Categories

Annual contract value (ACV) is a revenue metric you can use to analyze your data and get a deeper understanding of the impact of sales and marketing initiatives so you can highlight strategic insights for your business.

Keep reading to learn more about ACV and how to leverage it quickly and easily.

Table of Contents

How to Calculate Annual Contract Value

There are multiple ways you can calculate the ACV for your customer base. But at the highest level, the ACV formula is total contract value divided by the total years in that contract (focusing solely on recurring revenue).

Let’s see how the formula works in an example. Say a new customer signs a 3-year contract with you for $30,000 per year of service, and you give them a 30% discount on the first year.

Their annual payments would look like this:

Year 1 = $20,000

Year 2 = $30,000

Year 3 = $30,000

For a total contract value of $80,000 over 3 years. To calculate the ACV for this customer, you would take the total contract value and divide it by the number of years in the contract.

ACV = $80,000 / 3 = ~$26,667

By calculating the average amount you receive each year, you can easily visualize how your SaaS pricing strategy affects your annual income from this customer.

There are several ways you can look at ACV in your business, including:

- Individual ACV per customer (like the example)

- Total ACV of all customers

- Average ACV of all customers

- Total ACV for a time period

- Average ACV for a time period

Each of these metrics gives you slightly different insights into your business performance. Calculating ACV for a single customer doesn’t take much time, but finding company-wide averages and totals can be time-consuming in spreadsheets. Financial analytics software like Mosaic aggregates all of your CRM data to easily calculate metrics like ACV at the company level and in more granular ways, like by industry, product line, customer size, and more.

Why ACV Is Important

Leveraging ACV as a strategic finance tool helps you get a better understanding of your SaaS business in two ways:

- It can help you understand the true value of each customer when you have variable pricing.

- It informs which type of SaaS products you offer so you can tailor your growth strategies accordingly.

Helps Shape Your Pricing Strategy

SaaS companies are increasingly shifting toward consumption-based pricing, which means they offer pricing tiers that depend on usage variables. This pricing strategy puts annual income from individual customers in flux, impacting your ACV calculations.

There are several reasons why the actual income you earn from a contract varies each year, including:

- Discounted pricing

- Onboarding costs and other one-time fees

- Service and feature add-ons

- Product usage variables such as user licenses, features, queries, and number of integrations

ACV gives you a clear picture of the monetary value of each company by normalizing the total income over contract length. This way, when you look at historical data, you can see the effect your pricing strategy has on the value of a customer or various customer cohorts.

Informs Business Strategy & Decision-Making

SaaS companies come in a wide variety of shapes and sizes. But from an annual contract value perspective, you can split the SaaS industry into two broad categories: high ACV and low ACV.

- High ACV companies rely on bringing in fewer contracts with higher ACV. They’re more common for B2B companies that serve enterprise-level organizations.

- Low ACV companies focus on attracting a large number of low ACV contracts. This is more common in the B2C industry, especially with paid mobile apps.

SaaS companies with products that can be used by individuals and organizations of all sizes might have a high ACV product tier and a low ACV one. You see this from companies like HubSpot and Salesforce, which have free tiers that are meant to drive up customer acquisition for later expansion and increases in ACV.

Understanding which ACV strategy applies to your business can help you focus on the right activities and avoid getting caught up in industry trends that don’t work for your business model.

How to Leverage ACV To Make Better Decisions

ACV is one of the most important financial ratios to analyze a company in terms of strategy. In particular, you can use it to improve decision-making in sales and marketing by better understanding the levers that impact your revenue.

Benchmark New Contracts

Pricing discounts are one of the most effective sales tactics you can use, and they’re often helpful for landing major clients.

But how much of a discount should your sales team offer?

Tracking average ACV per customer for previous years can give you a baseline when creating new customer contracts. ACV helps you visualize how first-year discounts affect your total income from a new customer.

You don’t have to use it as a hard and fast rule, but it’s helpful as a guide that informs your cost-benefit analysis.

