NetSuite adoption can be a real nightmare for just about any business, as is the case with any significant organizational change.

But once your business reaches a certain scale and you start to outgrow accounting solutions like QuickBooks and Xero, upgrading to an enterprise resource planning (ERP) system like NetSuite starts to feel like a necessity.

There’s no getting around the fact that NetSuite implementation is complex. But you can simplify adoption by streamlining the data cleansing and migration processes that cause so many new technology implementation initiatives to fail.

Table of Contents

When NetSuite Starts to Feel Necessary

NetSuite first starts to feel necessary when your transaction volume and complexity exceed the accounting capabilities of Xero and QuickBooks — this is when the benefits of ERP software upgrades begin to look really appealing.

As your business grows, you need to keep a tight grasp on all kinds of transaction types—vendor bills, customer invoices, credit cards, prepaids, accruals, revenue recognition, amortization, purchase orders, and more. Xero and QuickBooks offer solutions to support them all, but the software does little to automate the accounting behind them on a consistent basis.

Some companies will dive straight into a NetSuite implementation for its advanced features that can handle the increase in financial complexity. But it’s not impossible to build a team to manage things like depreciation, amortization, prepaids, and order-to-cash processes in Xero or QuickBooks. You’ll feel more pressure to implement NetSuite when you reach the next level of complexity.

The Usual Point of No Return

The typical point of no return where we see our customers give in and take on a NetSuite implementation is when they open more than one subsidiary. Managing multiple subsidiaries leaves you no choice but to create and maintain multiple instances of QuickBooks or Xero—and that’s just not a viable option for growing finance functions.

A simple example of the subsidiary challenge is if a medium-sized enterprise or high-growth company expands from the U.S. and opens a new office in the U.K. That expansion leaves you with two subsidiaries operating with two different currencies.

If you’re still on QuickBooks or Xero, you’d need to create separate environments for financial management of those subsidiaries. So, you end up with one full-fledged accounting system for your U.S. operations and another one for the U.K. (not to mention multiple human resources and payroll systems…but that’s another conversation). And every month, you’d have to manually translate both instances into one currency and consolidate those instances into a unified view for financial analysis.

Consolidating financial data from multiple subsidiaries with QuickBooks or Xero might take two or three weeks. And by then, it’s time to close the books on the next month. You end up in a vicious cycle that buries in you in a financial reporting nightmare where you can never get a real-time view of your entire business.

Traditionally, this has been the final straw where our customers knew they outgrew Quickbooks and Xero.

What Makes NetSuite Cloud ERP Implementations So Difficult?

Adoption of ERP software can be challenging no matter which ERP vendor you choose, but the fundamental reason why the NetSuite implementation process, in particular, is so hard is that you’re essentially buying an empty software shell. It’s an incredibly powerful tool. But it’s not configured at all when you first purchase it.

It’s a bit like buying a new-construction home. Early on, it’s just a frame. You need to add insulation, plumbing, electricity, appliances, furniture, and more to make it livable. The NetSuite implementation process is the same way. You can’t make the purchase and expect to be up and running the next day. You’ll be making the move over the next three to six months as you shift your entire financial workflow into the empty NetSuite shell.

Even if you follow NetSuite’s own implementation methodology and steps to the letter, you’ll still face an uphill battle to finish the project. You don’t have to search hard to uncover horror stories about NetSuite implementations gone wrong—even with the help of implementation SMEs or change management specialists. And at an average of $55,000 per year to make use of ERP software according to research from CFO Roundtable, you can’t afford to have the project fall apart.

There are many different stages where the implementation of ERP software can go wrong. But the biggest hurdle for anyone moving from QuickBooks or Xero to NetSuite is the data migration process.

Data Migration Is A Major Pain Point

The data migration process is how you fill an empty NetSuite shell with all of your financial data. But exporting all of your business information from QuickBooks or Xero and preparing it for NetSuite is difficult. This data cleansing, migration, and information management process is grueling, and it’s one of the main reasons companies are willing to spend $150+/hour to outsource the project management work to a NetSuite consultant.

You have to go through your QuickBooks/Xero export line by line, reviewing every single transaction across your business. Each one has two sides: credit and debit. You need to make sure those sides balance and then format them in a way that NetSuite will actually understand. It’s a massive time commitment—especially if you want to go the DIY route and avoid spending tens of thousands of dollars on a consulting service.

