Customer Acquisition Cost (CAC)

What Is Customer Acquisition Cost (CAC)?

Customer acquisition cost (CAC) is the average amount of money a company spends to acquire a single new customer. It’s a core component of your unit economics and helps you understand how effective your sales and marketing functions are at attracting new business. When put in the right context, CAC can help investors understand the durability of your business model and factors into your valuation during any funding rounds.

Categories

Efficient growth is almost always the name of the game for VC-backed organizations. And while there are many different business metrics you can use to track growth efficiency, customer acquisition cost (CAC) is at the heart of many of them.

Understanding how much it costs to acquire a customer is the first step to getting strategic insight into your growth, profitability, and capital efficiency. CAC is a seemingly simple, often misunderstood, but nonetheless important metric. Here’s how to think about yours and how to put it in the right context for financial analysis and planning.

Want a CAC masterclass from Ben Murray, The SaaS CFO? Check out the full podcast episode.

Table of Contents

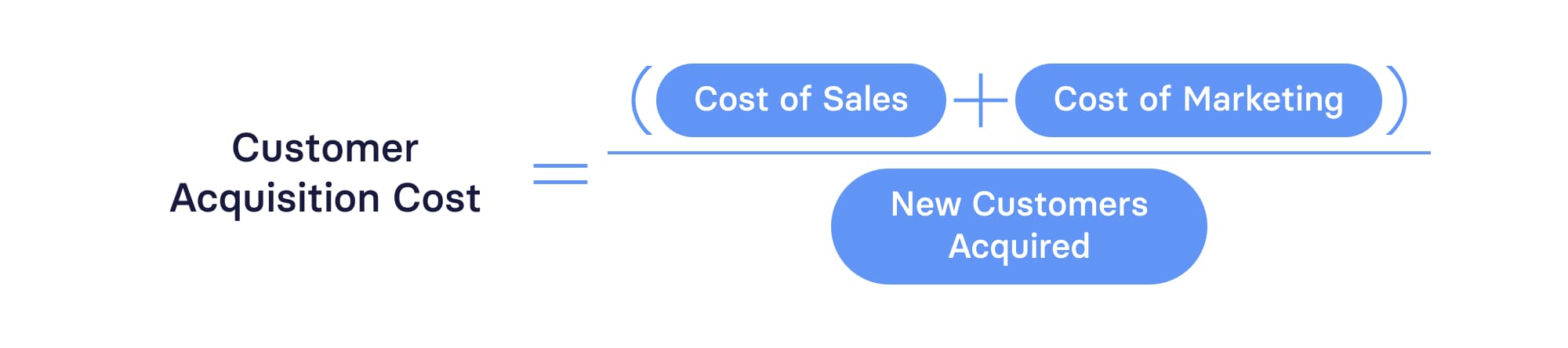

How to Calculate Customer Acquisition Cost

You can calculate CAC by taking the sum of all sales and marketing expenses and dividing it by the total number of new customers signed during the given period.

The formula for calculating customer acquisition cost is simple. However, it’s easy to get your calculation wrong. According to Ben Murray, The SaaS CFO, there are two nuances to the calculation that you can’t forget:

- Making sure CAC is fully-burdened. Don’t just include wages for your sales and marketing team in the CAC calculation. Roll in all relevant expenses, including wages, tax provision, benefits, travel, SEO, paid ads, swag, and everything in between, to get the complete picture of acquisition costs. And remember to include a percentage of executive wages if they’re involved in the selling process.

- Aligning sales cycle to the CAC period. Pay close attention to the length of your average sales cycle when deciding the right time period to use for CAC calculations. If you’re calculating CAC on a one-month time period, but your sales cycle is 50-60 days, you’re missing out on sales expenses that went into closing the relevant deals.

Examples of Customer Acquisition Costs

With the above nuances in mind, you can set up your formulas to get a true understanding of CAC. Consider this example calculation for a B2B SaaS company with a 30-day sales cycle.

