Categories

Unlike other efficiency scores like LTV/CAC ratio that focus on just sales and marketing, actions you take across every business function will impact your burn multiple. Understanding your burn multiple helps you find opportunities to extend runway through smarter cash management, which is especially important in times of market downturn.

There was a stretch of time when “growth at all costs” made sense for venture capital-backed companies. Even if you weren’t growing efficiently, additional SaaS funding rounds were highly accessible. But as market conditions change, you need to embrace foundational principles like the rule of 40, which mandates a balance between growth and efficiency, to ensure sustainable business progress.

There are many SaaS financial metrics that go into monitoring the balance between growth and efficiency: annual recurring revenue (ARR), customer acquisition cost (CAC), customer lifetime value (LTV), and logo retention to name a few.

But one has become increasingly important to investors and operators alike in recent years — your burn multiple. Here’s what you need to know about this key capital efficiency metric.

Table of Contents

Burn Multiple Formula and How to Calculate It (+ Calculator Tool)

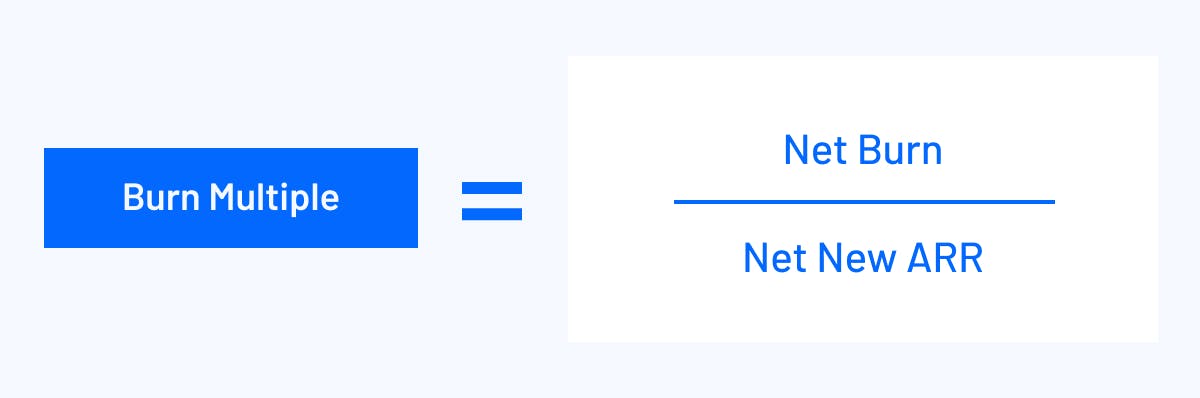

You can find your burn multiple by dividing your net burn by net new annual recurring revenue for a given period.

Craft Ventures founder and general partner David Sacks created the burn multiple formula as a response to considering growth and investment within market downturns.

Burn Multiple Calculator

Your Burn Multiple

0 x

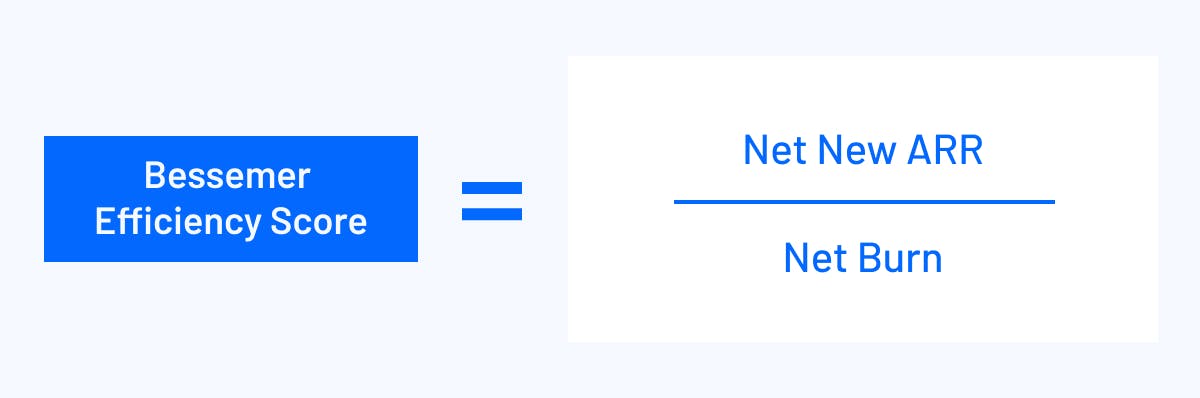

Sacks was inspired by Bessemer’s efficiency score formula and the hype ratio, which place net burn, capital, and ARR into a direct conversation with each other. By flipping the efficiency score’s denominator (net burn) and numerator (net new ARR), Sacks sees the burn multiple formula as an annualized hype ratio.

