Day Sales Outstanding (DSO): Why it Matters in 2024

What Is Days Sales Outstanding?

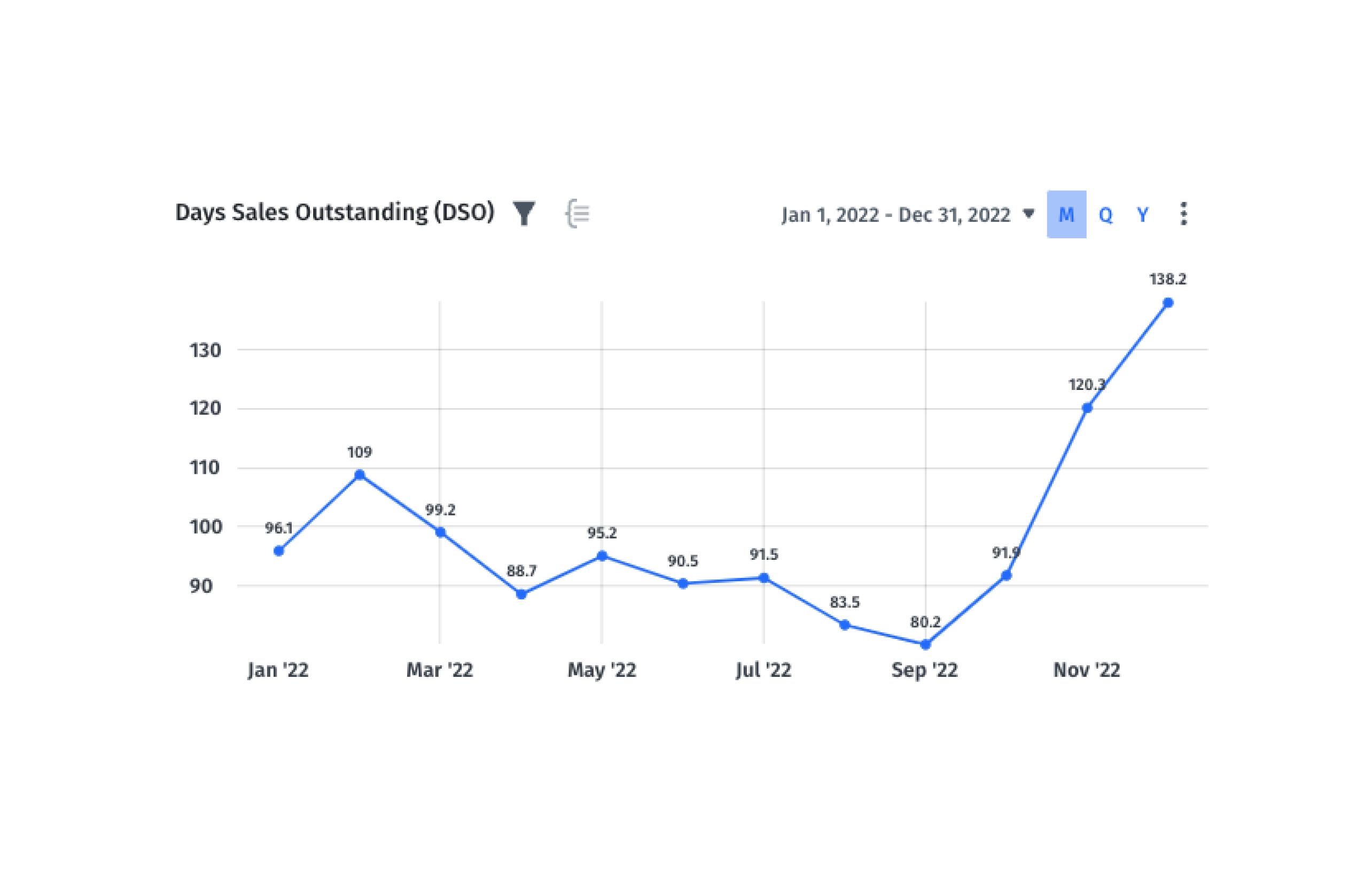

Days Sales Outstanding (DSO) is a financial collections performance metric used to measure the average number of days it takes for a company to collect payment after a sale has been made. Also called days to collect, this key performance indicator (KPI) helps finance and accounting leaders understand their cash conversion cycles, optimize cash flow, and manage accounts receivable more effectively. An accurate view of your average DSO over time makes it easier to monitor liquidity and fluctuations in working capital.

