Gross Profit

What Is Gross Profit?

Gross profit refers to your earnings after subtracting the cost of your revenue, otherwise known as the cost of goods sold (COGS). COGS and SaaS cost of revenue include the cost of your raw products and any costs directly associated with the production. It doesn’t include overhead — rent, utilities, and other administrative costs — and marketing expenses.

To determine if you should include an expense in COGS, ask whether you’d have that expense if you stopped selling products tomorrow. If the answer is yes, it’s likely not a cost of revenue.

Categories

Table of Contents

How To Calculate Gross Profit

Your gross profit, sometimes known as gross income, is calculated as sales revenue minus the cost of goods sold (COGS), also known as cost of sales.

For a SaaS business, sales revenue (or net sales) typically includes income from subscription fees and other add-on features. It doesn’t include money from non-business activities (like the sale of an asset) or from outside investment.

COGS, as mentioned above, includes the product- or service-related costs. For example, if you sell only digital products and services, your cost of goods sold will include costs of:

- Servers and cloud storage

- Hosting applications

- Software licenses and subscriptions

For companies that sell physical goods, COGS will also include raw material costs, labor costs, production costs, and other expenses to deduct from your company’s revenue.

When calculating gross profit, you don’t include overhead costs, interest expenses, or taxes.

What Is Net Profit?

Net profit, or net income, measures your company’s actual profit vs revenue after accounting for all positive and negative cash flows.

Positive cash flows include your sales revenue plus additional income sources, such as investments or money earned from the sale of an asset. Negative cash flows are all of your expenses, such as the cost of goods sold, cost to serve, loan interest, tax provisions, and one-time fees or payments.

Net profit is also referred to as the bottom line since it’s the last line on a company’s income statement.

How To Calculate Net Profit

To calculate net profit, you start with total revenue (also known as your top line), add all positive cash flow amounts, and subtract all negative cash flow amounts.

Here, total revenue includes all streams of revenue. You’d include both your revenue from sales and income from investments.

Similarly, total expenses account for all your company’s expenses — whether product-related or administrative and operating costs.

Gross Profit vs. Net Profit

Your company’s gross profit considers your revenue and direct costs related to your product, while net profit measures how much money your business makes overall.

Here’s a look at the key differences when comparing gross profit vs. net profit.

| Gross Profit | Net Profit | |

|---|---|---|

| Metrics considered | Income and expenses directly related to the product | All business income and expenses |

| What it measures | A company's ability to efficiently build and produce products | A company's overall ability to turn a profit |

| How to use it | Assess development and sales efficiency and the continued ability to turn a profit | Assess the overall financial health of an organization by looking at the bottom line |

What Gross and Net Profit Tell You About Your Business

Gross profit and net profit both provide valuable insight into your business’s financial health.

By using your gross profit, you can calculate your gross profit margin, which will compare your gross profit to your revenue. This profit margin is a key ratio to analyze a company.

You can use the gross profit margin to benchmark your product-related business operations against the market and similar businesses.

For example, SaaS companies typically operate with high gross profit margins, ranging from 60% to 70%, according to NYU Stern School of Business.

This means if your SaaS business operates with a gross profit margin below 40%, you may need to find ways to reduce your product-related costs.

However, if you’re starting and have significant upfront costs, you may operate at a net loss at the start. For instance, a limited dataset — including Salesforce, Asana, and HubSpot — showed that 83% of SaaS companies were operating at a loss when they went public.

Even though a SaaS business may not be making a profit overall, a positive gross profit is a crucial early sign many investors will look at. This is similar to the Rule of 40, which states that a SaaS company’s combined profit margin and growth rate should be 40% or more.

Your business’ net profit tells you if you’ve actually achieved profit. It also gives you a look at how efficiently you manage overhead costs.

For example, if you have a positive gross profit but a negative net profit, you have a good product, but your overhead costs prevent you from making money.

Tracking your net profit can help you determine how much income you have and whether you will need further investment to continue operations or if you have room to expand.

Equip Your Finance Team with the Ultimate Strategic Finance Tool

What Is Operating Profit?

Another common type of profit is your operating profit. This is your company’s profit before you pay interest and income tax. You may also hear it referred to as the earnings before interest or taxes (EBIT) over a given period.

Operating profit excludes income from non-core business operations, such as the sale of assets or interest earned from accounts, but includes expenses like depreciation — a reduction in an asset’s value over time.

Businesses typically carry various debts across loans and credit cards, which can eat into profits. By excluding interests on those debts, your operating profit can show a more accurate picture of how well your business is actually performing.

