Net Revenue Retention and Gross Revenue Retention Explained

The Difference Between Gross and Net Revenue Retention

GRR focuses on the percentage of recurring revenue retained from customers, excluding any revenue from upgrades or expansions, while NRR provides a more comprehensive view by including upsell and cross-sell revenues in addition to the retained revenue.

Categories

NRR is a key financial ratio used to analyze a company. It shows whether or not your product has value for your current customers and whether or not they’re happy with your SaaS pricing strategy, response time, and reliability. NRR helps you evaluate customer success and shows how successful your company and business model are not only at renewing business, but generating additional revenue from its existing customers.

When running a business, it’s easy to get distracted by the shiny prospect of attracting and adding new customers—and while that is an important thing to do when growing a company, it’s just as important to think about customer acquisition cost (CAC) because on average, it’s 12.5 times more costly to acquire a new customer than it is to retain or upsell an existing customer, so it is critical you pay close attention to your net retention rate.

Table of Contents

What is Net Revene Retention?

Net revenue retention (NRR), sometimes referred to as net dollar retention (NDR), is a metric that compares the change in revenue generated by a cohort of customers from one period to another. NRR accounts for lost revenue from customer attrition or downgrades as well as any increases in total revenue (annual recurring revenue or monthly recurring revenue) over a set period of time.

Get ahead of your top-line planning with this ARR Snowball Template

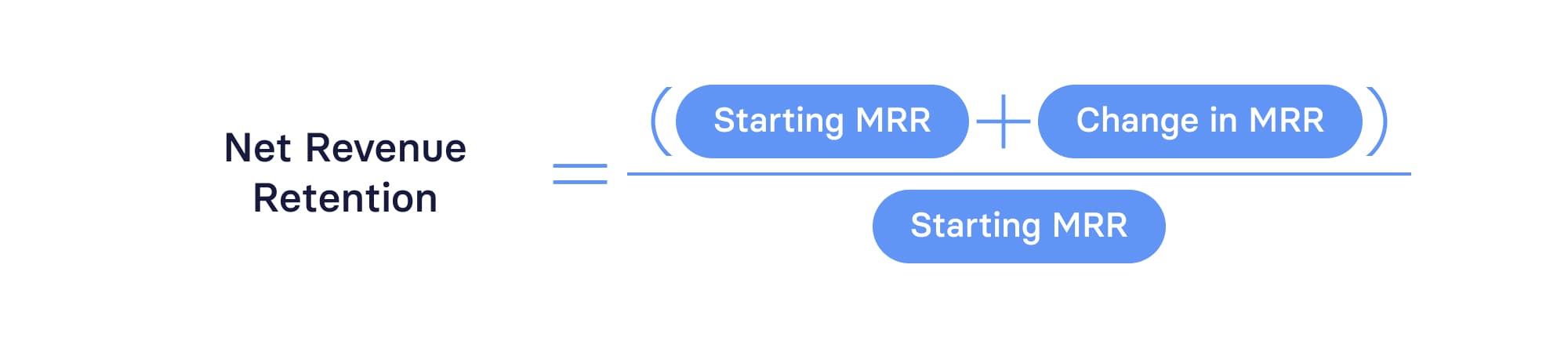

How To Calculate Net Revenue Retention

Net revenue retention measures the recurring revenue from your customers over a set period of time. Net revenue retention rate looks at the amount of change from one period of time to another. Curious about how to find net revenue? For the retention calculation, you divide the current monthly or annual recurring revenue (MRR or ARR) for a given cohort of customers by the recurring revenue for that same cohort in a previous time period of the same length—say, last month, last quarter, or last year. Below is the net revenue formula that can be used.

There are two basic inputs for a net revenue retention calculation:

- Starting MRR/ARR: The MRR or ARR from the previous period (last month, last quarter, last year, etc.)

- Change in MRR/ARR: Total MRR or ARR change from upsells, downgrades, and churn for the set of customers in your “Starting MRR/ARR” metric compared to the current period.

At first glance, this seems like a simple metric to calculate. However, there are so many different ways to interpret “Starting MRR/ARR” and “Change in MRR/ARR,” all of which depend on the specific context of your business.

Why Does Net Revenue Retention Rate Matter?

