Recession-Proof Your Business in 5 Steps

Carly Miller

Content Marketing Writer

When an economic downturn hits, you’ll notice there are two types of businesses — the reactive ones and the best-in-class ones that proactively address challenges and continue growing.

Especially in a startup, high-growth environment, it’s easy to forge ahead with a growth-at-all-costs mindset when venture funds are readily accessible. But once interest rates change or the market turns, you have to be ready to adapt and extend your cash runway.

Hitting that level of agility is easier said than done when you’re bogged down by problems like supply chain disruptions and backward-looking systems. With potential economic uncertainty looming in 2024, now is the time to make a change.

The right finance tools and scalable processes can help you turn an economic downturn into an opportunity to embrace the type of agility that leads to continuous improvement, strategic insights, and proactive decision-making — elements crucial to a recession-proof business.

Table of Contents

What Makes a Business Recession-Proof?

Making a business recession-proof relies on constant reevaluation — a continuous process of reforecasting that helps you maintain optionality. Since consecutive quarters of downturn can impact business finances, it’s crucial to prepare ahead of time.

The economy is officially considered in a recession when the worth of gross domestic product (GDP) declines for two consecutive time periods or longer. During The Great Depression, that period lasted a decade. The Great Recession lasted 18 months, making it the longest recession since the Great Depression. And most recently, the 2020 recession brought on by the pandemic was the worst recession since the Great Depression, in spite of lasting just two months (March and April 2020).

But whether or not the economy is technically considered to be “in a recession” is less important than your ability to remain resilient and adaptable in the face of any market downturn. Being recession-proof means operating in a way that safeguards you against the bad times as much as possible.

As Dan Chen, the CFO at Deltec, shared in an episode of Ramp’s podcast, Recession-Proof, “Good times build bad habits, and bad times build good character.” The key to making a business recession-proof is relatively straightforward — don’t panic and know how to determine what to save and what to cut. Without regularly evaluating and justifying your expenditures and validating each ROI, the impact on the business could be catastrophic.

The goal is to save money without impacting the function of the business. During our Weathering the Storm webinar, Jervis Williams, the CFO at Legion, said, “When things are great, it’s all about speed. Doing what works and doing more of it. When things are challenging, it’s all about agility.” Focus on what works while remaining agile by planning ahead for the worst, best, and base case scenarios. Rather than reacting out of fear when things are challenging, adjust proactively by asking department leaders to consider where they can rein in unnecessary spending and projects that need more diligence for effective return.

The following practices help you determine how to save costs with minimal impact to the business.

Measuring Metrics Proactively

Knowing the numbers isn’t enough — you need to know what metrics you need to track to create proactive decision-making. Ensuring your customer acquisition cost (CAC) and CAC payback period are fully burdened and trending the customer journey allows you to discover opportunities for your sales and marketing teams to dig further into to create quicker payoffs.

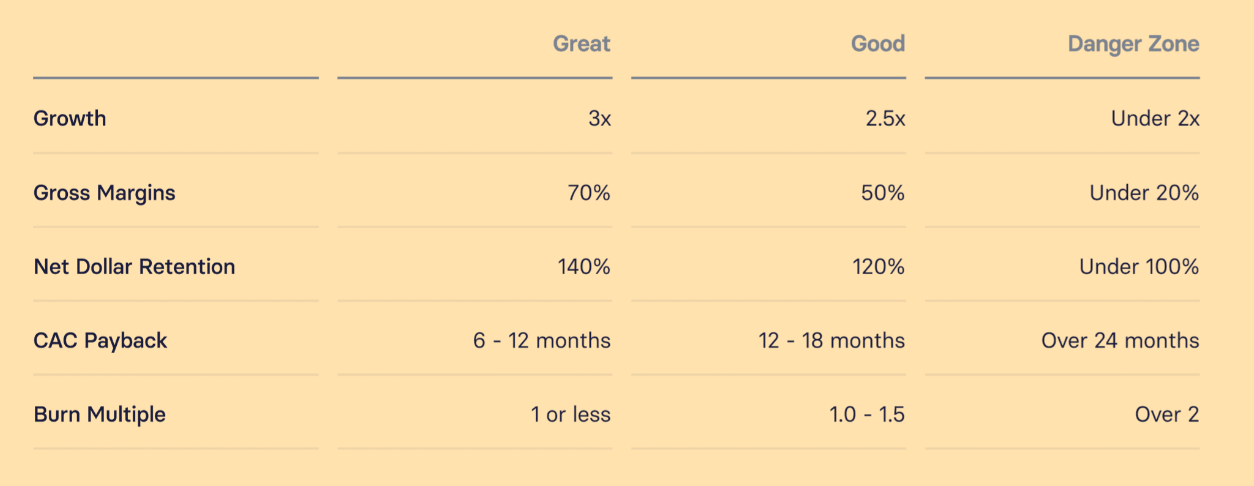

Operational metrics, like burn multiple, cash conversion score, and the SaaS magic number, are growing in importance for both executive leadership and stakeholders. Craft Ventures confirmed in a recent presentation that metrics like net revenue retention, gross profit margin, and annual recurring revenue (ARR) growth, remain important to help set operational KPIs and lead toward a clear “why” behind your numbers.

