Most companies are dealing with the same problem that nobody talks about — they’re operating on top of a messy, complex CRM setup (and that might be an understatement).

But it’s usually not sales that feels the brunt of this problem. Instead, finance is often left feeling the pain of disorganized data in the CRM.

Most CRMs, even if they aren’t perfectly optimized, are set up in a way that gets the job done for sales. That’s a good start. But that kind of CRM implementation isn’t good enough for finance teams trying to dig out of the back office trenches and take a strategic role in the business.

If you want to automate complex revenue and pipeline calculations to focus on more strategic analysis of top-line KPIs, you need to start by cleaning up your CRM setup. Here are five best practices to get started and put yourself on a path to deeper insights about your business.

Table of Contents

1. Match CRM Setup to the Customer Journey

CRM setup isn’t a one-time cleanup project that a finance leader can try to knock out when joining a new company. It’s an ongoing effort to match sales processes and CRM workflows with your evolving customer journey.

That alignment starts with a deep understanding of how you plan to analyze revenue and pipeline data.

Before diving into CRM configurations, think about how your business defines ARR. How do you look at pipeline data? Are you using your CRM to track both pipeline data and recurring revenue? Are there unique top-line metrics that your business has to track for investors?

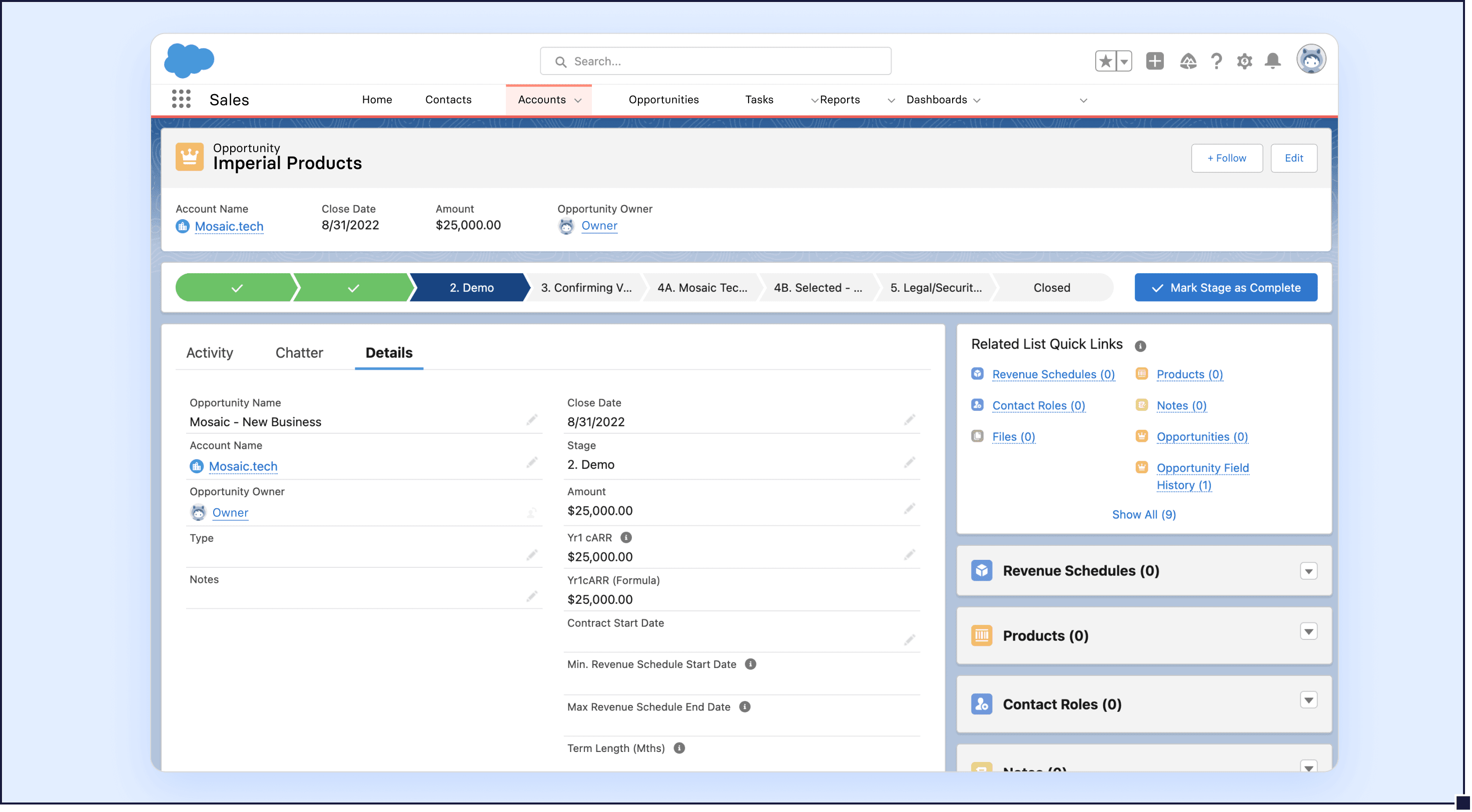

These questions give you insight into the financial customer journey — how a customer account moves through the sales cycle from new leads to opportunities, closed-won deals, and customer support/renewals within your CRM. According to Meir Rotenberg, Director of Finance at Spiff, making sure Salesforce, HubSpot, or any other CRM of choice reflects that journey is crucial:

"If you have good sales ops data, that’s going to flow through your CRM and turn it into a real source of truth for finance. There’s a lot of reporting that finance and the board like to look at in terms of productivity and success per rep, cohort data, and pipeline forecasts. Overall, if you can get good sales data, you can customize how you think about sales efficiency and get smarter about where you and the business are investing resources."

The flexibility of CRM software makes this first broad best practice necessary. If you want CRM data to unlock strategic insights about your top-line outlook, you need to take a step back and consider how exactly you want to look at the numbers. Then, you can start applying the remaining best practices to refine the CRM setup.

