Preface

e’re in the early days of an economic downturn that market analysts are already comparing to the likes of the dot-com crash and the Great Recession. And while that sounds dire, the situation presents new opportunities for the companies that can weather the storm by managing their resources effectively.

Countless VCs and operators have stepped forward to offer guidance to their portfolio companies and the startup community at large. And in many cases, the advice is what you might expect.

“We’ve realized that, when the market dips, founders crave advice that goes beyond the platitudes and provides a tangible framework to quantify the magnitude of the change in valuations and what it means for… charting their future course.”

Yes, you need to conserve your cash. Of course you should extend runway. And a shift from growth-at-all-costs to a focus on efficiency is key.

But how?

Finance has an opportunity to be the compass that guides companies through the storm. Your unique, business-wide perspective allows you to uncover strategic insights that other leaders can’t see.

This practical guide will explain how to identify those insights and make actionable recommendations to leadership about what to do next in this market downturn.

You’ll learn:

CHAPTER 1

Economic Thunderstorm or Economic Hurricane?

he first step to guiding your company through a down market is to understand what you’re dealing with in the first place.

That’s the topic on everyone’s mind right now. How bad is this market downturn going to get? How fast is it going to get there? And how long is it going to last?

The truth is that no one really knows. But if you look at the market analyses from VCs like Sequoia, Andreessen Horowitz, and Craft Ventures, you can see that the recovery may not be swift.

While the situation doesn’t seem quite as grim as the dot-com crash or the Great Recession, it’s still early days and it may be wise to operate as if those comps are accurate. According to John Luttig, we’re seeing the after-effects of issues stemming from the COVID economy. It has all the makings of a rough economic storm and you don’t want to wait until it’s too late to batten down the hatches.

“Tech massively over-earned in 2021 — generating growth and profits at a temporarily high rate — driven by substitute demand from the pre-COVID economy. Companies with accelerated temporary growth got credit for a permanent acceleration. But investors recently realized that underwriting growth permanence from COVID acceleration was wrong.”

There are a number of economic and geopolitical factors that have led to this down market. A spike in inflation following pandemic responses, the resulting rise in interest rates, sustained pressure on supply chains around the world, and the war in Ukraine are all contributing to market volatility. But how do these factors trickle down to impact your ability to raise funds, sell product, and operate your business?

Every market analyst and VC firm will have a slightly different take on what all this market volatility means for private companies. But there are a few throughlines across reports that every finance leader and founder should understand.

Public Market Performance Is the Leading Indicator of a Downturn

If you’re trying to see around corners and understand how this economic situation could impact your business, start by understanding how public software companies are performing.

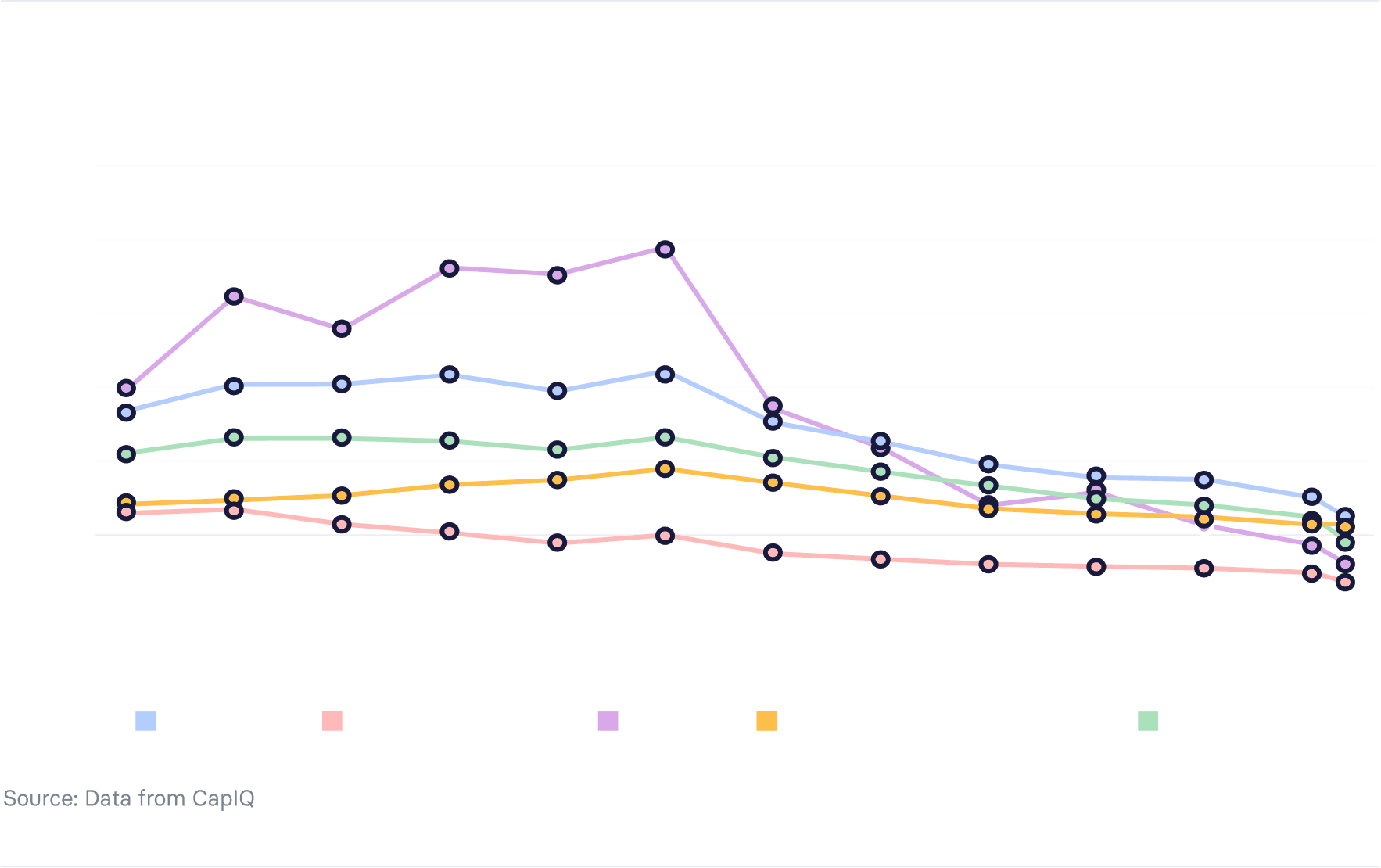

As of mid-May 2022, the median public software company valuation is down 60% — from about 12x revenue to 5x.

This crash back down to Earth isn’t due to any sort of performance concerns. Sequoia noted that 61% of all software companies are trading below pre-pandemic 2020 prices — despite the fact that many at least doubled revenue and profitability. Because public companies are valued using discounted cash flow models, sharp interest rate spikes lead to larger discount factors in valuation.

The reality is that, according to Craft Ventures, growth stocks are getting hit the hardest in the early days of this market downturn. Investors have been willing to pay a premium for the high-growth expectations in SaaS, but future revenue isn’t as valuable as it once was now that inflation is spiking. If you look at the high-profile SaaS stocks, you can see prices are dropping to a new equilibrium.

Investors agree that the trends you see in public software companies port over to the private sector. So, if you’re seeing valuation declines of 60%, it’s reasonable to assume your valuation is taking a similar hit.

Venture Funding Is Getting Harder to Come by

Raising a round of funding is never easy. But over the past few years, it’d been easier than ever to raise funds to keep your business growing. Now, the public market downturn will directly impact the ability of VCs to raise and deploy capital themselves.

