Days Payable Outstanding

What Are Days Payable Outstanding?

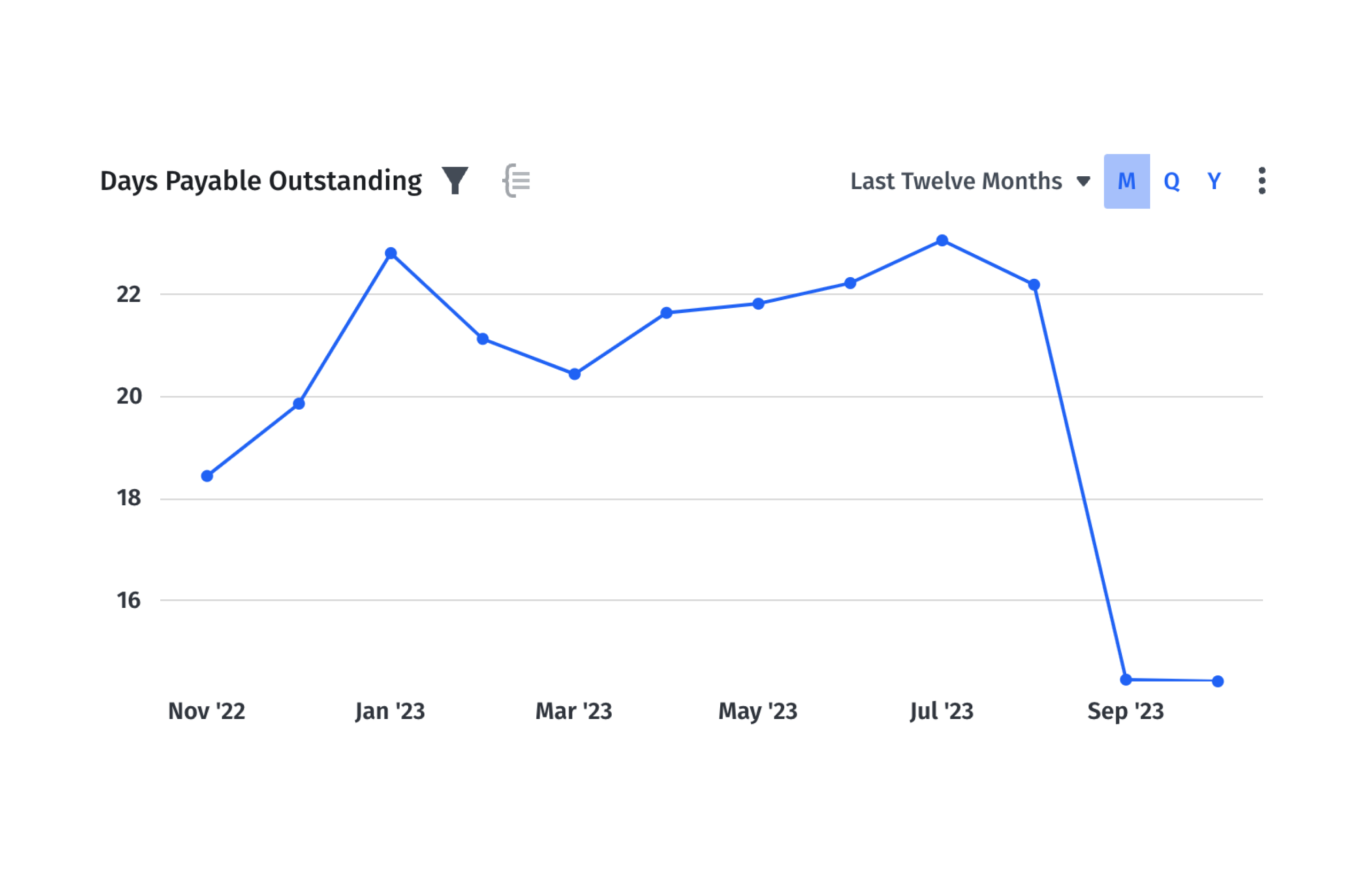

Days payable outstanding (DPO) is a measurement of the average number of days required for a company to settle its bills and invoices. At a high level, this metric evaluates the efficiency of a company’s management of its accounts payable.

