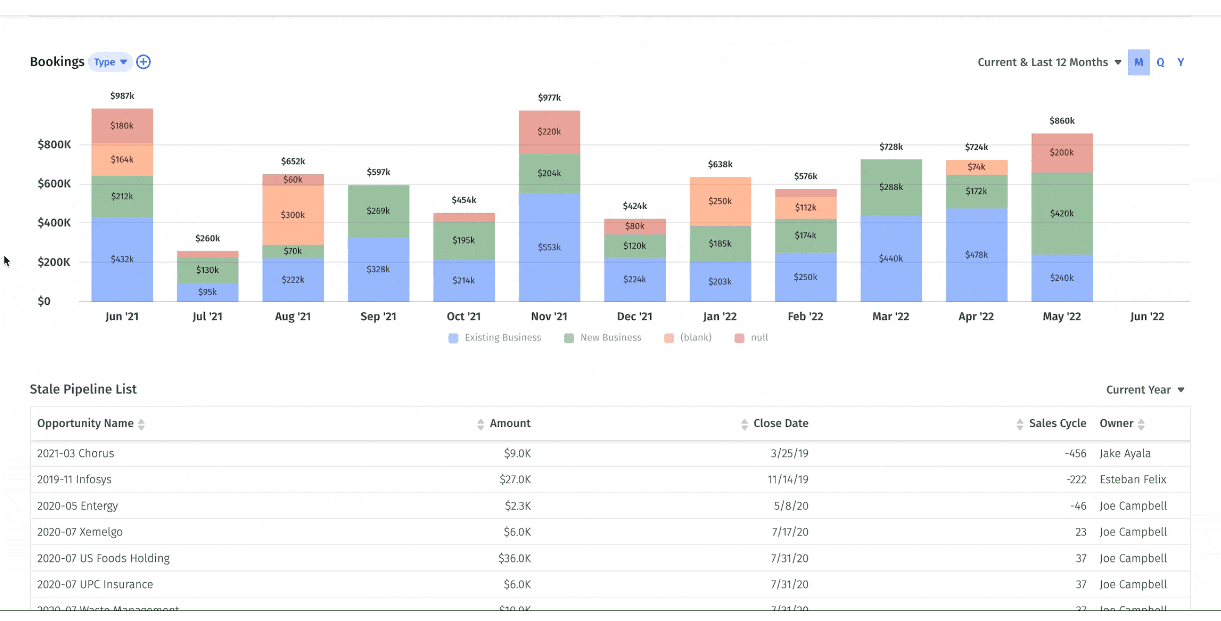

Pipeline Analysis Dashboard in Mosaic

By comparing these models, you can make sure all inputs make sense and align. For example, if your sales capacity model suggests that more sales reps will lead to more sales, but your pipeline generation model shows you don’t have enough leads to support those reps, you’ll end up with sales reps who have no deals to close and don’t hit their quotas.

Ultimately, triangulating your revenue plan helps you think through revenue from all angles and create a balanced approach. It ensures that your plans are realistic and that all aspects of your revenue generation strategy are working together to hit your targets.

Involve Key Stakeholders in the Planning Process

Getting input from key team members in finance, sales, and operations is essential for creating a well-rounded and effective revenue plan. That’s because when you bring together these diverse perspectives, you can leverage collective intelligence and expertise — all while gaining a better understanding of the factors that influence revenue generation.

For instance, if you’re on the finance team, you’ll bring your deep knowledge of financial metrics, budgeting, and forecasting and can offer insights into historical revenue trends, cost structures, and profitability analysis. You’ll be key in ensuring the numbers make sense and are grounded in financial reality.

On the other hand, the sales team is on the front lines with customers. They understand market dynamics and the competitive landscape. So, they can offer valuable insights into pricing strategies, demand forecasting, and new revenue opportunities — ensuring the plan aligns with real-world market conditions.

And then there’s the operations team. They bring a critical perspective on operational abilities, capacity constraints, and supply chain considerations. Their input can help make sure that the plan is realistic and that the company can deliver on its revenue goals without running into operational bottlenecks.

