Poor data quality can significantly impact a business’s financial health, costing an average of $15 million annually, according to Gartner. For many SaaS companies, customer relationship management (CRM) is often at the crux of this problem, as poor-quality CRM data can lead to bad decisions, missed opportunities, and lost revenue, which affect your bottom line.

And if you wait too long, getting your CRM in shape can be a painfully tedious process. That’s why it’s essential to prioritize CRM hygiene — where the data is accurate, organized, and current — as early as possible in your journey.

"Cleaning up a CRM is no joke. You have to go back and recreate your whole company from day zero — from the first sale — because if you don’t do it that way, then it’s still not going to pull the data correctly [...] You don’t think about these things in the beginning, and then when you have to recreate the past, you really kick yourself, and you’re just like, ‘Wow, why couldn’t we do this before?"

In this guide, we cover everything you need to know about CRM hygiene, so you can set yourself up for success now and in the future.

Table of Contents

Pitfalls of CRM Hygiene and How To Avoid Them

Initial CRM management plays a huge role in shaping data quality as a company scales. If overlooked, finance teams will face significant cleanup efforts, such as the challenge of managing duplicate data and inconsistent contract versions down the line.

Typically, CRM setup is tailored for immediate sales needs, which might not fully cater to the intricate needs of finance, executives, and investors. As sales reps focus on their immediate needs — opportunity value, expected close dates, and compensation — they might enter data in a way that works for them but becomes problematic for you or your finance team later on, especially when you need to pull reliable data. The result is poor CRM hygiene.

Consider the following tips to avoid some of the common pitfalls that cause dirty data:

- Simplify your CRM setup from the outset, only using the customizations or features necessary for your business stage.

- Designate a dedicated data chief early on, like a sales or Revops leader, to manage revenue data.

- Establish a uniform sales process to ensure all team members are aligned, making your CRM a reliable source of information.

- Lean on automation to streamline your CRM data entries so repetitive processes don’t hold your team back.

Ideally, your CRM should work effectively for all parts of the business. This way, there’s a solid foundation for the company’s future, and it’s easier for everyone, including yourself, to manage and understand crucial business metrics.

Strategic Value of a Clean CRM Setup for Finance

The importance of a clean CRM setup goes beyond just financial reporting. It’s about understanding the “why” behind your data. This matters for several reasons, as clean CRM data helps you create compelling investor narratives, gather deep insights into your company’s financial health, pinpoint trends and opportunities to boost sales performance, and, most importantly, lay the groundwork for accurate operational models so your financial planning is based on reliable data.

However, these benefits hinge on your ability to pull and analyze clean data efficiently. Traditionally, this involves manual data entry and analysis, which is tedious and prone to human errors — but the process doesn’t have to be this way. Integrating your CRM with a strategic finance platform like Mosaic allows you to streamline financial planning and analysis (FP&A) with real-time insights into all your financial metrics.

Take it from Revenue.io, a company that boosts high-performing teams by powering their revenue operations. By integrating Mosaic, Revenue.io transformed its static CRM data into actionable, live insights that supported strategic decision-making. And Revenue.io’s team saved 32 hours per month that would have otherwise been spent on manual work, thanks to Mosaic’s self-serve dashboards.

“Mosaic empowered us to have a more complete view of our product portfolio, turning our existing CRM data into strategic insights for future growth. Sales and finance can now have meaningful discussions around opportunities for expansion and critically by customer segment."

5 Rules of CRM Hygiene for Finance

Messy CRM data is a widespread issue for many companies. And it’s often the finance teams, not the sales teams, that feel the impact of poor CRM data hygiene. After all, finance teams are ultimately responsible for the company’s financial health and need reliable data to support sound business decisions.

So, how can finance teams ensure CRM hygiene in their organization? By taking measures to ensure your CRM setup works for you.

1. Make Sure Your CRM Setup Mirrors the Financial Customer Journey

Ensuring your CRM reflects the financial customer journey will organize the data, simplify the management of the entire customer lifecycle, and improve financial forecasting and planning. But keep in mind, setting up your CRM is not just a one-time cleanup job for the finance team. It’s a continuous process that needs to adapt as your customer journey and sales process evolve.

Before you jump into tweaking your CRM, take a moment to consider what’s essential for your business. For example, how do you define annual recurring revenue (ARR)? Do you look at the sales pipeline? Do you use your CRM to keep an eye on both? Are there specific metrics that are particularly important for your investors?

Knowing these answers will give you a clearer picture of the financial customer journey, from when new leads come in to when they become opportunities and all the way through to winning those deals and supporting your customers as they renew. With these insights, you can focus on the information crucial to the company’s financial decisions, filter irrelevant data, and deepen your understanding of customers’ needs.