The classic way to calculate DPO is by dividing your accounts payable for a given period by the cost of goods sold (COGS) or cost of revenue in SaaS. Then, multiply the result by the number of days in the period, be it monthly, quarterly, or yearly.

Categories

Table of Contents

How to Calculate Days Payable Outstanding: Two Methods

Days Payable Outstanding (DPO) indicates the average time it takes for your company to pay off its accounts payable. Below we walk through two different ways to calculate DPO: the first is the more classic calculation used by companies selling physical goods, and the second is a calculation method more appropriate for SaaS companies.

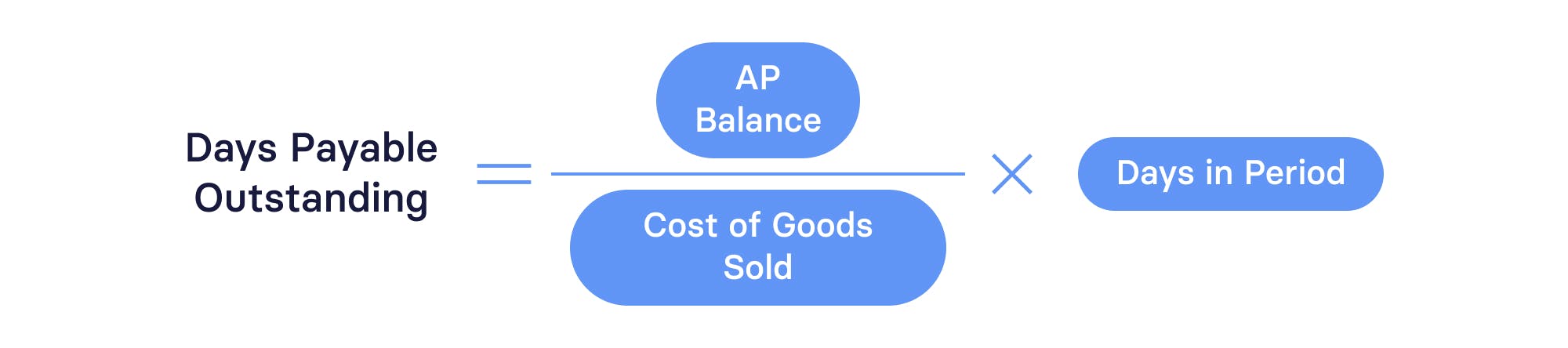

The Classic Method

To calculate DPO, divide the total accounts payable for a specific period (on a monthly, quarterly, or annual basis) by the cost of goods sold. Then, multiply this result by the number of days in the period.

Here’s the formula for this method of DPO calculation:

Let’s break this down.

Accounts payable generally covers the payable balance owed to businesses or vendors for services received but payment is pending. It represents the total amount of short-term obligations, or in other words, liabilities, on the company’s balance sheet (AP aging reports can help companies organize and gain visibility into these obligations).

In a SaaS context, COGS would refer to the cost of revenue, which includes expenses associated with revenue generation, such as application hosting fees (e.g., Amazon Web Services), customer support, personnel training, software fees, and web development and support, along with other indirect expenses essential for creating or maintaining the product or service.

The “number of days” refers to the total days in the selected period. For instance, Q4 of a year contains all days in October, November, and December, adding up to 92 days.

Days Payable Outstanding (DPO) Calculator Using This Method

Your DPO

0 days

Example of DPO Calculation Using This Method

To illustrate this calculation with an example, let’s consider a software provider. The company is calculating its DPO for the first quarter of 2024, spanning from January to March, totaling 90 days. During this period of time, the accounts payable to vendors and other service providers add up to $150,000.

Cost of revenue for the same period, which includes server costs, software licensing fees, and customer support, amounts to $300,000.

