Cash Inflows And Outflows

What Are Cash Inflows and Outflows?

Cash inflow is the money going into a business which could be from sales, investments, or financing. It’s the opposite of cash outflow, which is the money leaving the business. Knowing how to calculate and analyze both of these SaaS financial metrics helps you make better-informed strategic decisions and capitalize on your limited resources.

Categories

Table of Contents

Cash Inflow and Outflow Examples

While cash inflows typically include revenue from sales of products or services, investment returns, and financing, it’s important to recognize the nuances and additional sources that can help a company’s liquidity:

- Customer Prepayments: Prepayments for orders or long-term contracts improve cash flow immediately and provide early working capital before delivering services or goods.

- Government Grants and Subsidies: For businesses in certain industries or those contributing to economic development projects, grants and subsidies can be significant cash inflows that do not require repayment.

- Royalties and Licensing Fees: Companies leveraging their intellectual property can receive ongoing inflows from royalties and licensing, offering a continuous cash source without the need for physical inventory or services.

- Free Cash Flow (FCF): The cash remaining after funding operating expenses and capital expenditures, indicating the company’s ability to generate surplus cash from its operations.

Cash outflows extend beyond the obvious operational expenses, debts, and asset purchases to include strategic outlays that, while reducing liquidity in the short term, are investments in the company’s future:

- Research and Development (R&D): Investment in R&D may seem like a luxury, but for technology and biotech firms, it’s a necessity for innovation and staying ahead of the competition.

- Market Expansion: Costs associated with entering new markets or launching new products are substantial cash outflows but are critical for growth.

- Capital Expenditures (CapEx): Investments in new technology, machinery, or facility upgrades may deplete cash reserves but ultimately lead to increased production capacity and efficiency.

Why Managing Cash Inflow and Outflow Is Important

Cash inflow and outflow represent your business’s fundamental financial position.

Because cash is the lifeblood of any business, understanding your cash inflows and outflows is critical for operational finance and managing day-to-day activities.

To build a business that can profit in the long term, you need to know that your inflows will ultimately exceed outflow. When you have more cash entering your business than leaving it, this is known as positive cash flow. Conversely, negative cash flow means you have more outflow than inflow.

If you have positive cash flow, this is a good indicator that you have enough cash to invest in business growth and pay shareholders without taking on excessive debt. This is crucial for mature VC-backed startups and public companies that have to show they can run efficiently while still growing.

Negative cash flow, in contrast, means that you’re spending more money than you’re taking in. For growth-at-all-costs startups, this is often the norm. That’s why a high-level view of cash inflows and outflows isn’t enough. What you really want is deep insight into the breakdown of cash inflows and outflows so you can continuously improve efficiency and map out more strategic growth plans.

Types of Cash Flow

Your company’s cash flow results from three types of activities, each of which can break out into both inflows and outflows:

- Operating

- Investing

- Financing

Operating Activities

Cash flow from operating activities refers to cash entering or leaving your business as part of your regular business activities, namely the creation and sale of your products and services.

Inflow from operating activities includes the net income you generate from the sale of goods/products and services, inventory, and accounts receivable.

Conversely, outflow refers to the day-to-day costs associated with your business, such as the cost of production, rent, sales and marketing, income tax, and wages paid to employees.

Investing Activities

Cash flow from investing activities includes the movement of money associated with your company’s investments. You can have short-term investments, such as the purchase of marketable securities, or long-term ones, like buying new equipment or buildings.

The purchase of any investment counts as cash outflow. In other words, a certain amount of cash is leaving your business in exchange for the investment. If you sell a long-term asset, such as a piece of equipment, then that generates cash inflow.

In many cases, it’s common to see more outflow than inflow in the investing category. Growing businesses are more likely to invest in long-term assets that support business growth.

Financing Activities

Finally, you have cash flow from financing activities, which includes funding rounds, loans, stock sales, dividends, and long-term debt payments.

In the financing category, cash inflow includes the amount of money that you borrow and income generated by selling stock or equity. Cash outflows refer to dividend payments and the funds used for principal repayment of the principal amount on existing debt.

Keep in mind that cash outflow for interest payments is recorded as an operating activity, not financing on a balance sheet.

How To Calculate and Report Cash Flow

The most basic form of cash flow reporting is the standard cash flow statement (or statement of cash flows).