Many investment firms will go into a holding pattern as market conditions come into focus, limiting your options as far as who you can raise money from. And for the firms that are still investing, the bar for where to deploy capital is only going to get higher, making it more difficult to raise a round at all.

Even in Q1 of 2022, venture funding as a whole was down nearly 20% according to CB Insights. And that was before this market downturn really started to take hold.

David Sacks at Craft Ventures noted that he expects total funding to fall off a cliff for the rest of 2022.

Operating in a Down Market Isn’t Easy — But It’s an Opportunity to Win

If you’ve checked out enough content from investors about this impending recession (and there’s a lot of it), you know the mood shifts from firm to firm. Some might present the doom-and-gloom scenario whereas others take a more measured, “hope is not lost” approach.

Regardless of overall mood, there’s a common silver lining to highlight in the midst of the market downturn — the opportunity to weather the storm and come out ahead on the other side.

"You cannot overtake 15 cars in sunny weather… but you can when it’s raining."

There are plenty of well-known tech companies that successfully navigated an economic crisis on their way to becoming massive successes. Google, PayPal, and Amazon were shining examples coming out of the dot-com crash. Airbnb came up through the Great Recession. And DoorDash exploded during the market volatility of the COVID pandemic.

The point here is that despite the challenges that lie ahead, making the right moves at this time could pay massive dividends when the market eventually recovers.

CHAPTER 2

Metrics to Track to Avoid a Shipwreck

he metrics you track in the throes of an economic hurricane shouldn’t necessarily be different from what you track in calm conditions — but the ones that take precedence certainly change. And the speed with which you can access, analyze, and model the right metrics becomes absolutely critical.

For the last couple of years, the high accessibility of venture funding made a growth-at-all-costs mindset almost necessary to succeed. Efficiency had its place. But the name of the game was revenue growth and both early-stage and growth-stage startups were safe to heavily invest in customer acquisition.

Now, the pendulum has swung the other way. Revenue growth will always be critical. But the focal point has to be sustainable growth with an eye toward capital efficiency.

There are two ways to think about this renewed focus on balancing growth and efficiency — from the operations and fundraising perspectives.

