Average Contract Length Guide for SaaS

What Is Average Contract Length?

Average contract length (ACL) is the average amount of time your signed customer contracts last. It is a common calculation in the SaaS industry.

Typically, this metric is the mean length (in months) of all signed contracts and is based on the opportunity-close date for all won customers. ACL is an important SaaS metric to monitor, as it closely relates to customer churn rate and retention.

Categories

Table of Contents

How To Calculate Average Contract Length

Before you get started, gauge your current average contract length to establish a baseline. Then, once you’ve done the math, you can take measures to improve this metric with some targeted customer retention strategies.

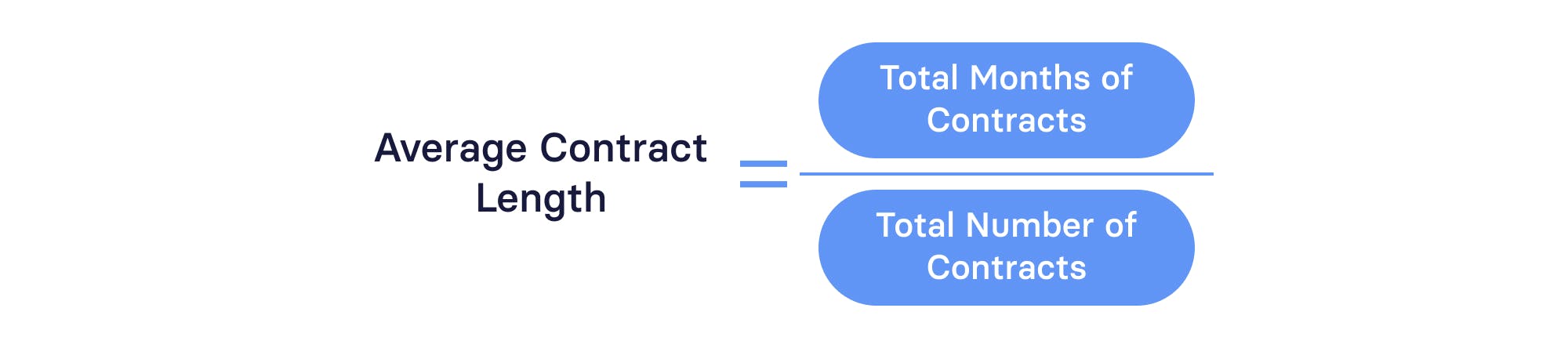

To get your ACL, add up the contract duration of all the committed customers you have at the moment. Then divide that sum by the total number of contracts.

If your company offers monthly subscriptions or plans, those count as a single month for contract length.

So, the formula looks like this:

Now, let’s dig into an example to illustrate how this formula works. Let’s say your company currently has 12 annual contracts, 12 monthly contracts, and five two-year contracts. Your calculation would look like this:

Total Number of Months: 12X12 Annual Contracts + 12 Monthly Plans + 5X24-Month Contracts = 276 Total Months

Total Number of Contracts: 12 + 12 + 5 = 29

Average Contract Length: 276 / 29 = 9.517 Months

Average Contract Length Calculator

Your Average Contract Length

0 months

Tips To Leverage Average Contract Length

Calculating your average contract length is useful for more than just using it as a benchmark for improving churn. Companies can leverage ACL in a variety of ways to help with scenario planning, boosting sales, and more.

Incentivize Sales To Increase Contract Lengths

Studies have shown there’s a strong correlation between average contract length and customer churn rate. When customers sign up for longer contracts, they’re more likely to stick around longer (and vice versa). So, it’s understandable why you’d want to take measures to increase the average length of your contracts.

One strategy is to incentivize customers to sign on for longer during the sales process — and this can take multiple forms for varying periods of time. For example, you can bake a discount into your pricing plan for long-term contracts.

Let’s say you typically sell annual contracts for an annual contract value (ACV) of $15k. In a push to increase contract lengths, you could empower the sales team to offer two-year contracts at $22k or $25k. The customer saves upwards of 30% of your ACV and you lock that customer in for a longer term.

In a situation where you typically sell month-to-month contracts, you could choose to offer one-time discounts, recurring discounts, or lifetime discounts to incentivize quarterly or annual commitments.

Create Assumptions For Scenario Planning

When you have your average contract length metric on hand, you can leverage it in forecasts and scenario planning.

For example, when you know your company’s ACL plus the average number of new customers who sign up per month, you can project how much revenue will roll in over your typical ACL period (i.e., the next six months).

You can also use ACL in your scenario planning process since it influences your growth. For example, play out a scenario where you incentivize new customers to sign longer contracts. You set a goal of increasing your ACL from eight months to a year, which lowers monthly churn and increases customer lifetime value (LTV).

How much would a four-month spike in ACL impact your revenue goals? And how would better customer retention help grow your organization as a whole?

View Metric by Product Line or Customer Segment

Companies can also slice and dice ACL data to hone in on trends across different products and/or groups of customers.

Let’s say you take a look at your data by product line. You might discover that one product has a far higher ACL than all your others, so you dig deeper. Why does this specific product resonate more with customers? With this trend data in hand, you can use it to inform future R&D conversations and weigh in on product launches.

The same applies to customer segments. If customers from one region or demographic boast a higher ACL, it warrants further investigation. What makes these specific customers stick around longer than anyone else? Is it because those are your best-fit customers? If so, this data might mean it’s time to update your buyer personas accordingly.

How Mosaic Can Help You Calculate Average Contract Length

It’s clear how crucial average contract length is for a SaaS business — and that’s why it’s one of the metrics Mosaic automatically tracks to propel your business forward.