For instance, if you have a high debt load, you can have a positive operating profit as well as a negative net profit — or net burn. This shows your business’s core operations are sustainable, and you can make better business decisions with this knowledge.

Tips for Monitoring and Improving Profit Margins

Before you grow your net profit margins, you need to have a baseline of your current profits and a method for consistently measuring them.

Check Finances Frequently

When managing profit and loss, many businesses compile statements that include quarterly net and gross profits.

However, you should track your cash inflows and outflows every week at a minimum. This is the lifeline of your business — and by keeping an eye on your cash flow, you can see signs of a problem before it occurs and make the appropriate decisions.

Automate Your Monitoring

Manually preparing expense reports, income statements, and cash flow statements can be time-consuming. To streamline the processes, you can use tools like Mosaic that automatically generate the financial reports you need.

Automating your financial analysis helps you save time and gives you access to real-time data whenever you need it. Not to mention, automation also reduces the errors that occur when you prepare reports by hand, so you can feel confident you’re making decisions based on the most accurate information.

Track Changes Over Time

As a business owner, you can find valuable information about your business within each financial snapshot, but certain insights from your profit monitoring only appear if you compare each financial statement with the previous statements.

For instance, unstable profit margins can indicate mismanagement, while declining profit margins could indicate rising competition or a lack of product differentiation. You will need to dive into the reports to pinpoint the cause of your downturn, but having a high-level look at your profits over time is the first step.

Get Real-Time Visibility of Gross and Net Profits With Mosaic

You should look at up-to-date profit information to get the most out of your financial analysis. Yet, for most early-stage startups, dedicating significant labor to financial analysis is not feasible.

