Categories

Table of Contents

What is Operating Income?

Operating income measures a company’s profit (also known as operating profit) from core business operations.

Operating Income Formula

You can calculate operating income by starting with your gross profit and subtracting operating expenses (OpEx), depreciation, and amortization:

where

- Gross Profit = Total Revenue minus cost of goods sold (COGS)

- Operating Expenses = Selling, general, and administrative (SG&A) expenses

- Depreciation Expense = Depreciation cost of assets for the given period

- Amortization = Amortization expense for the given period

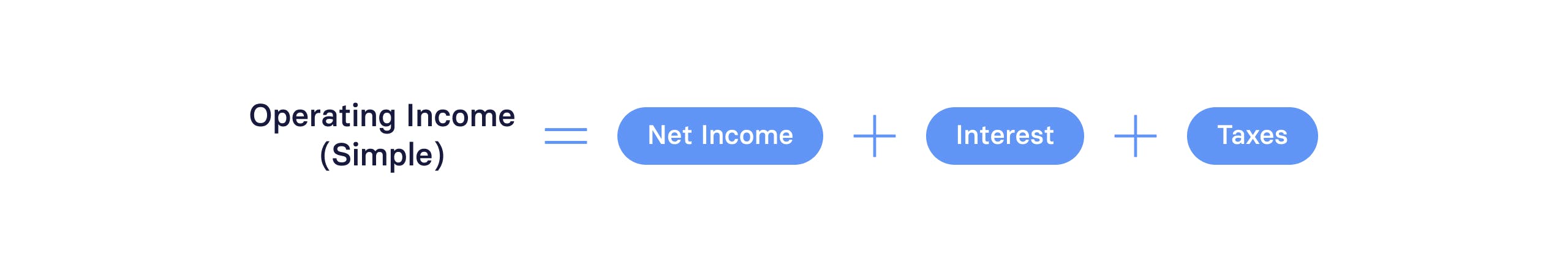

You can also work backward from your bottom line (net income) to calculate operating income.

However, keep in mind that operating income doesn’t account for non-operating income, such as interest earned on loans, investment gains, or the sale of assets (like real estate or machinery).

So, if your company has non-operating income, you’ll have to subtract that from your net income before you add back non-operating expenses (interest and taxes).

You can do so using the following formula:

Operating Income = (Net Income – Non-Operating Income) + Interest + Taxes

where

- Net Income = Net profit

- Interest = Interest expense on business loans

- Taxes = Business taxes (such as income tax)

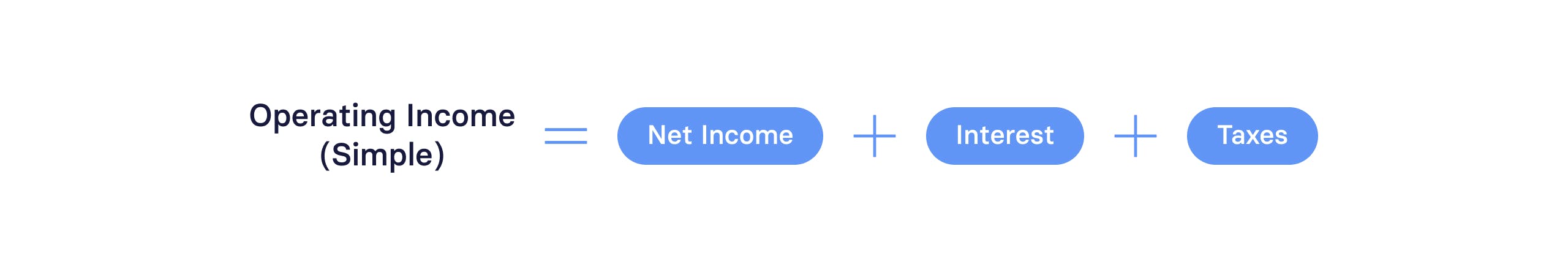

If you don’t have any non-operating income, the formula will simply be:

