Average Sales Cycle

What Is Average Sales Cycle?

Average sales cycle is the average time it takes a prospect to close after entering your sales pipeline. It begins with a new lead becoming aware of your services and ends with the lead becoming a customer and potentially sending referrals your way. The average sales cycle can differ greatly depending on the product or industry, but according to Hubspot, the average SaaS sales cycle is 84 days.

Categories

Your average sales cycle is a critical component of revenue forecasting. Without clear visibility into how long it takes for leads to become customers, you risk inaccuracies in revenue forecasts that stunt your growth trajectory and erode investor trust.

Many SaaS companies try to assess their sales cycle length by comparing it to industry standards, but this can be misleading. There are different products and price points in the SaaS market that affect the benchmark for the average sales cycle of SaaS companies.

Instead of comparing yourself to other companies, you should gather data on your own sales cycle, understand how to interpret that data, and find opportunities for improvement.

Table of Contents

Why Is Average Sales Cycle Important?

Average sales cycle is one of the most fundamental sales performance metrics because it acts as a leading indicator of revenue generation. Understanding your company’s average sales cycle helps you project revenue based on how many prospective customers are in your sales pipeline. This information allows the marketing team to consider how many qualifying leads their campaigns attract, which leads into deeper insights for them to build upon successful tactics.

Sales managers use this information to determine potential pain points throughout each stage of the sales cycle, and how to improve the cycle toward faster conversion. Sales and marketing can also evaluate sales funnel metrics to identify how they qualify leads, from the beginning of the funnel through what particular companies are looking for based on their industry and what services they require from your product.

Alternatively, the average sales cycle helps finance spot downturns in revenue. Your team can then trend particular losses and deliver insights to sales and marketing, who can then proactively improve campaigns or seek feedback on what prospective customers want to see from the company to convince them to sign the dotted line.

Average Sales Cycle Stages

Understanding the length of your sales cycle and how it functions allows you to keep an eye on spend throughout the sales process.

The average SaaS sales cycle has 7 stages:

1. Prospect and Find Leads

This stage involves finding potential customers that may need the company’s service. Sales development representatives (SDRs) spend time calling and sending emails, while the marketing team employs strategies for lead generation. One ideal option is to receive referrals from current customers, as it’s free word-of-mouth that already garners some trust between the prospect and the company’s product.

2. Connect

The prospective customer connects with your brand, whether that’s through visiting your company blog, attending webinars, or engaging with your social media content. This stage varies dramatically, as visitors can take a few minutes to months to initiate first contact via a demo request, call, or email to connect with your sales team.

3. Qualify

Not every website visitor is a viable prospect. In this step, your marketing team and SDRs verify that the leads are a fit for your service. The company can cut this stage down immensely by sorting this data in Salesforce, which also helps route customer information so a sales rep can initiate contact.

4. Present

Once your sales rep learns more about the prospective customer’s needs, they present the product and/or service to demonstrate its value.

5. Overcome Objections

During the product presentation, your sales rep receives feedback and deeper inquiries regarding the product. It’s up to your sales rep to figure out the prospects’ biggest reservations about the product/service and demonstrate solutions or discuss the products’ developments that encourage buy-in toward the future.

6. Close

Whether the sales rep wins or loses the prospect, they must lead buyers to a decision. If the customer decides the product isn’t right for them, the cycle may end here. And if the customer signs, the sales rep initiates introductions to the customer’s account manager and customer success team, alongside other resources.

7. Nurture

After winning a customer, it’s important to regularly follow up and check in with them to keep winning their business. With a happy customer, you can also ask for referrals, which keeps feeding the cycle (and increases their customer lifetime value). This stage is also important for any close-call prospects: Sales managers should check in on them to see if they’re happy with their chosen service, or keep them updated on product developments that would have swayed them during their initial sales engagement.

How to Calculate Average Sales Cycle

The sales cycle for each customer varies, but calculating the average allows you to identify trends that can create proactive solutions to improve the sales cycle.