2. Think About the Fields You Want to Create Before Setup

By being intentional about the fields to create before setting up the CRM, you lay the groundwork for a clean, organized, and useful system that supports accurate and efficient FP&A.

Moreover, as your business grows, so will its data needs. Setting up the proper fields early on ensures that your CRM system is scalable and can adapt to future changes — this also makes it easier to maintain and clean the data over time, reducing the need for extensive data cleanup projects later.

To start, ensure your CRM includes mandatory fields such as pipeline amount, total contract value of closed-won deals, and contract start and end dates. These basics will help ensure the sales data is reliable. For instance, CRM setups often go wrong because they miss important details and rely on the generic “notes” field for important variations, such as free months or delayed payments.

This can result in missing data or misinterpreting financial reports down the line. Instead, use dedicated fields for specific information to avoid having a skewed view of any metric. Most importantly, work with the sales team to understand the details of various deals, such as discounts or offers used, so all the information is accurately captured in your CRM.

3. Make the Data Easy for Sales but Deep Enough for Finance

While finance and sales teams both rely on CRM data, they view it from different angles. Finance teams need detailed, accurate data to analyze sales performance, customer behavior, and revenue trends, while sales teams, as the primary CRM users, require a system that’s easy to use. If the CRM setup is too complex, sales reps might not use it consistently or correctly, affecting the quality of information that finance teams need.

In other words, the more fields you add to the CRM, the more detailed your financial analysis can be, but it also increases the risk of frustrating your sales team. That’s why it’s crucial to balance the ease of use for sales with the depth needed by finance. This means creating a CRM system where data collection and entry are straightforward and also, organized and detailed enough for financial analysis — promoting overall CRM hygiene.

The key is knowing what data is necessary versus what is “nice to have,” which varies and evolves with each company. For instance, tagging opportunities by product line is helpful for detailed reporting but may not be necessary for businesses with only a few product lines.

To effectively balance these needs, consider the kind of inputs you might need in the CRM for easy reporting — this article on sales performance metrics can help you get started.

4. Don’t List Contract Renewals as New Opportunities

When setting up a CRM, finance teams aim to track each account’s journey from start to finish to gain insights into business growth. However, many companies mistakenly create new entries for contract renewals without linking them to the original opportunity. The problem is that this distorts the accuracy of your sales and revenue data, leading to a misrepresentation of actual customer growth and financial health.

Mixing these two inputs can artificially inflate your sales figures, making it difficult to distinguish between new business and recurring revenue. It negatively impacts CRM hygiene by cluttering your system with duplicate records or misleading entries and complicating revenue recognition, forecasting, and tracking customer lifecycle and retention rates. Moreover, finance teams have to manually cross-check data to avoid these issues, which are error-prone and time-consuming, diverting attention from strategic growth activities.

That’s why it’s essential to maintain separate, clear records for new sales and renewals for accurate reporting, analysis, and strategic decision-making.

5. Create Separate Opportunities for Ramp Deals

In CRM configurations, sales ramp deals often get recorded as a single opportunity with added notes for price changes. While this approach works for sales teams, it leaves finance with insufficient data.

For example, suppose an annual contract value (ACV) increases from $15,000 to $45,000 over three years. In that case, finance should record each incremental growth separately, as distinct opportunities, or as line items within one opportunity.

This way, you have a clear revenue schedule and avoid miscalculating your contracted ARR. Plus, it introduces a certain level of automation in tracking start and end dates, significantly improving data integrity. Distinct data entries for ramp deals will also make compliance and audits smoother.

3 Financial Dashboards You Unlock With a Clean CRM

Clean CRM data allows finance teams to gain advanced insights into pipeline data, sales cycle trends, and individual performance, going beyond standard CRM reports — especially with Mosaic.

While Salesforce provides snapshots of current metrics, it lacks trend and historical analysis. However, Mosaic’s three out-of-the-box financial dashboards facilitate deeper exploration into strategic go-to-market insights.