Operating Income Example

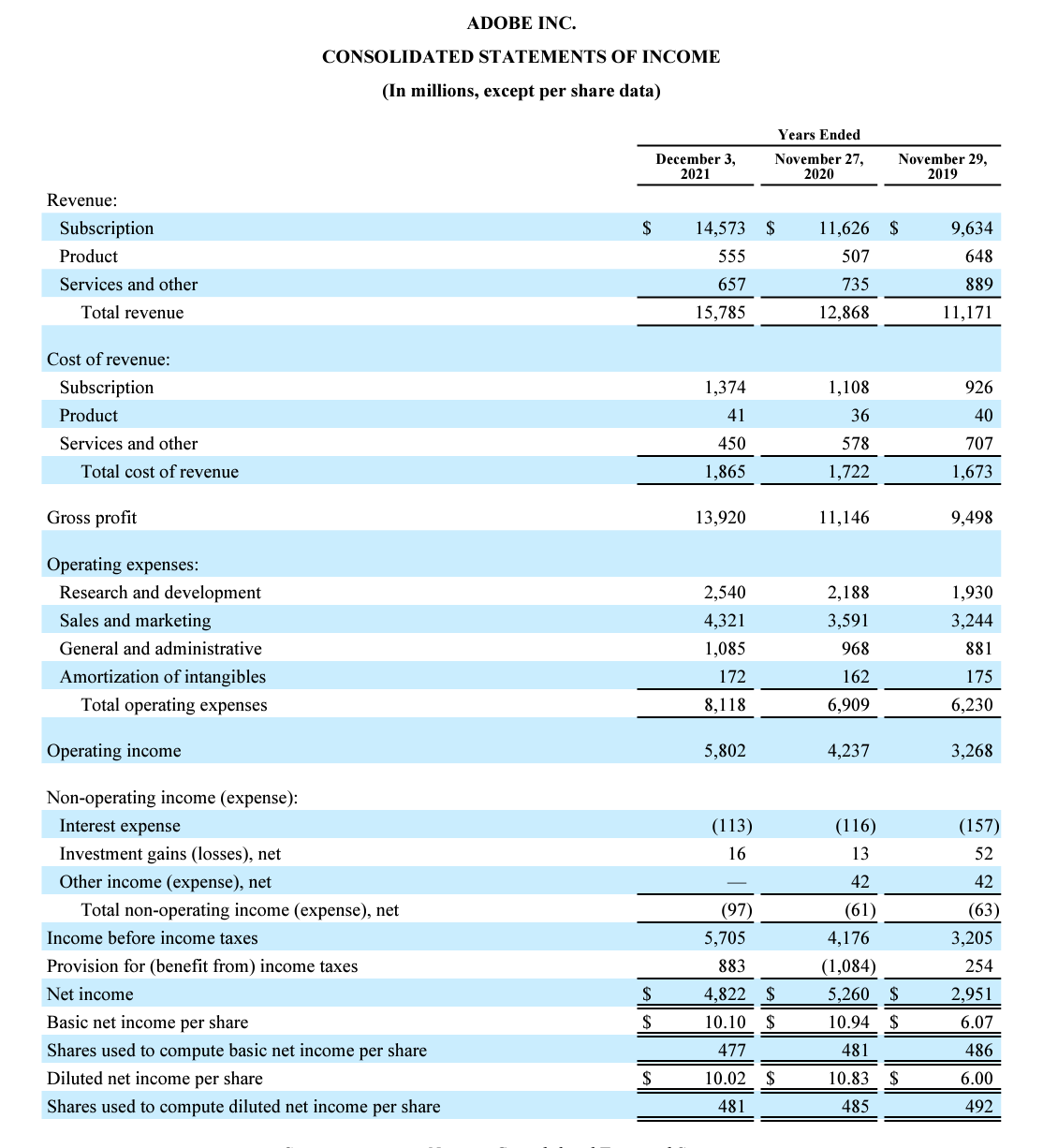

To get a better idea of how operating income works, let’s consider an example by looking at the annual income statements for Adobe.

For the fiscal year 2021, Adobe reported an operating income of $5.802 billion. Let’s use the operating income formula to see how they arrived at that number.

Operating Income = Gross Profit – Operating Expenses – Depreciation – Amortization

According to their income statement, Adobe had a gross profit of $13.920 billion and total operating expenses of $8.118 billion (which includes $172 million in amortization of intangibles). The company doesn’t list any depreciation expenses.

So, when we plug those numbers into the formula, we get:

Operating Income = $13.920 billion – $8.118 billion = $5.802 billion

How To Interpret Operating Income

While net income is a measure of a company’s earnings or losses after accounting for all expenses and sources of income, operating income helps you figure out how much of the total amount of profit comes from core business activities (i.e., your company’s operations).

For instance, we can see that Adobe has a $5.802 billion operating income from selling its products and services.

However, after adding non-operating income (investment gains) and subtracting interest and tax expenses, the company’s net income was $4.822 billion.

As you can see here, operating income is typically higher than net income. In Adobe’s case, its net income still shows it made close to $5 billion. Its income and tax expenses didn’t significantly impact its net income.

