Renewal Rate

What Is Renewal Rate?

Renewal rate refers to the percentage of users who purchase a new software subscription after their previous term ends. In SaaS, high renewal rates could indicate strong financial health, happy customers, and a successful product.

Conversely, low renewal rates could mean the company might have to pivot its customer service strategy or expand product features to capture at-risk customers. Renewal rate is often considered the other side of churn rate, which refers to the percentage of customers who don’t renew their subscriptions at the end of their contract.

Categories

If you’re part of a finance team, you’re likely well aware of renewals’ pivotal role in maintaining a smooth and predictable cash flow.

But here’s where it gets interesting.

There’s a common perception that lumps renewal rate and logo retention together. However, there’s a subtle but significant distinction between them: Renewal rate zeroes in on “at-risk” customers — those whose subscriptions are about to end and are nearing the moment of potential churn. The figure is rooted in a contract’s end date.

In contrast, logo retention measures the company’s ability to retain customers who subscribed to the product or service at a specific period. So, it’s calculated based on the contract’s start date.

A high renewal rate is a positive indicator for a SaaS business — it not only underscores cost efficiency but can also contribute to higher business valuations. While retention rates are undeniably important, renewal rates matter just as much.

Table of Contents

How to Calculate Renewal Rate (+ Calculator Tool)

While retention casts a wide net, encompassing your whole customer base, renewal rate focuses on a particular group: those customers whose subscriptions are up for renewal. This can be helpful, particularly when you want to keep a handle on monthly operations.