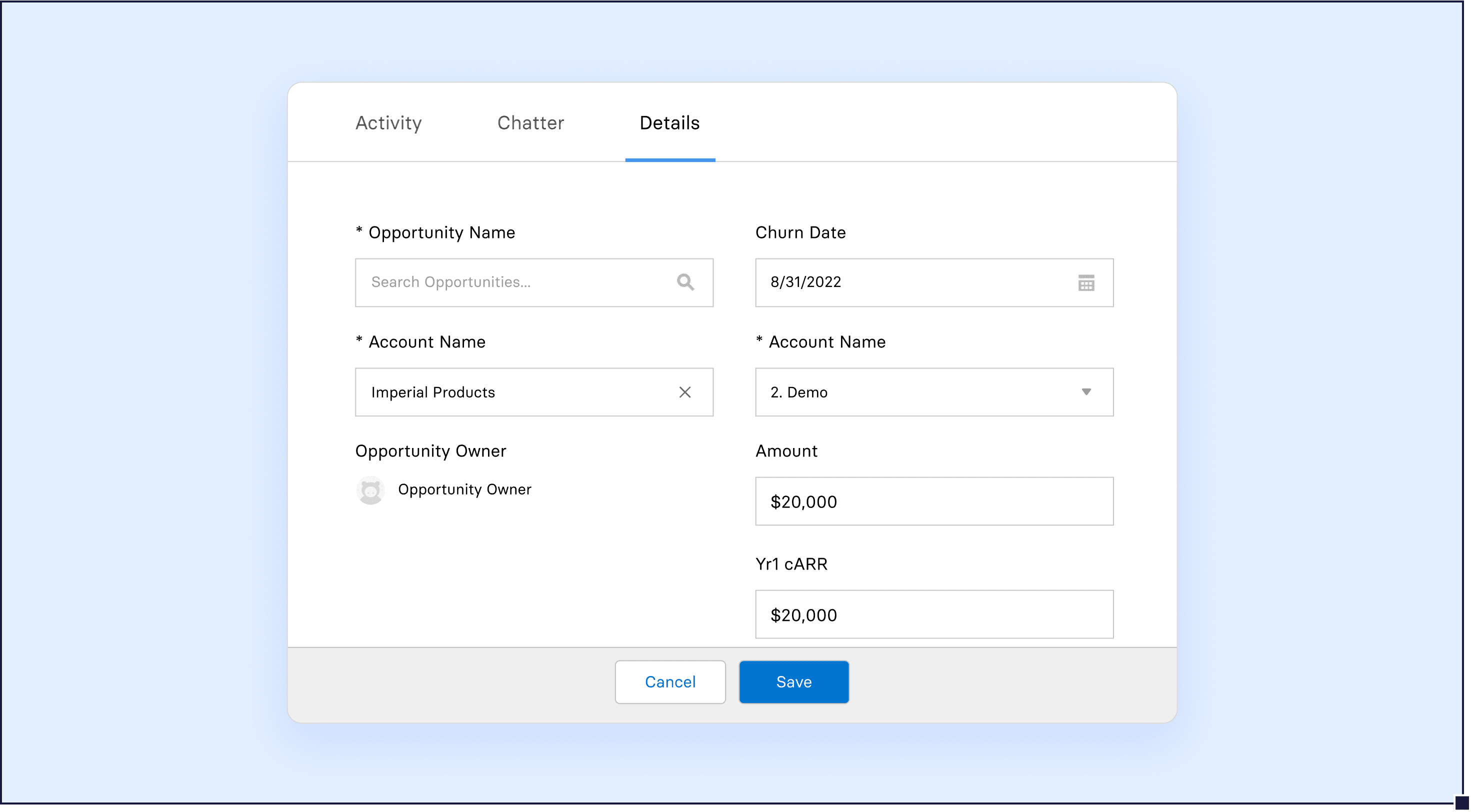

2. Create Required Fields for the Absolute Essentials

One consequence of companies setting up their CRMs with only sales in mind is that even the most basic fields that finance needs are often missing.

At the simplest level, make sure you have mandatory fields in your CRM for at least the following:

- Pipeline amount

- Total contract value for closed-won deals

- Contract start and end dates

These are the essential guardrails that finance needs for reliable sales data. They seem straightforward, but it’s important to account for nuances in each field.

Many CRM setups go wrong when using a “notes” field to account for these nuances. Account executives might enter a total contract value and additional notes explaining that the customer has a free month or that a specific implementation process will keep the customer from paying in the first month.

Having those details in notes rather than dedicated fields can lead to ARR miscalculations in your financial reports. For example, you may have a skewed view of annual contract value if the revenue breakdown per year isn’t clear.

Collaborate with the sales team to understand their touchpoints with prospects and the different discounts and offers they use to close deals.

3. Balance Data Granularity with Sales Simplicity

The more required fields and attributes you add to the CRM, the deeper you’ll be able to go in financial analysis — and the more frustrated your sales team will get with their jobs.

Once you get beyond the essential fields noted above, you have to start thinking about balancing data granularity with ease of use for the sales team. The use of financial data analytics software can help strike this balance, allowing the sales team to concentrate on selling while the software ensures accuracy and ease in data analysis. You want sales team members fully focused on what they do best — selling your products and services. Bogging them down with dozens of required fields will only lead to frustration. And, more likely, data integrity issues as the team looks to avoid tedious, time-consuming data entry work.

Striking the right balance comes down to deciding what’s necessary and what’s just nice to have. The answer will be different for every company, and it will evolve as business needs change.

For example, product line is a common attribute for CRM setups. Tagging opportunities and closed-won accounts by product line can help you report on sales performance on a deeper level for the board. But if you only have one or two product lines, is it really worth it to force AEs to fill the required field? Maybe, maybe not. In many cases, it’s best to wait until your product lines expand and the data is more likely to return strategic insights.

