Monthly Recurring Revenue (MRR)

What Is MRR?

MRR is your monthly recurring revenue — the sum of all monthly revenue you earn from your customers, regardless of their contract length.

This revenue metric is critical for tracking product-market fit, understanding your momentum as a business, and identifying the right times to invest money back into the company.

Categories

Experimentation is inherent in running a startup. Some experiments will yield favorable results, and some will disappoint (hopefully you’re tracking the results). On the road ahead, you’ll experience twists, turns, stops, starts, and, of course, the infamous “pivot.” Will your newly hired CTO inspire her team and drive innovation? What kind of ROI will your latest acquisition campaign yield? Will your new product launch generate a surge of demand or hit the market with a barely audible thud?

With so many variables in play, you might find yourself wishing for some sort of GPS for business success. Alas, that doesn’t exist — but while you wait for some other enterprising startup to invent one, you can generate predictability around your monthly recurring revenue stream. In fact, this is one of the most important metrics your business can track.

Table of Contents

What Are the Different Types of MRR?

In order to understand your MRR on a deeper level and gain valuable insights, you need to sort it into the five types of MRR. They are:

- New business MRR. This is new revenue from new customers. You can track this type of MRR by dollars and logos to gain insight into your customer base and how they value your product.

- Expansion MRR. When existing customers commit to an upsell or additional products, the additional revenue falls under expansion MRR. Keep in mind it needs to be a recurring billing and not a one-time purchase.

- Reactivation MRR. This type of MRR is from previous customers who return to your product or service.

- Contraction MRR. The opposite of expansion MRR, contraction MRR sorts any lost MRR from existing customers who downgrade the service or product, such as dropping modules or eliminating seats on your platform.

- Churned MRR. Cancellations and the resulting lost MRR fall under churned MRR. Track this type of MRR through dollars and logos for deeper insight into potential reasons for churn.

Why Should Your Business Track MRR?

Knowing your MRR provides short-term visibility into total revenue and is key to understanding the momentum across your entire customer base. However, it doesn’t provide great long-term visibility into how much of your revenue will reoccur — one-time revenue spikes are exciting, but if they aren’t repeatable, they won’t help you achieve consistent growth year over year.

The bigger story here is that tracking MRR provides essential insight into your product-market fit, your short-term momentum, and the trajectory of your recurring revenue, helping you to know how and when to invest in the business. Investors hold special interest in recurring revenue streams, as it’s a sign of profitability and how the company reconciles debt. Differentiating between types of MRR and sharing your insights across the company before a board meeting provides deeper insights into revenue forecasts and cash flow.

It’s worth noting that MRR is a point-in-time metric — when it comes to documenting your revenue story, it’s a snapshot, not a feature-length film. It’s also helpful to understand how and why MRR changes over time, be it due to new business, customer churn, or updates to your pricing structure.

Connect Mosaic with Your CRM to Automatically Track MRR

The Challenges of MRR

Understanding the nuances of revenue vs profit can significantly impact your financial strategies. While your MRR calculations are susceptible to plenty of potential errors — and if these errors persist, your revenue forecasts are off, which can cause issues with determining runway and optimal headcount planning and other growth opportunities. Here are the MRR challenges you may face:

- Overburdened MRR. The key word with MRR is recurring. You can’t include single-use purchases (like trials, which don’t guarantee renewal or signing on) or any fees (such as late payment fees, one-off upgrades, or installations for products or software). An overburdened MRR leads to overstating company growth and financial efficiency to not just executive leaders, but investors.

- Miscalculations with discounts, downgrades, and upsells. Information around discounts, downgrades, and upsells (such as billing cycle start and end dates) may exist in separate systems or rely on manual updates to ensure proper billing. It’s easy to attribute the full price of a product or service, which then overstates revenue earned over the month.

- Misalignment with billing cycle. Subscriptions offer plenty of room for flexible payment, whether they’re on a monthly, semi-annual, or annual payment schedule. If customers pay on a quarterly, annual, or semi-annual scale, you must ensure that the payment is spread out to a monthly rate to ensure an accurate MRR.