The Operating Perspective

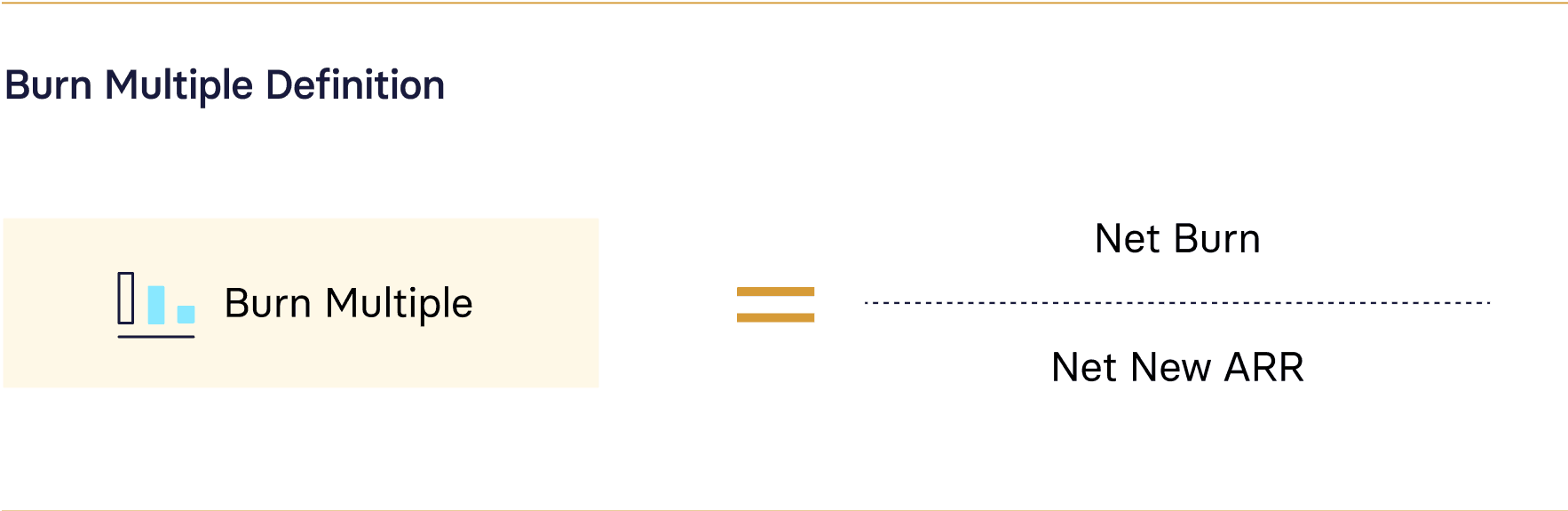

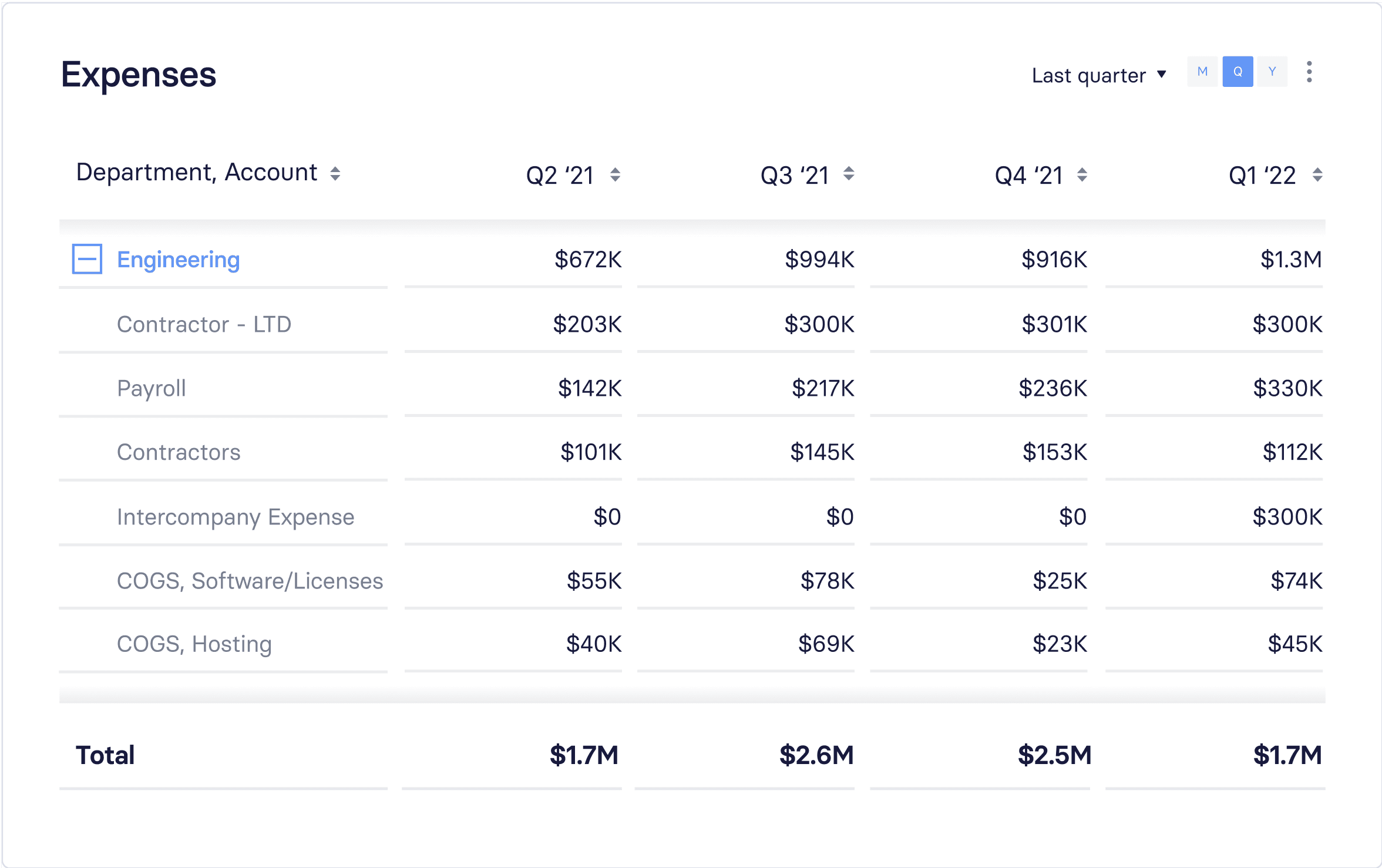

There are countless metrics you can track to measure the operational efficiency of your business. But the one that has become more popular than ever before is burn multiple.

"We like burn multiples more than other efficiency metrics for recalibrating when market conditions change because they are all-encompassing of your business activities. Unlike other efficiency scores (e.g., LTV/CAC) that focus just on sales and marketing, actions you take across every business function will impact your burn multiple."

You can find your burn multiple by dividing your net burn by net new ARR for a given period.

During a market downturn, your ability to understand how much money you burn to earn each dollar of ARR is critical to operational efficiency. You can use a16z’s benchmarks for burn multiple at various stages of growth to understand where you stand compared to your peers.

The problem is that simply knowing this metric isn’t enough to turn your business around. This is where finance has an opportunity to be a proactive, strategic partner in the business. If your company isn’t on the high-performing side of burn multiple benchmarks, you’re the one with the data visibility and cash flow acumen to understand which levers to pull and get the company on track.

Digging into the “why” behind burn multiple and adding context with other efficiency metrics will help you weather the storm and guide your company to calmer waters. The real question is “how?” (and we’ll get to that in the next chapter).

The Fundraising Perspective

Understanding your burn multiple will help you find opportunities to extend runway through smarter cash management, which creates breathing room for the company to ride out the economic storm. But even world-class cash management will only get you so far. For the vast majority of VC-backed companies, it’s only a matter of time before you need to raise another round of funding.

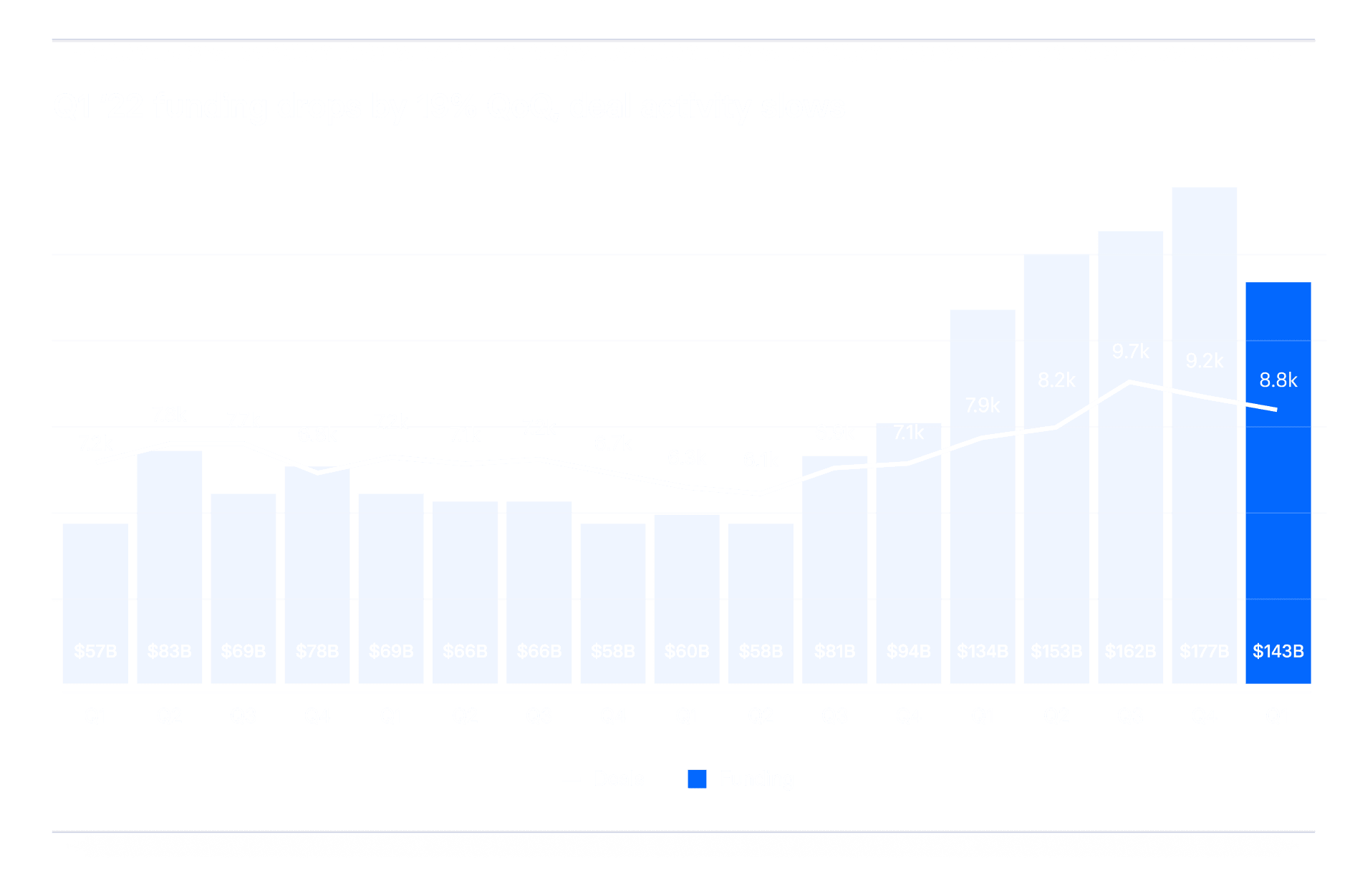

As VCs face liquidity challenges and continue to see rough market conditions, they’re going to be much more selective with their investments. But it’s important to note that they are still investing in companies that can show strong fundamentals and a healthy growth trajectory (2x+). And that means you need to position yourself as a solid bet for VCs if you want to raise with the best possible terms. Craft Ventures put together this table of benchmarks to highlight the difference between blue chip-type companies that are still investable and those that would struggle to raise a round in these conditions.

These benchmarks (like a16z’s for burn multiple) give you a great way to quickly see where you stand in the market and how investors will view your business.

But this is often where content about the market downturn stops short. If you’re in the danger zone or even just middle of the road, what do you actually do to course-correct?

Your ability to proactively partner with each business unit leader could make or break the company’s ability to turn market chaos into opportunity.

CHAPTER 3

Practical Ways to Help Business Partners Stay in the Eye of the Storm

he most strategic finance functions act like customer service orgs to the rest of the business. And in the midst of a market downturn, that role is more important than ever.

Being a customer service org for the business during these tough times means understanding the biggest challenges that each leader faces and proactively offering insights to help navigate around them.

Instead of giving broad, high-level hypotheticals about how to actually do that, our leadership team sat down and gave insight into how they’re thinking about operating during this market downturn. Then, our finance leaders went through the primary challenges and highlighted practical opportunities for finance to proactively offer strategic guidance to the rest of the business.