Supporting Agile Tech Stacks

When reviewing department budgets, flag areas that need evaluation. Each department leader must evaluate their department tech stacks and determine whether they contribute to organizational efficiency or if there’s an opportunity to cut spend. Are you paying for services or subscriptions no one uses anymore? Do multiple apps serve the same purpose? Ensure each department only pays for the number of seats needed for any given service or platform.

Conducting Scenario Analyses Throughout the Year

Scenario analysis examples typically follow a three-point system: base, worst, and best case. You now need to expand scenarios to match multiple market conditions and opportunities.

Capital efficiency plays a large part in how to recession-proof your business. It extends your runway, of course, but also fuels the business’ operational day-to-day to manage sustainable growth. This attracts investors, who are still willing to fund the right project — even during an economic downturn.

If the company still wants to pursue a funding round, you can adjust scenarios to include the ideal and smaller funding goal. Pushing these scenarios to look at foregoing the round entirely provides other options and insights that push your executive leaders toward other strategies and timelines. In turn, you can continue to adjust scenarios and models as market conditions change to remain ahead of the curve and ensure capital efficiency and operational integrity remain intact.

Common Business Challenges During a Recession

You don’t have to wait until it’s too late to batten down the hatches. When your finance team considers every angle, the company is able to dig into the strategic decisions that will help it stay afloat.

Prepare for each of the following common challenges as you plan for worst-case economic conditions.

Higher Costs Due to Inflation

High inflation rates often indicate a coming recession. Depending on the company’s benefits and perks, such as location-based pay, there may be a requirement to adjust salaries for inflation costs, which then impact operational efficiency, especially in terms of longer CAC payback periods and potentially diminishing your runway.

Declining Valuation

Recessions impact public market performance, which in turn drives down revenue multiples for company valuations. That reality, combined with the fact that downturns impact your SaaS valuation metrics, such as your LTV/CAC ratio as customers churn and ARR as customers receive downgrades to avoid churning altogether, will hurt your valuation. As growth slows or declines, venture capitalists and investors will press executive leadership on how they’re maintaining operational efficiency and filling their sales pipeline.

Harder to Secure Funding

While securing a round of funding takes work, tough economic times make getting funding significantly more difficult. Once the stock market indicates a coming recession, investment firms and VCs lock in their investments. Many stop investing at all, but the firms that continue investing have higher expectations and requirements, so funding becomes harder to come by.

Cash Flow Disruption

An economic downturn often causes an imbalance between cash inflow and outflow, resulting in cash flow disruption. Since the company’s cash inflow needs to sustain operating cash flow, your business may struggle to maintain runway reserves, pay off debts, or support growth. Without sufficient cash flow, investors are less likely to offer funding and re-investing in the business becomes harder. A monthly, versus quarterly, cash flow analysis then becomes vital to ensuring that the business uses cash inflow efficiently and can minimize excessive spend as quickly as possible.

Higher Cost of Revenue

During a recession, the cost of revenue increases because it’s harder to obtain sales from new customers. Since the cost of revenue helps you calculate the company’s gross profit and gross profit margin, a higher cost of revenue means less profitability. Shrinking gross margins requires proactively reexamining costs with the sales team to ensure a fully-burdened cost of revenue and find ways to increase financial efficiency.

Flag anything that needs to be addressed, and bring the necessary information to the sales lead and executive leaders. More frequent revenue forecasting can also help you plan ahead so you can proactively alert the sales team and prompt them to consider how to lower the cost.

5 Ways to Recession-Proof Your SaaS Business

When the economy is struggling and challenges arise, addressing them proactively ensures your small business is as recession-proof as possible. Meeting challenges head-on starts with clear plans about how the business will be ready for recession. Agile scenario planning, with a focus on efficiency and collaboration, is the map to navigating future storms. For SaaS businesses, it’s critical to minimize churn and extend the runway until the economy improves.

During the Weathering the Storm webinar, Jervis offered the following advice for how to make your business recession-proof: “Be thoughtful and careful about allocating capital. Be thoughtful and careful about reviewing expenses and strategy. The greatest risk is losing that discipline and agility and willingness to question.” Here’s how to address challenges so business can continue moving forward.

1. Collaborate Regularly with Other Departments

Rather than functioning as a siloed department, finance can act as a customer service organization to other departments in the business. Since you’re able to look at data across the business, you can understand the challenges each leader faces with context.