However, for small businesses and startups, the difference can be significant. This is especially true for companies still heavily leveraged and paying off earlier financing.

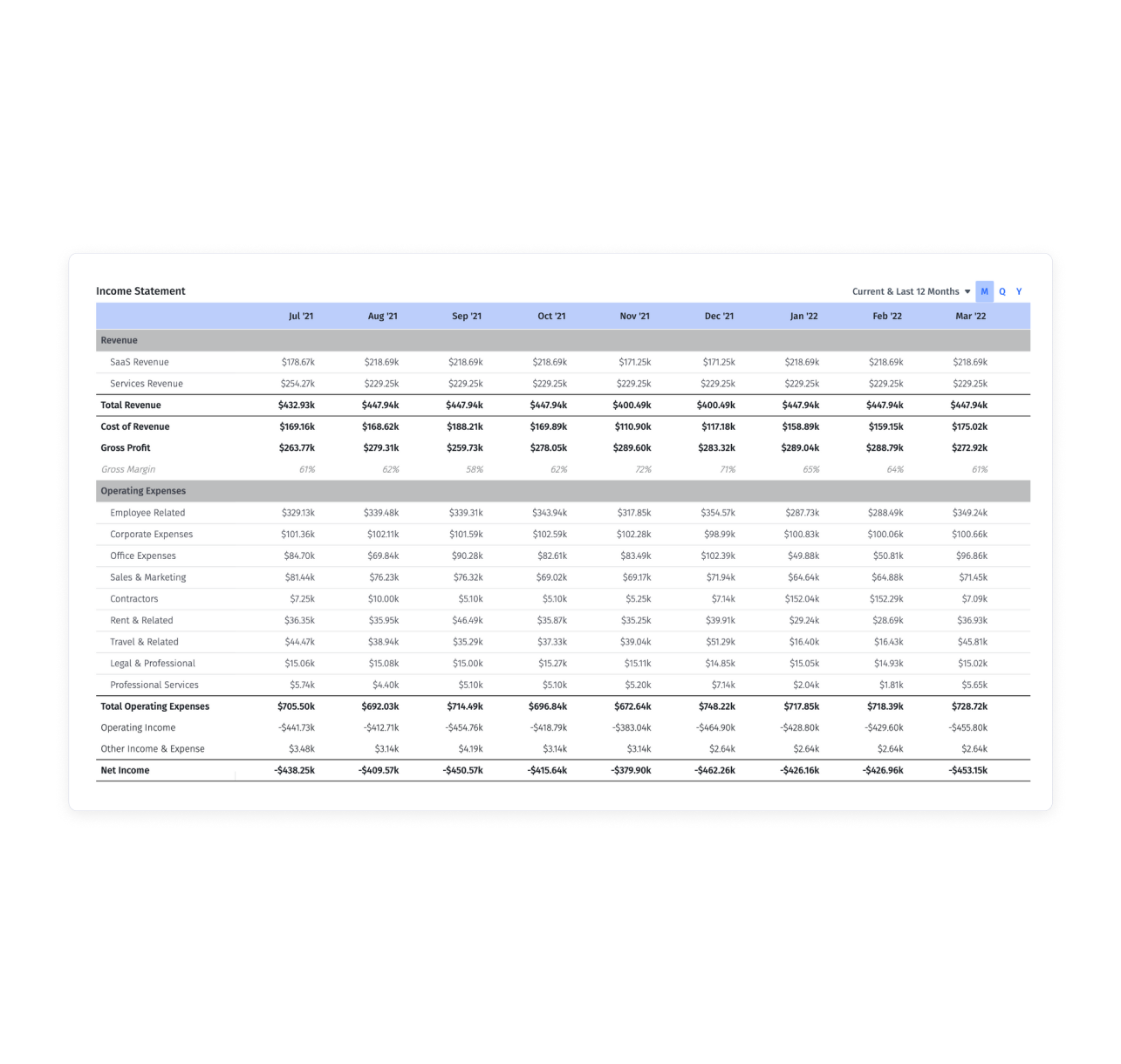

For example, let’s say you have the following financial performance records:

- Operating income: $100,000

- Interest expense: $70,000

- Tax expense: $40,000

Your operating income shows that the core business generated a $100,000 profit. But, after paying interest and taxes, you’ll have a net loss of $10,000.

By including operating income in your pitch deck, you can show potential investors that the core business is profitable despite having a net loss due to interest and tax expenses.

Also, you can use operating income for calculating other operating KPIs to understand your business’s performance and make strategic decisions.

For instance, you’ll get the operating profit margin if you divide operating income by total revenue. It tells you how much profit you make for every dollar of sales, which gives you information about the efficiency of the production and core operations.