You would add up the total costs of sales (including all payroll and benefits as well as any travel or additional expenses from sales) and marketing (including agency partner costs, PPC costs, social media advertising expenses, payroll/benefits, etc.) for a one-month period. Then, you’d divide that by the total number of customers signed in the period.

Another example to consider is an earlier-stage startup that is still doing founder selling and hasn’t quite built out its sales or marketing departments. You’d create an assumption for how much time the founders are spending on sales and marketing efforts — maybe 30% — and use that to determine the right payroll and benefits costs to include. Add in any marketing costs and divide the total to get your CAC.

Why Does CAC Matter?

Tracking CAC helps you understand not only how successful your sales team and marketing strategies have been at attracting new business but how scalable they are for future growth. If sales is only generating enough income to retain current customers, then you won’t have any money to spend on attracting new ones. And if marketing is spending more money to attract customers than booked new business, then you have a pretty big problem on your hands.

But CAC is only as valuable as the context you put it in. That’s why Ben Murray focuses more on the concept of a CAC profile as opposed to looking at acquisition costs in a vacuum.

When I talk about a CAC profile with my clients and when I’m coaching founders, I’m looking at a set of data to see, what does it tell me, what’s working, what’s not working within the business and not relying on just one metric.

There may not be a one-size-fits-all approach to looking at your CAC profile (it will depend on your business model). But these are the typical metrics you can add to CAC for deeper context about your business:

- CAC payback period. The amount of time it takes to recoup acquisition costs for the average customer. According to Murray, you can calculate CAC payback on both a logo basis and a dollar basis.

- CAC ratio. The cost of ARR on a dollar basis.

- SaaS magic number. A sales efficiency metric that shows how many dollars worth of revenue you create per dollar spent on sales and marketing.

- LTV/CAC. The ratio of a customer’s lifetime value compared to customer acquisition cost. This shows the ROI of new customers compared to what you spent to bring them in.