As you can see, involving these key stakeholders makes the revenue planning process a whole lot better. You can identify and address potential challenges, risks, and opportunities more easily and proactively. Plus, this cross-functional collaboration promotes buy-in, accountability, and a shared understanding of the revenue goals. So, that alignment gets you all on the same page, working toward the same outcome.

Leverage Historical Data and Market Trends

Historical financial data provides insights into a company’s past performance, trends, and patterns, informing revenue projections and planning. By analyzing your income statements, cash flow statements, and balance sheets you can identify key revenue drivers and establish a baseline for future forecasting.

But don’t stop there — integrating market trends and industry data is just as important. Keep an eye on consumer demand, economic conditions, competitive landscapes, and regulatory changes. Because doing so helps you anticipate potential opportunities and challenges and ground your plans in reality.

Ultimately, by merging internal historical data with external market intelligence, you can create more accurate revenue projections, discover new revenue streams, and make strategic decisions about resource allocation, pricing, product development, and market expansion. That’s pretty much everything that’s important to any business.

6 Revenue Planning Steps

Okay, you know why your revenue planning is important to your business. Now what? Every company does revenue planning a bit differently, and that’s because financial planning and analysis, or FP&A modeling, isn’t the same across the board. But to get you started, we’ve highlighted some essential steps that go into any good revenue planning process.

Step 1: Identify Your Revenue Channels

The first step in revenue planning is to understand how your business generates income from different channels. Does your revenue come from outbound sales, marketing efforts, referrals, or partnerships? You need to know where you’re getting the money from — and how much of it you’re getting from each channel.

And how do you do that? Evaluate how each channel contributes to your pipeline and how much you can rely on each one. For example, if you run an e-commerce business, focus on traffic and conversion rates. Think about how you can invest more or improve strategies to boost these metrics. If you’re in SaaS, look at recurring revenue. So, analyze how many of your current customers will renew and find opportunities to upsell or cross-sell additional products.

By triangulating your revenue channels, you can ensure you’re considering all aspects of your revenue generation. This way, you can make informed decisions and create a solid revenue plan that leverages each channel effectively.

Pipeline Generation Strategies & The Best Dashboards

And luckily, Mosaic makes this easier. For instance, Mosaic’s sales dashboard gives you insight into all the key sales pipeline metrics to make revenue planning easier — from bookings, renewals, and deal conversions to pipeline reports and customer acquisition costs. You can slice and dice your revenue channels to get detailed insights or zoom out to understand the big picture.

Since Mosaic collects large volumes of data by integrating with your business systems, and captures essential details, you can analyze everything, from conversion rates to the SaaS magic number. Essentially, this means you can view your pipeline from every angle and understand the “why” behind your numbers to make more strategic decisions.

Step 2: Define Clear Revenue Goals

As we discussed, setting goals is pretty much a non-negotiable step in revenue planning. This static number serves as your target for the year, so you set it at the start of a period and remember it consistently.

Specifically, well-defined revenue goals act as a clear roadmap for your organization. They align efforts across departments and ensure everyone works towards a common objective. Plus, they help you measure progress, spot areas for future growth, and make informed decisions to allocate resources effectively. Ultimately, having measurable revenue goals is essential for making smart decisions that lead to long-term success.

Step 3: Develop a (Reliable) Sales Forecast

Sales forecasting is crucial in revenue planning because it gives you a realistic picture of whether you’ll hit your revenue goals. But, 68% of companies miss their sales forecasts by at least 11%. Only 15% of revenue leaders are truly happy with their forecasting process, meaning 85% feel there’s room for improvement.

Example of a sales and marketing dashboard in Mosaic (Want to see it live? Get a demo.)

Sales forecasting often goes wrong when leaders base it on their gut feelings, or worse, dirty CRM data. For example, one account executive (AE) might log an opportunity after a few demos, while another might do it right after the first meeting. Obviously, this leads to wild fluctuations in data and in turn, useless analytics.

The fix? Consistency. Make sure everyone follows the same process and definitions.

Another common problem with sales forecasts is misaligned expectations between finance and sales. If both teams aren’t on the same page with their assumptions and expectations, someone somewhere will drop the ball.

