Cash Flow from Operating Activities in SaaS (Examples and Formula)

What Is Cash Flow from Operating Activities?

Cash flow from operating activities — also known as operating cash flow — is one of three sections in a cash flow statement and is a crucial part of an accurate balance sheet. Cash flow from operating activities specifically tracks the cash inflows and outflows of business operations, such as income taxes, accounts payable and accounts receivable, and any equipment or property depreciation.

Categories

Table of Contents

Your company’s cash flows from day-to-day business is a key metric to understand how well your core business is functioning. While positive cash flow is usually synonymous with a healthy business, its value often depends on the maturity of your business.

Most start-ups (seed through Series B) grow at the cost of profitability (or growth at all costs). Once they hit their Series C, though, showing positive cash balance becomes all important. But in times of market turbulence, companies of all stages and sizes need to take a closer look at their line items and drill down on financial efficiency more than before.

Though a growth-at-all-costs strategy can be effective in certain situations, it’s even more important to know exactly what you’re trading for profitability. Small tweaks in how cash moves through your business can have profound effects on your capital efficiency.

Running an operational cash flow analysis allows you to understand your working capital and address issues proactively. It’s also crucial to monitor the overall amount of cash available at any given time to ensure you’re equipped to meet both short-term and long-term obligations. You’ll need to know your operating cash flow in order to see what’s available for capital expenditures and to calculate your free cash flow, among other important figures.

Paying close attention to cash flow from operating activities in your financial reporting allows you to provide the strongest foundation for your company’s financial narrative, which can make or break securing the next round of funding.

What Counts as Cash Flows from Operating Activities?

Cash flow from operating activities only considers core cash inflows and outflows due to business activities. It doesn’t account for money from investing activities or lenders (those are the other two parts of your cash flow statement).

- Cash inflows from operating activities include any new product or subscription sales or upsells, existing accounts receivable, or interest paid to the business.

- Cash outflows from operating activities consider any spend or cash payments to keep business operations going, such as payroll, and any cost of revenue (ad spend and so on). But it also includes taxes paid, accounts payable, and rent.

Get a head start on planning season with our Financial Planning Blueprint.

Here’s How to Calculate Cash Flow from Operating Activities

There are two ways of calculating cash flow from operating activities: the direct and the indirect methods. The direct method calculation follows cash as it comes into and leaves the business. The result is a broadly accurate picture of your day-to-day cash standing.

The indirect method calculation provides nuance and granular financial details you miss with the direct method. You’ll start with your net income and work backwards, accounting for both cash and non-cash charges.

Either method will let you determine if you have a positive or negative operating cash flow. But know that the indirect method is preferred, as it provides the granular details venture capitalists want to know in funding rounds.

Direct Method

With the direct cash flow method, or the income statement method, you follow each cash transaction. The inflows (revenue) and outflows (expenses) are netted to determine a positive or negative cash flow.

The main benefits of using the direct method is that you know your actual cash status and can see it move through your cash flow systems.

While the calculation is straightforward, tracking individual cash transactions is time consuming. A sale may be noted on Monday, but the transaction isn’t posted until Friday. With the direct method, someone has to follow the transaction from promise to paid. Logging every cash receipt and disbursement into a spreadsheet is not the most efficient way to spend precious labor resources. That’s why many startups rely on the indirect method to understand net cash flow.

Indirect Method

The indirect method of cash flow accounting uses the accrual accounting method. You track cash transactions when they’re made, not when they’re realized. So in the above scenario, the transaction is reported on Monday (not Friday) — even if the transaction and receipt days fall in different months, quarters, or years. You’ll also adjust for other factors that can affect your runway, such as changes to current liabilities.