Advantages of Operating Income

Operating income is an excellent way to understand whether your core business is viable. A positive operating income tells you that the core business has broken even.

In other words, it generates enough revenue to cover the cost of goods sold and operating expenses. You can also see how well your business manages overhead by comparing operating income to gross profit.

Disadvantages of Operating Income

By itself, operating income doesn’t provide a complete picture of profit. Your core business can be profitable, but you may have a net loss if your interest and tax expenses are high.

Another disadvantage is that it doesn’t account for non-operating income streams, such as investments. It’ll not tell you how much your business made (or lost) once all income sources and expenses are considered.

What Is EBITDA? (+ Formula and Examples)

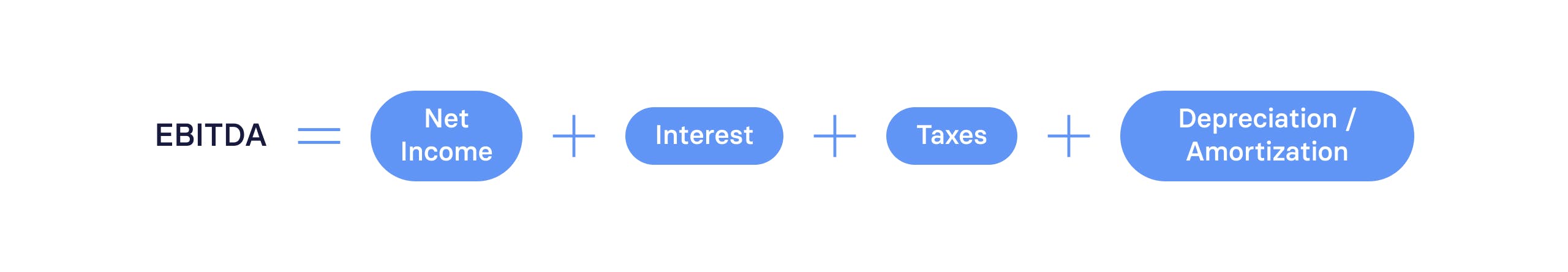

EBITDA measures a company’s ability to generate profit without subtracting key financial liabilities. To calculate a company’s EBITDA, we start with net income and add back several expenses, namely interest, taxes, depreciation, and amortization.

The net income is calculated as total income minus total expenses. It includes both operating and non-operating income. In other words, it considers the revenue generated by sales as well as income earned through non-operating activities, such as investment gains or the sale of an asset.

EBITDA Formula

where

- Net Income = Total income minus total expenses

- Interest = Interest expense on business loans

- Taxes = Business taxes, such as income and employer taxes

- Depreciation Expense = Depreciation cost of assets for the given period

- Amortization = Amortization costs for the given period

EBITDA Example

Unlike operating income, EBITDA is not an official measurement of the Generally Accepted Accounting Principles (GAAP), which means that companies are not required to disclose this number on their financial statements. However, you can calculate it using the numbers available on those statements.

Let’s see how this works by looking back at Adobe’s income statement.

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

EBITDA = $4.822 billion + $113 million + $883 million + $0 + $172 million

EBITDA = $5.99 billion

How to Interpret EBITDA

Financial analysts and potential investors often use EBITDA to compare earning potential between companies. Interest, taxes, depreciation, and amortization are excluded in this case because they are unrelated to the cost of production or sales.

Investors also use EBITDA to see how much cash companies have available to pay off their debt, which is especially relevant for small businesses and startups.

If we compare the various profit estimates for Adobe, we have:

- Net income of $4.882 billion

- Operating income of $5.802 billion

- EBITDA of $5.99 billion

Looking at these three metrics, we can see that the EBITDA calculation provides the most optimistic measurement of Adobe’s profit. This is usually the case since it includes non-operating income and adds back most expenses.

EBITDA is often the starting point for financial analysis. After calculating it, you can calculate the EBITDA coverage ratio, which tells you how much capital a business has available to pay off its liabilities. Similarly, you can use it as a valuation method for post-revenue startups.

Also, you can use the EBITDA margin, which is calculated as EBITDA divided by total revenue, to compare one business to another and see which one has more growth potential.

Advantages of EBITDA

Compared to the net and operating income, EBITDA can make your company look more profitable, resulting in a higher valuation.

It’s also commonly used by investors and financial analysts since it helps them compare the earning potential of businesses with different debt and tax situations.

Disadvantages of EBITDA

The primary drawback of using EBITDA is that it can significantly overstate a company’s profitability, especially if the business is highly-leveraged.