Getting cleaner, more granular CRM data doesn’t necessarily mean adding complexity for sales, though. The best sales ops teams will automate workflows as much as possible or lean on third-party data to add granularity without any effort from AEs. If you purchase company databases or use tools like Clearbit, you can enhance account data and add attributes like industry without making it a mandatory field for sales reps to fill.

For Bryan Schmitz, Director of Revenue Operations at LogDNA, ARR calculations are a good area to focus on in terms of balancing data integrity with contact management simplicity:

“I often use a custom field on every opportunity to show the account renewal ARR and the impact of the current opportunity on this account’s ARR. This helps across the board in reporting, not only at the exec level but all the way down at the individual level. That way, you don’t have sellers calculating how much new ARR they’ll make on a deal, it’s all just right there in front of them. That’s an example of providing them some workflows that are automatic, easy, and repeatable, so they aren’t spending time doing things they don’t need to do.”

If you’re wondering what kinds of inputs you might need for effective reporting, this article on key sales performance metrics to track can help you think about balancing attribute complexity in your CRM.

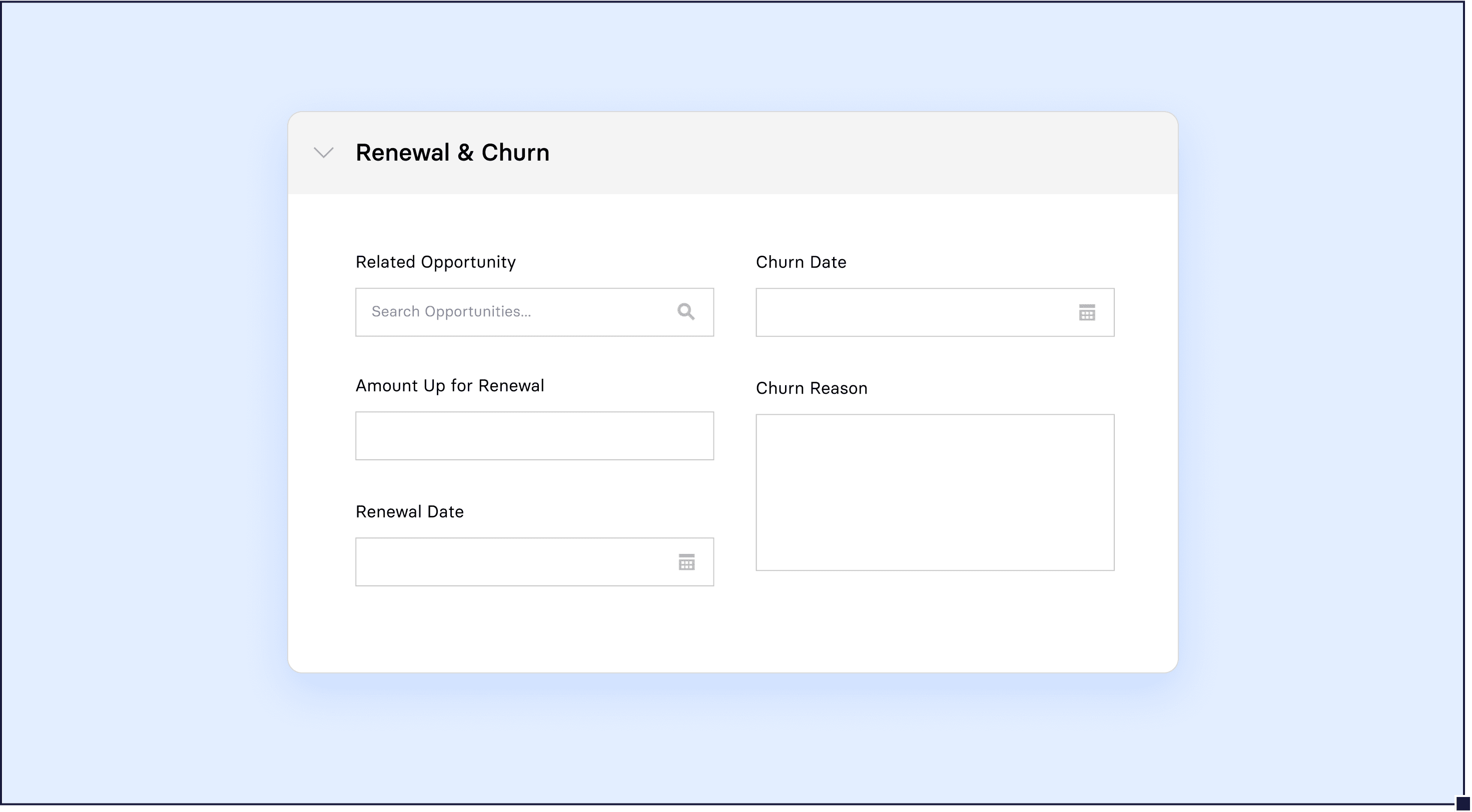

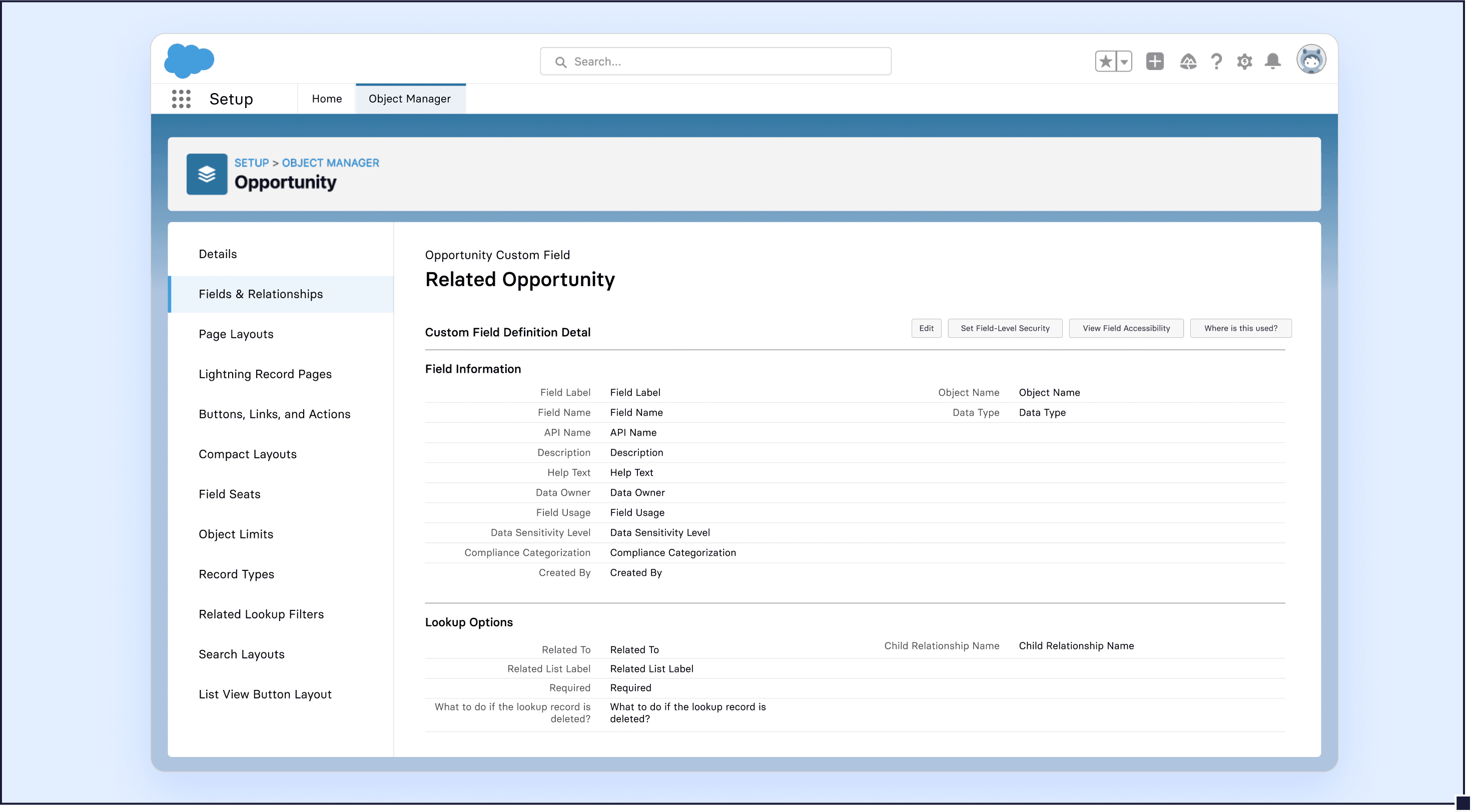

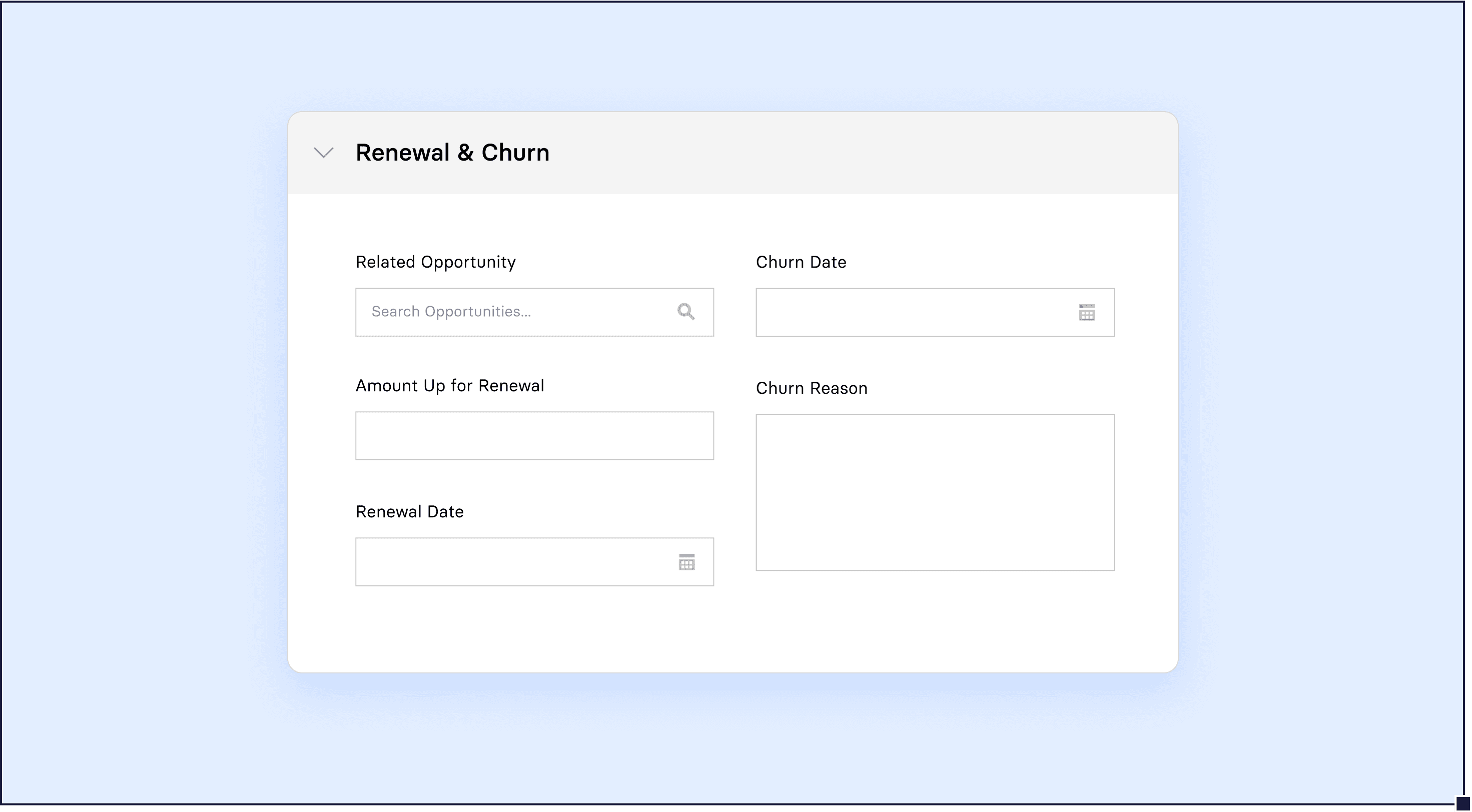

4. Link All Renewal Opportunities to Original Opps

The big-picture goal for finance teams when setting up a CRM is to ensure there’s a cohesive story for each account. Tracking that financial customer journey from end to end enables you to uncover strategic insights about how your business is growing.

This may seem obvious. But so many companies choose to create new opportunities for contract renewals without linking them to the original opp. When you don’t connect your renewal opportunities, you risk:

- Double counting ARR when there are early contract renewals

- Seeing a dip in ARR when a contract renewal is late even though you know it’s closed

- Counting ARR for debookings or accounts that churn mid-cycle due to lack of visibility

Companies that don’t automatically link renewal opportunities to origin opportunities often have someone in finance manually cross-checking the data. There are two problems with having finance cross-checking data manually. First, it’s a point of failure for data integrity, opening the door for errors that lead to inaccuracies. And second, it’s a time sink for anyone in finance, whose time would be better spent focusing on forward-looking growth efforts.