Here’s how you’d calculate DPO for Q1 2024:

DPO = ($150,000 / $300,000) x 90 days = 45 days

On average, the company takes 45 days to pay its outstanding invoices and bills. This metric is crucial in assessing the company’s efficiency in managing cash flow and vendor relationships.

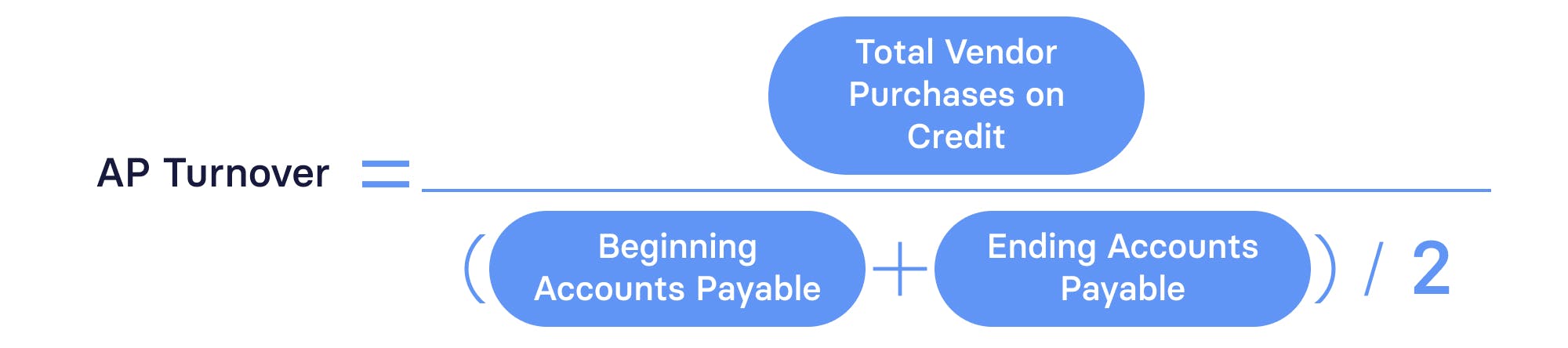

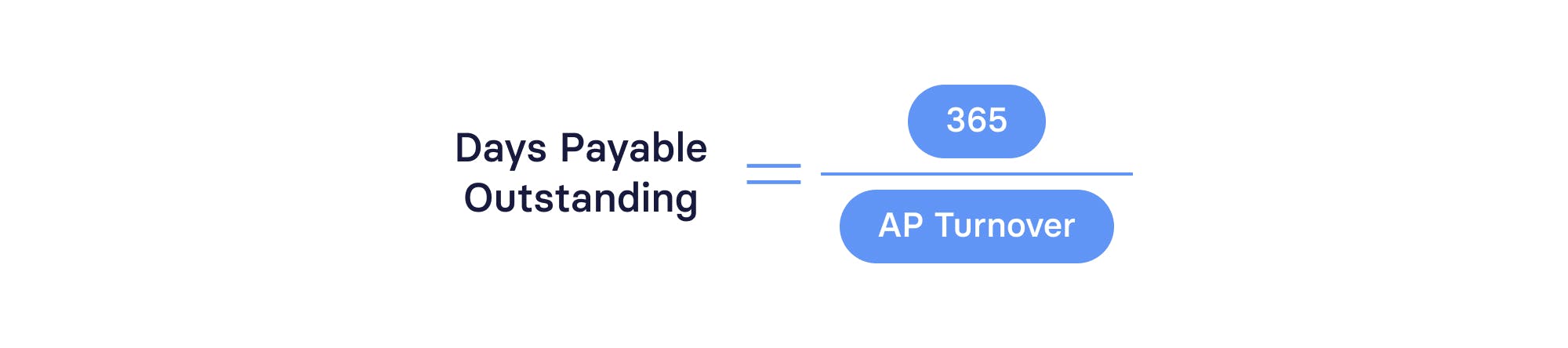

The More SaaS-Friendly Method

To calculate DPO, first get your AP turnover by adding together the beginning and ending accounts payable amounts over a given period and dividing that number by two, then divide the total value of purchases from vendors on credit over that time period by that amount. Once you have this number, divide it into 365 days and that’s your DPO.