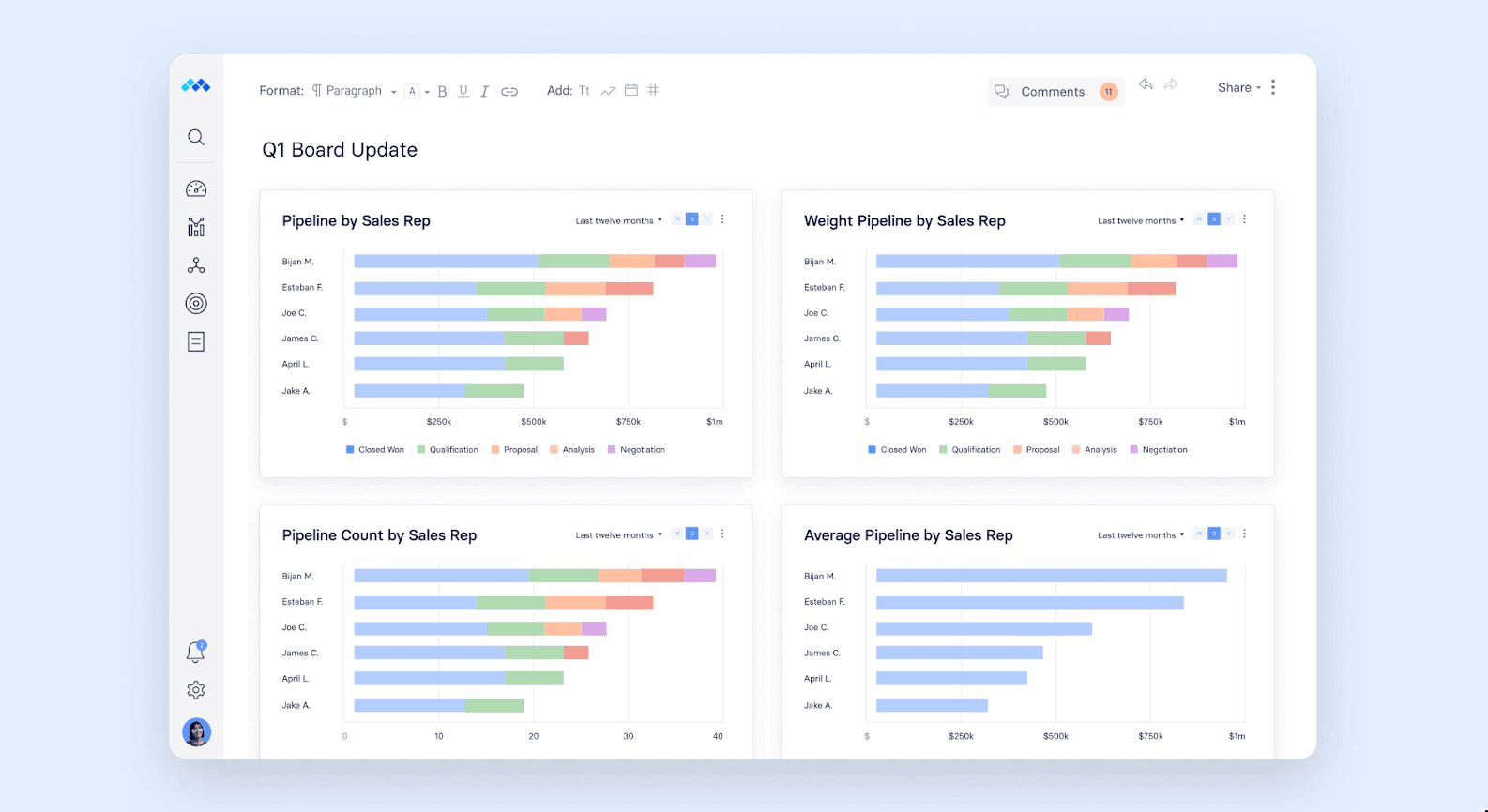

1. Pipeline Analysis Dashboard

A pipeline analysis dashboard is an essential sales dashboard that lets you engage in more detailed discussions with sales and marketing leaders throughout the quarter. If your growth projections aren’t on track, this analysis can assist in pinpointing the reasons why.