Net revenue retention rate is a key metric that accounts for churn or downgrades (i.e., loss of customer value) and for expansion revenue or upgrades (i.e., upsells or cross-sells to current customers). The net revenue calculation is key to knowing the rate at which you are retaining revenue and helps you understand your overall business health and the growth trajectory of your business. For example, if you stopped adding new customers tomorrow, how much revenue could you expect to bring in next month? How about next quarter?

What is Gross Revenue Retention?

Gross Revenue Retention (GRR) is a metric that shows the amount of recurring revenue (expressed as a percentage) retained from one given period to another. GRR denotes a company’s ability to preserve its core revenue streams, explicitly sidelining revenues generated from enhancements like upsells or cross-sells. For businesses operating on subscription models, especially in the SaaS realm, GRR is a vital metric spotlighting pure customer retention without the skew of additional revenue avenues.

How To Calculate Gross Revenue Retention

Gross revenue retention is always equal to or lower than net revenue retention, and it can’t be greater than 100%. The basic calculation is the same as net revenue retention, but the MRR for each individual customer in the current month can’t exceed the MRR for that customer from one year ago (remember, gross retention can factor in downgrades, but not upgrades from your existing customer base).

Much like the calculation for NRR, gross revenue retention is based on two main inputs:

- Starting MRR/ARR: The MRR or ARR from the previous period (last month, last quarter, last year, etc.)

- Downgrade/churn MRR/ARR: Total MRR or ARR downgrade and churn amounts from the set of customers in your “Starting MRR/ARR” up through the current period.

The complexity of this calculation comes down to the way you define these inputs. If you have a strong definition of ARR/MRR, upgrades, downgrades, and churn in your organization, calculating NRR and gross revenue retention should be simple.

Why Does Gross Revenue Retention Rate Matter?

As you now know, gross revenue retention measures how much revenue you retain from customers over a period, while net revenue retention measures how much you retain and grow from that same pool of customers. The gross revenue calculation is important because it excludes the impact of price increases and expansion within your customer base. Since it doesn’t factor in upsells, gross retention is a more conservative metric, and a better indicator of how well your company is retaining revenue from its existing customers over their lifetime.

The Challenges of Tracking Revenue Retention Rates

Tracking retention rates alone isn’t especially challenging. If you know the current value of each customer’s account and the value of these accounts last month or last year, you can pull this metric easily enough. The tricky part is fleshing out the full story behind this important metric. Like all SaaS metrics, your revenue retention rate is just one character in a large cast, and it’s essential to know its backstory and understand its relationships with the other cast members.

For example, let’s say your net revenue retention rate is high, but your gross rate is low. What will happen to your net retention if half of your customers downgrade their subscriptions within the next year? Or, for another example, would you rather lose 10 customers with subscriptions of $10,000 each, for a total of $100,000 in lost revenue, or one customer with a subscription of $150,000? Depending on your CAC and average customer lifetime value (LTV), the answer may be different.

It’s important to understand why your customer retention rates are what they are by looking not just at the key players (MRR and ARR), but at adjacent metrics that shed much-needed light. Many data sources feed these metrics and having all of them at your disposal, on-demand and error-free, is when the real challenge enters the scene.

How to Make Your Revenue Retention Rates Make More Sense

With Mosaic, you can see your customer retention metrics any time you want and easily plug different customer cohorts and time periods into the equation for different perspectives (and therefore, a more holistic understanding of your revenue story). But Mosaic does more than just make it easier to run your retention analysis.

By integrating with your CRM, HRIS, ERP, and payment system, Mosaic pulls and normalizes relevant data and automatically calculates all the metrics mentioned above, as well as your magic number, your cash runway, and many others. It’s easy to map your calculations to your business’ KPIs and just as easy to present deep financial insights via crystal clear representations.

The Bottom Line

Understanding your net revenue retention rate helps you understand how your customers are feeling about you. Understanding your net revenue retention rate in context helps you understand how your business is feeling financially and how it will fare in the future. Get to know your customer retention metrics by requesting a demo today.

Net Revenue Retention FAQs

What is the formula to calculate net revenue retention?

The formula to calculate net revenue retention is starting MRR plus the change in MRR divided by Starting MRR. Starting MRR (or ARR) is MRR/ARR from the previous period. Change in MRR/ARR is the change in MRR/ARR from upsells, downgrades, and customer churn.

What is the formula to calculate gross revenue retention?

What is the difference between gross and net revenue retention?

How do you increase net revenue retention?

What is net dollar retention?

Explore Related Metrics

Own the of your business.