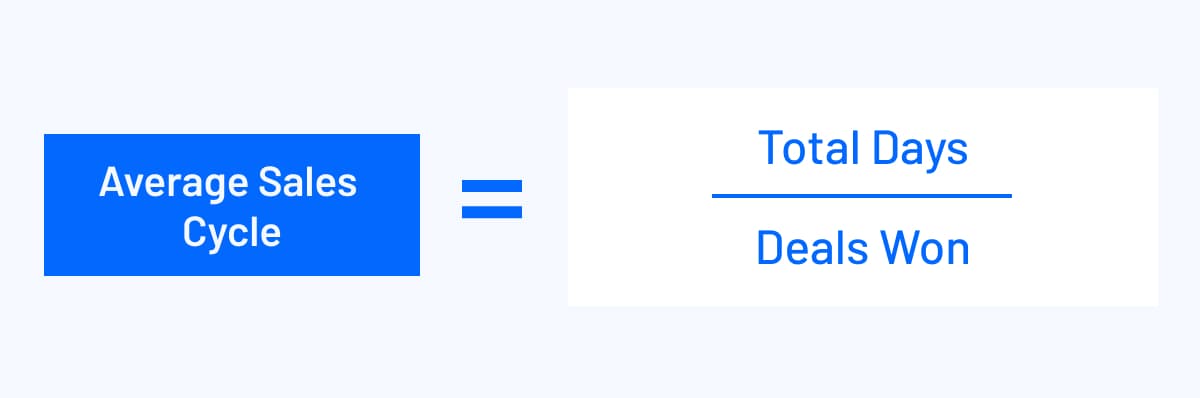

To find your company’s average sales cycle during a specific time period:

- Add up the total number of won deals in the period.

- Sum up the total number of days it took for each deal to close.

- Divide the total number of days by the total number of deals.

For example, suppose you had two closing deals. One deal took 30 days, while the other deal took 20 days. Here’s how you’d calculate the average sales cycle:

Total number of deals = 1+1 = 2

Total number of days = 30 + 20 = 50

Average sales cycle = 50/2 = 25 days

So the average sales cycle in this scenario would be 25 days.

Your average sales cycle will change as your company grows, acquires new customers, and introduces new offerings. More sales reps leads to more conversations with prospects and typically higher sales funnel conversion rates — but you need to track sales rep ramp times to add context to how your hiring plans impact average sales cycle.

Why SaaS Companies Shouldn’t Focus on Average Sales Cycle Benchmarks

Average sales cycles for SaaS companies vary widely, making most benchmarks less useful for your particular business offering.

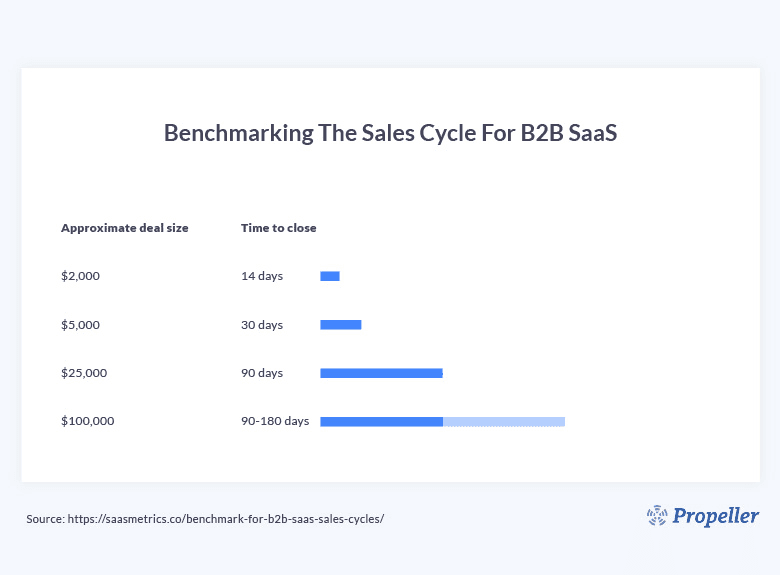

So while the average sales cycle in SaaS is 84 days long, your business’ sales cycle can be much higher or much lower and still be acceptable. Data from Marketing Charts shows that the average B2B sales cycle length varies from a few weeks to over a year:

Several factors affect the average sales cycle for SaaS that essentially distills any benchmarks. These include:

Pricing Strategy Alters Sales Cycles

Your SaaS pricing strategy sets the foundation for your sales cycle. If you offer a product-led freemium product like Dropbox, you’ll have a shorter sales cycle (in this case, conversion leads directly to nurturing the customer and potentially upselling them). A more expensive product without extensive free features will take longer to see conversions.

You may consider a usage-based pricing model, where price fluctuates around the amount of time customers use your product — which may lead to customers upselling for additional features once they get their foot in the door. It’s not that any one model is better than another. But rather, it’s important to understand how your choice will impact your average sales cycle.

Annual Contract Value Helps Contextualize Sales Cycle Timing

In general, expensive services take more time to sell and have longer average sales cycles. Jason Lemkin, the founder of the SaaS service EchoSign, gave these general benchmarks for sales cycles based on annual contract value:

The overall value of the contract may grow due to any upselling opportunities. With larger value accounts, it may be worth initiating renewal conversations sooner than smaller companies to ensure buy-in from the customer’s stakeholders.