You could skip the onerous data cleansing and extraction process by going live with a blank slate in NetSuite. Instead of transferring historical data, you could instead just add the most recent account balances from QuickBooks to your new NetSuite instance and move forward from there.

But losing all of that financial historical information will limit your ability to understand exactly what happened and hinder your decision-making going forward. When questions arise about the past, you won’t have the granularity you need to understand the why behind the numbers. Losing this level of visibility will also damage the accuracy of your SaaS financial models and forecasts.

If you don’t get the data cleansing and migration process right (without losing historical data), NetSuite won’t work properly for you once it goes live. It’s a critical success factor in the NetSuite implementation process, and it shouldn’t require a quarter-long engagement with consultants to execute.

Mosaic Integrations Give You Two Solutions to NetSuite Challenges

Mosaic integrations form a bridge between your existing accounting solutions and your new ERP solution to streamline data consolidation and migration process, giving you two approaches to the NetSuite adoption dilemma.

Using Mosaic, you could solve your multi-subsidiary, multi-instance challenge and avoid the NetSuite implementation process longer than previously possible. Or, you could simplify the transition by making it easier to move all your financial data into NetSuite.

Mosaic Automatically Consolidates Data from Multiple Instances of Quickbooks or Xero

Mosaic enables teams to integrate multiple instances of ERP systems such as QuickBooks and Xero to analyze, report, and forecast both financial and non-financial metrics at a consolidated level. And as a result, you can make up for the shortcomings of QuickBooks and Xero. Instead of having to move to NetSuite to manage your multi-subsidiary, multi-instance environment, you can use Mosaic to overcome the shortcomings of your SaaS accounting software. And even when you do move over to NetSuite, you’ll have a more cohesive Custom Reporting tool that goes beyond what NetSuite report builder is capable of.

Mosaic does more than just provide a simple financial statement output. The platform maintains transaction-level detail across all ERP systems which means customers no longer need to rely on detailed and error-prone manual financial consolidation in spreadsheets.