If you’re wondering how to step into a more strategic role during these tough times, these examples of finance partnerships with each departmental and executive leader should help.

When a market downturn hits, the CEO’s job is to maintain that 30,000-foot view of the business and understand how to pull levers that will strike the right balance between growth and efficiency. They can start by communicating with advisors and investors who have seen similar market cycles, making sure everyone is aligned with how the business is operating on a broad scale, and thinking through how to adjust strategy moving forward.

"Maintaining optionality has always been big for us. We don’t want to get ahead of our skis in terms of growing too quickly or spending recklessly. We look at the numbers all the time and run the business somewhat conservatively, which will help us through this market downturn."

For now, we’re hearing that companies should be prepared to ride out the storm because valuations and multiples have declined so much. That means ideally having 18-24 months of runway. The CEO has to determine:

- If you have enough cash on the balance sheet and how long it will last.

- How to use the company’s cash in the most efficient ways possible, extend runway, and position the business to raise another round on the other side of the downturn.

When looking to extend runway, CEOs can think about expenses in three buckets:

Forecasted spend

Are there things in the budget you haven’t spent money on yet that you can cut? Maybe you were planning on opening a new office and you can scrap that plan. Or, maybe you had a company on-site on the calendar that could go virtual. These are often easy levers to pull.

Discretionary spend

What are the things that aren’t business critical that you can pull back on without impacting the business? Maybe you can supply new employees with lower-cost laptops. Maybe you can lower the budget for swag and be more conservative with gifting. Again, these are easy levers to pull.

Variable spend

What are the non-fixed costs that you could potentially cut? This is where the conversations get more complicated as you try to weigh the cost savings and business impact of different departmental expenses.

The goal is to always make “cutting into the bone” with layoffs or eliminating mission-critical spend the last resort. A tight partnership with finance leaders gives CEOs a complete view of the company’s numbers and helps them identify the opportunities necessary to get to that 18-24 month runway mark.

How Finance Can Support the CEO in a Market Downturn

The CEO perspective boils down to a need for more granular insight into cash inflows and outflows and a more frequent cadence of visibility into operational and financial performance. These are prime opportunities for finance to showcase its strategic value.

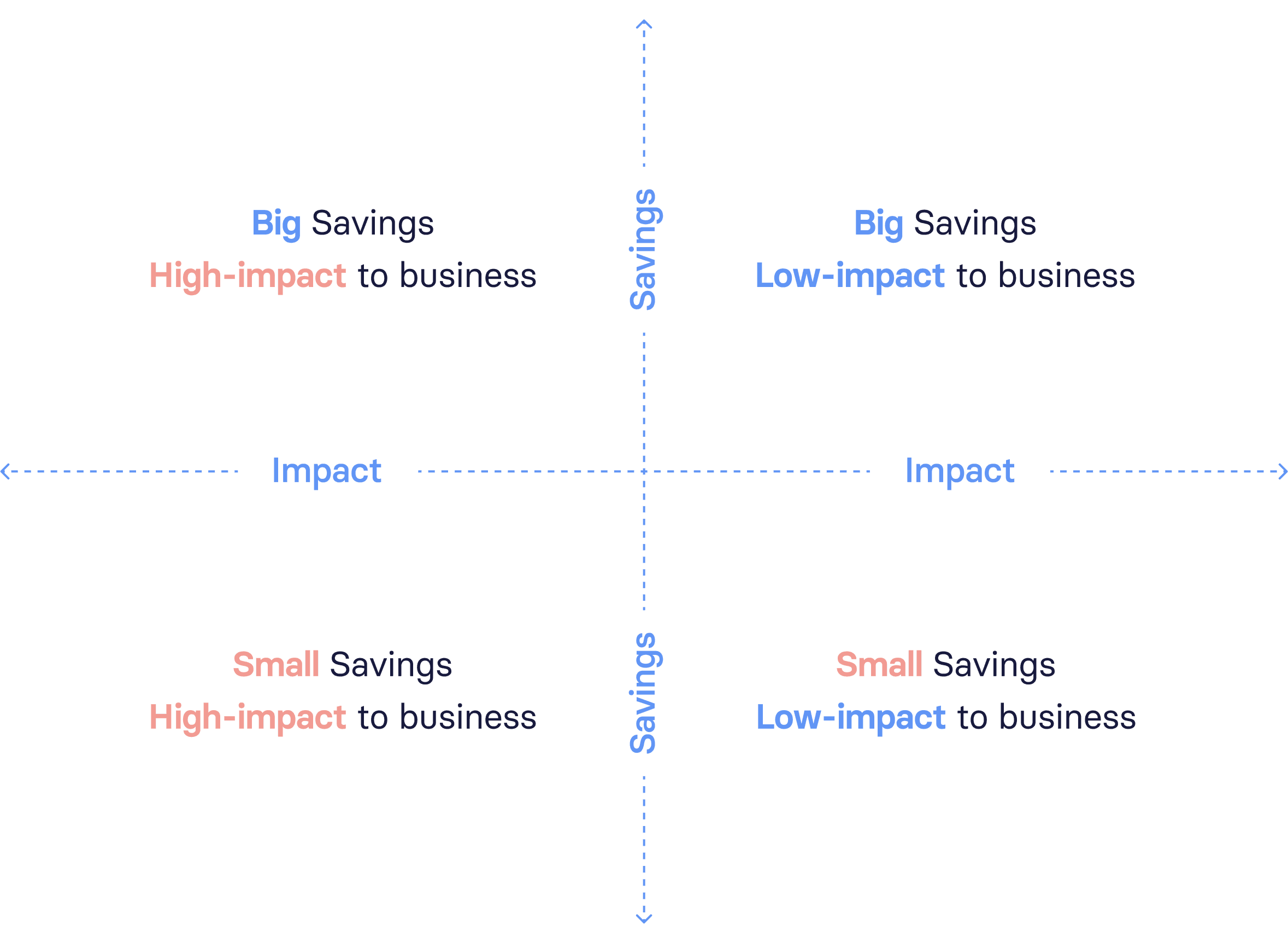

You can work with your CEO to identify opportunities to extend runway by building out a matrix of your variable spend.

You want to help the CEO identify different levers to pull that would conserve cash. The goal should be to find opportunities where cutting spend will save a lot of money, but won’t have a large negative impact on the business.