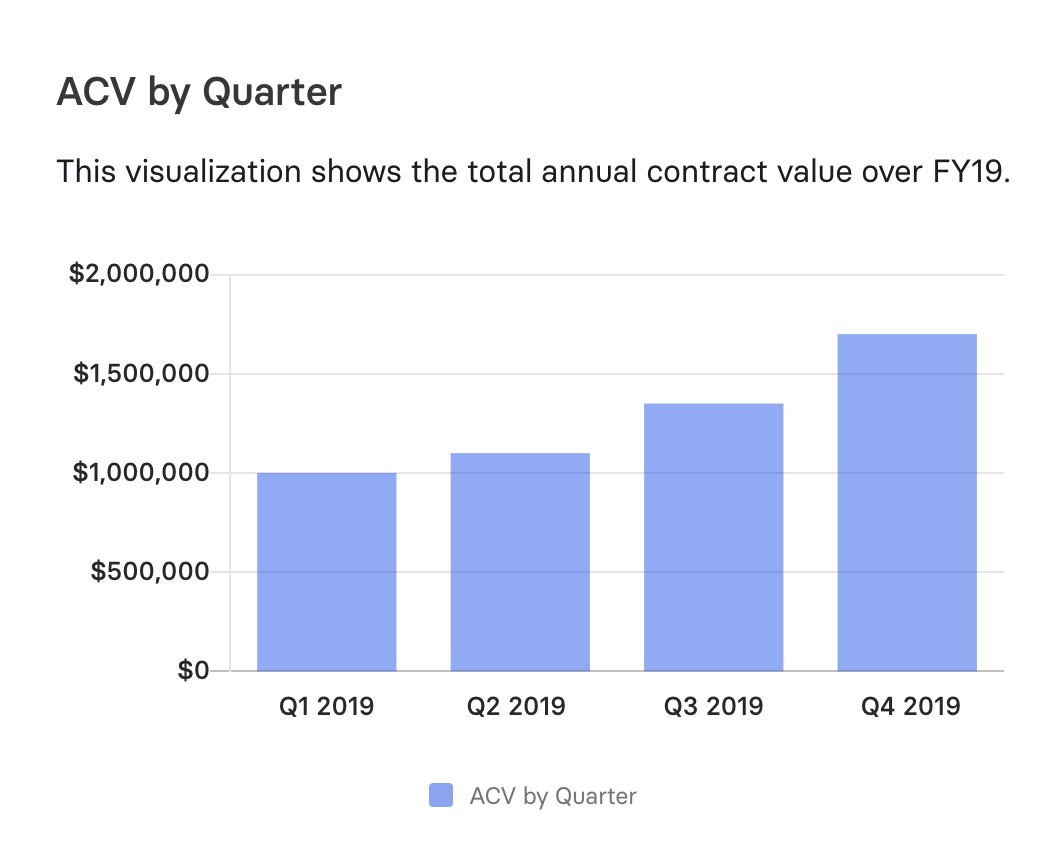

Total ACV per quarter, on the other hand, can show you how seasonal customer acquisition trends affect your income. For example, you may see an ACV dip in the fourth quarter if your sales teams offer more discounts than usual to hit year-end sales quotas.

Evaluate Upsell Opportunities

Key Bank Capital’s 2021 SaaS Metrics Report found that most SaaS companies earn 36% of their net revenue from existing clients. And as businesses grow, upselling continues to become more important as a revenue stream.

Tracking per-customer ACV insights help you identify valuable upsell opportunities. For example, if you have an engaged customer with a below-average ACV, your account management and sales teams can work with customer success to offer an upgrade.

Assess Sales Rep Performance

Top sales performers don’t need to rely on discounts to close every deal. If you have sales reps that over-use pricing as a customer acquisition tactic, this will start to eat into your profits.