A cash flow statement is divided into three sections, one for each activity type. You record cash inflows as positive amounts (credits) and cash outflows as negative values (debits) in each section. Then, you have your net cash flow for each activity and your business as a whole.

In addition to cash expenses and receipts, the cash flow statement includes credit or debit purchases, changes in the value of current assets (such as depreciation), and dividends.

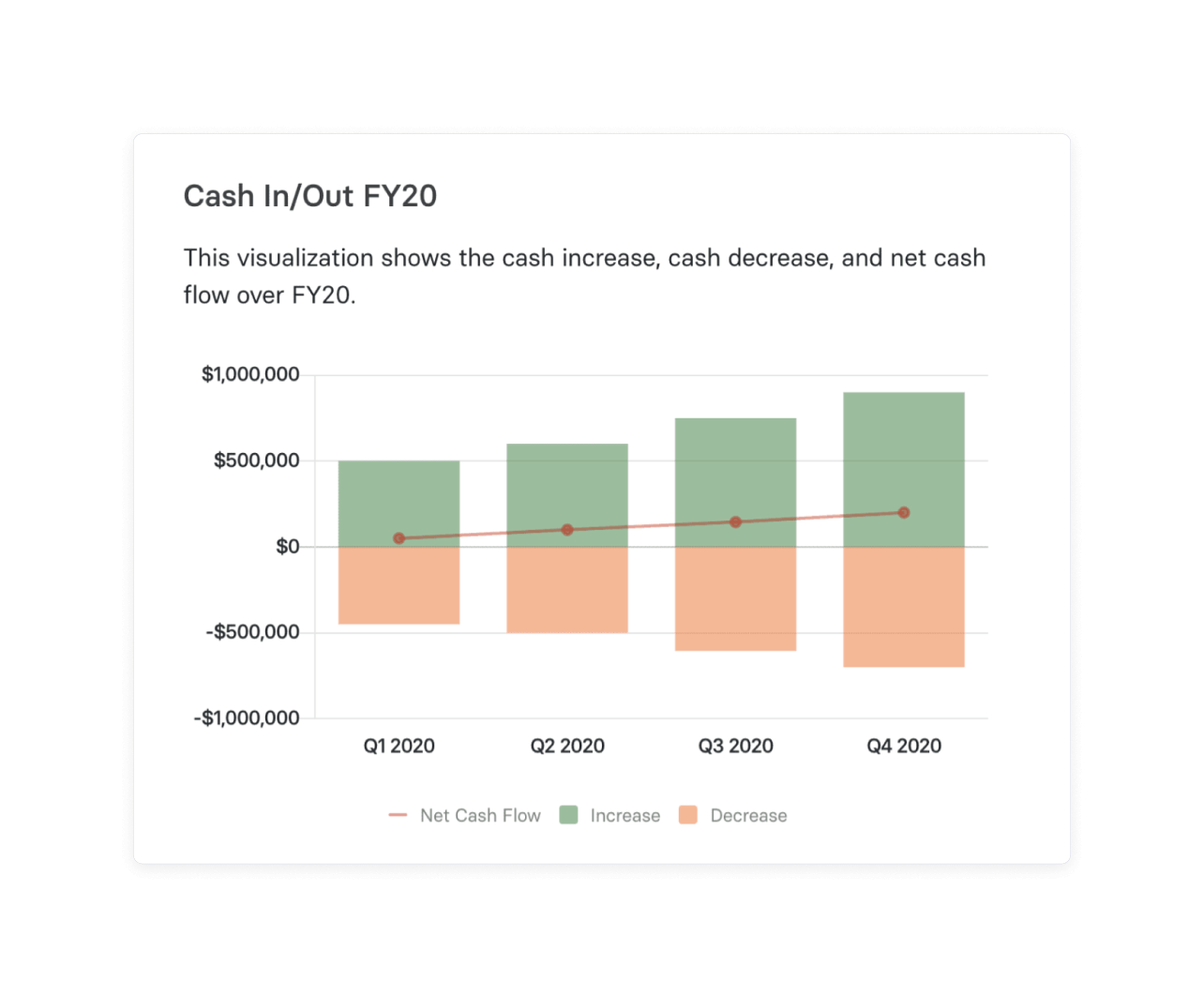

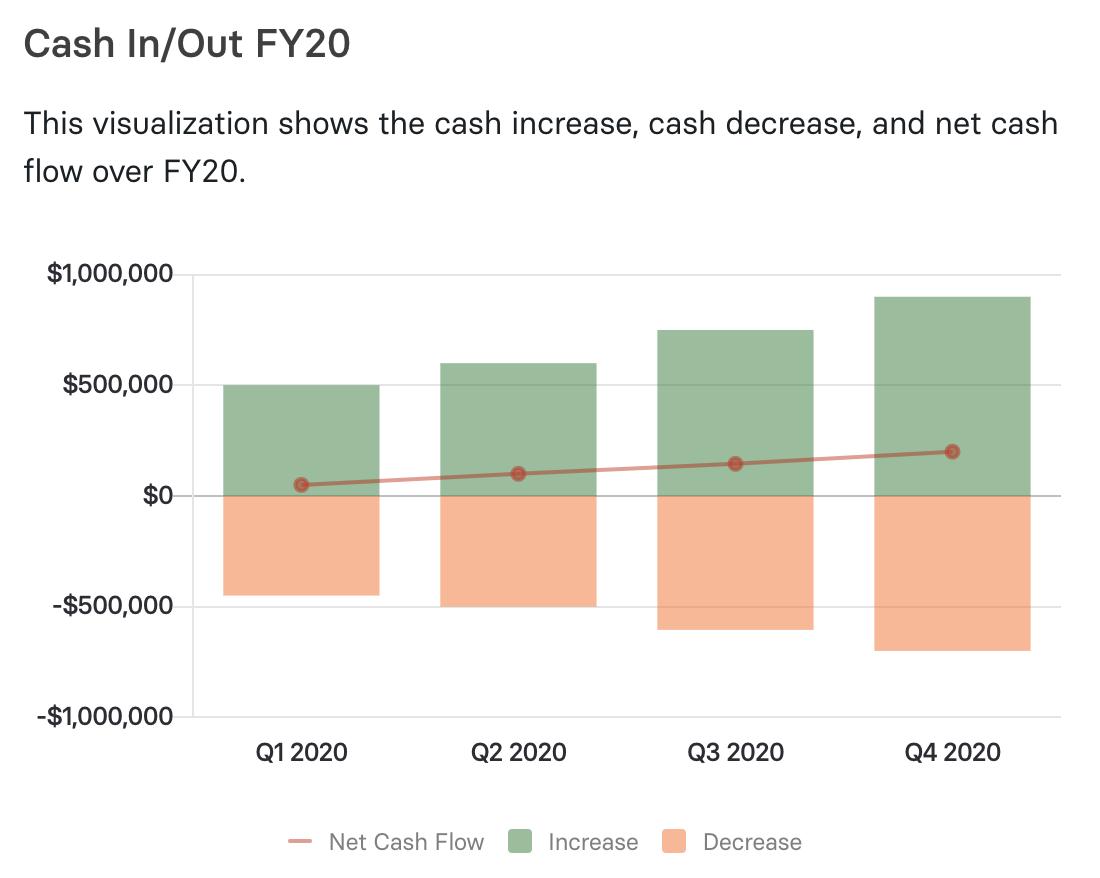

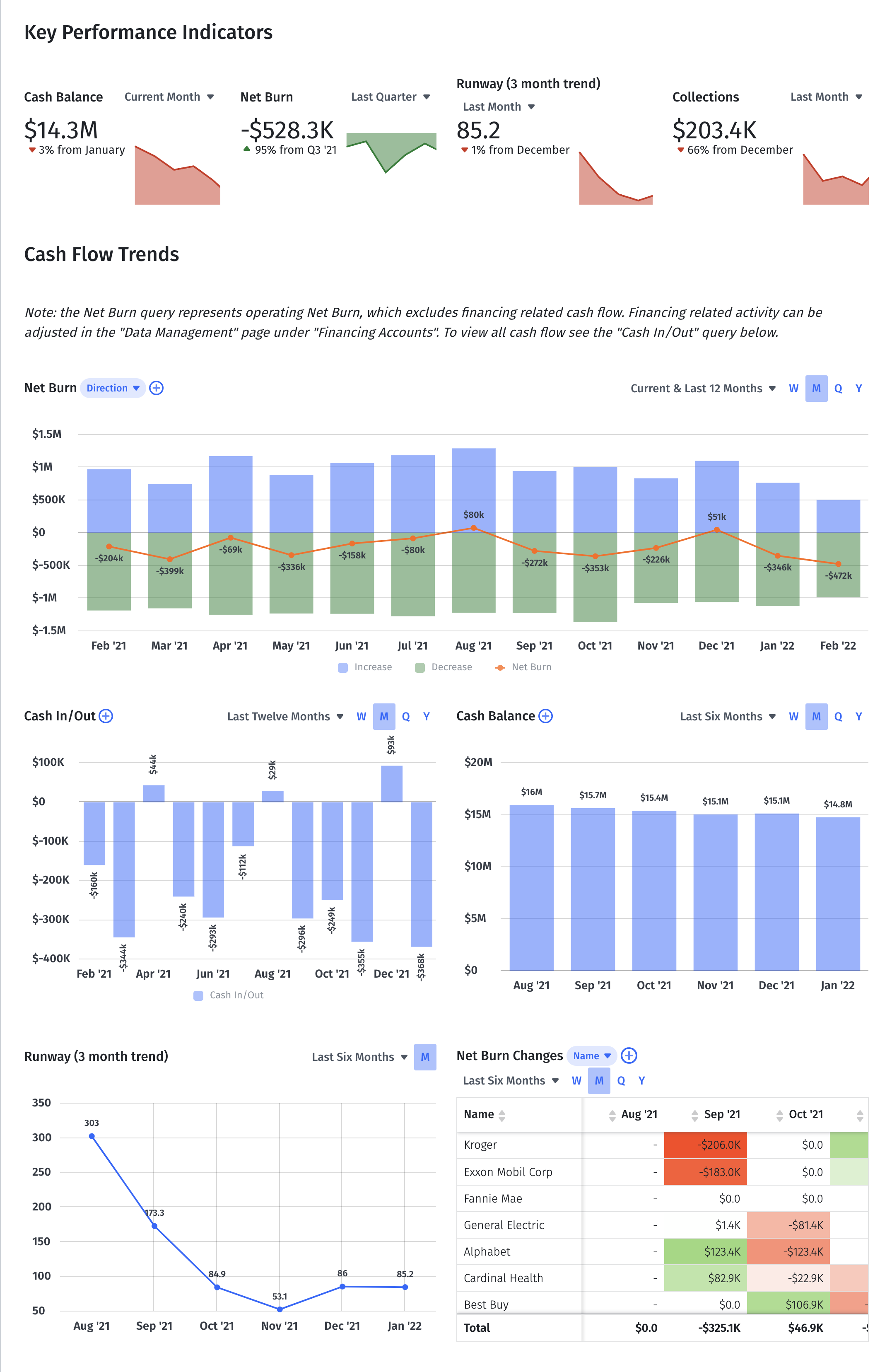

Alternatively, you can use financial analytics software to visualize your cash inflow and outflow over time. In Mosaic, open your Cash Inflows and Outflows report to see a graph of the money flowing in and out of your business and a line representing your net cash flow over a given period of time.

Using software to perform financial and budget analysis empowers you to generate rolling forecasts and take a more agile approach to your money management because it gives you real-time data.