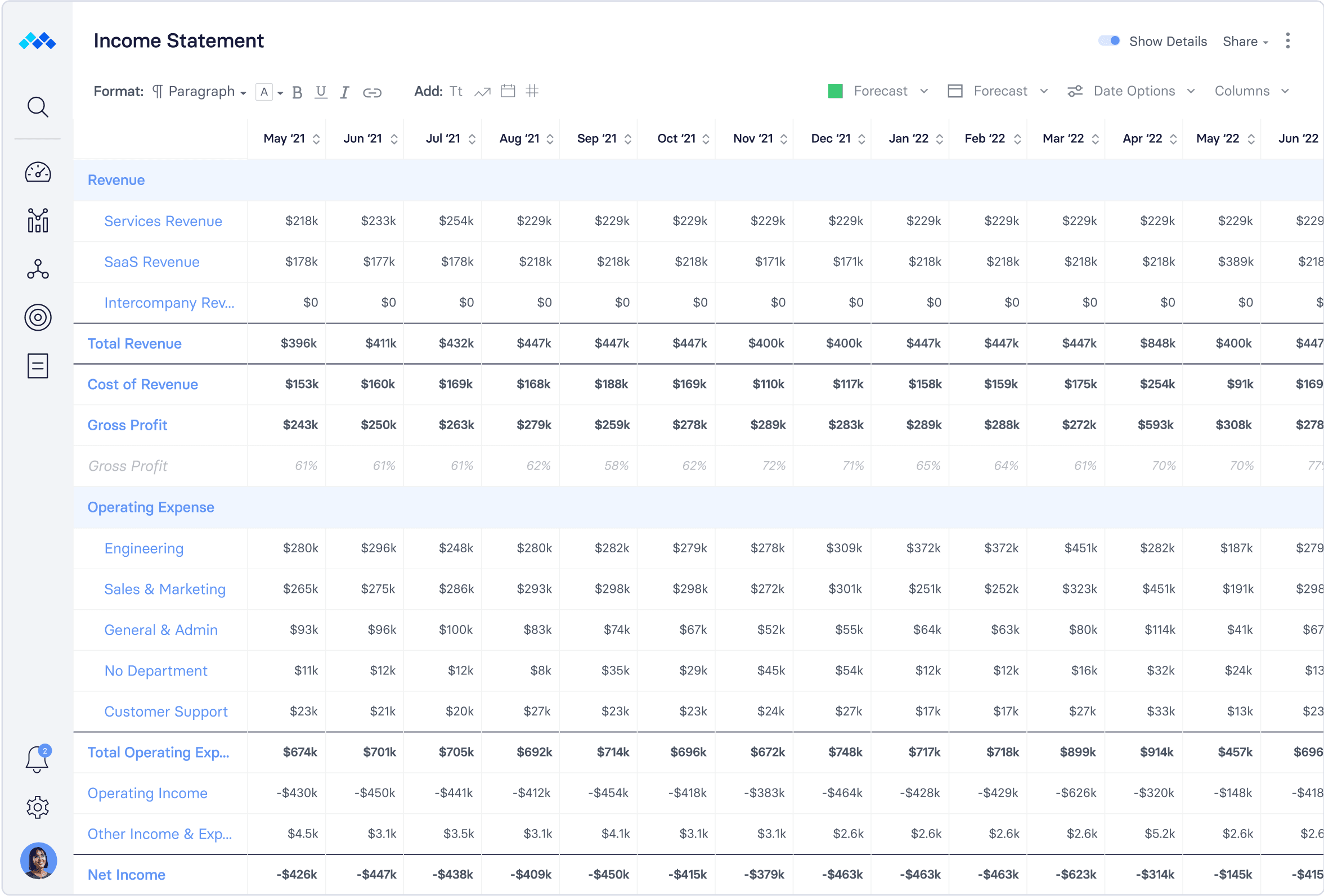

For example, start by running a financial report that breaks operating expenses out by department.

Use this report to get a high-level understanding of trends in your departmental expenses. You’ll want to bring three recommendations to your CEO that fit into that upper-right quadrant for cost-cutting, so try to identify a few trends that might fit. Maybe you see that hosting and servicing costs are higher than industry benchmarks and you want to dig into opportunities to cut your cost of revenue in that area. Maybe you see that sales and marketing expenses are too high for the amount of revenue you’re generating. Or, maybe there’s some fat to trim in G&A.

You can take those surface-level observations and dive into the details to understand the underlying business drivers to see if there are any good opportunities to present to your CEO.

You can double click into your data to understand where you’re spending that money. Maybe you see a recent spike in AWS overage fees. Can you work with engineering to look into reserved instances and get a discounted rate on server usage to reduce overall costs? That could be a strong opportunity to extend runway that doesn’t negatively impact operations.

This is just one example of an opportunity you could highlight for your CEO. You could do the same exercise for metrics like sales cycle and CAC ratio to present areas of improvement to your CEO.

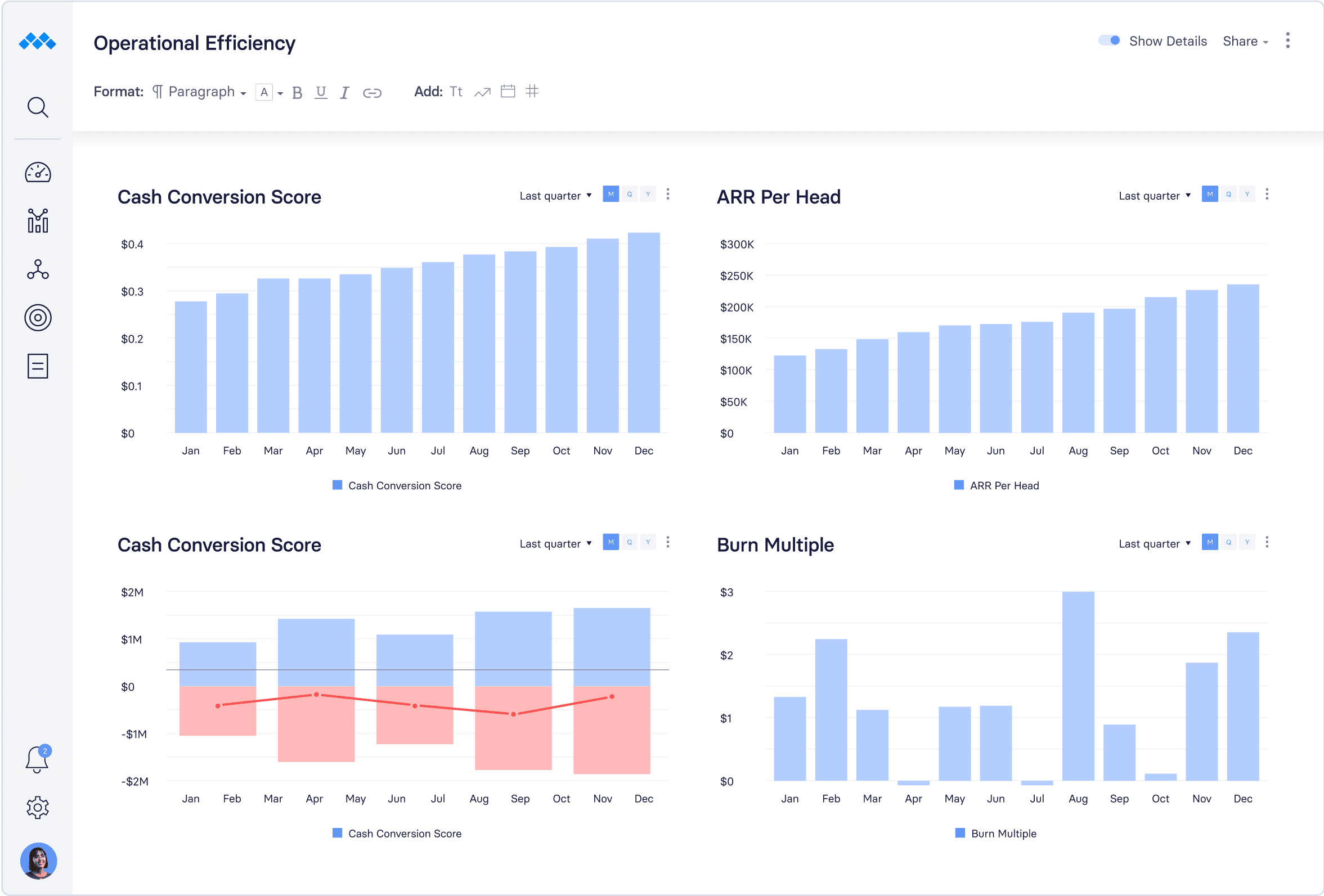

The other way you can provide strategic value to your CEO is by making sure they have real-time access to operational efficiency data. In a market downturn, you should be reviewing that data with the CEO on a weekly basis (or even multiple times per week depending on your runway).