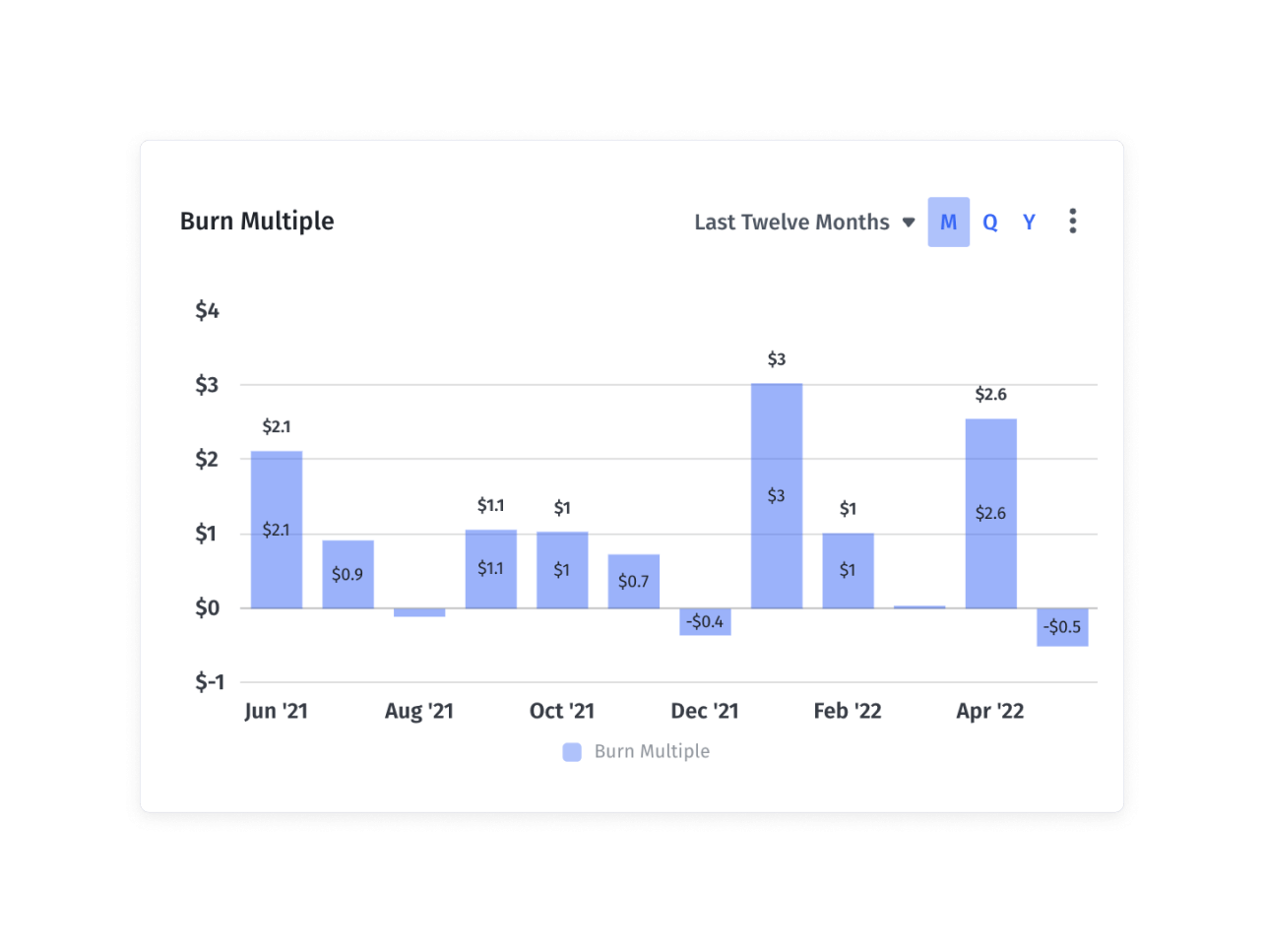

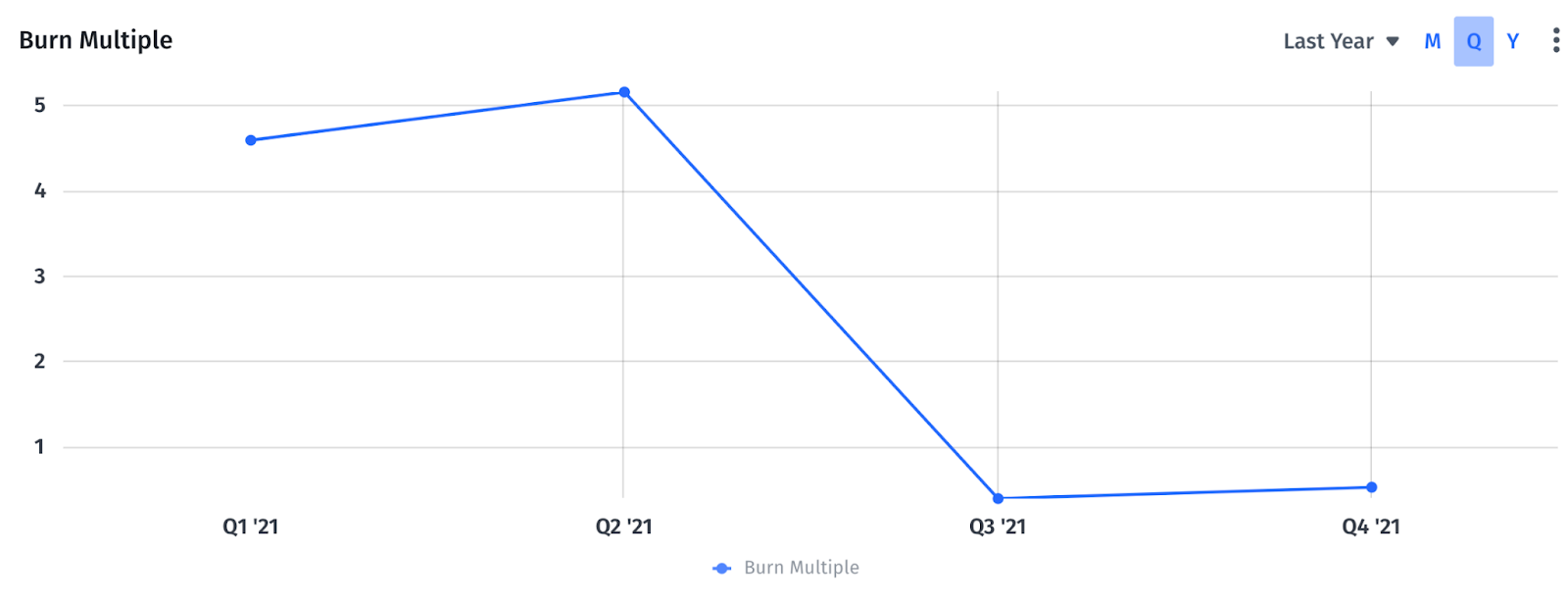

During a market downturn, your ability to understand how much money you burn to earn each dollar of ARR is critical to operational efficiency. As an annualized formula, it is capable of calculating your burn by month, quarter, or year, which provides a macro- and micro-view of the company’s capital efficiency.

How to Understand Your Burn Multiple

The more a company burns to achieve a unit of growth, the higher the burn multiple. More efficient growth results in a lower burn multiple (closer to 0).