More established organizations may be satisfied to look at cash flow statements monthly and quarterly. But for high-growth companies focused on maximizing runway and stretching VC funds as far as possible, cash flow analysis is often more frequent.

More established corporations might be able to draw up a cash flow statement once a quarter, but it’s not the same for startups with a limited runway and higher stakes.

Factors That Affect Cash Flow

Cash touches every aspect of your business, so it makes sense that several factors can affect your cash flow.

Here are some of the business functions that have the most direct impact on cash flow:

- Accounts receivable. Too many outstanding receivables can slow the money coming into your business and negatively impact cash flow. It’s important to closely monitor accounts receivable metrics, so you can identify overdue payments and work to find a resolution quickly.

- Accounts payable (AP). Paying vendors on time helps create smooth cash flow. But, if you have poor AP management, you can rack up late fees and damage vendor relationships, making it harder to negotiate better buying terms. Tracking key AP metrics can help you prevent these issues and optimize your payables process.

- Headcount. Headcount is the biggest expense for any SaaS company. As your company scales, you have to plan for payroll to significantly outpace any other cash outflow you have to manage.

- Cost of revenue. Ramping sales and marketing expenses is crucial to hitting significant revenue goals. In the short term, how much you spend on ads will impact cash flow. But your cash flow analysis should also include longer-term projections of how those ads turn into revenue.

- SaaS pricing and cost of revenue. SaaS pricing strategy isn’t a perfect science, but you should price your products and services in a way that optimizes cash flow. If your prices are too low, you may not have enough cash inflow to support growth.