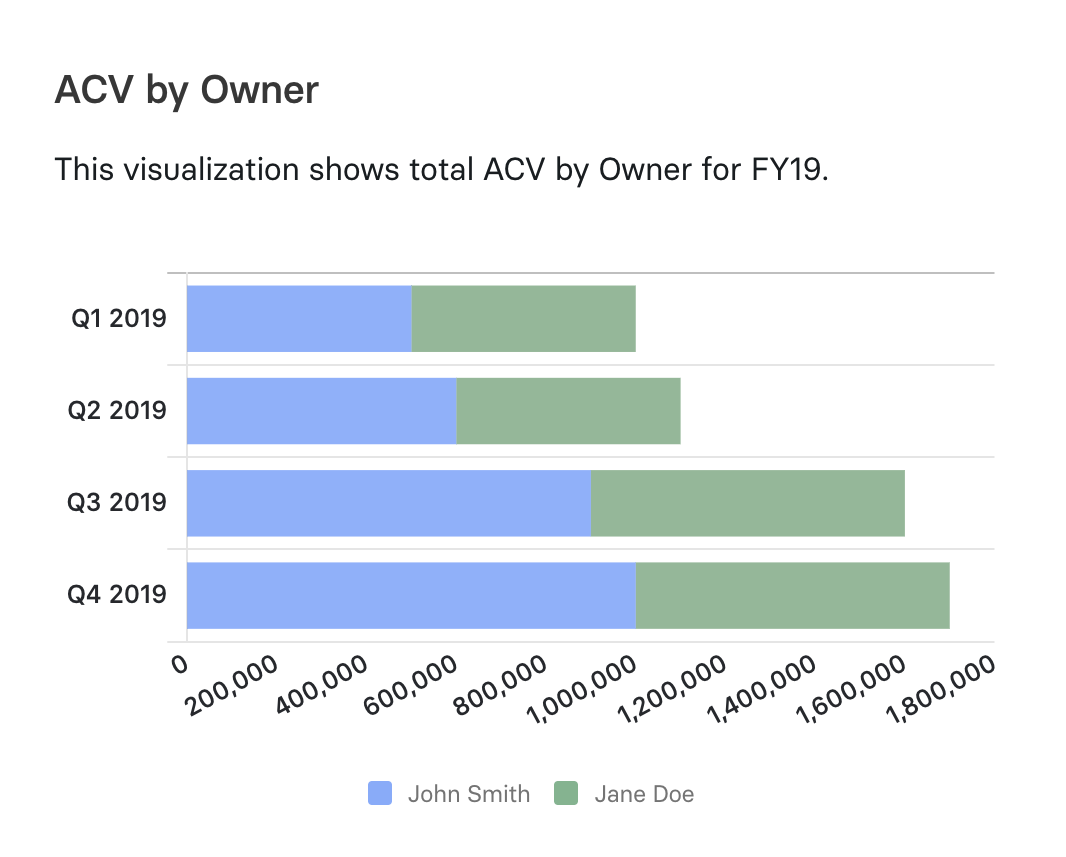

Analyzing average ACV by account owner gives you insight into how your sales reps perform compared to one another. You can also look at account manager performance and see which reps consistently identify opportunities to cross-sell and upsell to your existing customer base.

For companies with more than one product line, average ACV by owner can help you decide how you allocate reps to different-size prospects.

Allocate Sales and Marketing Resources

There’s no “right” ACV to aim for. Rather, ACV helps you understand the revenue impact of your strategic initiatives.

Over time, it can help you invest in tactics that achieve the most growth at the lowest cost.

Sales teams can look at ACV as a way to identify the accounts that deserve more attention than others. For example, you don’t want reps to spend months chasing down a low ACV prospect, but you may choose to invest more time into a higher-than-average ACV account.

Marketing can use ACV to better understand top-of-funnel goals. If you have a low ACV strategy and lower conversion rates, then you need a high volume of leads at the top of the funnel.

Enterprise marketing funnels with high ACV prospects, on the other hand, require a more targeted account-based approach that relies more on lead qualification and other sales funnel metrics instead of lead volume.

Comparing ACV to Other SaaS Metrics

The world of SaaS is filled to the brim with metrics. Here’s how ACV compares to other important metrics frequently used by CEOs and investors.

ACV vs. Annual Recurring Revenue (ARR)