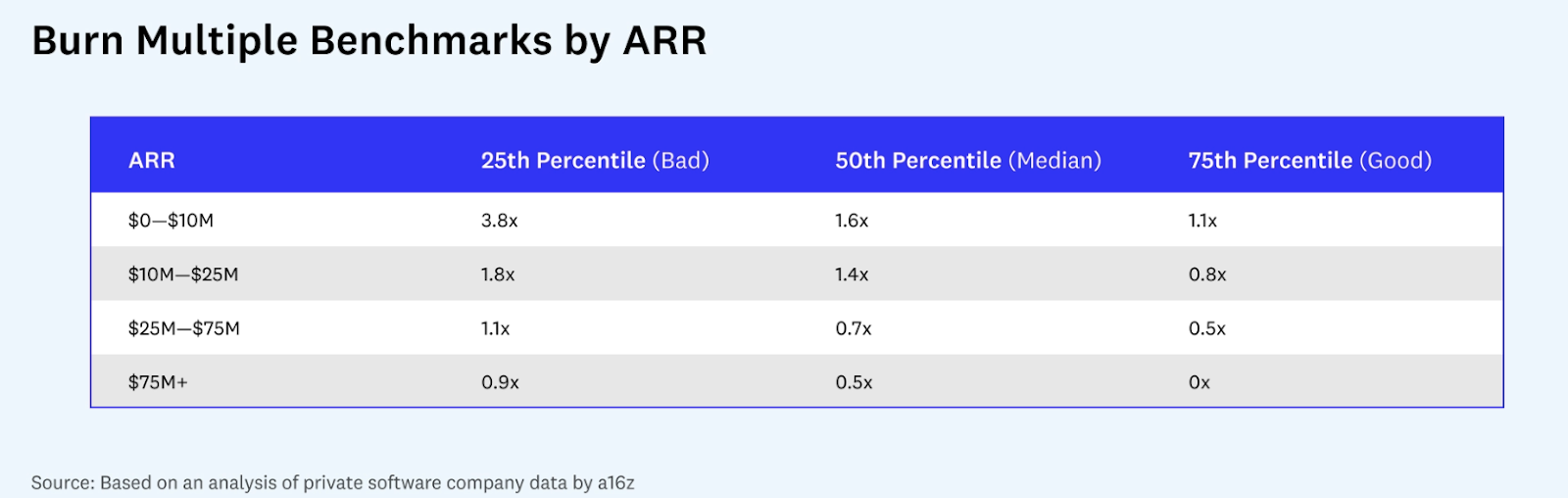

A “good” burn multiple looks different at different stages of growth. A seed-stage company may have high net burn due to growing the company before signing customers or having their CAC payback period complete (hence, turning the customer profitable). VCs have particular expectations for mid- and later-stage SaaS companies (such as Series B and higher) that should be scaling operations to increase efficiency. This is why it’s important to contextualize your burn multiple within your growth stage.

You can use burn multiple benchmark data from a16z to understand where you stand compared to your peers depending on your stage of growth.

How to Improve Your Burn Multiple

If your burn multiple isn’t where you need it to be, there are many ways to improve cash management and grow more efficiently.

Lower CAC

A lower CAC works toward a lower CAC payback period, where customers start contributing to profit. Evaluating CAC on a deeper level requires collaboration from the marketing and sales teams, who can look at where CAC is prohibitive or sales productivity diminishes.

Is the sales rep ramp too slow? How can the sales cycle rev a little faster? Marketing can rethink how much should you spend on ads in correlation with SEO terms and potential customer/product fit, and evaluate next steps to improve efficiency.

Improve Margins

Your gross margin points toward operational efficiency: Spending too much on cost of revenue/cost of goods and services (COGS) or burning far too much in regards to headcount and product development cause burn to skyrocket. You need to look at where you can cut costs.

For overall gross profit margins, make sure you account for cost of revenue. The time customer service teams spend with existing customers falls under COGS — but if they assist with sales and marketing, categorize them as part of sales and marketing to ensure correct measurements of operational efficiency (and a fully-burdened CAC).

Evaluate net burn across the company, and point out discrepancies to department leaders. If team members aren’t using a software that charges per seat, department leaders need to investigate why.

ARR is sensitive to churn rates and downgrades. It’s better to have existing customers renew under the same contract or at a discount than churn entirely, since it guarantees some revenue versus losing it entirely. Keep in mind that any discount or promotion campaigns increase marketing spend and impact burn, as you’ll spend money on these campaigns faster than potentially securing the sale.

Make Revenue Forecasting and Scenario Planning More Agile

Finance has access to financial knowledge and levers that are the difference between reactivity and proactivity. If you did your revenue forecasting on an annual basis typically, it may make sense to start doing it quarterly during times of difficult market conditions. Doing so will let you create more accurate top-line models and adjust assumptions for new circumstances.

More frequent scenario planning allows you to go beyond the general forecasting process to understand how different strategies will impact revenue growth and burn. Collaborate with sales and marketing to conduct scenarios that would increase bookings and improve ARR. Conduct a customer cohort analysis that pinpoints on seasonality and new customers. You’ll notice where annual contract value (ACV) may be lower and whether CAC may have changed due to the market. Model cash inflows and outflows to see how billing cycles impact ARR, and where spend increases for paying vendors for their tools and services.

Evaluate and Track Your Burn Multiple in Real-Time with Mosaic

The information you need to calculate your burn multiple is spread out through various spreadsheets that could take hours to manually collect, clean, and reconcile. By the time you have your burn multiple calculation, the information is outdated, which leads to less efficiency and longer periods of inactivity to create viable solutions.

You don’t have that type of time — especially in an ever-changing marketplace. Mosaic offers the burn multiple as one of the 150+ KPIs in the Metrics Catalog and as part of an out-of-the-box Operational Efficiency Template.

Mosaic pulls your source systems together and updates them in real time, so you can proactively manage the performance metrics that matter most, identify when fundraising is required, and position the company for a successful raise (especially in tough market conditions) by showcasing a strong and healthy trajectory moving forward.

Your burn multiple is the catch-all metric for growth — and Mosaic offers a catch-all financial picture that allows you to drive into the sunset successfully. Request a personalized demo and see where you can drive your company’s narrative forward.

How Strategic Finance Software Can Support Founders & CEOs

Burn Multiple FAQs

What is a good burn multiple?

What constitutes a good burn multiple depends on the growth stage of your SaaS startup. High growth, early-stage startups should aim for a burn multiple as close to 1 as possible, aiming for a burn multiple of 0 as your SaaS valuation and maturity increase.

How do you reduce burn multiple?

Is there a difference between burn rate and burn multiple?

Explore Related Metrics

Own the of your business.