Categories

Table of Contents

Days Sales Outstanding Formula

The formula for your days sales outstanding calculation is your average accounts receivable balance divided by revenue for the given period of time, all multiplied by the number of days in the period.

Here’s an example to better show how the calculation works. Consider a company with revenue of $1 million and an average accounts receivable balance for the year of $150,000. You would calculate DSO as follows:

($150,000 / $1 million ) x 365 days = ~55 days

If you work on net-60 payment terms, you might be happy with this performance. But if you expect to be paid in 30 days or less, and it’s actually taking an average of 55, this is something you’ll want to dig into.

Days Sales Outstanding Calculator

Your Average Days Sales Outstanding

0 days

The Importance of Monitoring DSO for SaaS Companies

Monitoring DSO is crucial for the financial health of B2B SaaS startups. The more proactive you are in measuring days to collect, the easier it will be to spot cash flow problems early and address them before they start to impact your operational efficiency.

If your average accounts receivables don’t align with the cash it takes to run your operations, you could find yourself in a situation where you can’t keep pace with business growth. Combined with a metric like AR aging to understand the buckets of outstanding receivable balances, DSO makes it easier for SaaS finance leaders to embrace the “cash is king” mindset.

Generally speaking, there are four main benefits of monitoring DSO.

Improve Cash Flow Management

Get a better understanding of when you experience higher DSO trends so you can resolve issues alongside your partners in accounting and customer success.

Assess Customer Credit Risks

Analyzing changes in DSO allows companies to assess customer credit risk more effectively. An increasing trend might signal difficulties faced by clients in making timely payments or problems within your own collections process.

Benchmark Your Performance

Comparing your company’s DSO against internal and SaaS benchmarks provides valuable insight into how well you are performing relative to expectations. You don’t want to over-index on competitor benchmarks, but it’s helpful to have the context as a baseline.

Optimize Billing and Collection Processes

Regularly monitoring your organization’s DSO enables you to identify inefficiencies within invoicing procedures or collections strategies that need improvement — ultimately leading to faster payment cycles and improved cash flow.

Days Sales Outstanding vs. Average Collection Period

The differences between days sales outstanding and average collection period are nuanced and dependent on your industry. Some will say that DSO and ACP are interchangeable metrics while others note subtle differences in their calculations.

In SaaS, DSO and ACP are essentially the same metric. This is largely because you’re not dealing with cash sales the way you would in consumer packaged goods or retail.

You calculate average collection period as:

(Accounts Receivable Balance / Net Credit Sales) x Number of days in given period of time

Unlike ACP, you typically divide AR balance by total revenue to calculate DSO. For different industries with physical goods, you might distinguish between your DSO calculation and your ACP calculation because net credit sales (total credit sales minus cash sales) account for warranty claims, product recalls, and returns.

In SaaS, your variables for the DSO formula and ACP formula should be tightly aligned.

What does a high DSO mean?

A high Days Sales Outstanding (DSO) indicates that it takes longer for a company to collect payments from its customers after a sale has been made. This can have several implications on the financial health and cash flow of your B2B SaaS startup:

- Negative impact on cash flow. When you have outstanding invoices, it means that there is money tied up in accounts receivable instead of being available as liquid assets. This can create challenges when trying to cover operational expenses or invest in growth opportunities.

- Inefficient collections process. A high DSO might suggest inefficiencies within your invoicing and collections processes, which could be due to manual procedures, lack of automation, or poor communication with customers regarding payment expectations.

- Potential credit risk issues. If clients consistently take longer than expected to pay their invoices, this may indicate potential credit risk concerns. In such cases, reevaluating customer credit terms or implementing stricter policies may be necessary.

What does a low DSO mean?

A low Days Sales Outstanding (DSO) is generally considered a positive indicator of the health of your accounts receivable process (check out our article on accounts receivable KPIs for other ways to track this).

