Categories

Table of Contents

3 Common Invoice Statuses

For SaaS finance teams, managing and analyzing invoice statuses isn’t just about billing — it also provides insights into company health, operational efficiency metrics, and is closely correlated with customer satisfaction. For example, invoice statuses can help companies better track cash flow, allocate resources to manage collections, or assess customers’ creditworthiness.

That said, there are three common invoice statuses: overdue, open, and closed.

Overdue

As the name implies, overdue statuses are invoices that customers haven’t paid by the stated due date. When an invoice remains unpaid past the specified date, it’s usually flagged as overdue in the company’s CRM or accounting system. These invoices need to be addressed swiftly to prevent cash flow crunches, typically through follow-ups or email reminders, yet handled with sensitivity to not strain customer relationships.

Sometimes, when an invoice becomes overdue, customers may take this as a cue to renegotiate contract terms, or it could surface potential churn risks as they might unsubscribe altogether.

Within the realm of SaaS accounting, overdue invoices influence revenue recognition, and the complexity amplifies with the matching principle in play, where revenue and associated costs should be reported within the same accounting period. So, paying close attention to the number of invoices that are overdue during the month end close process is crucial.

Open

Open invoice statuses refer to active invoices sent to customers but not yet paid, indicating that payment is pending. This status suggests that a payment is expected to come in, but the customer is still within the agreed-upon terms and timeframe.

Open invoices can offer insights into future cash inflows, crucial in SaaS revenue forecasting and planning. Moreover, if an open invoice becomes overdue, it can complicate revenue recognition, a process that is inherently complex in SaaS.

Closed

Closed invoices are those that have been fully paid and settled. The status of an invoice changes from “open” or “overdue” to “closed” once the customer’s payment is processed and confirmed by the company.

These invoices can be recognized in financial statements within GAAP guidelines. As customer payments have been received, closed invoices can be particularly valuable in accurate revenue forecasting and strategic business planning, with decisions grounded in actual revenue.

How to Track Your Invoices Quarter Over Quarter

By regularly tracking invoices, you can quickly spot inaccuracies or overdue payments and ensure the accuracy of your financial reporting. However, a small business or growing company may find this challenging, as it might miss, overlook, or deal with inaccurate invoices.