6 Tips for Improving Your Business Cash Flow

Improving cash flow can mean increasing positive cash flow or changing negative cash flow into positive. To do so, you must increase cash inflows, reduce cash outflows, or both.

Here are some top strategic finance tactics you can use to improve your business’s cash flow and open up more resources for growth.

1. Improve Accounts Receivable Processes

In addition to changing your terms, look at your billing procedures and see if there are any payment obstacles you can remove on your end. Specifically, ensure that you’re sending invoices out promptly and giving your customers enough time to review and pay.

Finally, accepting online payment forms, such as credit, debit, and ACH deposits, can reduce late payments associated with mailing checks. SaaS companies can benefit from setting up recurring payments to avoid chasing down customers and reminding them about payments.

2. Tailor Your Cash Flow Forecasts

Cash flow forecasting uses your existing cash flow to help you predict future bank balances. When you’re managing the finances for a startup, you need to approach cash flow forecasting differently.

For example, you need to focus on short-term cash flow as well as long-term. Short-term cash flow reports let you see how you manage your limited runway in real-time. With Mosaic, you can access this information easily on your financial dashboard..

CEOs and CFOs should take an active role in watching over cash flow trends so they can improve money management and optimize their limited resources. This way, cash flow becomes a forward-looking strategic tool, not just another element of financial analysis after the fact.

3. Lease Instead of Buying

Buying property and equipment may be cheaper in the long run, but it requires more capital upfront. Even if you finance your purchase, many banks and lenders require down payments of 20% to 30%.

This might not be a deal-breaker for more established businesses, but many small businesses and new startups need to be very strategic about their cash flow at the beginning.

When you lease, you get the same equipment for a smaller initial cost, and you can negotiate terms to lower your monthly expenditures. Doing so reduces your cash outflow and leaves more money in your business to use for operating expenses.

Modern CEOs and finance departments should consider cash flow, as well as bottom-line savings when determining their budgets.

4. Incentivize Early and On-Time Payments

Late payments from customers can put a strain on your cash flow. Your suppliers won’t extend your payment dates just because you’re waiting on your accounts receivable.

If your customers don’t consistently pay on time, consider changing your payment terms. Try offering early payment discounts or creating clauses in your contracts that penalize late payments

5. Pay Vendors Electronically

Same-day transactions are better for your cash flow, especially in your accounts payable department. It’s better to know that your account will be debited the same day you make a payment instead of waiting for your supplier to cash a check after it arrives in the mail.

Leverage credit and debit payments for your expenses to improve your overall financial efficiency. As an added benefit, you may be able to take advantage of early payment discounts, reduce late fees, and even earn cashback rewards from your credit card provider.

Plus, when you’re known as a customer who always pays on time, you have the leverage to renegotiate better terms with your suppliers.

6. Adjust Your Pricing Strategy

Sometimes you’ve done everything you can to reduce expenses, but you can’t achieve positive cash flow, or you don’t have enough on hand to invest in growth.

In that case, it may be time to reevaluate your pricing strategy. This might mean increasing prices or charging for features and services you’ve been providing for free.

According to CB Insights, 15% of startups fail because of pricing or cost issues. This might not seem like a lot until you realize that poor pricing kills more startups than bad teams, wrong timing, and inferior products.

It may be tempting to stick with freemium models to help with customer acquisition, but if you want to grow your business, you need to be comfortable charging in accordance with the value you provide.

Improving Cash Inflow and Outflow Is All About Visibility

Running a business without checking your financials is like a doctor trying to select a treatment without taking their patient’s vitals.

CEOs and CFOs who understand the business’s cash flow are crucial for startups, small businesses, and enterprises alike. Discovering how money enters and leaves your business by tracking cash flow metrics in real-time can be the difference between securing another round of funding and throwing in the towel.

For more information on financial intelligence dashboards that cut down data aggregation times and deliver powerful insights faster, get a personalized demo of Mosaic.

Manage Your Cash Flow with Strategic Finance Software

Cash Inflow and Outflow FAQs

What is cash flow management?

Cash flow management is the practice of conducting regular cash flow analyses to stay on top of your business’ cash position. It allows business owners and finance leaders to make important business decisions based on their company’s financial health.

What is operating cash flow?

What is the difference between cash inflow and cash outflow?

Explore Related Metrics

Own the of your business.