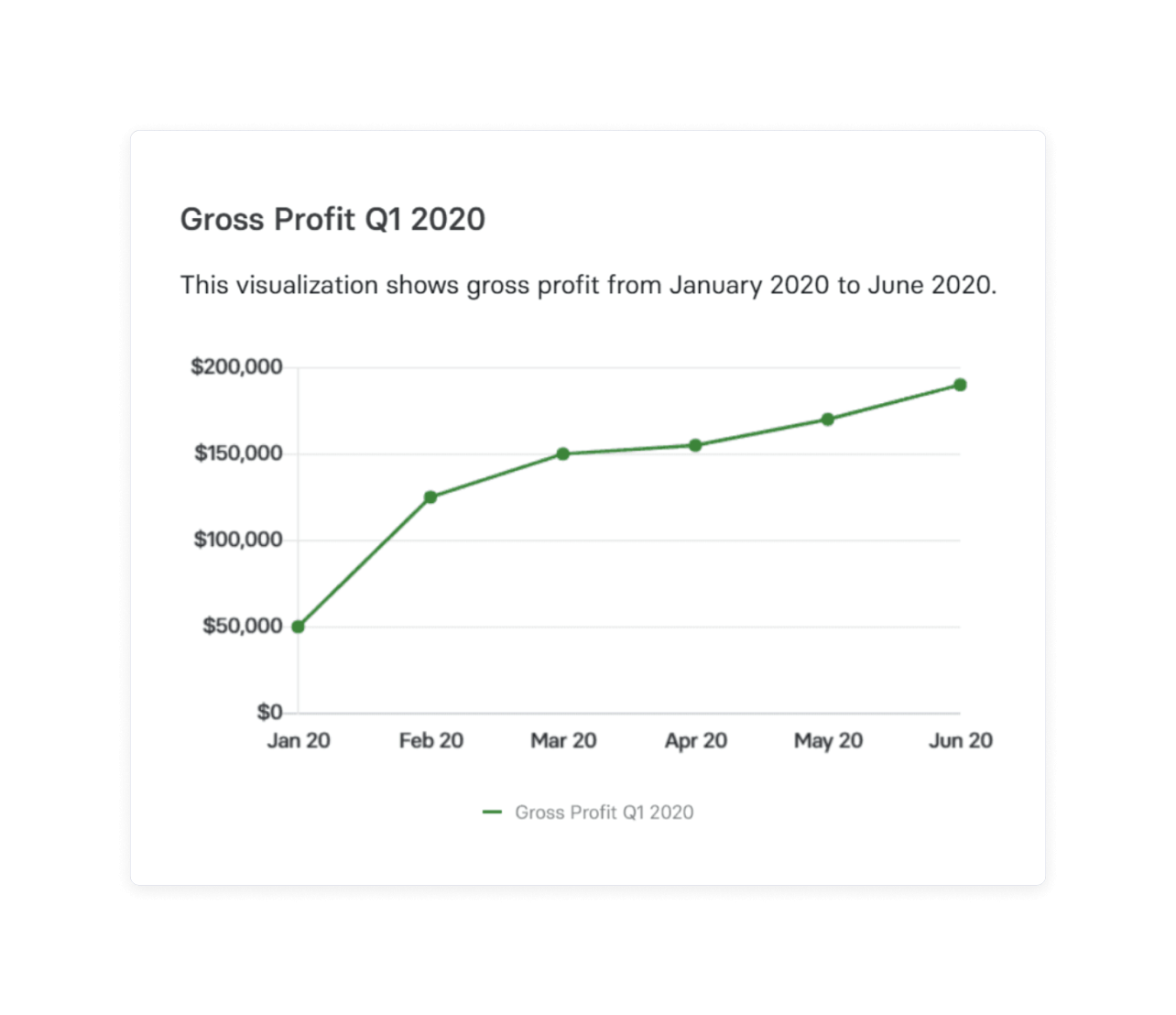

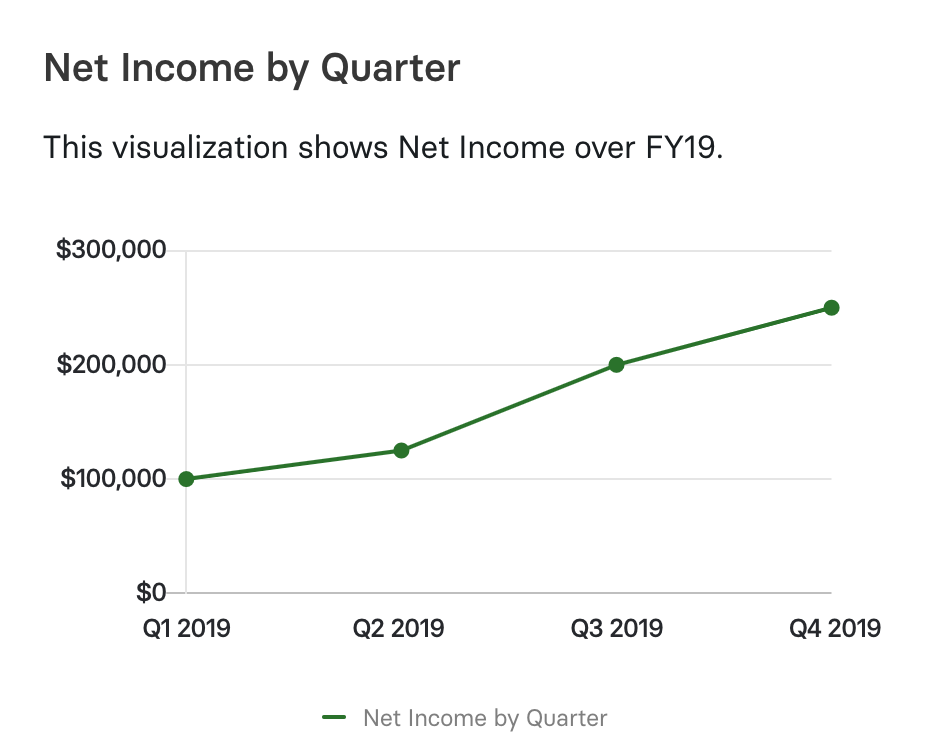

With Mosaic, you can easily check the real-time metrics on your gross and net profits.

The Mosaic platform provides data at your fingertips and serves your company’s information via accessible and shareable charts, perfect for internal communications and to have a quick snapshot of your company’s performance.

The range of useful financial dashboards makes your analysis effortless, letting you focus on what you do best.

Simple Gross Profit vs. Net Profit Calculations Are Just the Starting Point

It’s not enough to understand whether you are making a profit or not. Analyzing your profit across different stages of your operations helps you pinpoint what is and isn’t working in your business to help make informed decisions.

Your gross profit describes the money you make after expenses on your products. Understanding this number tells you how efficiently your company uses labor and supplies. On the other hand, your net profit considers all business expenses to serve as a broader indicator of your overall financial reporting.

With Mosaic, you can stay on top of these financial metrics and get accessible and effective financial analysis. Schedule a personalized demo today to see how Mosaic helps businesses track everything in one place in real time.

Gross Profit vs. Net Profit FAQs

What is the difference between gross vs. net profit?

Gross profit takes all income and total cost of goods sold/revenue into account, while net profit measures all income and expenses of a business. That means gross profit is used to evaluate the profitability of product development, while net profit measures the profitability of the company.

What is an example of gross profit?

What is an example of net profit?

Is gross profit higher than net profit?

Explore Related Metrics

Own the of your business.