If concerns over a market downturn teach SaaS businesses anything, it’s that business leaders need to make faster, more proactive decisions. It’s no longer enough to rely on traditional financial processes and software that don’t offer automation and real-time updates. Instead, finance and accounting departments need to adopt more malleable strategies to meet current market conditions.

One way to do that is with a rolling budget. While traditional budgeting tends to be inflexible and reactive (not allowing for any changes throughout the year), finance teams are embracing the more agile rolling forecast to address changes monthly or quarterly. When you embrace the rolling budget, you’ll be able to make your budgeting process more than a formality — and less painful for all involved.

Table of Contents

What Is a Rolling Budget?

A rolling budget, or continuous budget, is a budgeting process that is updated on a regular, ongoing basis. Rolling budgets gradually extend the current year’s budget by adding a new budgeting period as the previous period expires, such as anticipating the budget for the next month or quarter.

Rolling budgets provide a summary of your company’s revenue, fixed and variable expenses, as well as your profits. When using a rolling budget strategy, you will conduct a budget variance analysis on a monthly cadence in order to monitor your financial budget model and revise budget assumptions based on existing figures or spending projections in the current quarter. You can then deduce which areas of the business may need more flexibility with their department budgets and where there are opportunities to reduce spend or uncertainty throughout the company’s financial plans.

Rolling Budget Example

Unlike traditional annual budgeting, rolling budgets are usually updated monthly or quarterly and projected 12, 18, or 24 months out. For example, a company’s 2023 annual budget will become a rolling budget if, in March 2023, it adds the budget for February 2024 (to replace the February 2023 budget). At this point, the rolling budget will cover all revenue, expenses, and profits from March 1, 2023, through February 29, 2024.

Once March 2023 has come and gone, the rolling budget will consist of the 12 monthly budgets from April 1, 2023, through March 31, 2024. And the cycle continues on from there. After the current monthly budget ends, a new monthly budget is added at the end of that term — thus maintaining the 12-month outlook.

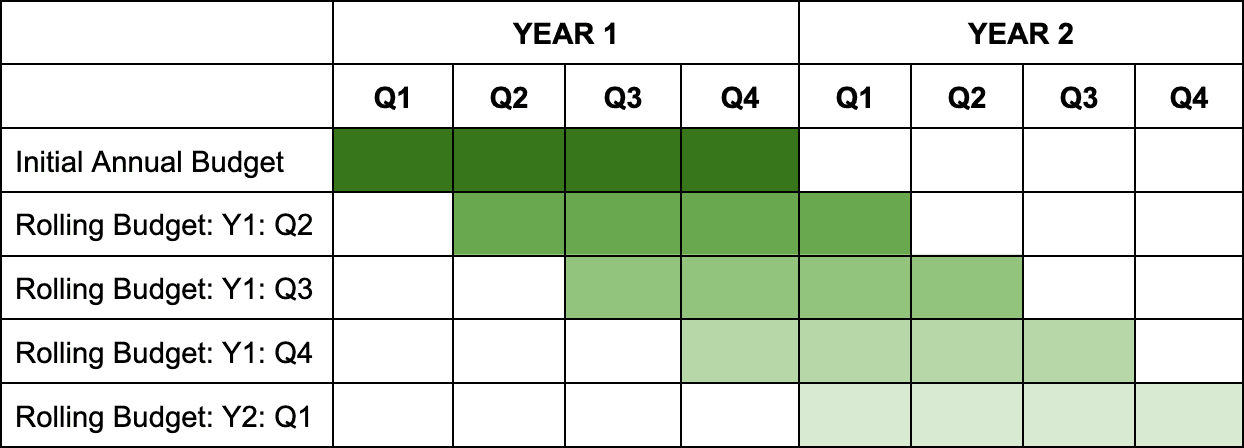

The following table provides a simple visualization of how rolling budgets work:

Note that even though rolling budgets are updated on a monthly basis (or quarterly basis, as shown here), they’re still applied over an entire year.

What Is the Difference Between a Rolling vs. a Continuous Budget?

The terms rolling budgets and continuous budgets are used interchangeably.

While rolling and continuous budgets are synonymous, they differ from traditional budgets quite a bit. While most conventional types of budgets are static plans updated on an annual basis, a rolling strategy is regularly updated during the designated budgeting period. In that way, rolling budgets are a lot more dynamic and flexible as compared to traditional budgets (which tend to be more rigid/fixed).

Advantages of Rolling Budgets

Rolling budgets come with a number of advantages for SaaS businesses, such as providing an accurate picture of the company’s financial state and supporting increased financial agility.