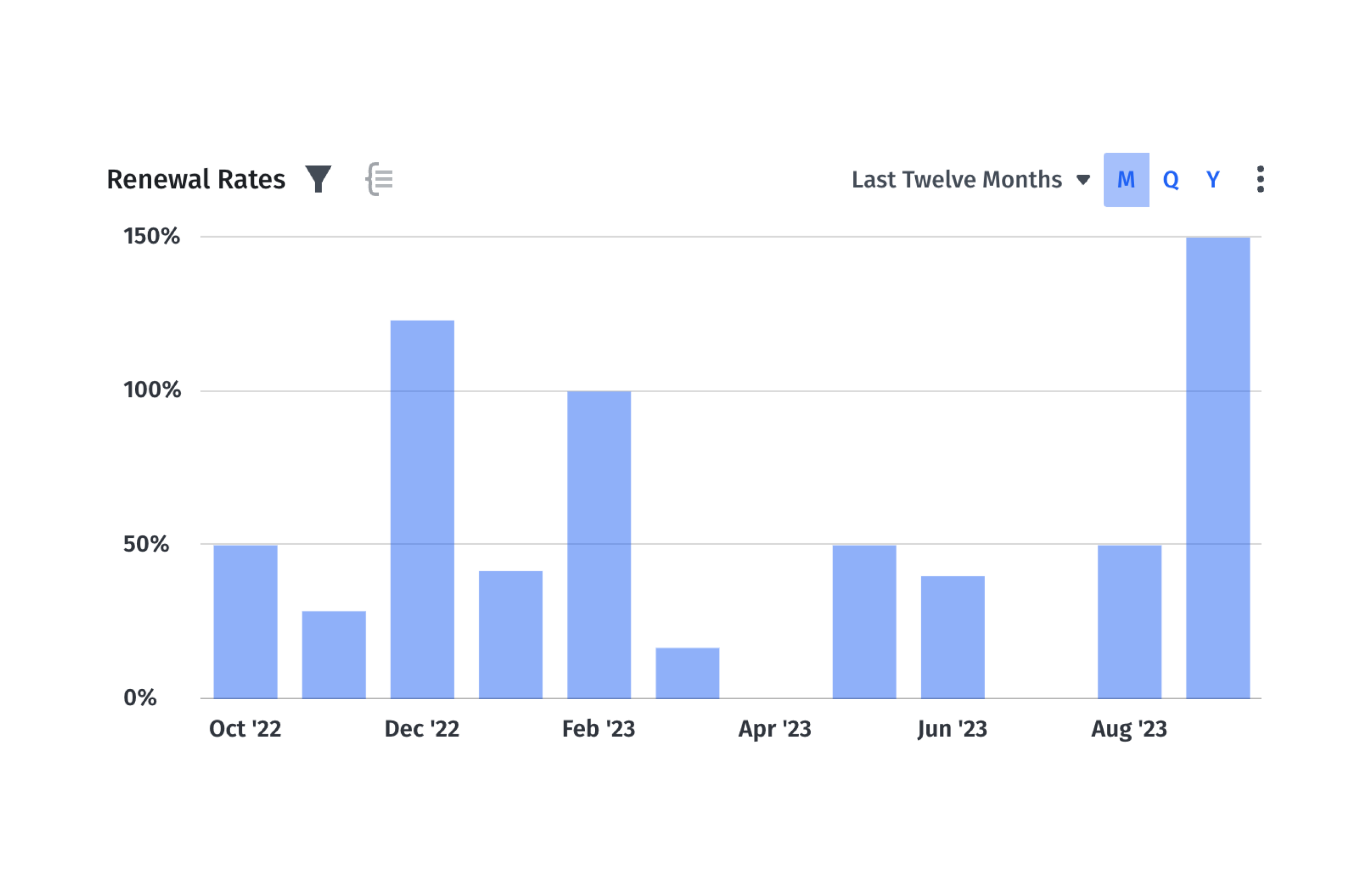

To calculate your company’s renewal rate, identify the total number of customers whose subscriptions are due for renewal within a specific period — this could be monthly, quarterly, bi-annually, or annually. From this pool, count the ones who have renewed their subscriptions.

Now, divide the number of customers who renewed their subscriptions by the total amount of customers up for renewal. Then, multiply that figure by 100.

Renewal Rate = Number of Customers Who Renewed Subscription / Number of Customers Up for Renewal * 100

The resulting value represents the percentage of customers due for renewal and decided to continue with your software.

Bear in mind that sometimes customers might renew their subscriptions early. While this secures the business’ revenue for the foreseeable future, it can skew the numbers. For instance, it could lead to an overinflated renewal rate if an account that wasn’t up for renewal is counted. Such inconsistencies can complicate the comparisons of renewal rates across different periods.

Renewal Rate Calculator

Your Renewal Rate

0%

Renewal Rate Example

For example, say you’re calculating the renewal rate for Q4 of last year. The company has 150 customers due for renewals, of which 120 have renewed their subscriptions. Here’s how you’d calculate the renewal rate:

Renewal Rate for Q4 2023 = 120 / 150 * 100 = 80%

An 80% renewal rate signifies that most customers have opted to continue using your service or product, indicating customer loyalty. On the flip side, it also presents an opportunity to re-engage the 20% of the company’s customers who have churned. Being aware of your renewal rates can inform your customer success strategies and shape the development of new product features.

Additional Metrics to Consider Along With Renewal Rate

Like any metric, on its own, renewal rate only tells you part of the picture. To truly grasp your company’s operations and financial health, you need to assess renewal rate in tandem with other metrics.

Gross Revenue Retention

Gross revenue retention (GRR) measures the percentage of recurring revenue maintained from one period to the next. It is a benchmark for a business’s ability to sustain its foundational revenue streams, excluding additional revenues sourced from upsells or cross-sells.

GRR highlights pure customer retention for subscription-based businesses without distorting the number with additional revenue streams.

Net Revenue Retention

Net Revenue Retention (NRR), or Net Dollar Retention (NDR), analyzes the revenue fluctuation from a specific group of customers over distinct periods. It factors in both the revenue loss from customer attrition or downgrades and boosts in revenue, whether from annual or monthly recurring revenue, within a specific period.

Customer Lifetime Value

Customer lifetime value (LTV or CLV) represents the average revenue anticipated from customers throughout their relationship with your company. It offers insights into whether your product is aligned with customer needs, what you’re doing right, and spotting areas for improvement.

LTV is crucial in assessing the long-term path of your business model and calculating the effectiveness of customer acquisition and retention strategies.

Customer Acquisition Cost

Customer acquisition cost (CAC) refers to the average money a company spends to acquire a new customer. It helps you understand the effectiveness of your sales and marketing strategies. Along with other metrics, CAC can help you assess your business model’s viability and support future funding rounds.