- Running out of resources. Your cash inflows and outflows indicate how quickly you can invest back into your business — and without cash, you run out of runway and resources to grow. Keeping MRR in conversation with your customer acquisition costs (CAC) and CAC payback period helps you understand when customers become contributors to company and revenue growth.

- Undervaluing customers. Your customer lifetime value (LTV) measures the revenue customers generate for the company over their lifetime. Customer success managers must ensure the quality of service remains efficient, from onboarding to retention. If any dips in attention or quality occur for MRR-generating customers, they will churn.

How to Calculate MRR

To calculate MRR, divide each customer’s total contract value (from recurring revenue) by the number of months in their full contract. Sum the results to get your total MRR.

Considering the different types of MRR, you can segment MRR into their individual types and calculate each one. But MRR becomes even more powerful through a few other MRR formulas and calculations that can forecast and push insights even deeper.

One such calculation that gets you an annual view of your recurring revenue is to calculate your annualized MRR. If your business primarily sells monthly recurring subscriptions, annualized MRR is a great indicator to measure customer momentum. To get your annualized MRR, simply multiply your MRR by 12 months.

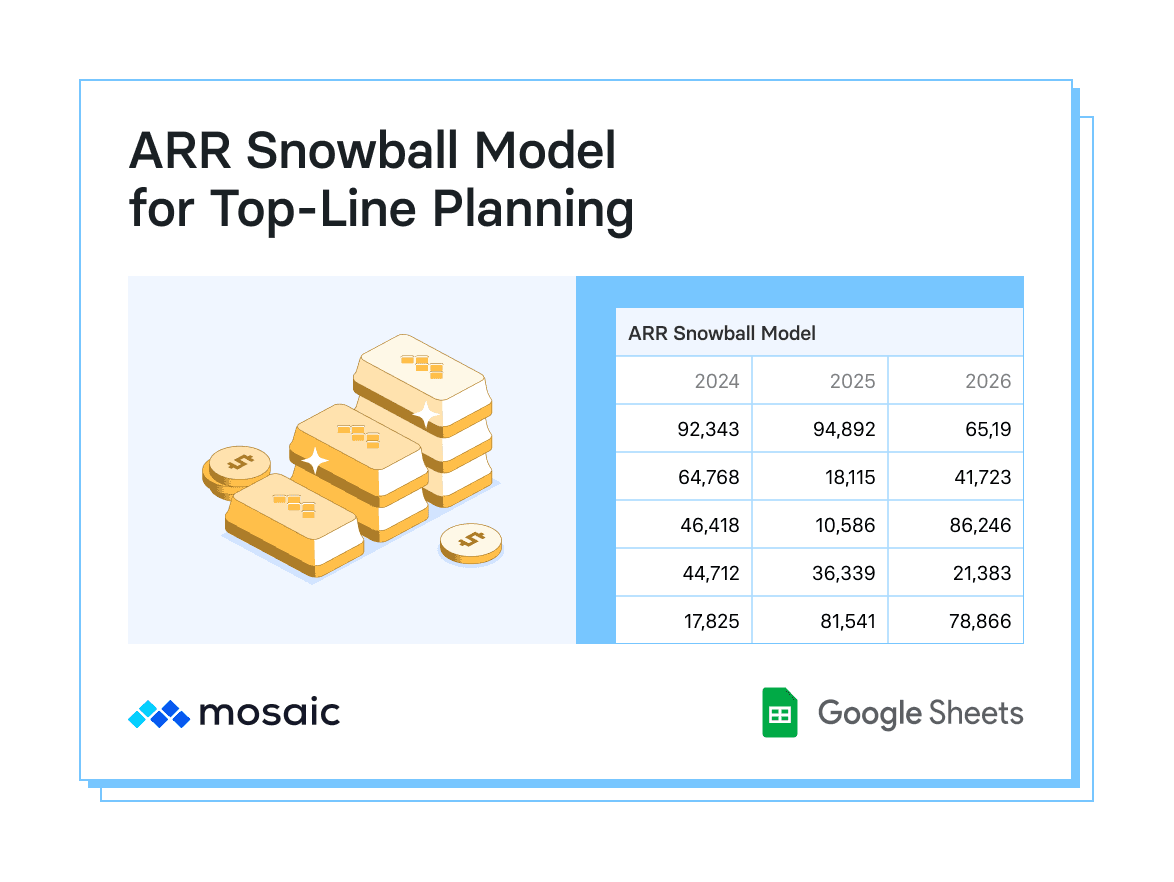

Your annualized MRR is also your annual recurring revenue (ARR).