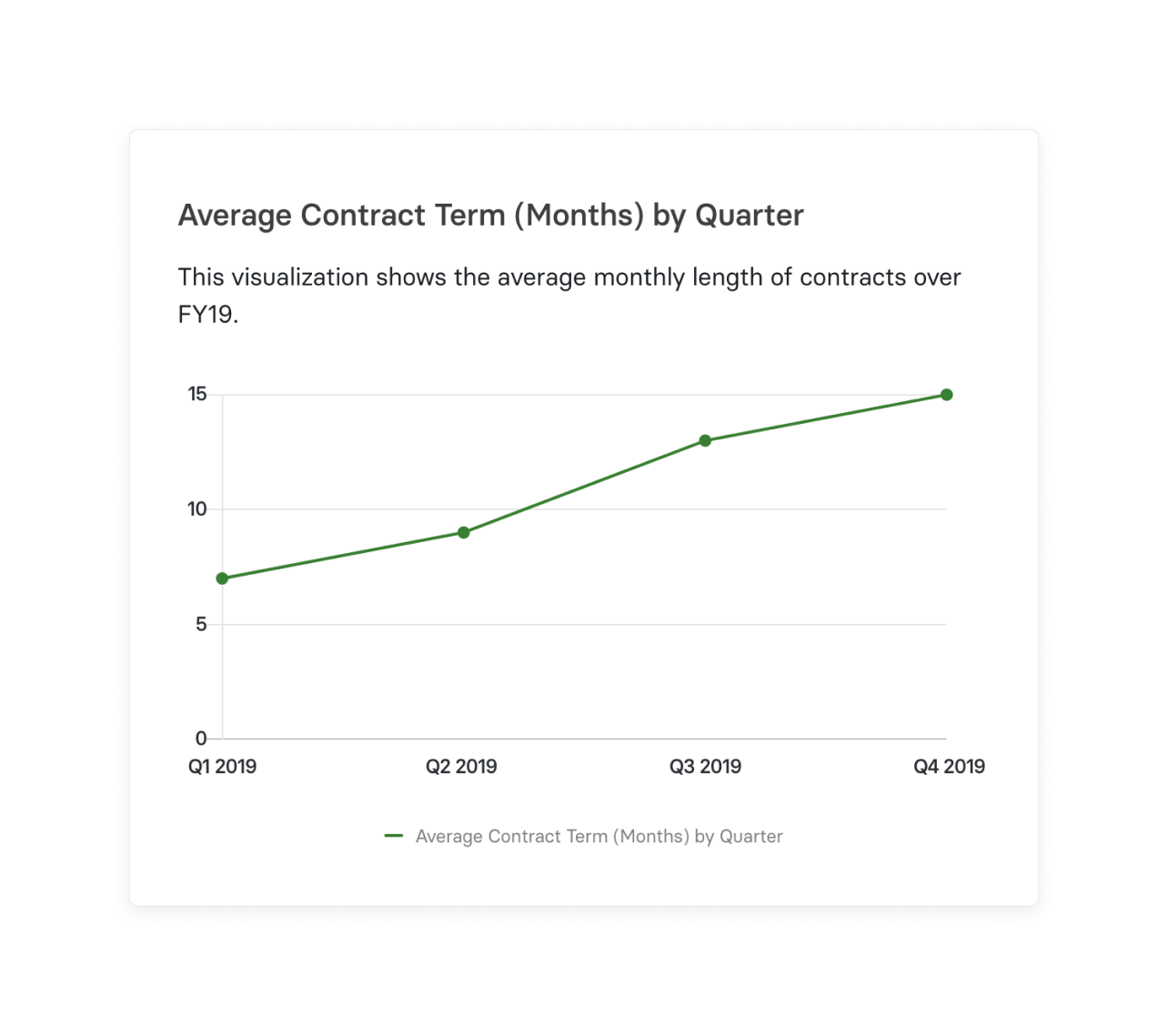

The Mosaic platform monitors ACL, called “Average Contract Term of Bookings,” for all new customer contracts within a given period of time. The best part? It starts tracking this metric right out of the box.

Mosaic makes it easy to understand ACL and other key drivers for your company’s growth. Because Mosaic closely follows ACL (along with other essential SaaS metrics like average contract value and ARR), you can rest assured you’re using the most up-to-date data in revenue forecasts and growth projections.

Important metrics are right at your fingertips — no need to dig through clunky reports to find the right info. On-demand metrics allow you to quickly pull up your organization’s ACL, set goals, and strategize on how to increase customer retention.

With all your important data in one place, it’s also easier to connect every piece of the puzzle for a holistic view of your finances. And with Mosaic’s powerful forecasting features, you can use all these puzzle pieces to predict incoming revenue from sales and marketing.

This level of robust insights means you can make better decisions for your organization — both now and in the future. Request a demo to see what additional insights Mosaic can unlock for your team.

Get Real-Time Insight Into ACL and Other Critical SaaS Metrics

Average Contract Length FAQs

What’s the difference between ACL and ACV?

Average contract length (ACL) is a time value that represents how long customers typically have a commitment with a particular company. The calculation for ACL is:

Average Contract Length = Total Number of Months of Contracts / Number of Contracts

On the other hand, Average Contract Value (ACV) is a metric that represents a dollar amount over a specified period (usually over a year). ACV breaks down the total value of a customer’s contract into an annual average value.

The formula for average ACV is:

Annual Contract Value = Total Contract Value / Total Years in Contract

For example, a $12 million, 12-year contract has an ACV of $1 million per year.

How can Mosaic help me analyze my business's average contract length?

What is the average length of a SaaS contract?

Explore Related Metrics

Own the of your business.