Accurate Representation of Financial State

Rolling budgets rely on historical data versus guesswork and gut feelings. In turn, these budgets provide an accurate representation of the company’s financial state at any given time. Keep in mind the same cannot be said for static budgeting methods — which often rely on assumptions.

With rolling budgets, you have a closer sense of what exactly is going on with the company’s finances due to the constant collaboration with department and executive leadership. You gain deeper insight into capital efficiency as leadership works through headcount planning and forecasts for critical hires, as well as operational efficiency as department leaders look at upcoming campaigns or additional seat purchases for any software that requires it. And when it’s time for leaders to send an investor update, you can quickly supply numbers around capital allocation due to being closer to the numbers on a consistent basis.

Greater Flexibility and Agility

Rolling budgets allow you to expand in line with revenue growth since you have up-to-date financial statements. You can easily adjust the budget and conduct scenario analysis to match market fluctuations, leverage new opportunities, and create realistic spending limits for the next year.

Because rolling budgets account for surprise expenses, they support greater financial agility. Changes are more easily managed rather than rendering your current budget obsolete. Surprise expenses can also be made up for in future months by cutting or adjusting more flexible line items, such as marketing PPC campaign spend or postponing a non-mission-critical hire — which is next to impossible when you’re working with a static budget.

Reduced Levels of Uncertainty

Reduced uncertainty is the key to driving smart decisions and scaling the business in a sustainable way. Executive leaders need to understand what the company’s growth looks like, and if you’re constantly unsure about the company’s financial status or what to plan for next, the company will surely see the end of its runway and potential.

Companies must be aware of market conditions at all times because they dictate the ebb and flow of cash flow. Because of their inherent flexibility and agility, rolling budgets are able to respond to market conditions appropriately. eliminate uncertainty around what your cash inflow and outflow look like so you can keep your financials on track.

Better Collaboration Across Departments

Because you update rolling budgets more consistently, you need to collaborate with department leads more often to ensure department budgets are accurate. This collaboration also improves visibility across the organization, as leaders must provide updates or look into anything that may be wasteful. With static budgets, these conversations may not happen as often due to the budget being set — or leadership may have to pivot the budget entirely in the event of an economic downturn or low sales figures.

Plan for company growth with our Financial Planning Blueprint.

Disadvantages of Rolling Budgets

Despite all the benefits of a rolling budget, they have a few drawbacks as well. Namely, these budgets can require more skilled personnel and possibly trigger a lot of confusion.

Requires More Buy-In and Dedication from Department Leaders

Since rolling budgets are frequently updated, they typically require more time and dedication from department leaders and the finance team alike. Seeing as every department has to provide numbers and assist in projections at the end of each month (or quarter), rolling budgets have the potential to put more strain on resources, especially at critical times for other reports (such as the month-end close). The introduction of financial close software can help streamline these monthly updates, easing the workload on team members and ensuring a smoother budgeting process.

Business budgeting software can also help relieve some of this strain by way of automation. Not only does finance automation boost productivity and team morale, but it’s a great asset that reduces human errors that can pop up during the budgeting process.

Can Be a Catalyst for Confusion

The whole idea behind rolling budgets is that they can constantly adapt and adjust as you see fit. Unfortunately, these constant changes can also be a catalyst for confusion and frustration among employees. If these changes add more responsibilities to any team leader’s plate, feelings of frustration might be apt to increase as well.

The best thing you can do is make sure you clearly communicate what’s going on with the budget, explain how changes will affect each department, and divide up the responsibilities evenly so certain teams (or team members) don’t feel overwhelmed or demotivated. One way to get past confusion is discovering the “shared language” between finance and departments, whether it’s relying on written-out paragraphs or visualizations that help everyone remain on the same page.

More Time-Consuming Than Annual Budgets

In general, you can expect rolling budgets to be more time-consuming than annual budgets. This is especially true when you’re working with a lot of different stakeholders. So the more stakeholders you have, the longer it’ll take to prepare a budget. That said, rolling budgets also require more of your time because they call for continuous monitoring — which is obviously more demanding than working on just one budget per year.

Financial software can automate certain tasks to reduce the hours spent monitoring or creating a rolling budget. You can then shift your time and attention to other value-added tasks, like diving into the “why” behind the numbers and looking at opportunities and trends that may help the business’ growth.

