Annual Recurring Revenue (ARR)

What Is ARR?

ARR is your annual recurring revenue, which is the sum of all revenue derived from customer contracts over the course of the next 12 months. This includes customer contracts that last one year or longer as well as annualized versions of monthly, quarterly, or semi-annual contracts.

SaaS companies focus on ARR as their high-level means for understanding the company’s growth, identifying when to invest money back into the company, and tracking product/market fit. And investors use ARR as a benchmark for betting on a company’s future because it provides a high-level view of revenue predictability.

Categories

Recurring revenue streams are the key to generating predictability around your company’s growth. Recurring revenue means your company is building momentum and has a secure sense of product/market fit, as seen through attracting customers through organic growth measures, securing bookings, and signing renewals with existing customers.

But recurring revenue means so much more than that: When it comes to SaaS valuation, investors benchmark companies around recurring revenue growth.

Here’s why your annual recurring revenue (ARR) is a critical SaaS business metric to track and how you can get the most out of it across the business.

Table of Contents

How to Calculate ARR

To calculate ARR, divide each customer’s total contract value (for recurring revenue) by the number of years in their full contract. This gives you the annual contract value. Then, sum the results to get your total revenue (in terms of ARR). The formula is:

Total Revenue of Yearly Subscriptions + Total Expansion Revenue – Total Contraction Revenue.

For multi-year contracts, you should divide the revenue they generate by the number of years in the contract to get the average revenue per year.

The ARR formula is similar to the monthly recurring revenue (MRR) formula, except that ARR looks at yearly values instead of monthly.

While the general formula for ARR seems simple, this is one of the most complicated metrics in a SaaS business. Parsing out the nuances of your ARR logic requires a deep understanding of contract terms, pricing structure, and what should/shouldn’t roll into the calculation.

What You Need to Consider When Calculating ARR

The focus of ARR is on yearly subscriptions, but you should break it out into its various components, including:

- ARR added from new customers

- ARR added from renewals

- ARR added from upgrades and add-ons

- ARR lost from downgrades

- ARR lost from churn

This produces the following ARR formula, which offers deeper insight into how customer segments factor into your recurring revenue stream:

You want to ensure that when calculating ARR, you don’t include any trials (which don’t guarantee renewal or booking), one-time fees (such as a software setup fee), one-off upgrades, or installation payments (such as customers who are on a monthly billing cycle). For any installation-paying customers, include them as part of your MRR.

In many cases, ARR and annualized MRR will be equal. But depending on your business model, there are situations where ARR is smaller than annualized MRR due to fluctuations in monthly churn for shorter average contract length.

Why Is ARR Important?

Your ARR is a key metric that signals revenue predictability for the long haul — your long-term macro-view of your business and business model over time. ARR provides an understanding of truly recurring revenue versus a spike (which can happen with MRR). If these spikes aren’t repeatable, you can’t achieve consistent financial growth year over year.

ARR is still, however, a point-in-time metric in that it provides a snapshot for a specific year. You want to ensure that your ARR tells a story through its historical data and your careful eye to discover the “why” behind the numbers. You can use ARR to:

- Explain your company’s health. As a long-term metric, ARR highlights the high-level financial efficiency of your organization and shows investors the strength of your top-line growth.

- Attract investors. ARR is seen as the standard metric that investors want to know about. Recurring revenue streams intrinsically attract investors since they recur. A subscription business with annual term contracts offers a sense of predictability due to the sales model (a guaranteed source of cash flow throughout the year unless there’s an opt-out or cancellation clause within the contract). Of course, to maintain investor interest, the company needs to continue showing signs of profitability and debt reconciliation.

- Retain talent. As your ARR grows, your runway extends and offers opportunities to invest back into the business. Investments include headcount planning to grow the company and compensation changes for tenured employees.

- Assess customer satisfaction. Changes in ARR indicate customer satisfaction over time. Renewals and recurring upgrades and add-ons are signs that customers continue to see product/market fit and value, whereas churn and downgrades show signs of doubt.