You don’t want to wait until the CEO is Slacking you asking for updates to provide strategic recommendations. The more proactive you can be in identifying opportunities to extend runway and presenting critical insight into operational efficiency, the easier it will be for the CEO to guide the company through the storm.

In normal market conditions, the business variables that impact a sales leader are more or less controllable. How much you spend on marketing, what your pipeline looks like, the data frameworks that they use to run sales and go-to-market motions — they’re all in play for tweaking as needed.

But when a market downturn like this one hits, suddenly your sales leader has to start monitoring KPIs on a much more granular level on a weekly or even daily basis to stay on track. If they want to hit their monthly and quarterly goals, they have to be able to react to even the smallest shifts instantaneously.

"The storm will dissipate at some point in time. The question is when. You want to know that answer as early as possible so you can lean into hiring and play offense on growth. But tactically, during the market downturn, you need to be more flexible with terms because prospects are going through the same situation as you."

There are three metrics that sales leaders become hypersensitive to in a down market:

Win rates

Are we winning at the same rate or is it declining? Who are we losing to and why?

Pipeline generation

Do we have fewer qualified opportunities than normal and will it prevent us from hitting our number? Is outbound becoming less effective as prospects become more conservative about spending? Is it taking us longer to move prospects through the sales funnel?

Annual contract value (ACV)

When we’re winning, are we having to give more discounts to meet decreased budgets? Should we modify our pricing strategy to better serve the mood of our buyers?

These metrics are always important to sales leaders. But the closer they can get to real-time insight during a market downturn, the easier it is for them to understand whether or not it makes sense to modify the revenue forecast, get creative with special promotions and discounts, and adjust hiring plans.

How Finance Can Support Sales in a Down Market

The relationship between finance and sales is among the most important in any company. There are countless ways these two departments can collaborate, but two stand out in the case of a market downturn.

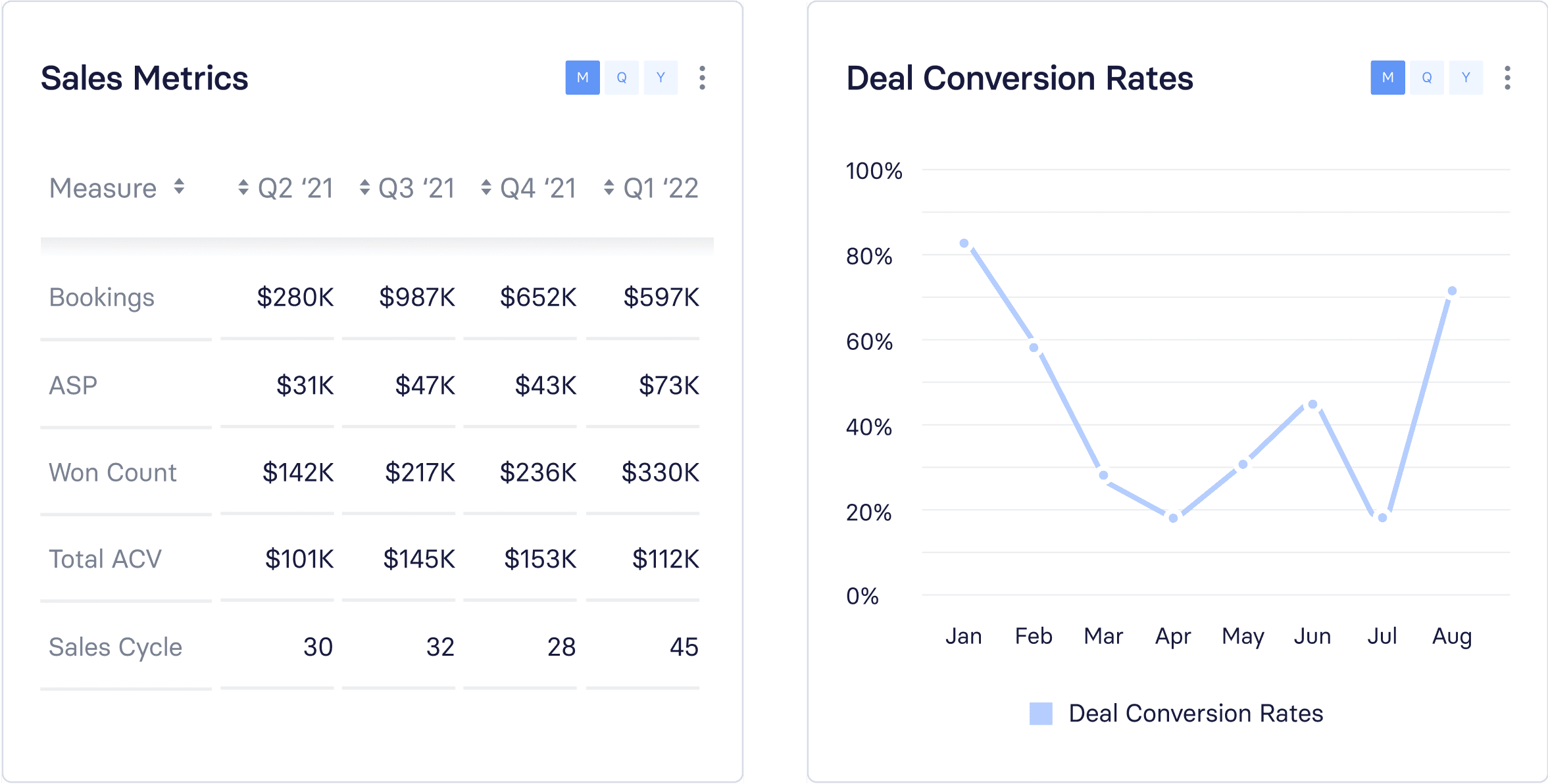

First, you want to make sure you’re providing trend data for at least those three metrics that matter most to your sales leader — win rates, pipeline generation, and ACV.

While the sales leader has access to basic CRM reporting, a tool like Salesforce isn’t always able to provide the visual trend analysis you need to understand what’s really happening. Your sales leader can see current win rates, but might not be able to quickly compare period-over-period the way you can with your broader data visibility. They also might not be able to see the relationship to other business metrics the way you can.

Surface that bigger picture and analyze it with your sales leader to unlock strategic insights about which segments to focus sales efforts on, which reps are performing well and why, and how strong the pipeline is.

The other way you can collaborate with your sales leader is by triangulating forecasts. In a down market, maximizing forecast accuracy is more important than ever. These three vectors can help you and your sales leader do that together:

- What are AEs committing to in the current period and what’s the upside?

- How healthy is the opp pipeline on an AE-by-AE basis? If there are deals that have been sitting for months, there could be an issue.

- What’s the historical trend of pipeline conversion, specifically in the prior quarter, and are we seeing the same rates apply now?

Providing snapshots of data that triangulates these three vectors is critical to understanding whether or not you should continue investing in AE headcount. Your sales leader has to make decisions based on what they think the world will look like six months from now. That’s complicated, but data analysis from finance can make it easier to get the timing right.

The best marketing teams always tie their initiatives to bookings and revenue. But that focus becomes even more critical in challenging market conditions. Whereas marketing leaders might typically have a full-funnel focus, in tough markets they’ll be under more pressure to drive sales-qualified leads (SQLs) and high-quality opportunities as opposed to leads or traffic.