LTV:CAC Ratio

LTV/CAC ratio evaluates the connection between your LTV and CAC of individual or group customers in a given time period. This metric highlights your return on investment (ROI) based on how much it costs the business to acquire the customer and what they have paid you through their time with your company at the time of calculation.

While revenue rate certainly offers a snapshot of current financial inflow, each of these metrics addresses specific aspects of a SaaS business’s financial and operational health. As mentioned, consider various customer success metrics simultaneously to get a holistic view of the business’s performance, sustainability, and growth potential.

Challenges and Solutions Surrounding Renewal Rates

Unfortunately, revenue rates aren’t foolproof. As we highlighted above, it’s possible to distort the numbers when customers renew early.

Moreover, “Sales teams may pull forward renewals just to beat their quotas in the current period — it’s like borrowing from tomorrow to pay for today. This can be a slippery slope if you get aggressive and over-mine your renewal base. This problem is further exacerbated if sales teams are not only pulling forward renewals, but also overly discounting them to hit their number,” says CJ Gustafson, Chief Financial Officer at PartsTech.

So, how can you overcome these hurdles? It begins with diligent tracking of renewal rates — without deep insight into the numbers, it’s impossible to make improvements.

Additionally, finance teams should proactively engage with customer success and account management teams. This collaboration can help you understand what goes into the renewal process, how long it typically takes, and if there are frameworks in place for price increases, among other factors.

You can dive deeper into this topic by listening to Steve Groccia, Mosaic Head of Customer Success and former finance leader, discuss retention and cohort analysis on an episode of The Role Forward.

Influence of Multi-Year Contracts on Renewal Rates

Your SaaS pricing model and the type of contract your company offers can influence renewal rates. For instance, the renewal rate is particularly relevant for SaaS businesses that offer customers an annual subscription or multi-year contracts because the contract has a specified end date.

In contrast, for businesses that offer monthly recurring billing, where customers can cancel anytime, the renewal rate essentially mirrors the retention rate. Which means the subscription start date is considered the end date.

During periods of economic downturn, SaaS startups may encourage customers to sign up for multi-year contracts proactively — the intention is to mitigate the impact of the market dip. However, these multi-year contracts aren’t just about securing immediate revenue. They can also be a long-term play to build deeper customer relationships, ensure product integration, and set the stage for higher renewal rates in the future.

Benchmarking Success: What Are Good Renewal Rates?

The highest performing SaaS companies will typically see renewal rates of 80% to 90%, with numbers trending slightly lower in SMB segments and higher for enterprise accounts. While that’s a good rule of thumb, context matters.

Renewal rates are influenced by various factors, such as product quality, pricing, customer service, economic conditions, and contract terms, to name a few. So, it’s essential to consider all factors when gleaning insights based on your company’s renewal rate. For example, in a market downturn when budgets are tight, it’s not surprising to see low renewal rates.

You can check out the latest SaaS metric benchmarks — including metrics like logo retention and net dollar retention — in our updated research report.

Access Our 2023 SaaS Benchmarks Report

Strategic Advantage of Proactively Analyzing Customer Retention

For SaaS companies, retention is of utmost importance — it influences investors’ valuation of the company and shapes the future of the business. Although renewal rates are the other side of that coin, they can offer better insights in the context of other metrics.

But, grasping retention metrics is intricate, and it goes beyond finance teams merely monitoring these numbers or presenting them to the board.

The actual value of a retention analysis lies in deeply analyzing customer retention, spotting business challenges ahead of time, and steering toward solutions. Request a demo if you’re curious to learn how Mosaic helps finance teams do all that and more.

Customer Renewal Rate FAQs

How does churn rate affect the renewal rate in a SaaS business?

In SaaS, churn rate and renewal rate have an inverse relationship. While churn rate refers to the customers who cancel their subscription over a specific period, renewal rate measures the percentage of customers who extend their subscription at the end of their contracts.

So, a higher churn rate indicates more customers leaving, which results in low renewal rates. Conversely, a low customer churn rate could lead to a high renewal rate, as customers stick with the product.

How do multi-year contracts impact the calculation of renewal rates?

How does renewal rate correlate with customer satisfaction?

Can using platforms like Mosaic improve the accuracy and utility of tracking renewal rates?

Explore Related Metrics

Own the of your business.