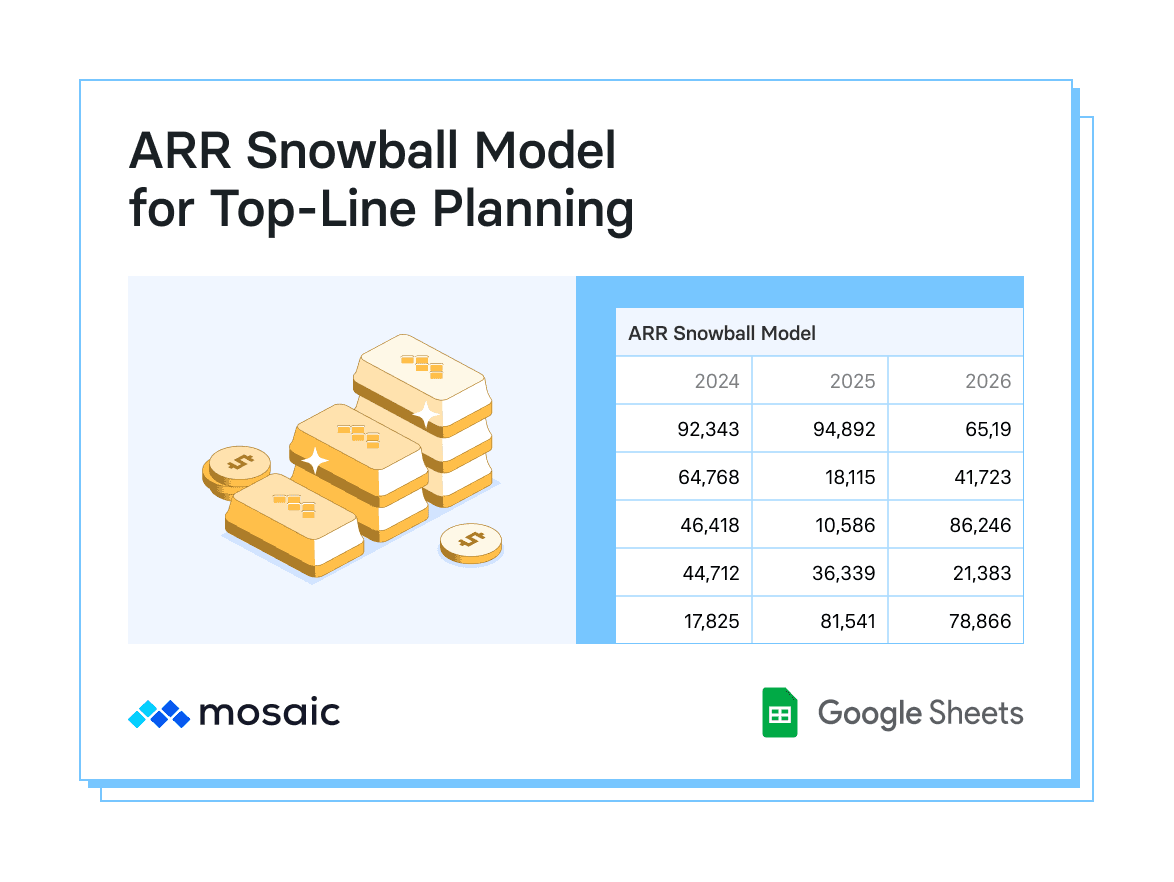

- Forecast revenue. Revenue forecasting focuses on the path toward achieving growth targets and revenue projection and plays an important part when it comes to funding rounds. You can use an ARR snowball for your SaaS revenue forecasting, which blends bottom-up and top-down approaches using the various ARR and MRR types to provide a strategic approach to managing future growth.

ARR vs. Other Metrics

The simplest difference between ARR and MRR is within their names: ARR focuses on an “annual” scope of recurring revenue, while MRR looks at your “monthly” recurring revenue. And while both key metrics provide insight into revenue predictability, the differences go much further than their names and customer-filing implications.

ARR provides the macro-level, overarching view of revenue. That’s why investors use ARR as the standard metric to understand your company’s growth goals and how revenue both sustains your business (through debt reconciliation and extending your runway) and how the company invests back into it (through headcount and optimizing workflows and processes).

Your MRR digs into the micro-level, short-term view of revenue per month and quarter. Your MRR looks at operational efficiency on a deeper level since the marketing and sales teams can consider how campaigns and customer experience impact MRR and where there are opportunities to grow or improve the overall customer journey.

MRR and ARR enter into another conversation when it comes to generally accepted accounting principles (GAAP) revenue. While MRR and ARR focus on subscription metrics and analytics, your GAAP revenue dives into your accounting and income statement/profits and losses (P&L) performance. Your GAAP revenue includes actual SaaS revenue recognition, which differentiates itself from ARR that factors in committed revenue (revenue that a customer has signed a contract to pay but has not yet paid).

Although ARR and MRR aren’t GAAP metrics, your ARR should act as a rough estimate of future GAAP revenue.

The Limitations of ARR as a Financial Metric

ARR is arguably the most important financial metric for SaaS companies — but that doesn’t mean you can look at it in a vacuum.

Like all SaaS finance metrics, ARR is only as insightful as the context you have around it. Here are a few limitations of ARR on its own.

- It doesn’t account for efficiency. Focusing solely on ARR as a standard of financial health leads to a “growth-at-all-costs” mindset. Add context to the top-line metric with operational efficiency metrics to understand the true health of your organization.