Here’s the formula for this DPO calculation method:

Again, let’s go into more detail here.

First, choose a time period that you want to analyze (such as a quarter or a year). The total value of vendor purchases on credit is straightforward enough: to find this number, add together all purchases from vendors within the time period you’re analyzing and make sure you only include purchases made on credit, not cash. For this calculation you’ll also need both the beginning and ending AP values for the time period.

Example of DPO Calculation Using This Method

To illustrate this calculation method with an example, let’s again consider a software provider calculating DPO over the same time period: the first quarter of 2024, spanning from January to March, totaling 90 days. The total number of purchases on credit in this period amounts to $750,000. The beginning AP balance in this period was $100,000 and the ending balance was $200,0000.

Here’s how you’d calculate DPO for Q1 2024:

AP Turnover = $750,000 / [($100,000 + $200,000) /2] = 5

DPO = 73

On average, this company takes 73 days to pay its outstanding invoices and bills.

Interpreting Your DPO

While pinpointing a specific number that’s considered as an ideal or average DPO can be challenging, it’s important to remember that the baseline for any metric involves various nuances, ranging from market influences to industry-specific factors.

In general, DPO is a crucial indicator of cash flow management. A higher DPO suggests that a business retains its cash longer, which can be beneficial since there’s funds available for other needs. However, on the flip side, excessively delayed payments might adversely affect vendor relationships.

So, maintaining the delicate balance between cash inflow and outflow is critical to the company’s success in SaaS accounting.

Importance of DPO for B2B SaaS Startups

While DPO measures the average amount of time a company takes to pay its bills, the insights it offers extend beyond just a number for B2B SaaS startups. Simply put, this metric gives you a look into the efficiency of your company’s cash management. When you understand DPO, you can align the revenue inflow from customers with the outflow of payments to vendors, which is crucial for long-term financial stability.

That’s where smart AP, or strategic accounts payable, comes in, which goes beyond merely measuring operational efficiency. A strategic approach to DPO involves understanding and optimizing expenses, through insights into spend compliance with vendor terms while highlighting potential over-expenditures. By evaluating vendor ROI and ensuring cost-effective deals, startups can align DPO with broader financial strategies.

So, DPO isn’t just about paying vendors on time — it’s about strategically managing resources for sustainable business growth and success.

Comparing DPO with Other Cash Flow Metrics

In the present market, SaaS companies have shifted mindsets from “grow at all costs” to a more intentional “grow as efficiently as possible,” strategy — this transition has made DPO more important than ever.

When measured alongside other key cash flow and expense metrics, DPO can be a powerful indicator for companies, helping you better understand your spend and spot areas of opportunities for greater efficiency.

With a strategic finance platform like Mosaic by your side, tracking and analyzing these metrics becomes effortless.