Offer proactive insights to help department leaders navigate challenges with a focus on minimal impact to the business’ efficiency. Keep an eye on costs for tools and systems, and inquire about how often people use tools to see if there’s an opportunity to cut any spend or discover a less costly option. Prompt the marketing team to consider campaign costs and the sales team to look deeper into how to speed up the buyer journey.

2. Be Proactive with Real-Time Data to Provide Accurate Metrics

Reacting to last quarter’s data is an ineffective and inaccurate way to approach financial planning. Financial dashboards using real-time data allows department leaders to see where they are now, in the moment, and make decisions that address the current situation. Optimize your budget allocation by establishing a quarterly financial plan review, rather than an annual budget process, and leave room for flexibility based on what the business needs to stay on track. This allows departments to integrate proactive decision-making and plan ahead, knowing they have a clearer picture of the company’s critical financial and operational metrics.

3. Know the “Why” Behind the Numbers

Providing the necessary real-time numbers to each department is important, but it’s just as important to examine the context of each metric and KPI. Offering strategic insights about the “why” behind the numbers helps business leaders make informed choices about what’s working well and what’s not. The SaaS magic number, for example, helps you determine if the revenue produced for each dollar spent on customer acquisition is providing the ROI you need to maintain your runway. This makes forecasting budget and cost-cutting decisions significantly more effective, reducing the impact on the business overall.

4. Stay Agile and Flexible with Regular Scenario Planning

The market can change quickly, so the business needs to be as agile as possible. Effective scenario analysis is the best way to ensure that happens. Using scenario planning tools to prepare for best, worst, and base case scenarios is a fantastic start, and the worst-case scenario plan will guide you through the worst storms. But you’ll also need to run various forecast models to show department leaders how things could change with various adjustments. Be ready to test and adjust various scenarios at any moment so that you’re prepared to adjust on the fly to any market changes.

5. Focus on Efficiency Over Growth

When a recession is on the horizon, it’s time to get lean. Runway needs to be at least 18-24 months long during a recession to outlast the downturn. You’ll need a foundation of cash to last the slowdown, maintain operational efficiency, and extend the runway. Look at forecasted spend to find opportunities to reduce or cut. Examine discretionary spend to eliminate unnecessary costs. Review variable spend to see if anything can be reduced. The goal is to make layoffs or mission-critical cuts a last resort.

Make Your Business Recession-Proof with Flexible Forecasting

Discipline is essential for identifying how to recession-proof your business, but so are the right tools. As Dan said in Ramp’s Recession-Proof podcast, “Technology gives us a roadmap to helping organizations rethink how they work.” Use that technology to help guide your business through a recession.

Mosaic offers you the tools and technology to navigate a recession by allowing you to access the information you need the moment you need it. From tracking the right operational metrics — like your burn multiple or your annual recurring revenue (ARR) per head — to integrating metrics with source systems for automatic calculations, finance automation saves you time. Rather than wasting time tracking down numbers and filling in a spreadsheet, strategic finance systems provide:

- Real-time visibility into your financial analytics and operational metrics

- Drill-down abilities to break down metrics and identify strategic insights and context

- Agile scenario planning so you can calculate and analyze a variety of scenarios

You can opt to use Mosaic’s out-of-the-box dashboards and templates or create your own custom views to access and analyze metrics across your business. From there, consider the “why” behind all of your data to uncover the insights that are vital in a recession. These insights can help the business redesign operations and learn to manage resources effectively and efficiently, even in a market downturn. With tools like Mosaic’s Operational Efficiency Dashboard template, you can improve operational efficiency across the business and achieve accurate forecasting to get you through a tough economy.

Dan considered recessions in relation to all trends — they aren’t a “permanent state… as long as your business model makes sense.” They’re a pendulum, and the pendulum always swings back. He continued, “The market will de-risk itself, and at the bottom it will be an incredible platform for growth for businesses that are there.” Make it through the recession with the right tools and action plans in place, and the business has the potential to grow even more.

Request a demo today to see how Mosaic can help you learn how to recession-proof your business. Ensure you have the resources to stay ahead of potential downturns and analyze a wide range of economic scenarios so the business is ready for whatever comes its way.

Recession-proof Business FAQs

How can social media assist in maintaining a customer base during a recession?

Social media platforms can be impactful tools for maintaining and even growing an existing customer base during an economic downturn. By actively engaging with existing customers and potential leads through meaningful content, businesses can foster loyalty and keep their brand top-of-mind.

What role do business loans play during economic uncertainty?

Why is having multiple revenue streams important in a recession-proof business strategy?

How can real estate impact a business during a recession?

Why is it essential to monitor receivables closely during economic downturns?

Own the of your business.