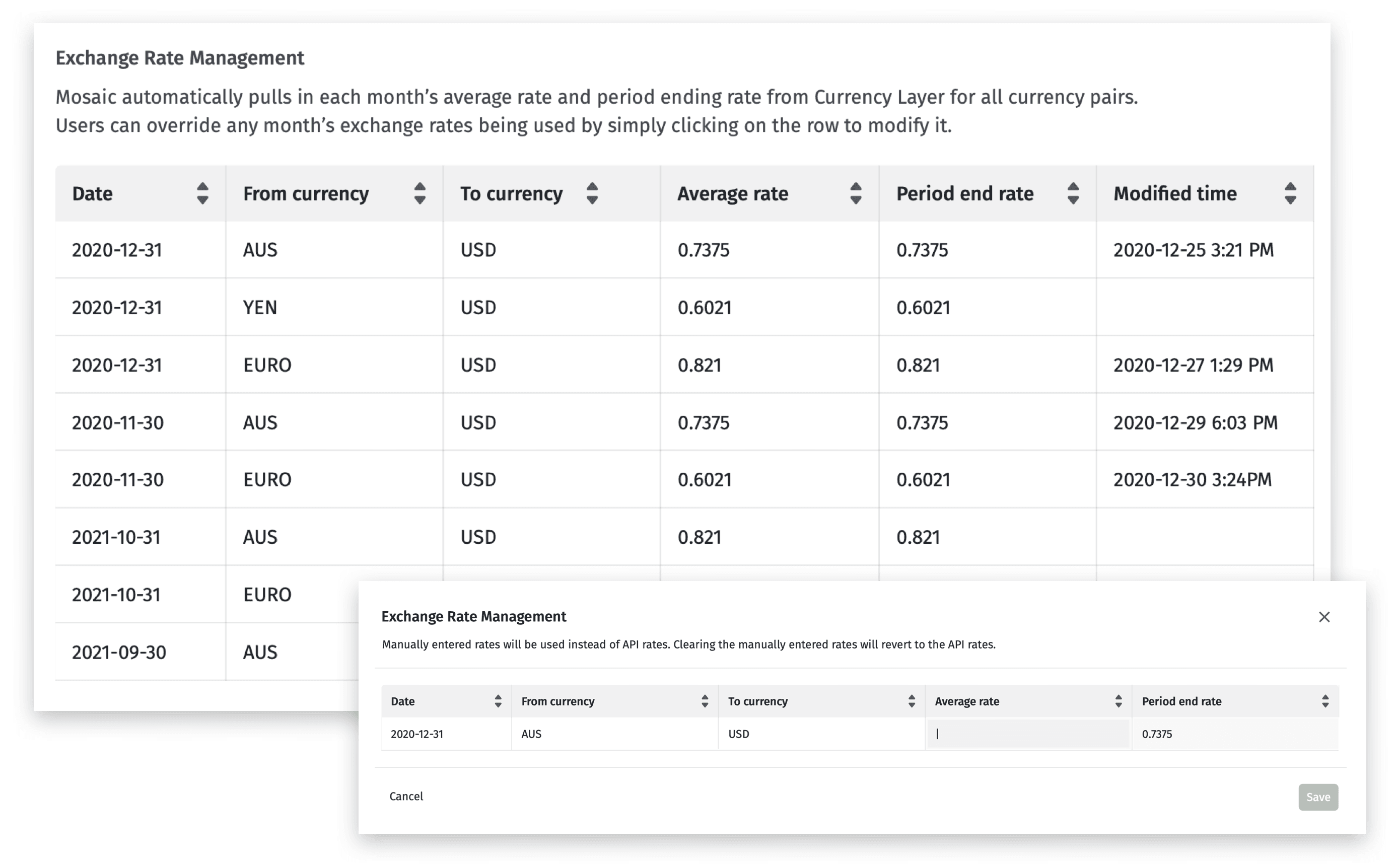

We seamlessly connect siloed financial data and automatically convert foreign currencies to assist with complex intercompany eliminations. And we leverage CurrencyLayer data to calculate each month’s average daily exchange rate and period ending rate for you, eliminating hours of manual effort in spreadsheets.

Mosaic’s strategic finance platform allows teams to consolidate insights across global systems so stakeholders can use data to inform strategic plans and collaborate around business insights. The platform transforms the modern finance function into a clear, connected, collaborative power center built for adaptability — even if you aren’t quite ready to make the jump to NetSuite.

Mosaic Makes It Easy to Import Financial Data into NetSuite

Mosaic brings a layer of automation to the data cleansing aspect of NetSuite implementation, making it easier to import financial information and business processes into your new system.

Data exports from QuickBooks and Xero are full of empty rows, wrapped text, inconsistent spacing, and other formatting issues. An accountant can work through those formatting issues in Excel—but NetSuite won’t understand the data.