Different Markets Come with Different Buying Processes

If you’re entering a new market, your sales cycle increases because you’ll need to spend a greater amount of time educating your prospects on your software before you can begin showing its value. This is also true for brand-new software with unique features. Yet the payoff when the sales cycle is complete is worth it, as you can then begin to optimize engagement and reduce conversion as more customers sign on and provide feedback.

Software Complexity Means More Details to Consider

If you offer incredibly niche software aimed at B2B companies, your prospects may take longer to evaluate how your service meets their needs. The more complex the software, the longer it’ll take your potential customers to recognize the full value of the product, which leads to a lengthier sales cycle.

Target Customer Profile Dictates Deal Complexity

Your target audience will also affect your average sales cycle length.

If you’re targeting mid-level managers or a wide audience of business users with a low-price SaaS tool, you’re likely dealing with a single decision maker who can make a purchase almost instantly. Having a months-long average sales cycle to sell an $11/month tool may not make sense.

But as you start selling to larger groups of buyers with higher ACV products, you’ll inevitably have more complex deal cycles. If it’s going to take months to implement your product, your prospects will want to do more due diligence before making a decision.

Instead of comparing yourself to others in the industry with different target customers, you should use a sales dashboard to assess the company’s sales data to guide the sales and marketing departments toward determining ways to improve and make the best strategic finance decisions around their efforts.

Get Deeper Insight Into Your Sales Cycle to Boost Performance

What Your Average Sales Cycle Data Is Telling You

To get the true value out of your sales cycle, you need to dive deeper into your data.

If you believe your sales cycle is far too long after accounting for factors like the ACV, target audience, and software, it’s time to look into possible factors.

You May Not Be Targeting the Right Leads

If the sales cycle is unexpectedly long, the sales team could be working with leads that are too cold. In other words, the company may be pursuing people who know almost nothing about your service and don’t currently have an interest in your product.

Visibility into these issues starts in your customer relationship management (CRM) system. If you have a strong CRM setup, you should be able to see exactly where leads are falling out of the sales cycle.

You can work with the sales and marketing teams to dive deeper into potential trends in where qualified leads and opportunities drop off in the sales pipeline. There may be opportunities to reallocate spend to drive better results or hire additional team members to generate stronger demand — but to get there, finance needs to discuss the numbers with the marketing team to get to these important decisions.

You May Have Underperforming Sales Reps

A long sales cycle may also occur due to an underperforming sales rep.