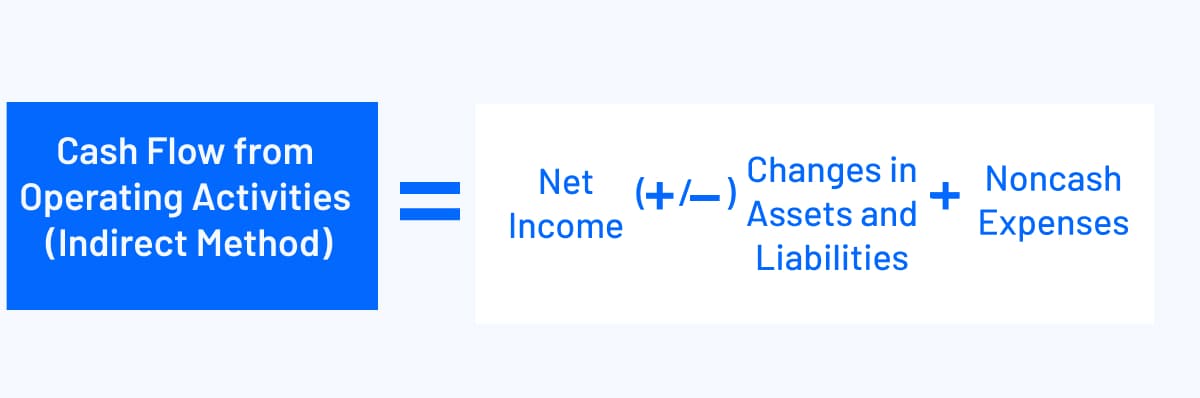

The indirect formula starts with your net income and works backwards, accounting for changes in current assets and liabilities and non-cash items.

The main benefit of using the indirect method is that you’re recording revenues and expenses within the period they occur. Cash takes time to move. Following the direct method can skew how you perceive the need for cash as it changes throughout the year.

While the direct method offers the most accurate picture of where your cash stands in the moment, the indirect method is much more useful for getting an accurate picture of your company’s current and future finances.