“Advertising spending is one of the easiest costs to control. If you want to cut your ad spend in half, you can do that immediately, which is why it’s likely one of the first things to trim when you’re in cost-cutting mode. Since it’s more expensive to win new customers than to retain existing ones, teams should put more effort into customer marketing and get companies closer to that 120% net retention benchmark.”

Like any other department, efficiency metrics become crucial to marketing when weathering the storm. Return on ad spend, customer acquisition cost (CAC), SQL generation, email open rates, and sales cycles for inbound opportunities are all examples of metrics that marketing will become more sensitive to while the market remains in its current state.

How Finance Can Support Marketing in a Down Market

A strong relationship between finance and marketing can be a gamechanger for businesses — especially in a market downturn. But this is often one of the most complicated partnerships for finance teams. While ad spend is straightforward, many marketing initiatives don’t provide such direct ROI, which can lead to tough conversations about budget and resource allocation.

However, if your company is trying to extend runway and grow more efficiently, you’re going to have to align on more conservative marketing spend. That starts with making sure you and the marketing leader are on the same page regarding customer acquisition costs.

Once you have a shared understanding of the high-level acquisition costs, you can dig deeper into the numbers to try and better understand the opportunities to lower CAC. Depending on where you’re currently spending, that could mean:

- Doubling down on high-performing channels and campaigns while pausing the low-performing ones.

- Cutting high-cost, low ROI activities. Are live, in-person events worth the high cost? Are your highly-produced marketing videos generating enough views to justify the cost?

- Shifting to on-demand, self-service content formats like webinars and product demo videos and automating sales handoffs.

- Tightening your ICP to double down on accounts that historically close more often and faster.

The deeper you can dig into the pipeline conversion data for specific campaigns and channels, the easier it will be to proactively approach marketing with strategic insights. That’s what will strengthen your partnership and help the company extend runway in these difficult times.

The same way sales teams face an uphill battle to close customers when companies are trying to cut spending, customer success teams face an uphill battle to drive renewals when budgets are tightening.

“The reality is that a lot of companies will struggle to survive through a severe market downturn. They’re going to cut costs, which means customers will get stricter about their budgets for software tools. We have to focus on communicating our value effectively.”

Customer success leaders will continue to track the same retention metrics during a downturn as they would in an upmarket. But there’s an added level of pressure on the renewal cycle that the entire company should be invested in alleviating. Beyond that pressure to limit churn, CS leaders also face headcount planning challenges as they adapt plans according to market conditions.

How Finance Can Support CS in a Down Market

Retention analysis is always one of the best ways for finance to provide strategic value to a business. Under normal circumstances, a CS leader may have a finger on the pulse of high-level net revenue retention and gross revenue retention numbers. And you may have a regular cadence of checking in to go deeper on those numbers.

But in a down market, it’s critical that you work with the CS team to identify any and all opportunities to minimize churn. Start cutting your retention data on deeper levels to see if any insights stand out. You could filter net dollar retention by product line or market segment to see if certain segments outperform others and where CS reps should focus their efforts.

Or, you could filter by support tier to see if that offers any insight into the customers that deliver the most value.

This kind of analysis is especially important when you have a lean CS team. You want your CS reps to be in a position to spend enough time with each account. But when they’re resource constrained, knowing which customers are most likely to renew can help them prioritize their time.

The other way you can help CS manage the down market is to work with them on updating their headcount plans. While the company at large may need to scale back on hiring, you may be able to surface insights into account distribution among CS reps that show the ROI is there to bring on more heads. After all, it’s far more expensive to acquire a new customer than to retain an existing one.

Look at how many customer accounts each CS rep has and overlay that data with NPS and CSAT scores by customer. Are there patterns in where customers are green and where they’re yellow or red? If you notice that the reps with fewer accounts have more green customers, you may be able to give CS leaders recommendations on the optimal customer to CSM ratio.

If your company doesn’t have enough CSMs, you can help strengthen the customer success leader’s business case for hiring more to drive up customer satisfaction, renewals, and expansions despite the tough market conditions. This is a great example of how you can prove the ROI of strategic initiatives that help the entire company win.

In a healthy market, product and engineering teams can load up the roadmap, bringing features to market quickly and doubling down on what goes well. But in a market where the company can’t raise and sales are harder, they need to know exactly how what they’re building will improve CAC, ARR growth, adoption, and retention goals. And that’s the challenge that these leaders face.

“In a strong market, you can fill out the product roadmap with the hope and expectation of adding more resources next quarter and beyond. But you can’t assume that anymore. Your hiring plans are going to change and they could change quickly. You have to plan the roadmap around current resources — no more, no less — and go from there.”

The impact of market conditions on the product roadmap itself will depend on the maturity of your product. If your product team is still building out core functionality that all customers want, the plans won’t change. (They might just get pushed out depending on resource availability.)

But when your product team starts to plan more specialized feature releases, they’re placing bets on what to focus on first, second, third. In a down market, knowing how well the sales team will be able to sell into specific verticals or segments is crucial to efficiency.

It all comes down to a collaborative effort between product, engineering, sales, and CS to understand which features will move the needle for new and existing customers and how quickly the product team can get core functionality out the door.

“We need to stay as close to the customer as possible and ensure the decisions we make are both fiscally responsible and map to the needs our customers have. Fundamentally understanding the customer and their problems is crucial. And no matter what size your team is or how your hiring plans change, the ability to prioritize intentionally is what will keep the product roadmap on track.”

How Finance Can Support Product and Engineering in a Market Downturn

The value that finance can bring to product and engineering is really a culmination of the value you can bring to sales, CS, and the rest of the business.

In a market downturn, it becomes increasingly critical for product leaders to stay in lockstep with partners in sales and CS — but it’s not always easy to bridge the gaps between departments and create alignment. Finance’s unique ability to maintain a holistic picture of the business makes it the perfect connective tissue between all these departments.

One way you can connect the dots between product, sales, and CS is to dig into churn, downgrade, and upsell data. Are there any patterns that could help product focus its development efforts? Maybe a new product line is performing better than a legacy one and warrants more attention. Highlighting increases in ACVs and upsells around individual product lines can help you make sure sales and product are properly aligned.

But timing is also a critical factor for your product team. You can bring a big-picture view of development timelines to product teams and highlight the historical accuracy of forecast accuracy. Are new products actually going to launch when expected? Improving alignment on timing will ensure everyone has a clear understanding of ROI.

The most obvious role the people team plays in helping a company operate through a market downturn is finding ways to optimize payroll costs. But where the people team truly acts as a strategic partner is in revising workforce plans that they built with leadership during the annual planning process. By updating those plans to include potential risks, challenges, opportunities, and scenarios, the people team becomes a guiding force in how the company moves forward in these difficult conditions.

"Your role as People leader and culture steward is to be clear on what you do and do not have control over. Your employees and the executive team are looking to you to help navigate the uncertainty while trying to maintain employee engagement, productivity, and viability of the business. An updated plan provides a clear and consistent lens through which your organization makes decisions and how you communicate these changes to employees."

Even if the company is happy with how it has hired so far, it’s important for HR leaders to look at opportunities to improve as these economic forces hit. In an effort to help the company grow, HR leaders can work with other business leaders to see if there are ways to reorganize the work being done to maximize clarity, focus, and overall effectiveness — without having to hit the aggressive hiring goals they may have had in place before the market downturn.

How Finance Can Support HR in a Market Downturn

Finance and HR collaborate best when they embrace what each department is best at. Finance can come to the table with a deep understanding of the “hard” costs that come with headcount and the timing of those costs. And people leaders can provide insight into the “soft” costs and potential impact of any changes to workforce plans.