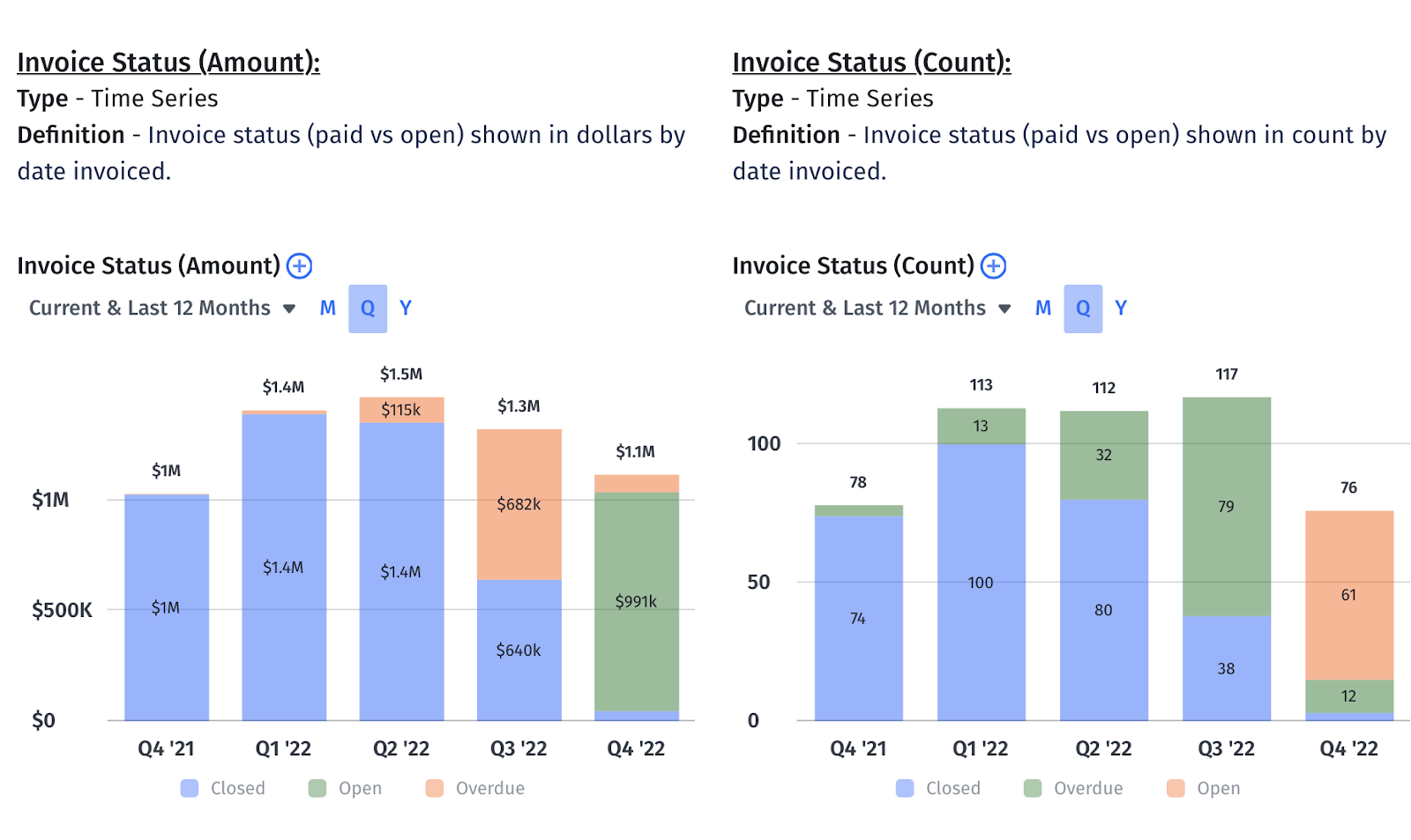

Mosaic’s financial reporting software provides real-time data on invoice statuses, both in dollars and counts, including overdue, closed, or open — right out of the box. So, finance teams can benefit from the convenience of having this information readily available. Plus, they can easily identify specifics about overdue invoices, such as which clients have the most overdue invoices.

This way, you can target your effort in collections, focusing on high-value overdue invoices rather than just the count — which is crucial to your bottom line. For example, “Company A” might have the highest total number of overdue invoices, but it might not necessarily be the highest priority for collections when considering the total amount owed. In contrast, an invoice from “Company B,” though only one, might be a more significant amount due, making it a higher priority.

Additional Metrics You Should Track

Ideally, you should track invoice statuses alongside other key collections performance metrics to get a clearer view of the company’s revenue. This holistic approach provides nuanced insights into your financial landscape and empowers confident, well-informed, data-driven business decisions.

Collections

Collection involves gathering payments from customers who have subscribed to your software or service — this is key to ensuring that expected revenue is received and recognized.

Collection metrics offer insights into both current and projected cash flow. Plus, it gives you crucial insights to manage your company’s financial well-being. For example, Mosaic lets you track various collections metrics, such as total collections and collections effectiveness index (CEI), to name a few.

Notably, collections largely depend on invoices, which state the details of the customer, services provided, charges, contract details, and payment due dates. In SaaS, invoices are often recurring and aligned with subscription periods. Without reliable invoicing, effective collections wouldn’t be possible.

AR Aging

AR aging is an accounts receivable and collections performance metric that presents unpaid invoices based on the days past the invoice due date.

Typically, an AR aging report will organize customer invoices by name, invoice number, and aging schedule, such as 30-day date “buckets” with a time range from the invoice’s due date. This way, you can quickly identify incoming cash inflow from customers, spot customers with late payments who may be credit risks, improve your collections process, and avoid bad debts.

Ideally, it would be best to aim for an AR aging percentage of overdue accounts to be as close to zero as possible.

Billings

Billing is a distinct concept from SaaS bookings.

SaaS billing refers to money you invoice to your customers, whether monthly, annually, or simply a one-time transaction. Suppose a customer signs a 3-year contract for an annual contract value (ACV) of $12,000, paid monthly. In that case, the SaaS billing will be $1,000 every month. Billings highlights if you have sufficient cash flow to run operations smoothly, giving you a better idea of your business’ health each month.

Outside of SaaS, billings are usually considered the same as invoicing by most businesses.

Get Better Invoice Status Insights With Mosaic

It’s no secret — juggling data across multiple systems can make tracking invoice statuses and other metrics challenging. This is where Mosaic’s Metric Builder steps in.

Mosaic offers a comprehensive dashboard pre-built for billings and collections, including AR aging and detailed information on overdue invoices, so users have extensive context to make the collections process more efficient and effective.

Our goal? To empower the accounting or collections team with detailed, actionable insights to optimize revenue collection.

Our strategic finance platform integrates with many systems, including your ERP, CRM, HRIS, Billing, and data warehouse, via API or flat file upload. In addition to supporting custom metrics, Metric Builder comes with preloaded SaaS metrics so your finance teams can hit the ground running.

Request a demo to get a firsthand look at Metric Builder.

Invoice Count FAQs

Is an invoice number the same as a billing number?

No, an invoice number is not the same as a billing number. An invoice number is a unique value assigned to each specific payment request, enabling easy tracking and referencing of individual transactions.

In contrast, a billing number is typically assigned to a specific account, customer, or billing cycle and can encompass a broader set of invoices issued to a particular customer.

What is the difference between an invoice and a bill in Quickbooks?

How can Mosaic help with billing and invoices?

Explore Related Metrics

Own the of your business.