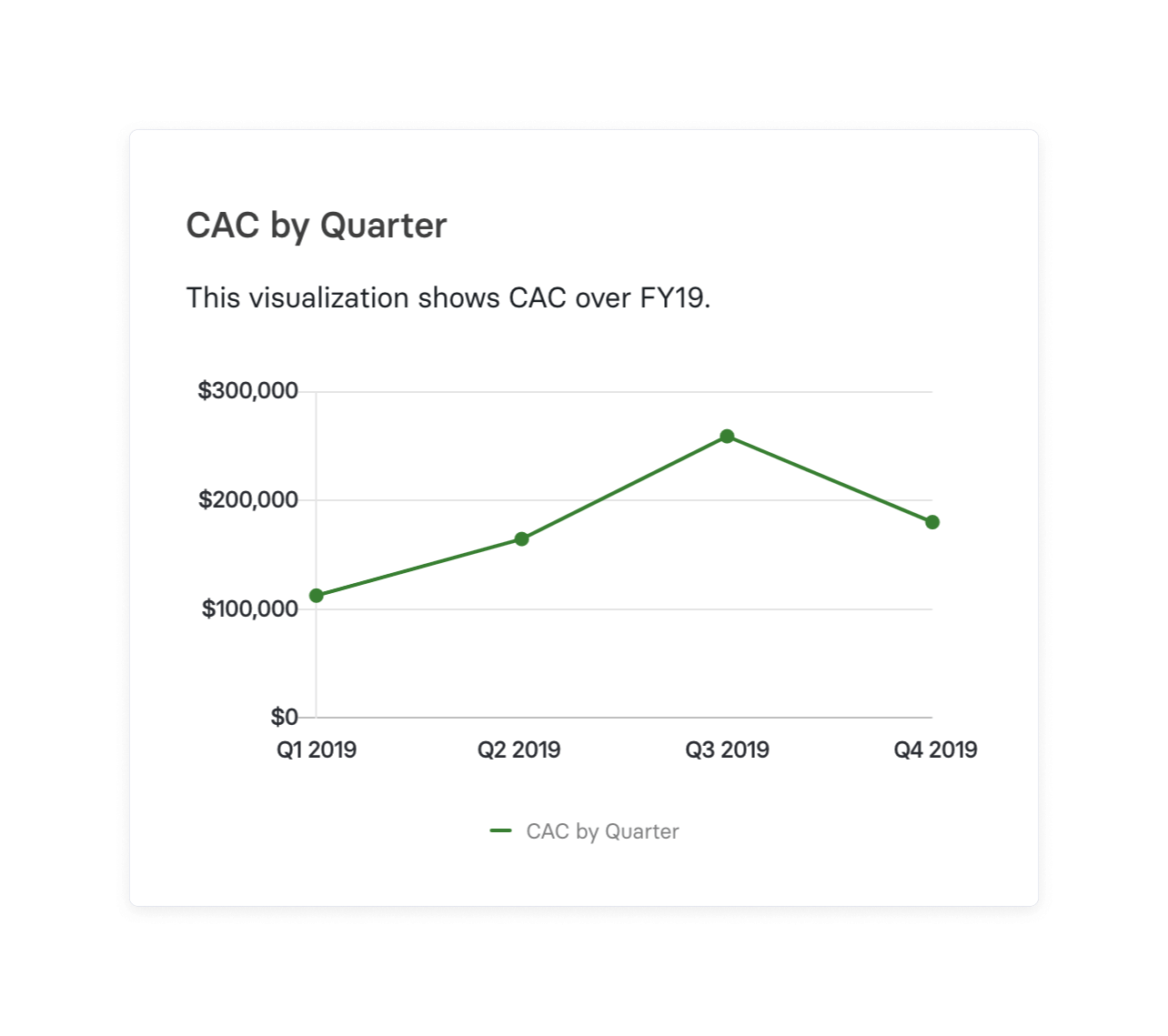

Tracking Customer Acquisition Cost: A Notoriously Difficult Task

At face value, the customer acquisition cost formula sounds simple enough. Addition and division. Pretty basic math skills. But when you start thinking about compiling all that data, things quickly become much more complicated. The data that feeds your CAC equation often lives in disparate systems and isn’t normalized. The employee salaries and commissions of your sales and marketing teams live in your HR system. Your advertising spend lives in your ERP. Your customer count lives in your CRM.

On top of that, you probably need to factor in some indirect costs of customer acquisition: Travel costs for sales reps meeting with customers (remember when that was a thing?). The cost of the software tools your teams use to track leads and engage customers. The price tags on related hardware and equipment. These costs live deep within your ERP, lumped in with the myriad other costs involved in running a business. And what happens when an affiliate or a non-marketing, non-sales employee is involved in booking business? Or, conversely, total marketing spend that is not expected to drive direct acquisition (e.g., brand strategy, product positioning, etc.)?

There’s no system that compiles, allocates, and calculates this data for you—it’s always been a people-powered metric and one that isn’t measurable or accessible in real-time. It’s usually something you can get eyes on quarterly—once a month if you’re lucky (and usually a few weeks after the end of the period).

4 Ways You Can Lower Your Customer Acquisition Cost

Benchmarks for customer acquisition costs don’t offer much value because there’s so much variance in the calculation. Having a high CAC isn’t necessarily bad if you’re selling high-ACV enterprise deals and your related operational KPIs are strong. If all you did was benchmark yourself against aggregate numbers, you might be comparing your CAC to those of companies with much smaller ACVs or higher-volume deals.

Instead of looking for the perfect benchmarks, focus on what you can control in your business. Here are a few ways you can lower your cost of acquisition.