5. Treat Ramp Deals as Separate Entries

It’s common for CRM configurations to have ramp deals set up as one opportunity with notes added to outline the price upgrades. That might work for a VP of Sales and their AEs, but it leaves finance with limited data.

If you’re charging $10k for the first year, $20k for the second year, and $30k for the third year, finance needs to see each tier as a new entry. Whether that means creating three different opportunities or one opportunity with three different line items depends on the level of granularity your team already uses.

This approach ensures there’s a formal outline of the revenue schedule linked to the original account. This approach prevents overlap in contracted ARR calculations and brings some automation level to metric calculations as start and close dates for each opportunity line up.

While this may seem like a simple change, the impact on financial reporting and data integrity is significant.

Don’t Let a Chaotic CRM Setup Stand in the Way of Strategic Finance

We’ve seen it time and time again with our customers. A finance leader joins a company only to find that CRM solutions don’t have the right functionality or configuration to support their reporting needs.

But the level of flexibility and complexity of CRM systems leaves many of these finance leaders wondering where to start the cleanup process.

The best practices we outlined here should get you started down the right path. And they should give you a solid foundation for strategic finance — a more forward-looking approach to your work instead of vicious cycles of backward-looking reporting due to mass amounts of manual work.

Finance teams rarely have the luxury of building a new CRM from scratch. So, if you want help taking your CRM strategy to the next level, getting your data in shape, and automating business processes like top-line reporting and planning, reach out for a personalized demo of Mosaic and learn how we’re helping hundreds of customers unlock insights hidden in their sales data.

CRM Setup FAQs

What does a CRM system do?

A CRM system collects, analyzes, and stores customer data, including contact information, customer interactions and purchases, assets, and proposals. It achieves this in a highly-sharable and digestible manner; granting access to approved colleagues and stakeholders.

What are the benefits of setting up a CRM?

What is the difference between a CRM and an ERP?

Own the of your business.