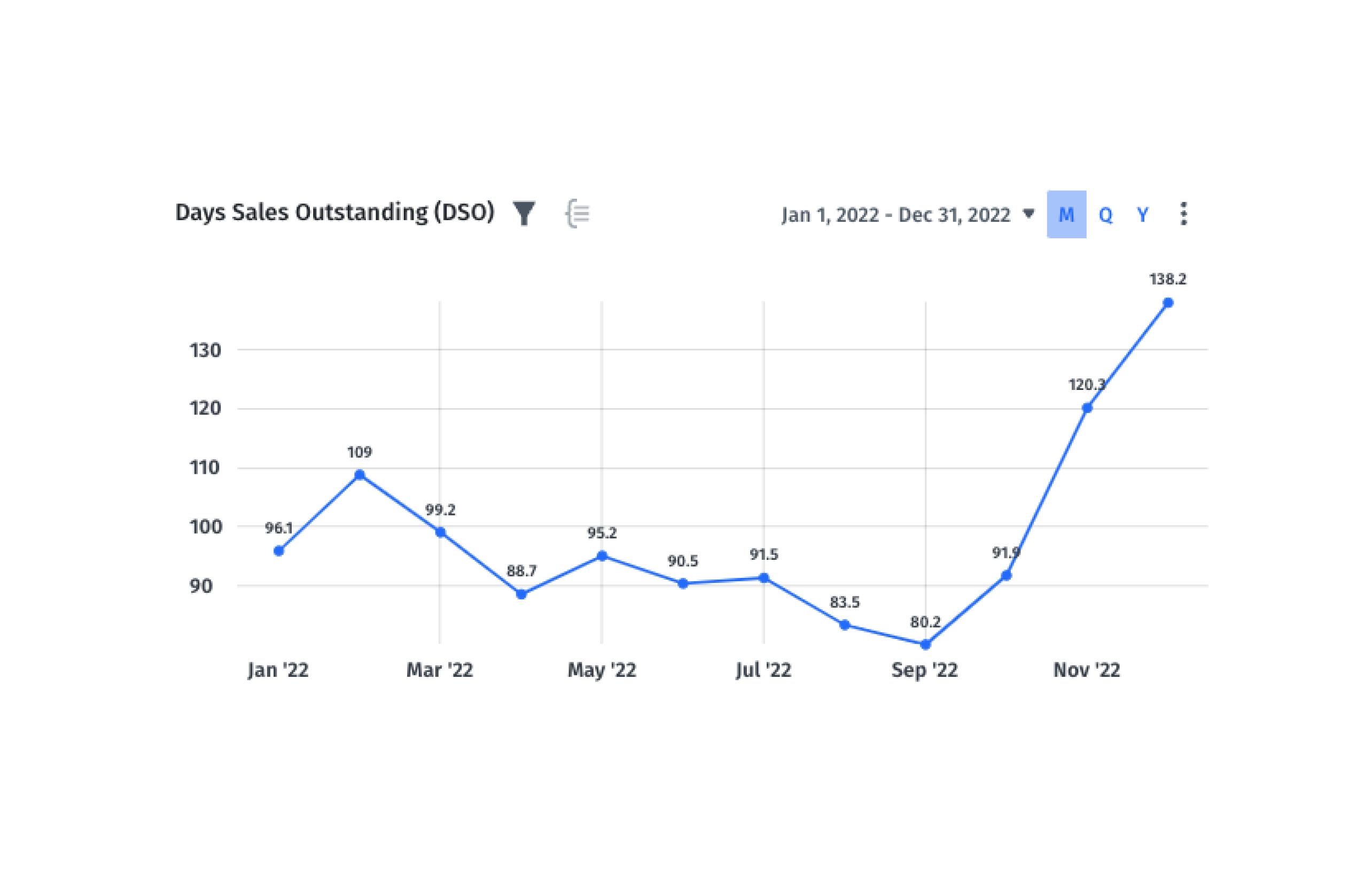

Day Sales Outstanding

Days sales outstanding (DSO) measures the average time to collect payments after a sale, helping businesses assess their cash conversion efficiency and manage receivables.

Together with DPO, which focuses on bill payments, DSO provides a comprehensive view of a company’s cash flow health. For SaaS companies, analyzing both DSO and DPO is essential for understanding cash flow efficiency and making strategic financial decisions.

Cash Flow from Operating Activities

Also known as operating cash flow (OCF), cash flow from operating activities shows the cash generated from regular business operations. This metric helps finance teams understand the company’s capacity to generate enough positive cash flow to maintain and grow operations.

Together with DPO, these metrics provide deeper insight into a SaaS company’s financial health. In other words, they reveal the crucial balance between generating sufficient operational cash, as indicated by OCF, and the effective management of liabilities, reflected in DPO — this equilibrium is vital in sustaining operations and supporting growth.