Give Department Leaders Deep Financial Insights for Better Budgeting

Create a Rolling Budget in 6 Steps

Thinking about creating a rolling budget for a SaaS business? Follow these six steps:

1. Get Everyone on Board

Make sure you have buy-in from all relevant stakeholders to implement a rolling budget. After all, the financial planning process should never be done in isolation — it calls for input and commitment from founders and department leads to ensure they understand how this method works so that everything flows as optimally as possible. If your heads of marketing and sales are used to creating budgets at the beginning of each year, you’ll need to explain that the rolling budget will be managed on an ongoing basis.

Unless everyone is fully aligned and on the same page, updating your budget could bring about a lot of headaches and hassle. For that reason, be sure you have the support of any additional stakeholders before moving forward with these changes.

2. Map Out Your Resource Needs

Even with the approvals, you’ll need to map out your resource needs before you can adopt a rolling budget strategy. For example, department heads should prepare their numbers and projections before they implement the rolling budget since those roles play a significant part in budget creation and further allocation.

Test out any current software, or explore other options to ensure automation and other capabilities are available. Make sure that despite any additional costs for any software, you can still deliver the ROI your company needs.

3. Come Up with Budgeting Workflows

Once you have a grasp on your resource needs, you can design your budgeting workflows (along with defining key stakeholders). Different departments will need to collaborate to come up with an accurate budget and optimized workflows. So you’ll want to run plenty of test scenarios before your rolling budget is in full effect. Similarly, check with executive leadership to ensure the budget accounts for current and updated business goals.

4. Settle on a Time Horizon

With your workflows in place, you can settle on a time horizon for how far into the future your budget will go (and how frequently it will be updated). For instance, do you want to make updates every month or every quarter? Would you like to forecast your budget six months from now or a full year from now? The answers to these questions will guide how your rolling budget comes together based on what’s most appropriate for your current circumstances.

Note that long budgeting and accounting periods can help directionally, whereas short-term budgeting will likely improve your accuracy. However, shorter time frames may not be forward-looking enough to suit the company’s business model (so that’s something else for you to consider).

That said, the budgets for SaaS businesses tend to fluctuate more than other industries. An acquisition channel can take off in a hurry, or a new competitor might latch on to a larger market share. Therefore, it makes sense for SaaS companies to update their budgets more regularly.

5. Adjust Your Budget Accordingly

After your time horizon has been established, you’re ready to make adjustments to your budget. More often than not, these adjustments happen according to the changes revealed in your budget variance analysis at the end of each month. Still, it can be challenging to connect every trend to your rolling budget model. Say your employee onboarding costs increased by 5% — what does this mean for your total operating expenses?

That’s why you should only change what makes sense right now and determine how other elements impact the budget over time. It’s better to make budget adjustments incrementally rather than rush into things and regret some of the changes you approved. In short, you always want to understand the “why” behind any changes you make so they’re as effective as possible.

6. Monitor Budget Performance

The final step in creating a rolling budget is to monitor the actual performance of the budget. This monitoring stage should involve a careful financial audit of your budgeting process to ensure your rolling budget has the best chance of strengthening the business’ objectives.

If you’re not seeing higher margins or achieving your financial goals, you’ll need to figure out where your rolling budget has room to improve — or whether this is even the right budgeting method for your business at this time.

Mosaic is the ideal partner for SaaS businesses looking to shift to a rolling budget strategy. When you team up with Mosaic, you’ll have the tools you need to identify budget variances so you can further investigate what’s causing them. In many ways, being able to pinpoint these variances is the foundation for more collaborative (and more effective) financial planning.

Mosaic knows a modern SaaS budgeting process has to be flexible in order to get the most agile, actionable insights that lead to strategic decision-making across the organization. Mosaic integrates with your main source systems, which allows you to see changes in real time so you can forecast/update your budget and see it reflected on other metrics in real time as well.

After HappyCo joined forces with Mosaic, they were able to analyze expense and revenue forecast variances in real-time via Mosaic’s budget tracking canvas. The HappyCo team was able to quickly pull insights and drill down into the data on the spot, which made their critical budget information available on-demand so reports and insights could be shared with stakeholders quickly. With so much of the heavy lifting handled on their behalf, HappyCo could focus on bigger variables related to their growth initiatives.

Ready to excel at budgeting and fuel your own business growth? Request a personalized demo from Mosaic today.

Rolling Budget FAQs

When should you use a rolling budget?

As rolling budgets are dynamic and provide ample flexibility, a rolling budget is best for companies that feel they need to watch their budget on a more consistent basis, such as during tough market conditions, low sales periods, or periods of hypergrowth.

What is a rolling budget vs. a static budget?

What are rolling budgets used for?

What is a continuous budget?

Own the of your business.