It means your company is able to collect payments from customers quickly after making sales. This can lead to improved cash flow and financial stability, allowing the business to reinvest in growth initiatives or cover operational expenses with ease. It can also indicate a strong handoff from sales teams to customer success as well as strong alignment between you and your customers on pricing and payment processes.

There are several reasons why a company might have a low DSO:

- Efficient invoicing and collections processes. A well-organized billing system that sends out invoices promptly and follows up on overdue payments can contribute significantly to reducing DSO.

- Favorable payment terms. Offering attractive payment terms such as early-payment discounts or shorter due dates may encourage customers to pay their bills sooner, thus lowering your DSO.

- Selective customer base. Working primarily with clients who have good credit histories and track records of paying on time can help keep your average collection period short.

How to Build Custom Receivables Metrics

5 Ways to Lower DSO

Reducing your Days Sales Outstanding (DSO) can significantly improve cash flow and overall financial health for your B2B SaaS startup. Here are some strategies you can implement to lower your company’s DSO:

Offer Early Payment Discounts

Encourage customers to pay invoices sooner by offering a discount for early payments. Offering an incentive, such as a discount for prompt payment within ten days or making upfront payments, can incentivize customers to prioritize your invoices.

Automate Invoicing and Collections Processes

Implement new software to streamline the billing process and ensure timely delivery of invoices. Automated reminders help in following up with customers who have outstanding balances, reducing the chances of late payments.

Improve Customer Communication

Regularly communicate with clients regarding their account status, upcoming due dates, and any overdue balances. Clear communication helps maintain healthy relationships while keeping them informed about their financial obligations towards your business.

Create Clear Policies on Late Payments

Establish well-defined policies outlining penalties or interest charges associated with late payments. Make sure these terms are included in contracts signed by both parties at the beginning of each engagement so there’s no confusion later on.

Analyze Customer Payment History

Tracking DSO at the most granular levels with a tool like Mosaic will allow you to identify slow-paying customers and proactively address potential issues before they escalate into larger problems.

Each of these tactics hinges on your ability to cut down on the amount of time spent simply calculating DSO. This is a deceptively complex metric, giving you a prime opportunity to leverage automation to drive efficiency.

Tracking DSO at a Granular Level with the Mosaic Metric Builder

The high-level formula for calculating days sales outstanding is important — but the results can only tell you so much. While this metric seems simple on the surface, you’ll want to customize the calculation to get more granular views for your business.

A few different use cases for a more granular, customized days sales outstanding formula include:

- Looking at the average days to collect for specific customer segments (e.g. enterprise only)

- Cutting DSO calculations by product line to understand which ones generate more efficient customer relationships

- Analyzing how long it takes to collect cash from customers on two-year contracts versus those on one-year deals

All of these insights live in your general ledger and revenue data — you just have to be able to unlock it. This is what Mosaic’s new Metric Builder can do for you and your business.

Rather than going through the painful process of building custom metrics in Excel — collecting data, structuring it properly, combining multiple datasets, crafting the syntax for your metric formulas, and keeping the data updated — Mosaic automates the process.

Metric Builder lets you bring data in from any system, any format, to create any metric you can think of — all in a lovable UI that leverages a familiar pivot table experience and a no-code approach. For example, maybe you want to look at DSO for an individual customer segment. Or, you could cut the metric by product line or contract length.

The more granular you can get with the calculation, the more strategic insights you’ll get from the results.

But DSO is only as valuable as the context you put it in. In addition to DSO, you should be analyzing collections metrics, accounts receivable metrics, and financial ratios, like your accounts receivable turnover ratio, AR aging, average days delinquent, bad debt to sales, and more. And you should be customizing those metrics according to the unique nuances of your business.

Don’t keep fighting with spreadsheets and manual processes to customize metrics. Reach out for a personalized demo of Metric Builder to learn how you can start going deeper on DSO and other critical KPIs.

Days Sales Outstanding FAQs

What is the difference between DSO and AR?

Your accounts receivable balance shows the dollar amount you’re owed from customers in outstanding invoices. It’s a variable of the DSO calculation, which tells you how many days, on average, it takes your customers to pay the AR balance.

What does a higher days sales outstanding mean?

Why calculate days sales outstanding?

Explore Related Metrics

Own the of your business.