Track Cash Flow in Granular Detail with Strategic Finance Software

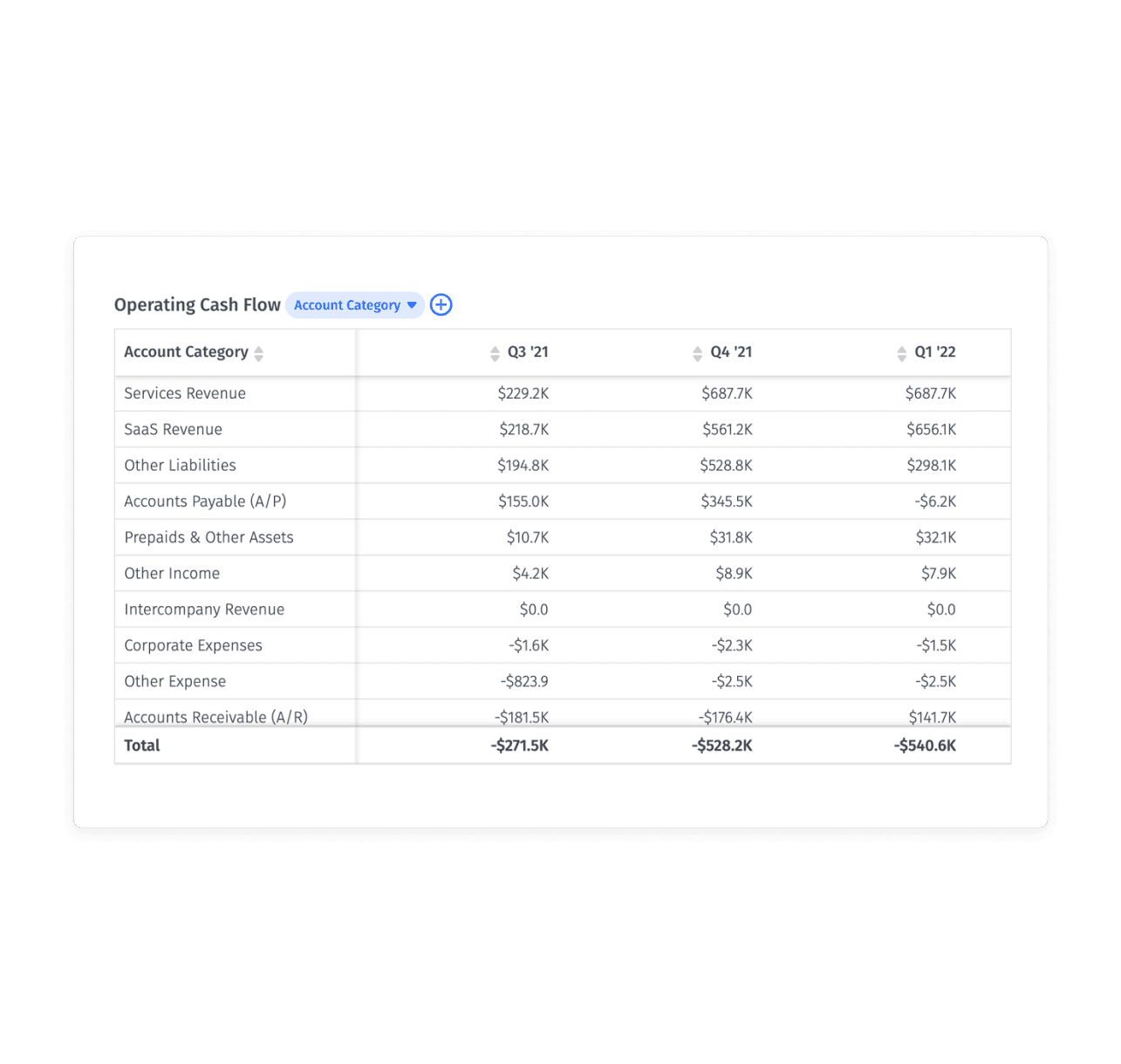

Example of Cash Flow from Operating Activities

Understanding your cash flow is the lynchpin to strategic planning. Without it, you don’t know your burn rate or the length of your runway. And you can’t plan for anything long term — at. At least not accurately. But between data handoffs and manual analysis, reviewing cash flow gets pushed to the corners.

That’s what was happening at Sourcegraph, a San Francisco-based startup with a mission to democratize code. There, cash flow reporting and analysis had to wait for the end of each quarter. That meant potentially 12 weeks could pass without the chance to catch costly hiccups (or worse) in the cash flow journey. This wait was necessary — the heavy demands to gather and consolidate data meant teams spend days, if not weeks, preparing financial statements.

So when Sourcegraph raised $50M from their Series C, the finance team was ready for a more efficient process. They wanted better ways to understand expense trends sooner so they could forecast how various growth scenarios would affect the company’s bottom line.

“We had a system in place, but that system would not scale with our ambitions. This meant that everything and anything related to finance strategy needed to be done manually. We knew we needed a better way to crunch the numbers and offer insightful short-term guidance while also planning for the future."

Sourcegraph was able to consolidate revenue metrics, including cash flow, into one accessible dashboard tailored to what their finance team needed right now. By integrating Mosaic with Xero and Salesforce, they’re able to track cash flow changes in real time. From there, critical SaaS metrics such as annual recurring revenue (ARR), ARR changes, and net burn are calculated automatically. And with automated cash flow reporting, Souregraph’s finance team saved hundreds of hours of manual labor, and could dive deeper into proactively collaborating with business partners to quickly understand cash variances and cash inflows and outflows.

Track Cash Flow from Operating Activities with Mosaic

Getting up close and personal with your company’s cash flows from core business activities lets you grasp the big picture from small details. The more accurate your view of cash flow metrics, the more accurate your understanding of core business health and the more efficiently you can run your operations.

But the labor costs of real-time tracking isn’t realistic. Mosaic syncs with your source systems so that your data reflects any updates in real time. Plus, with preloaded dashboards and templates (like the cash flow dashboard), you can get away from data manipulation and consolidation, and focus on making the financial narrative of your company spark the imagination of your audience — whether that means pitching a pivot to management or inspiring the next venture capitalist to invest.

Mosaic’s plug-and-play financial dashboard helps you monitor operating cash flows in real time and get you from data to insights faster. Request a personalized demo to discover how.

Cash Flow from Operating Activities FAQs

What does cash flow from operating activities include?

Cash inflow from operating activities include product sales and existing accounts receivables, while cash outflows from operating activities cover the cost of goods and revenue, and overhead. Line items include wages, interest payments, income taxes, cloud storage, hosting applications, and software subscriptions.

Why can cash flow from operating activities be so important?

Is the indirect method of cash flow better than the direct method?

Explore Related Metrics

Own the of your business.