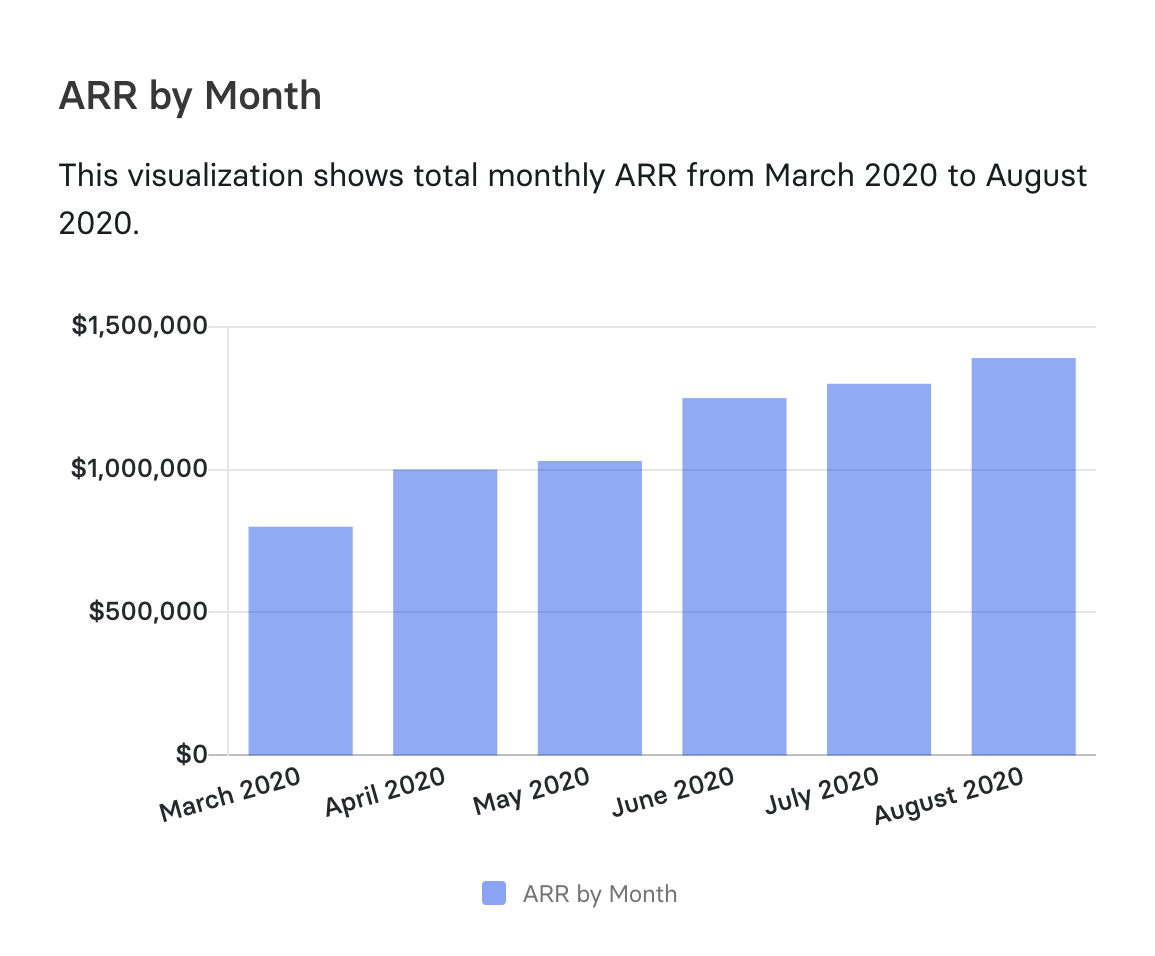

Annual recurring revenue (ARR) is a subscription metric that also measures annual revenue. It tells you how much income you generate each year from all of your subscription accounts (including new bookings, upgrades, and renewals).

ARR also accounts for customer churn, which is the total revenue lost from customers who stop using your service

SaaS companies and startups use ARR to measure growth over time and predict future revenue. Compared to ACV, ARR is the more fundamental financial metric that companies and investors use to benchmark growth.

ACV vs. Total Contract Value (TCV)

Total contract value represents the total income you receive from a fixed-term contract, and it’s used in the ACV formula. When you calculate ACV, you divide TCV by the number of years in the contract.

TCV is based on customers you’ve already won, and it’s useful for providing an accurate report of the income generated by multi-year contracts with a clear end date. With TCV, you can look at which customer segments bring in the most income and use it to help focus your customer acquisition efforts.

ACV vs. Customer Lifetime Value (LTV)

Customer lifetime value (LTV) is a SaaS metric that predicts how much profit you’ll receive from a potential customer during the time they use your service.

It’s calculated using the LTV formula:

LTV is a predicted value that considers your costs and churn rate. In contrast, TCV and ACV are accurate calculations of the income brought in by signed contracts. But TCV and ACV measure income, not profit.

Since LTV predicts future profit, investors and analysts use it to measure your company’s health and growth prospects. It’s often analyzed along with your customer acquisition cost (CAC) to determine how well you allocate resources to generate profits.

Automating Annual Contract Value: Get More from Insights Out of ACV

Financial metrics are necessary when evaluating your growth and pitching to investors, but they’re also valuable strategic tools that can help you put your limited resources to better use.

Using ACV to understand the annual value of your existing contracts can help you improve your marketing strategies, identify the best upsell opportunities, and optimize your sales strategy.

For more information on getting real-time insights that lead to impactful analysis and data-driven decisions, reach out for a personalized demo of Mosaic.

Annual Contract Value FAQs

What is the difference between ACV and ARR?

Annual contract value (ACV) is the value of a customer’s contract when averaged for every year of the contract. On the other hand, annual recurring revenue (ARR) measures the annual value from all contracts and considers things like upgrades and churn.

What is included in ACV?

Is ACV the same as SaaS bookings?

Explore Related Metrics

Own the of your business.