Additionally, you can multiply your number of monthly subscribers by your average revenue per user (ARPU) to calculate your MRR.

MRR vs. ARR: What’s the Difference?

On the surface, the difference between your MRR and ARR is straightforward: MRR is your monthly recurring revenue, while your ARR is an annual scope of your recurring revenue (for any customers past 12 months of service). Both provide a sense of predictable revenue. But the differences stem much farther than that.

While MRR provides a short-term view of your revenue, it reveals the deeper, micro-level insight of revenue per month and quarter. These insights are especially important for the marketing team and sales team, who can strategize around immediate impacts and consider any effects on MRR, whether that’s adjusting campaigns, quickening the average sales cycle, or improving the onboarding experience.

Depending on contract structure, however, there’s a particular risk with the monthly subscription model versus annual. Annual contracts guarantee money throughout the year unless there are opt-out or cancellation clauses included in the contract, whereas monthly subscriptions most likely have opt-out/cancellation clauses before the next billing cycle.

Your ARR gives a long-term, macro-view of the business. ARR is a great indicator for overarching goals and serves as a better metric to help signal revenue predictability for the long game. ARR is also the more popular metric to show investors to gauge a company’s financial health, as it allows the numbers to speak toward the growth goals investors are eager to learn about.

Metrics Related to MRR

MRR is a powerful building block for other SaaS business metrics that provide insight into effective planning.

SaaS Quick Ratio

For early-stage SaaS companies, the SaaS quick ratio measures your MRR growth (your new and expansion MRR) against your MRR losses (any churned and contraction MRR).

If your business model operates under monthly subscriptions/contracts or you want to focus on short-term performance, the SaaS quick ratio provides a quick comparison of top-line vs. bottom-line growth and stability.

Net New MRR

Your net new MRR takes your new and expansion MRRs and subtracts any churn and contraction MRR.

New MRR + Expansion MRR – Churn MRR – Contraction MRR

Not only is this formula insightful in regards to churn and customer upgrade velocity, but it can help forecast the company’s financial health. Would revenue continue to drop in six months or would it remain constant due to new and expansion MRR?

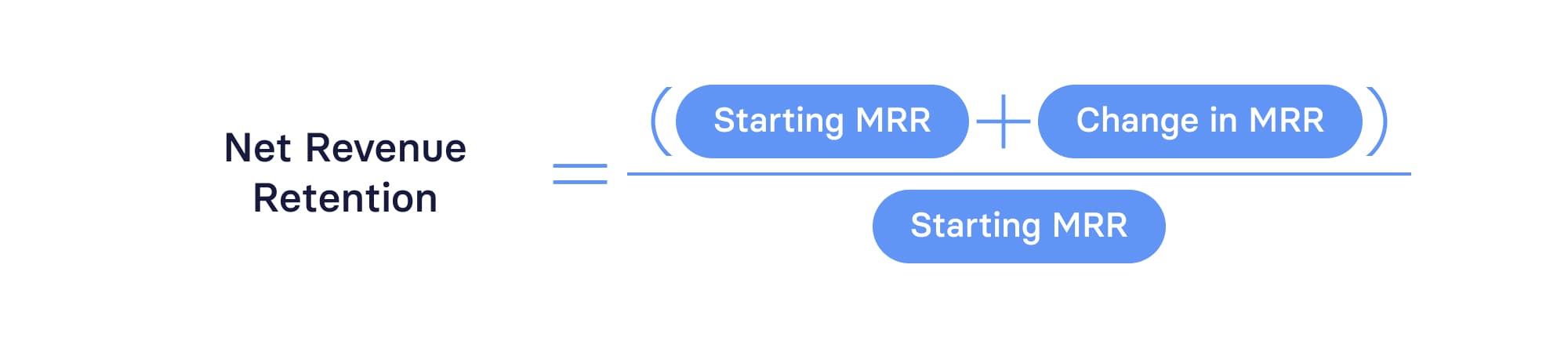

Net Revenue Retention (NRR)

To understand the company’s growth rate and trajectory, you need to have a sense of customer retention. Net revenue retention (NRR) divides the current MRR for a customer cohort by the MRR in the previous month. It accounts for changes in MRR, which indicates where you may be gaining or losing revenue overall.