Watch the On-Demand Webinar: 4 Traits of a Highly Effective Finance-Sales Partnership

And don’t forget to build flexibility into your forecast. In fast-paced environments, things change quickly, so your forecast needs to adapt to stay accurate and useful.

So, how can you develop a reliable sales forecast? It’s simple: Make it data-driven. Regularly update key data points like stage, amount, and close date, and ensure everyone understands and follows these definitions. Additionally, share average sales conversion rates by stage to help AEs build more accurate forecasts by giving them another perspective on their pipeline. This way, you can create more accurate sales forecasts and support better revenue planning.

Step 4: Estimate Operating Expenses

By accurately forecasting costs like salaries, marketing expenses, rent, and utilities, you can better understand your profitability and cash flow needs. That’s why projecting operating expenses is crucial for creating a comprehensive revenue plan. With these insights, you can set realistic revenue targets — ones that account for the necessary expenses that come with revenue operations and planning for growth.

Additionally, projecting operating expenses helps you identify areas to optimize costs and allocate resources effectively. Thanks to a holistic view of the financial landscape, you can make informed decisions about pricing strategies and revenue streams to mitigate risks and increase the chances of achieving your revenue goals — all while maintaining a healthy bottom line.

Step 5: Create Multiple Revenue Scenarios

Your revenue forecasts, when compared against actual performance, will let you know if you’re going to hit or miss your revenue goals.

Ask any finance leader what their toughest responsibilities are, and you’ll inevitably hear revenue forecasting near the top of the list. [...] But it’s critical that finance pushes through the sleepless nights and headaches to nail down an accurate revenue forecast. Your company lives and dies by its ability to hit growth targets and revenue projections,

But to get revenue forecasting right, you need plan for multiple scenarios: the best case, worst case, and most likely. This way, you’ll be prepared for various outcomes, ready to act with a strategy that will still get you closer to your revenue goals.