1. Focus More on Customer Retention

Murray says to think about CAC as debt: “If you have poor retention, you’re putting all this money into CAC. You’re losing customers sometimes before they pay back CAC. Now, you’re relying on new customers to fund both those previous ones and the CAC for themselves.” If you’re struggling with churn, bolstering your CS department could help foster positive customer relationships to improve retention and make CAC more manageable.

2. Determine How Much You Should Spend on Ads

One of the easiest levers to pull for marketing expenses is your paid ads budget. Work closely with your partners to understand how much you spend on ads and your return on investment from past marketing campaigns. Build out models to better forecast ad spend and find ways to stretch those dollars further and improve ROAS.

3. Cut Back on Travel Expenses

Before the COVID pandemic, travel expenses were a major component of CAC. During lockdowns, teams had to find ways to sell without attending conferences or visiting target accounts in person. Can you find ways to limit travel expenses for the sales process now that the world has opened back up?

4. Balance Long-Term and Short-Term Marketing Spend

Not everything marketing does has the direct ROI of paid ads. But you still need to invest in those brand-building activities to strengthen the long-term pipeline. If you need to lower CAC, collaborate with marketing to limit the more experimental channels and double down on what’s showing promising value already.

Customer acquisition cost optimization depends on one thing — a deep understanding of what your CAC is and whether or not it’s good in the context of your business.

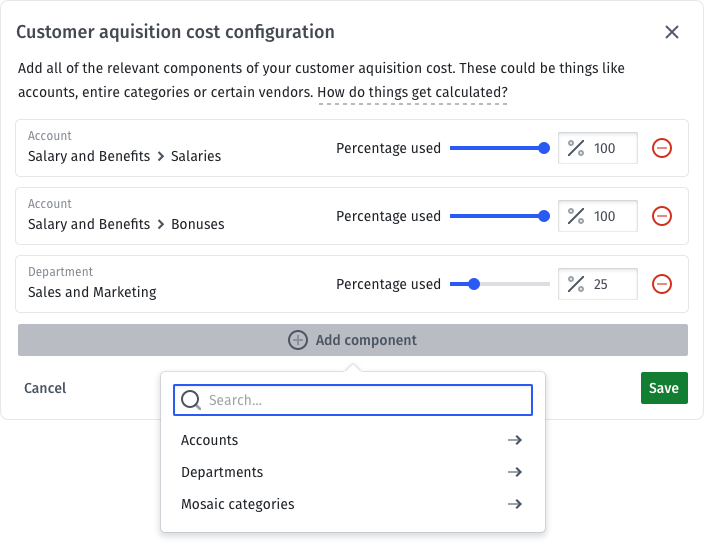

How to Track Customer Acquisition Cost More Easily & Efficiently

Mosaic’s platform is connected to all the key data sources that power your CAC calculation. Clear, simple dialog and intuitive components allow you to configure exactly what is included in your customer acquisition cost without the many dreaded hours of manual data manipulation or Excel magic.

Mosaic also allows you to build forward-looking models, which let you see what will happen to your CAC if you increase your advertising spend or hire more sales reps. Now you can adjust your marketing and sales budgets to strategically respond to business needs without feeling like you’re writing a check in the dark.

Fine-Tune & Automate CAC Calculation

The Bottom Line

Understanding your conversion rate and how much it costs to convert potential customers is essential to understanding how efficient your sales and advertising costs are. Mosaic integrates with your HR, CRM, and ERP systems to aggregate and normalize your dispersed CAC data.

Once connected, you can check in on your customer acquisition costs any time you like and then make informed, data-driven plans around what you see, ensuring your teams, programs, and budgets are set up for success. Request a personalized demo to see Mosaic in action.

Customer Acquisition Cost FAQs

How can you project CAC?

You can use a software solution like Mosaic to calculate and track CAC and build forward-looking models to project CAC based on sales rep activity and activations across marketing channels. Custom dashboards and templates allow you to gain the financial insight required to lower CAC as well.

What should be excluded from CAC?

What is the formula to calculate CAC?

Explore Related Metrics

Own the of your business.