Gross Revenue Retention (GRR)

GRR is a more conservative financial metric than NRR in terms of understanding revenue retention. GRR doesn’t factor in any expansion MRR, and cannot exceed 12 months. Instead, it focuses on churn and downgrades and provides insight into how well the company retains revenue from existing customers, which is an important indicator in terms of customer satisfaction.

Understanding Your MRR Data and 4 Ways to Improve MRR

Your MRR serves as the micro-level insight you need to understand if the company is to generate future revenue growth. Recurring revenue provides a pathway to plan and improve operational efficiency and serves as a gut-check for product/market fit.

Improving MRR begins with understanding the “why” behind the numbers. The sales team gets customers to sign a contract and commit to providing payment, but the marketing campaign continues to build the pipeline, and the customer success team focuses on retention. You need to share data around MRR in a way that matches each team’s responsibility when it comes to the company’s growth goals.

Focus on Matching Ideal Customer Profiles (ICPs)

The marketing team’s main goal is to attract new business, so new MRR is a primary focus. To build that attraction, marketing needs to know what attracts their customers to ensure as close of a product/market fit as possible. Churn MRR may show what channels are bringing in unsuccessful customers, which prompts marketing to focus on different channels.

Sales also needs to constantly evaluate ICPs to ensure the product matches the customer’s expectations.

Update Your Pricing Strategy

Your SaaS pricing strategy is another nod toward your product/market fit: Are potential customers turning away from the price? Or do they see the value? And are your prices competitive within your industry? The sales team can evaluate the pipeline and keep tabs on existing customers’ interest in upsells or cross-sells to gain a temperature check on customer satisfaction and overall brand recognition.

Of course, an update may mean increasing prices, which means higher cash flow, lower CAC payback periods, and a quicker path toward profitability. If you offer free trials, keep the trial period short to help convert trial users to paying, committed customers.

Expand Your Revenue Streams

Successful upgrades and cross-selling additional products show that existing customers are enthusiastic about your product and want more. If your product expands its features, there’s the option to price it as an “add-on” or eventually raise prices for the additional value.

Reduce Churn

MRR grows with less churn — but that doesn’t mean that churn is unavoidable. Reducing your churn rate relies on cross-departmental collaboration. By conducting a customer cohort analysis around churn, finance can ask other departments for their insights into “why” these numbers are the way they are, which spurs everyone into action.

If your total number of customers falls off around the three-month mark, the sales and customer success teams can evaluate the onboarding process and how to improve it. The customer success team passes on feedback around product features and functionality to the product team, whose engineers can work through updates and improvements. And sales can continue to ensure product/market fit by helping customers sign up for the right products at the right time.

Here’s How Mosaic Can Help You Track Your MRR

Mosaic connects seamlessly to your CRM to automatically calculate your MRR based on contract dates. Mosaic can also connect to your ERP so you can compare your GAAP revenue against your MRR so you can easily understand how the two metrics differ. Even better, it tracks changes in these metrics to show you exactly how each metric is growing or contracting.

This dynamic reporting not only helps you derive a deeper understanding of your revenue’s history, but it also enables way-more-accurate revenue forecasts and way-more-strategic investments — and the list of things you can do with that is virtually endless. Request a personalized demo and discover how a Strategic Finance Platform brings you recurring strategic insights that lead to optimal growth and efficiency.

Monthly Recurring Revenue FAQs

What is a good MRR growth rate in SaaS?

It’s difficult to define a “good” MRR growth rate — factors are endless; including your starting MRR, your industry, your company goals, etc.

However, a popular theory, as outlined by Jason M.Lenkin (Co-Founder of Adobe EchoSign), states that, once your SaaS startup has reached $1m ARR, a month-on-month growth rate (MRR) of 10%+ is an ideal target.

How is MRR different from ARR?

Should I use ARR or MRR for my SaaS metrics?

What is ARPU?

Explore Related Metrics

Own the of your business.