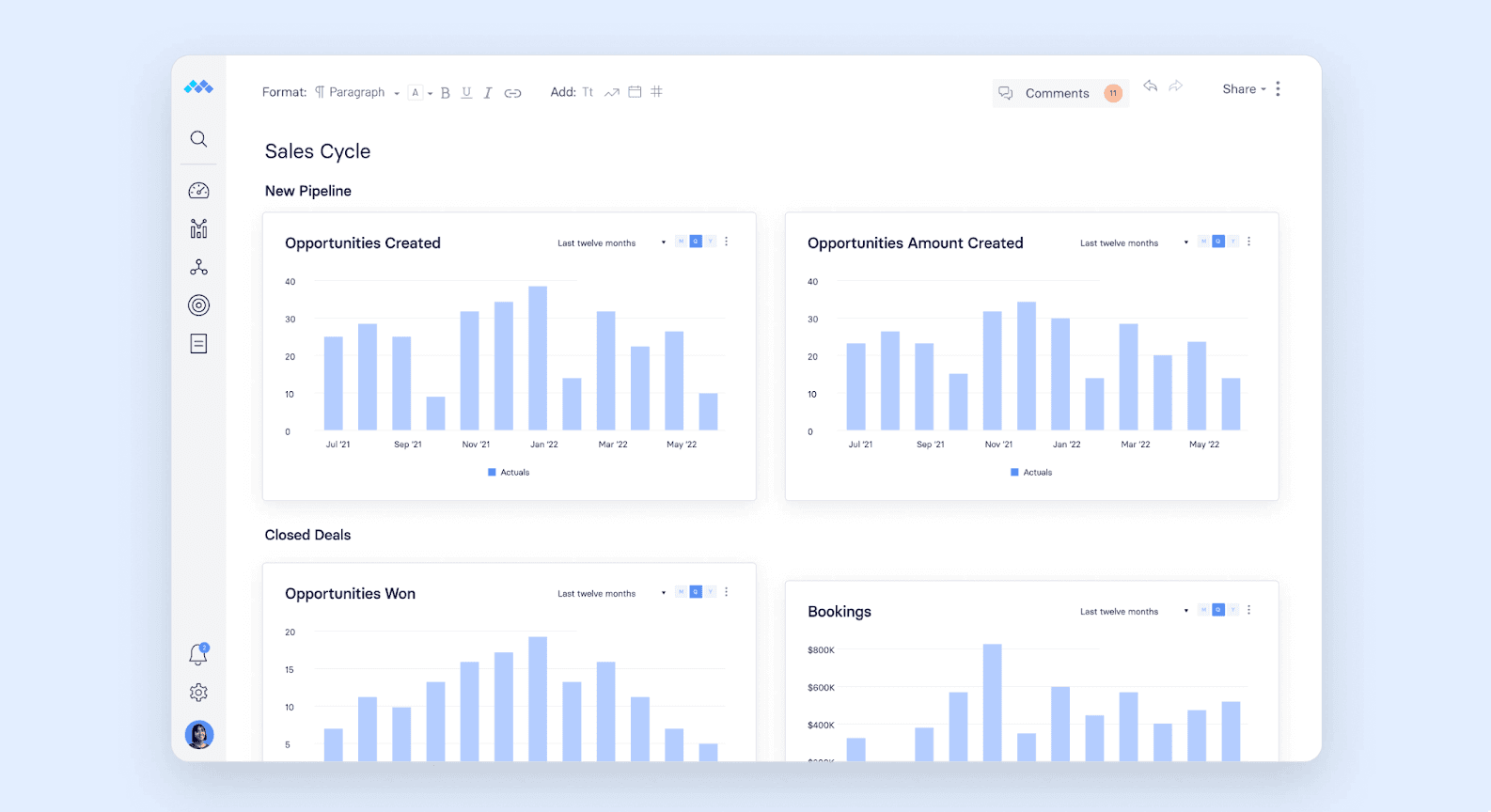

2. Sales Cycle Dashboard

Mandatory fields such as Contract Start/End Dates, ARR, non-SaaS ARR, and uniform stage structures give you a basis for evaluating vital sales cycle metrics.

Mosaic’s pre-built sales cycle dashboard uses this data to offer both retrospective and predictive insights into sales cycle trends, allowing you to be a proactive, strategic collaborator with sales and marketing. Additionally, it integrates data from systems like your ERP to compute intricate metrics, including customer acquisition cost (CAC).

3. Sales Team Performance Dashboard

A well-organized CRM setup also allows you to assess sales team performance individually. By merging CRM data with information from your HRIS, you can arm your sales leader with the insights needed to improve both headcount planning and top-line forecasting.

Don’t Leave CRM Cleanup on Your Back Burner

Embedding CRM hygiene early across your organization benefits not just finance but all departments. Whether hiring for sales operations or enhancing cross-departmental collaboration, cleaning up your CRM is worth the time and effort that goes into the task.

But remember, the high adaptability of your CRM also means sales processes can often result in unorganized financial data. So, addressing this sooner rather than later can make all the difference in setting you up for success. You may not have streamlined your CRM right at the start, but delaying this any longer won’t help.

Learn how Mosaic can support your company’s CRM hygiene. Request a demo today.

CRM Hygiene FAQs

How do you maintain CRM hygiene?

Ideally, CRM hygiene begins at the start, when you first set up the CRM system. To maintain CRM hygiene, regularly clean and update data, ensure consistent data entry, streamline fields and processes, or use a strategic finance platform like Mosaic for automation to reduce errors.

What are the costs of poor CRM hygiene?

Which CRM fields are most important to fill out?

What are some of the causes of poor CRM hygiene?

Own the of your business.