Furthermore, it doesn’t differentiate between operating and non-operating income sources. Due to this, EBITDA isn’t a reliable metric for understanding whether or not your core business is profitable.

When To Use Operating Income vs. EBITDA

Understanding profit is essential for business owners and investors. The question becomes: Which metric should you use?

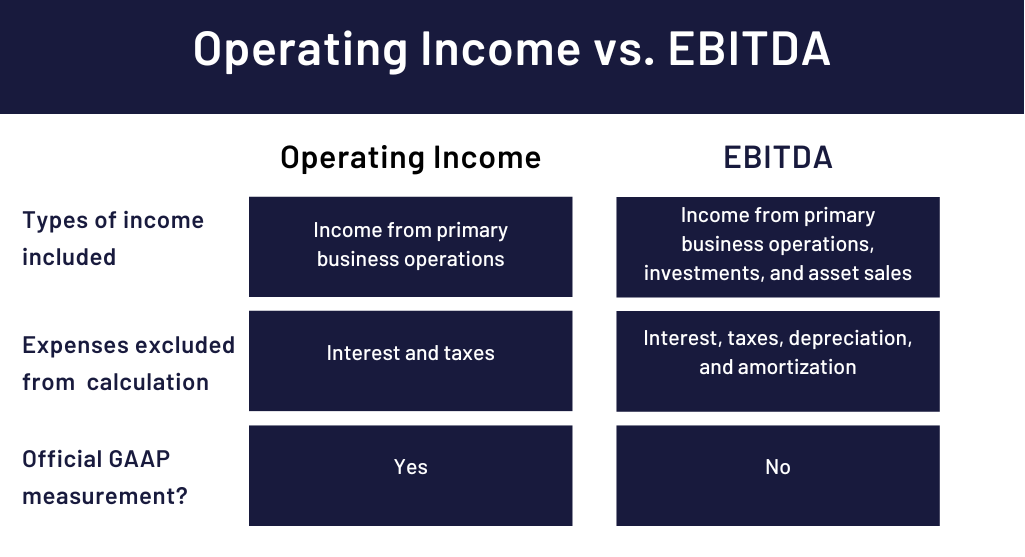

Before we dive into that, let’s take a quick look at the key differences between the two.

In essence, both operating income and EBITDA give you information about a company’s profitability from different angles.

Operating income tells you whether or not the core business is profitable. It’s useful for determining the viability of your product or service in the market.

Not to mention, the operating income is used to calculate some of the most important financial ratios to analyze a company, such as operating profit margin. These numbers tell you how much of your total revenue gets turned into profit.

EBITDA looks at the profit-generating ability of the entire company. Specifically, it provides insight into the company’s ability to earn money using all its income sources, including revenue and investments.

If you’re a startup founder or small business owner, operating income may provide you with more relevant information about your business, such as when you turn a profit and how that number grows over time.

Additional Performance Metrics To Track

Ultimately, no single metric can summarize your company’s financial health and business performance. Let’s look at some other essential metrics to track and see what they tell you.

- Sales performance metrics (such as average deal size and conversion rates) tell you how efficiently your sales reps work. In particular, conversions are helpful for revenue forecasting since they tell you how many leads you need at the top of the funnel to meet your sales goals.

- Rule of 40 (sum of growth rate and profit margin) accounts for the growth rate and profitability and gives you insight into how well your company can sustain its performance.

- Cash flow metrics (such as net burn and runway) support SaaS financial modeling, and tell you your operating costs and how much it takes to keep your company running.

By tracking sales performance, growth, and profitability over time, you get a much better picture of the health and potential of your business.

Tracking Your Operating Income With Mosaic

According to the 2022 survey we conducted with RevOps Squared and The SaaS CFO, only 6% of companies say they can have performance metrics ready in one day. The number one challenge with metrics calculation is using a manual process to calculate and track performance, which affects 69% of the companies that responded.

Financial tracking software, like Mosaic, lets you access real-time financial metrics whenever you need them. If you’re interested in a strategic finance solution that helps you make more data-driven decisions for your business, explore Mosaic today.

Operating income vs EBITDA FAQs

Which is higher: EBITDA or Operating Income?

Typically speaking, EBITDA should be higher than operating income because it includes income plus interest, taxes, depreciation and amortization. EBITDA offers a more holistic view of company profitability while operating income only takes into account core operations.

What is the Rule of 40 and how can it help a company increase growth and profitability?

How are EBIT and EBITDA different?

What is tax provisioning?

Explore Related Metrics

Own the of your business.