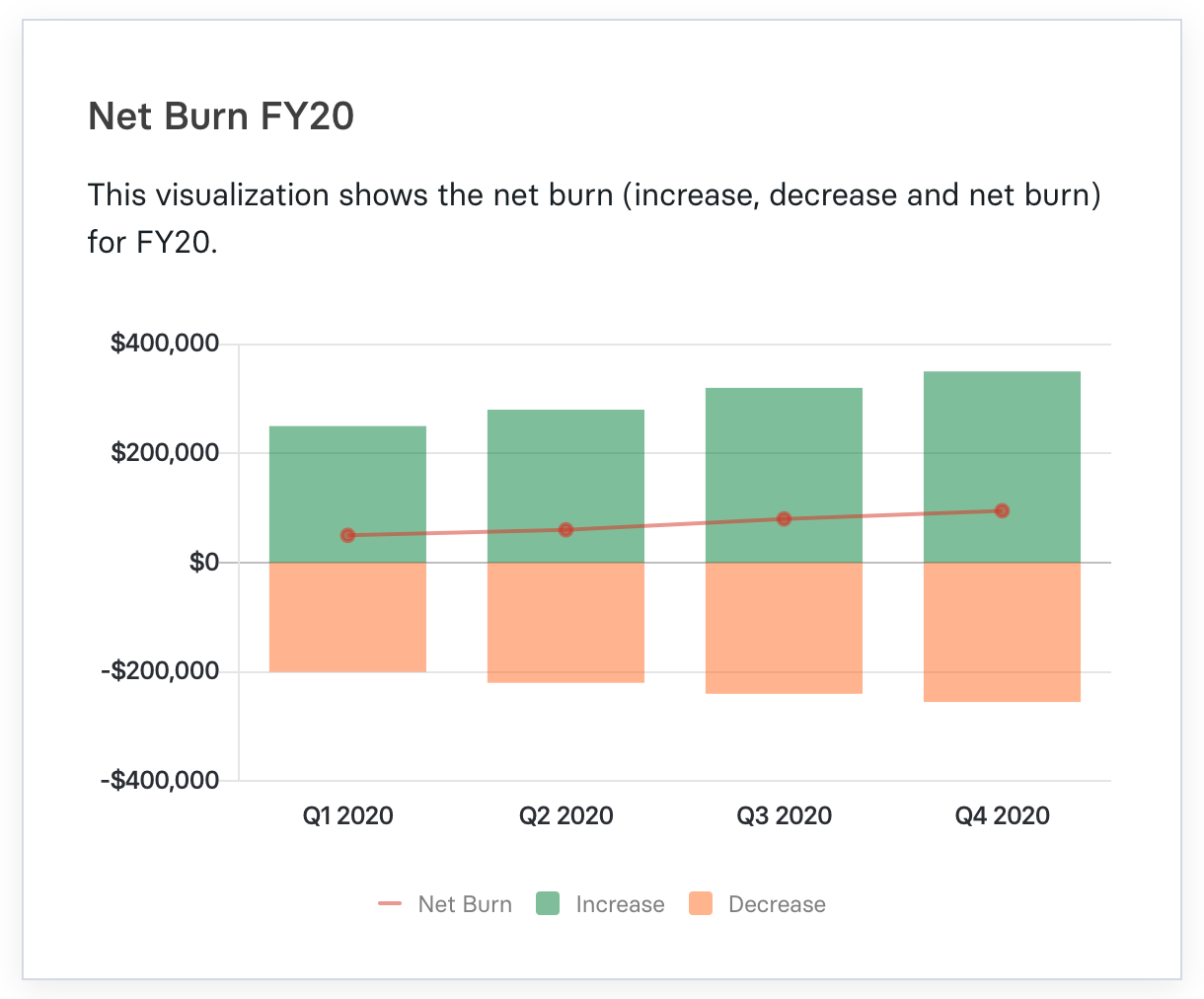

Net Burn

Net burn, also known as burn rate, measures the rate at which a company spends its capital to finance overhead before generating positive cash flow from operations. This metric is particularly relevant to B2B SaaS startups in the expansion stage.

When analyzed with DPO, a SaaS company’s burn rate—a measure of capital expenditure speed—sheds light on cash flow management. A high burn rate and low DPO might indicate cash flow issues due to rapid spending and faster payables clearance. In contrast, a balanced approach suggests effective financial management, marking the company’s stability and growth.