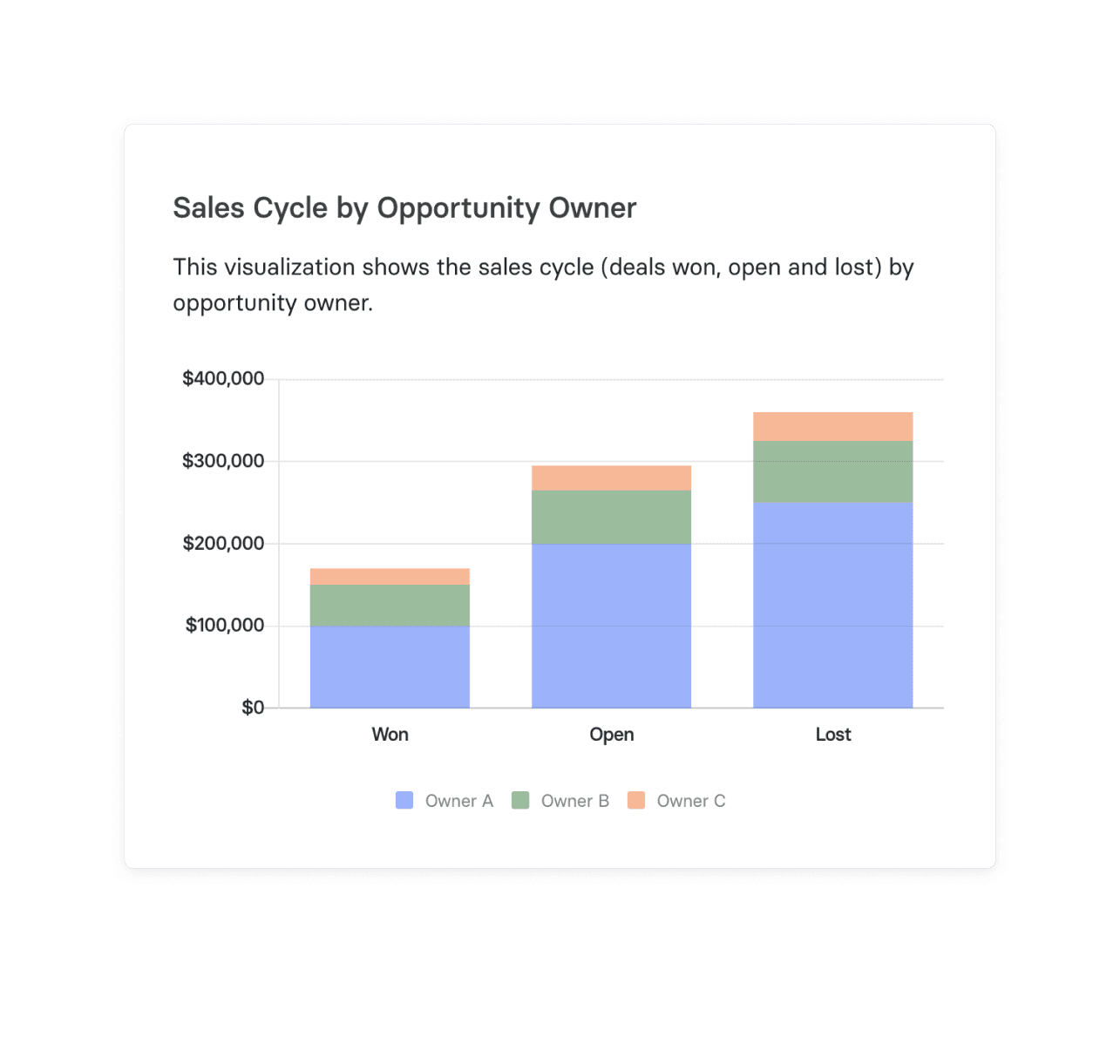

The VP of Sales or sales team leader have better insight into low or underperforming sales cycles. They can look for an account executive with abnormally high sales cycle averages compared to other sales reps and discuss their success.

The solution may lie in providing more or updating sales ramp training or better sales enablement material to get customers across the finish line. And it may unfortunately just not be a right fit for the account executive overall, which may lead to letting them go or putting them on a performance management plan to see them succeed.

Your Product-Market Fit Is Off

Check your product-market fit. If the sales team is doing all it can to win customers, and it still seems like a difficult sell, it’s possible the company simply doesn’t have the right service for their audience. Especially if the company is an early startup or Series A, a long average sales cycle could mean an issue with product-market fit.

Break your average sales cycle by industry, persona, and segment to see if there’s a common thread between the market and average sales cycle. This data can guide marketing and sales toward shifting away from n that market segment and re-evaluating their ideal customer profile (ICP) to create better matches.

A Recent Strategic Decision Missed the Mark

If your average sales cycle is trending toward getting longer and longer over time, your sales team is having a harder time moving deals down the sales funnel.

Did the company change its pricing? Did the product team add an excellent but hard-to-understand feature? A longer sales cycle after these changes could mean prospects are not seeing the value with these changes or additions quite yet.

A slow increase could also be caused by a competitor. Competition could be giving a reason for your prospects to consider your services for longer. Discuss what you notice in your numbers with the marketing department to proactively resolve the issue. From there, marketing, sales, and executive leadership can collaborate to update their overall strategies with respect to your competitors to ensure you’re the clear winner.

Collect Average Sales Cycle Data That Matters with Mosaic

Understanding your average sales cycle can be a useful tool for sales forecasting and assessing company strategy. And because SaaS sales cycles vary widely by industry and product, you should focus on your data and changes in your average sales cycle to base strategic decisions off.

To have the most up-to-date information about your average sales cycle, Mosaic can help. Mosaic serves as a Strategic Finance Platform that pulls real-time KPIs about your sales cycle and automatically calculates the average length. With this metric in conversation with other out-of-the-box metrics, you can fuel the conversation around financial analytics through one powerful financial dashboard.

Request a demo today to see how Mosaic empowers collaboration toward proactive decision-making and helps get prospects to the proverbial “pen to paper” faster with smoother sales cycles.

Average Sales Cycle FAQs

How can reducing your average sales cycle impact revenue?

Reducing your average sales cycle has a direct and positive impact on revenue. A shorter sales cycle means you can close deals faster, which allows your sales team to focus on new leads and opportunities. Increasing sales velocity not only boosts your revenue but also enhances customer satisfaction as clients appreciate a swift and effective sales process.

What are common challenges in shortening the average sales cycle?

How can technology improve the average sales cycle?

Explore Related Metrics

Own the of your business.