- It doesn’t highlight retention. While ARR includes revenue from renewals and upsells, it doesn’t provide clear insight into retention on its own. Layer in net revenue retention and churn data to get a clearer view of the momentum your company is building.

- It isn’t a reportable metric. As mentioned above, there’s no guidance in GAAP standards for ARR. While private SaaS companies can focus on ARR for investors, more mature organizations will have to get in the cadence of much stricter GAAP reporting.

- It doesn’t account for revenue recognition. Even if you have a clear view of ARR, your revenue growth is incomplete without accurate revenue recognition. For example, according to GAAP you’re required to recognize accrued (unbilled) revenue when it’s earned, even if you haven’t been paid yet. Deep insight into the efficiency of your billing and collections processes is therefore critical.

4 Ways You Can Improve Your ARR

Improving ARR means looking deeply into retention and operational efficiency strategies. By collaborating with the sales, marketing, and customer success team, you gain a sense of the “why” behind the numbers.

Conducting a customer cohort analysis for these long-term customers gets into the “why” and illuminates patterns in customer satisfaction (both in regards to renewals and churn) that spur the following improvements into actionable insight.

1. Reduce Churn

Churn with ARR hits a bit differently, as customers commit to the product for more than 12 months. While finance can’t reduce churn itself, it can lead the way toward understanding “why” churn occurs by collaborating with the sales and customer success teams.

If product functionality is the reason for churn, customer success can align with the product team to work through prioritizing particular updates and improvements. Sales can address product/market fit by focusing on what customers need and want at the time of signing, and ensuring that they continue to match customers to the right services at the right time.

2. Market Toward Ideal Customer Profiles (ICPs)

As sales evaluates ICPs for product/market fit, the marketing team also needs to evaluate the type of customers they attract to build the pipeline. Churn ARR provides insight into what channels bring in unsuccessful customers, while expansion ARR showcases opportunities to attract similar customers.

3. Differentiate Revenue Streams

If your company offers different platforms, tiers of functionalities, and additional products, it’s easier for sales to offer upgrades and add-ons for interested customers. Of course, these upgrades and add-ons can’t be on a monthly basis — for them to factor in ARR, the customer must commit to them for the duration of the annual contract.

4. Update Your Business Model and Pricing Strategy

Subscription models lock in a particular price — but does the price align with your value proposition and what competitors offer? Updating your SaaS pricing strategy allows you to realign your pricing with your competitors or create opportunities for customers to see your intrinsic value.

Fivetran changed from a subscription model to a usage-based pricing model with multiple tiers for faster sync times. Pricing via “rows” emphasizes that Fivetran values what customers will use over their lifetime.

An increase in pricing results in a lower CAC payback period, which leads to quicker profitability.

See Your ARR In Seconds With Mosaic

Your customer relationship management system (CRM) can house your customer data, but it won’t automatically categorize your revenue streams as recurring or non-recurring, and it certainly won’t help you track the changes in your ARR and MRR or help you understand the how and why behind those changes.

Your enterprise resource planning (ERP) system stores your generally accepted accounting principles (GAAP) revenue calculation. But since ARR is a non-GAAP term, it’s not easy to track in an ERP.

The point is: There’s no canonical system to track your ARR. These metrics are most likely tucked away in a spreadsheet that’s tracked by one or two people at your company, and they’re almost always stale, rearview-mirror calculations that offer little in the way of workable insight.

Mosaic is a Strategic Finance Platform that integrates with your source systems to automatically calculate your ARR based on contract dates. Mosaic also compares your GAAP revenue against your ARR to quickly understand the difference between them. And it tracks changes in your ARR to show how it grows and contracts in real-time.

Mosaic offers SaaS dashboards and preloaded, customizable templates that you can generate in a few minutes to view your ARR and dig deeper into the data. ARR can be broken into a monthly view to show growth over time, by product line to dig into product/market fit, and by customer to consider their satisfaction.

You can then transform your insights into dynamic reporting that allows you to collaborate across the company to help ensure the company achieves its growth goals. If you’re ready to craft the company’s growth narrative with stunning, easy-to-digest visualizations and deeper insights into the “why” behind the numbers, request a personalized demo of Mosaic today.

How Strategic Finance Software Can Help CFOs and Finance Teams

Annual Recurring Revenue FAQs

What is the difference between total revenue and ARR?

The total dollar amount coming into a business is revenue, while a company’s ARR is the amount of revenue generated by annual subscriptions. While revenue is a GAAP accounting metric, ARR has to be modeled out according to a revenue recognition schedule to meet GAAP requirements. ARR is an important metric to evaluate the health of your business based on the predictable revenue of long-term subscriptions.

What is the difference between ARR and MRR?

What is the difference between ARR and annual profit?

What is a good ARR growth rate?

Explore Related Metrics

Own the of your business.