Free Cash Flow

Free cash flow (FCF) is a company’s cash after accounting for all the costs associated with operations and maintaining capital assets. This metric is essential in understanding the cash available for expansion, dividends, or debt repayment.

When analyzed with DPO, FCF helps assess overall cash management efficiency. For a SaaS company, a healthy FCF and a strategically managed DPO can signal strong operational efficiency, indicating its ability to invest in growth while effectively managing its short-term liabilities.

Practical DPO Tips for B2B SaaS Startups

While it’s clear that maintaining a healthy DPO is essential, tracking and optimizing the metric accurately is easier with an automated finance platform like on your side, unlike Excel.

Mosaic’s Metric Builder is built for SaaS businesses — it centralizes your data sets, allows you to customize metrics, and unlocks detailed financial insights in a no-code setting, tapping into data directly from your different systems.

Let’s dive into how B2B startups can improve their DPO, armed with the data from a powerful platform like Mosaic.

Negotiate Favorable Payment Terms with Suppliers

Extending the time allowed to pay vendors or suppliers can lengthen the company’s DPO effectively. So, the company retains cash longer, enhancing its liquidity and cash flow.

The extra time gained from an extension can make all the difference in managing operational expenses, investing in growth initiatives, or maintaining a buffer for unexpected costs. Essentially, longer payment terms provide greater financial flexibility, allowing the company to optimize its cash management strategy.

Leverage Early Payment Discounts

You can reduce the company’s overall costs by taking advantage of suppliers’ early payment discounts. Sure, this might lead to a shorter DPO as payments are made sooner, but the cost savings often outweigh any benefits of holding onto cash a little longer.

This strategy is often particularly effective in the SaaS industry, where maintaining strong supplier relationships and optimizing operational costs are critical.

Regular Review and Analysis

Frequently examine the DPO to ensure it aligns with the company’s cash flow strategy and operational needs. This way, you can quickly spot any trends, understand the impact of payment changes on cash flow, and notice opportunities for improvement.

Regular review and analysis of your metrics can help make informed decisions, such as adjusting payment terms with suppliers or optimizing the timing of payments, to maintain a healthy balance between liquidity and good vendor relationships.

Maintain Healthy Vendor Relationships

Good relationships can lead to more favorable terms, such as extended deadlines or flexibility during tight cash flow periods. Usually, this results in a longer DPO, allowing the company to keep cash on hand a little longer without rocking its relationships with suppliers.

Additionally, like with any industry, strong vendor relationships put you in a better negotiation position, possibly resulting in cost savings or preferential treatment — all of which matter when you’re thinking about revenue versus profit.

DPO Propels SaaS Startup Growth

For B2B SaaS startups, mastering DPO is more than just a financial necessity — it’s a strategic lever for growth.

By optimizing DPO, startups can effectively enhance cash flow management, balance operational expenses, and invest in growth opportunities. So, it’s essential for you to not only monitor DPO regularly but also to make informed decisions based on this metric.

Continuously tracking and optimizing DPO can lead to favorable credit terms, better vendor relationships, and a stronger financial foundation. So, startups should make DPO a central metric in their financial planning and analysis to propel the company’s growth and success.

Reach out for a personalized demo to see how Mosaic’s Metric Builder can help optimize your days payable outstanding and other key financial metrics.

Days Payable Outstanding FAQs

How is DPO different from Days Sales Outstanding (DSO)?

While both are crucial for understanding a company’s cash flow management, Days Payable Outstanding (DPO) and Days Sales Outstanding (DSO) are different financial metrics.

DPO measures a company’s average days to settle its bills and invoices. Essentially, the metric reflects the company’s ability to manage its payables. On the other hand, DSO calculates the average number of days it takes for a company to collect payments after making a sale, indicating the efficiency of its receivables collection.

So, while DPO focuses on the company’s payment to vendors, DSO is about collecting money from customers.

Why is DPO especially important for B2B SaaS startups?

Are there any external factors that might influence a company's DPO?

Explore Related Metrics

Own the of your business.