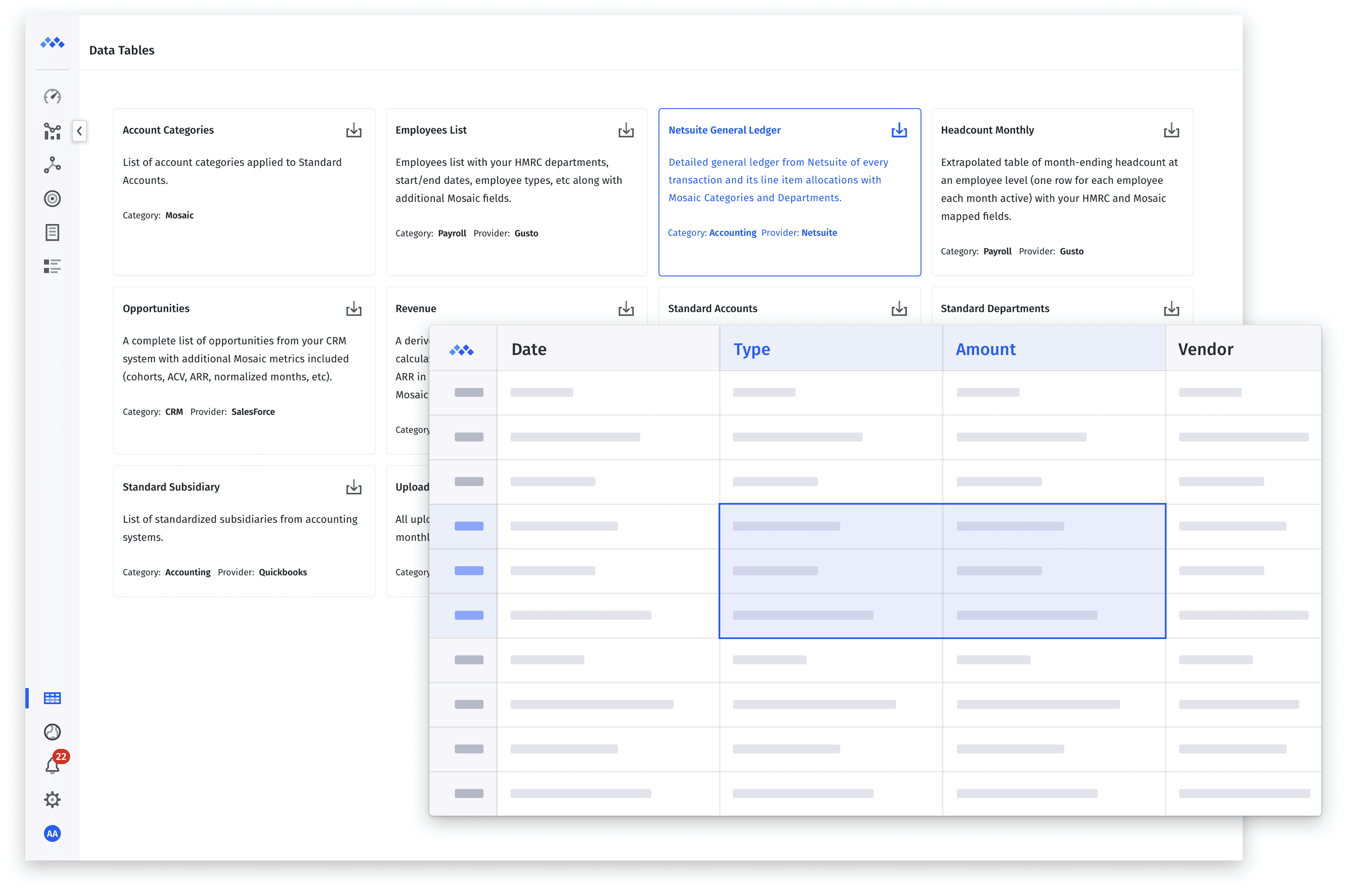

Mosaic reformats your data in a machine-readable way. That way, when you pull data from legacy systems through Mosaic, you’re left with a set of perfectly formatted financial information that you can port directly to NetSuite. Compare the following image of a Mosaic data export to your QuickBooks or Xero exports and you’ll see the difference for yourself.

We know this is a major pain point for any scaling finance team. That’s why we spent so much time trying to create an intuitive data architecture when building Mosaic.

Streamlining the data migration process doesn’t suddenly make the entire implementation process easy. A successful NetSuite implementation plan still requires you to understand business requirements, map out system customization, and create workflows that maximize NetSuite’s functionality. But streamlining data cleansing and migration will save you money—and increase the likelihood of a successful ERP project.

Mosaic Integrations Empower More Strategic Financial Planning and Analysis

NetSuite integrations enable more than just a smoother data migration process during implementation. Mosaic integrates your new NetSuite solution with your other critical information systems, including your CRM, HR system, and billing systems, to empower more strategic financial planning and analysis (FP&A).

Solutions like QuickBooks and the NetSuite platform support accounting processes first and foremost—not financial planning and analysis. So, even after you’ve gone live with NetSuite, it would typically take an FP&A analyst to go through and continue mapping data in a way that supports forecasting and modeling needs.

We built Mosaic to fill the gap between accounting processes and more forward-thinking strategic finance and help companies unlock competitive advantages with financial data. Our NetSuite integration merges ERP system data with real-time actuals from your other critical business systems. Instead of having an analyst waste time mapping data, you get at-a-glance insight into key metrics for your SaaS company like:

- Runway and cash balance

- Customer acquisition cost

- Accounts payable and accounts receivable

Want to learn more about how Mosaic enables a smoother transition to NetSuite (and empowers strategic finance at the same time)? Get a demo today and see for yourself how the platform unlocks real-time insight into your financial data.

Own the of your business.