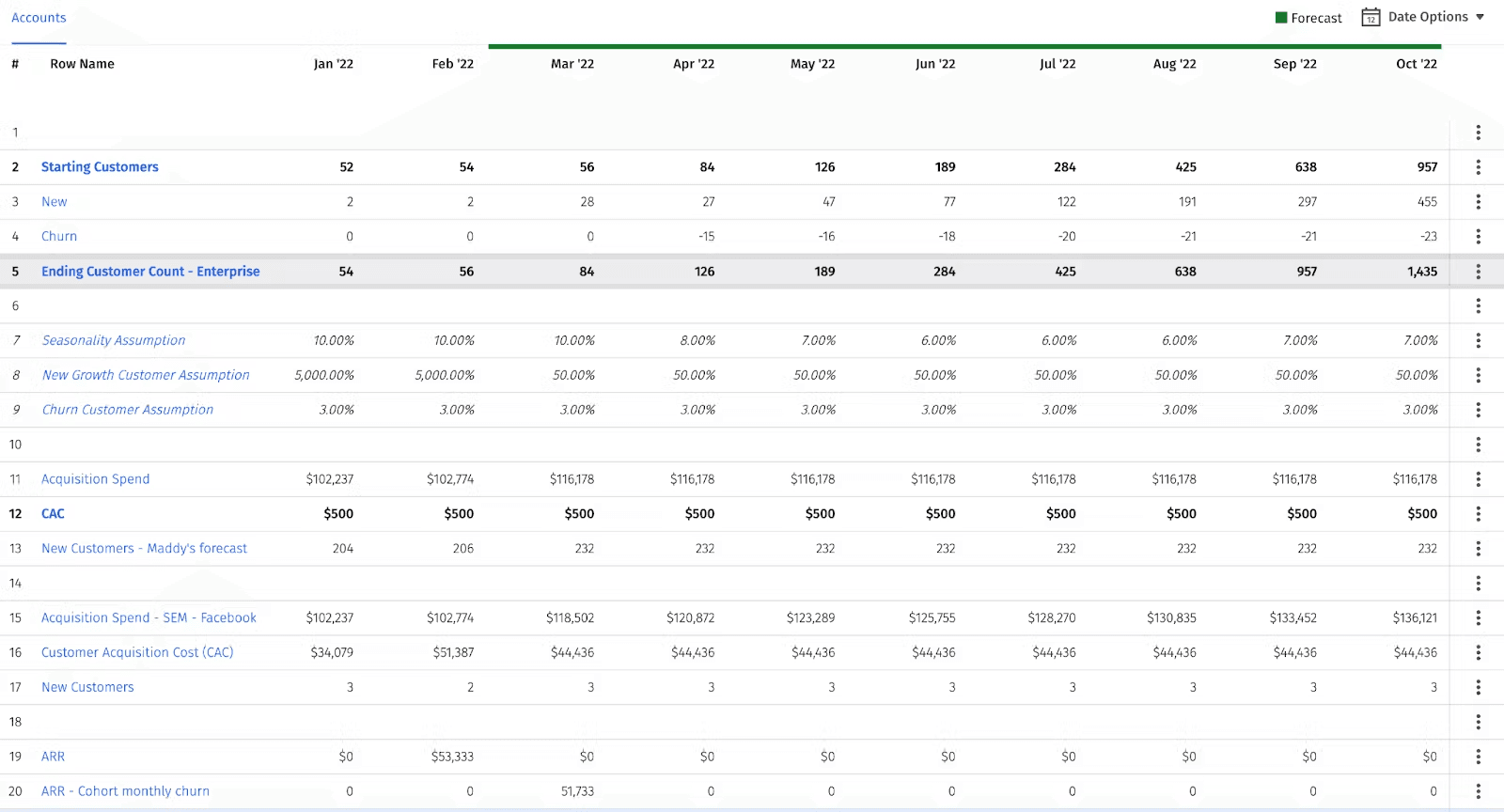

ARR snowball top-line model in Mosaic.

Start by adjusting your assumptions for each scenario — base, low, and high. Consider factors like win rates, conversion rates, the number of account executives, and advertising spend. Each scenario should have clear drivers for its inputs to ensure that the projections are grounded in reality. For example, if you increase the number of sales reps in your best-case scenario, make sure your pipeline generation supports this growth.

By creating multiple revenue scenarios, you can anticipate potential challenges and opportunities. Essentially, the best-case scenario allows you to capitalize on unexpected growth, the worst-case scenario prepares you for downturns, and the most likely scenario keeps you grounded in reality.

Ideally, you should have a flexible and responsive plan that can adapt to different market conditions and help you stay on track.

Download Mosaic's Annual Planning Blueprint Ebook

Step 6: Monitor and Adjust the Plan Regularly

As market conditions, customer preferences, and internal operations shift, adapt your revenue plan. This adaptation allows you to seize new opportunities and avoid potential risks.

Continuously monitor key performance indicators to spot deviations from your projections and incorporate new data and insights. This process helps you make timely adjustments to your revenue strategies, resource allocation, and target markets. By keeping your plan updated, you ensure your business stays agile and competitive, aligning your revenue efforts with your overall goals and objectives.

Create a Revenue Plan Faster Using Mosaic

Using Excel and Sheets for top-line planning might seem convenient, but they can be time-consuming and cumbersome. The effort spent pulling data, updating assumptions, and revising models could be better spent on strategic business planning.

Mosaic’s Topline Planner combines the flexibility of spreadsheets with the real-time data you need to keep up with a high-growth company. So, you can quickly build and maintain custom revenue forecasts that fit your unique business needs.

The best part? Mosaic integrates with all your business systems — ERP, CRM, HRIS, billing, data warehouse, and flat file upload — to pull all the essential data into a single source of truth, all in real time.

Mosaic's Metric Builder

When you use Mosaic for revenue forecasting, you can do it faster and more accurately than ever before. With direct connections to a comprehensive metrics catalog, you get access to a full library of 150+ on-demand financial metrics for real-time, accurate modeling. Plus, creating custom formulas in Metric Builder is super easy with Mosaic’s auto-complete features.

Ready to make revenue planning easier? Reach out for a personalized demo of Mosaic.

Revenue Planning FAQs

How often should a business update its revenue plan?

A business should update its revenue plan regularly, ideally on a monthly basis.

How can businesses ensure their revenue plan is realistic?

How do market trends influence revenue planning?

Own the of your business.