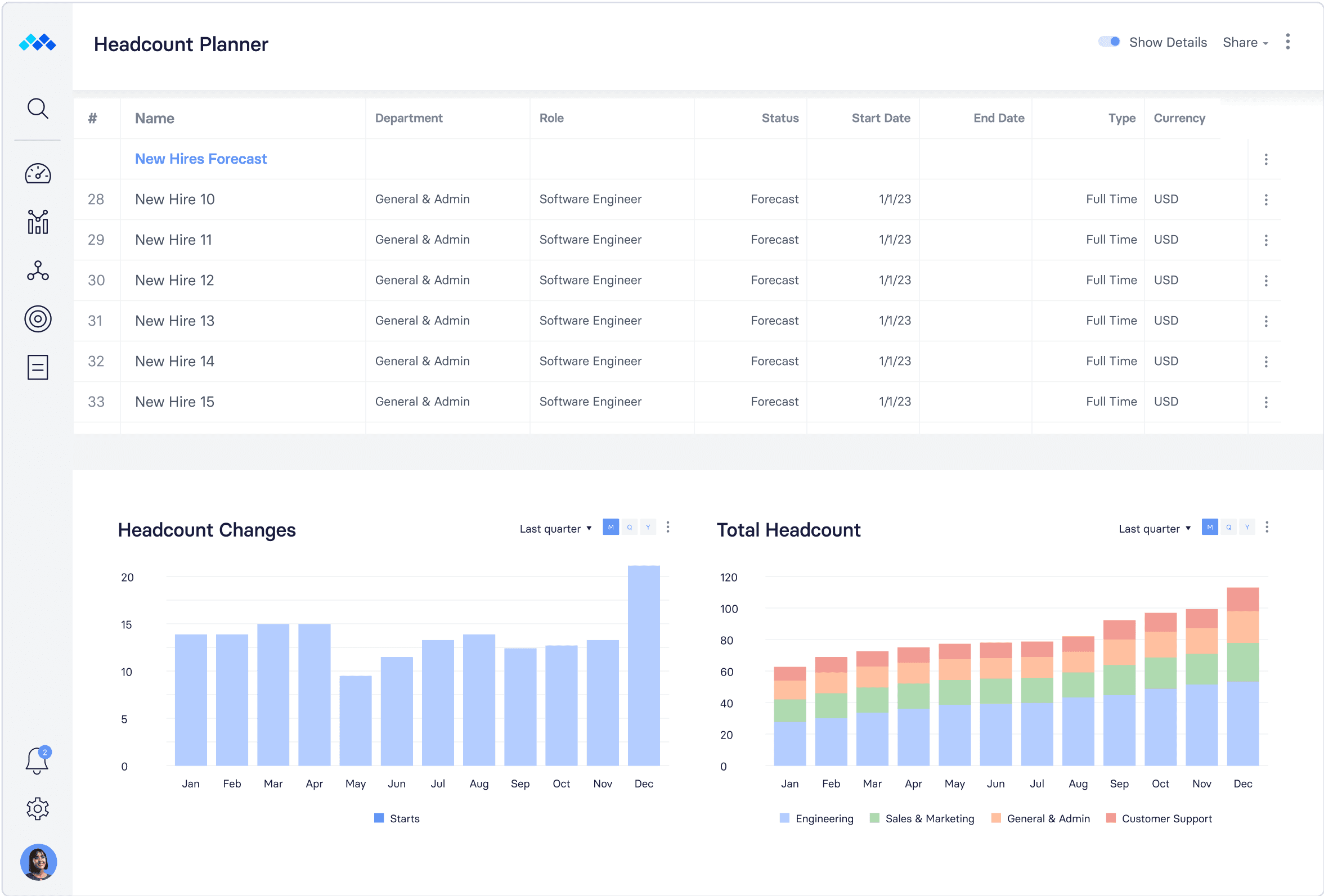

This comes to life in the form of agile scenario planning. Finance can add assumptions to models based on historical data from past recessions, calculating the costs of various initiatives that HR proposes for culture development.

Speed is of the essence for scenario planning during a market downturn. Business leaders need to know how reducing headcount plans will impact their numbers. Or, if they pushed out hiring to a later date, how that change will impact their plans. Finance is uniquely qualified to run these analyses — and the faster you can get answers to your business leaders, the more strategic value you’re bringing to the org. Working in lockstep with HR on headcount scenario planning will help drive outcomes for individual departments and the company at large.

People will always be the biggest expense for SaaS companies, so the more you can do to streamline costs without derailing growth, the better off your company will be in a downturn.

CHAPTER 4

Finance Can Navigate a Company to Clear Skies with the Right Tools

here’s long been this idea that leadership only loops finance into conversations once money comes up. Other leaders may talk strategy and think through various ways to manage the challenges of a down market — but once they start talking about cutting costs and attaching dollar values to those ideas, that’s when they bring finance in.

While that’s still a critical role that finance plays, the modern finance leader brings an extra layer of value to the team.

Now, you add strategic value by analyzing data from every corner of the business and improving decision-making. Every opportunity to collaborate with department leaders is another opportunity to help your company navigate its toughest challenges — whether that’s in a down market or in clear conditions.

But if you want your company to be one of the ones that come out the other side of this economic hurricane poised to win big, you need to master the role of strategic partner as soon as possible. Your company needs it now more than ever.

As you start down the path of weathering this storm, there are three things that will unlock your ability to be the compass your business needs.

Real-time data access

The market is going to change rapidly and the best companies are able to adapt just as quickly. But you can’t do that if you’re still stuck in a cycle of waiting until weeks after month-end close to get a clear view of your data. By then, you might have missed the window to capitalize on a strategic opportunity. Get out of spreadsheets and make sure you have real-time visibility into your most critical financial and operational metrics.

Drill-down abilities

It’s not enough to just report on the metrics your executives and investors want to see. Being a strategic partner means getting to the “why” behind your numbers. And that means drilling down deeper than the high-level metric to see what’s driving business performance, what’s working well and not, and what opportunities exist to quickly course-correct. The ability to slice your metrics by accounts, departments, market segments, marketing channels, product lines, feature areas, and more is crucial to your ability to guide your business through good markets and bad.

Agile scenario planning

Effective scenario planning is a pillar of any great company’s ability to navigate market turbulence. But most finance teams can’t build and rebuild models at the pace the business needs to adjust plans when they’re hampered by outdated tools. Maintaining base case, best case, and worst-case scenarios is table stakes.

You need to go a step further and be able to run multiple what-if models on the fly and pull levers in real time to show department heads and executives how new plans could impact runway and growth. The deeper your understanding of critical business assumptions like ACV, LTV, average sales cycle, sales rep quotas, and win rates, the easier it will be to stress test and adjust scenario plans on the fly.

Mosaic is a Strategic Finance Platform that gives you these three keys to navigating your company through the down market. Mosaic seamlessly brings in data from your entire business tech stack and effortlessly organizes it into on-demand metrics for instant analysis across every aspect of your business. Start analyzing metrics immediately in out-of-the box dashboard templates or build custom views from scratch. Dive deep into the key business drivers and trends behind the numbers with point-and-click analysis in our interactive Canvases, Dashboards, and Reports. Build forward-looking plans, forecasts, and what-if scenarios to chart the best path forward and instantly see how a change to one area of the business affects all the others.

Now is not the time to maintain the status quo and make do with cumbersome spreadsheets and outdated and technical finance tools. Investing in finance tech today is what will help you drive growth tomorrow, throughout the entire market downturn, and beyond.

Want to learn more about Mosaic? Request a personalized demo and find out how you can take advantage of all the use cases we discussed here.